牛20240228

commented on

Translated

1

1

$INNO (6262.MY)$ The estimated dividend for this quarter will be between 4 to 4.2 cents, with Q4 earnings 8% higher than Q3.

Translated

牛20240228

commented on

$CAPITALA (5099.MY)$ what is going on? So quiet here. no movement at all

1

2

牛20240228

commented on

$INNO (6262.MY)$ Is the current price suitable to buy for dividends?

Translated

3

1

牛20240228

commented on

$CAPITALA (5099.MY)$ consider decent earnings result , any idea why?

1

3

$CAPITALA (5099.MY)$ Tony is just flying the plane to land at the airport, he will take off again, don't worry![]()

![]()

Translated

牛20240228

commented on

Translated

1

2

牛20240228

commented on

牛20240228

liked

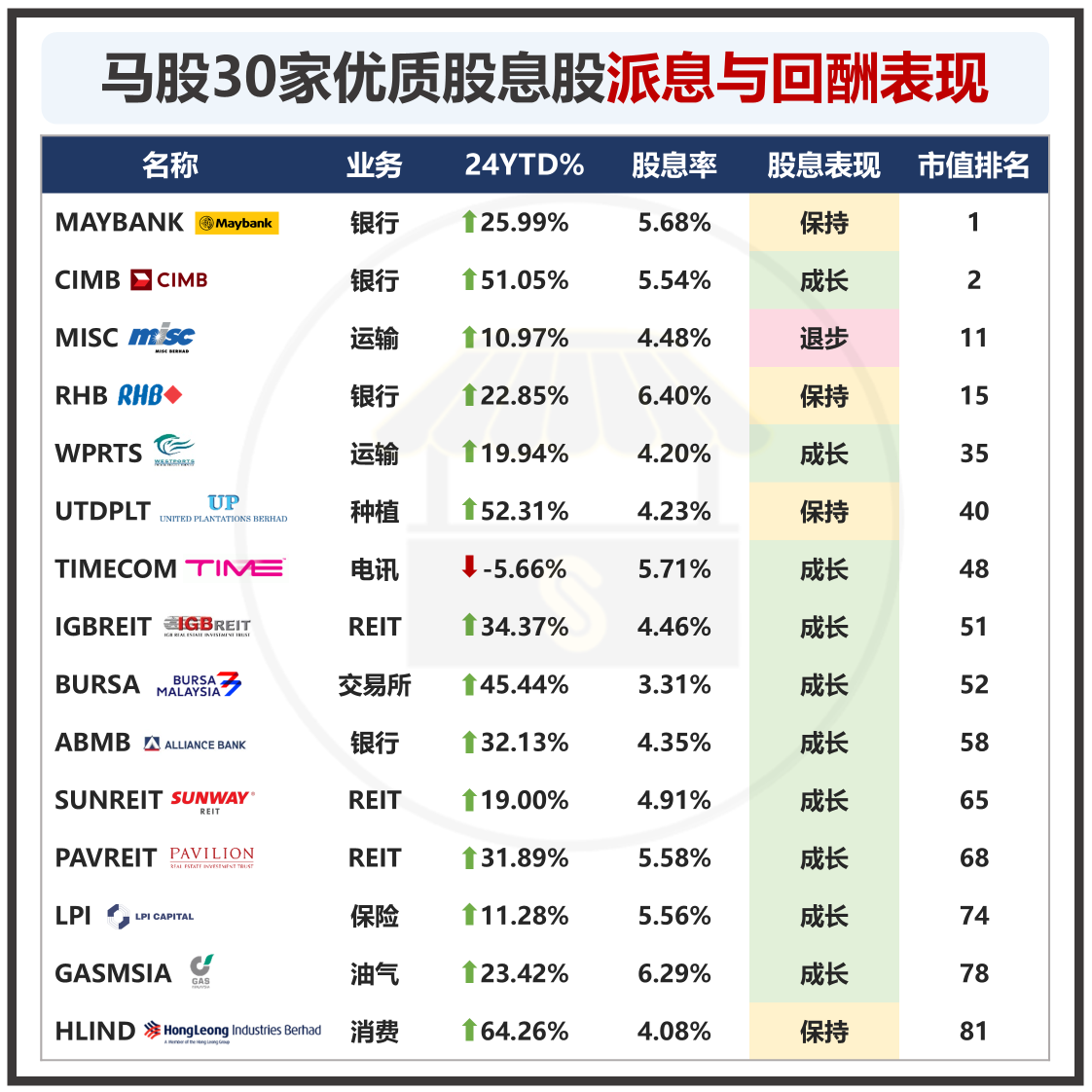

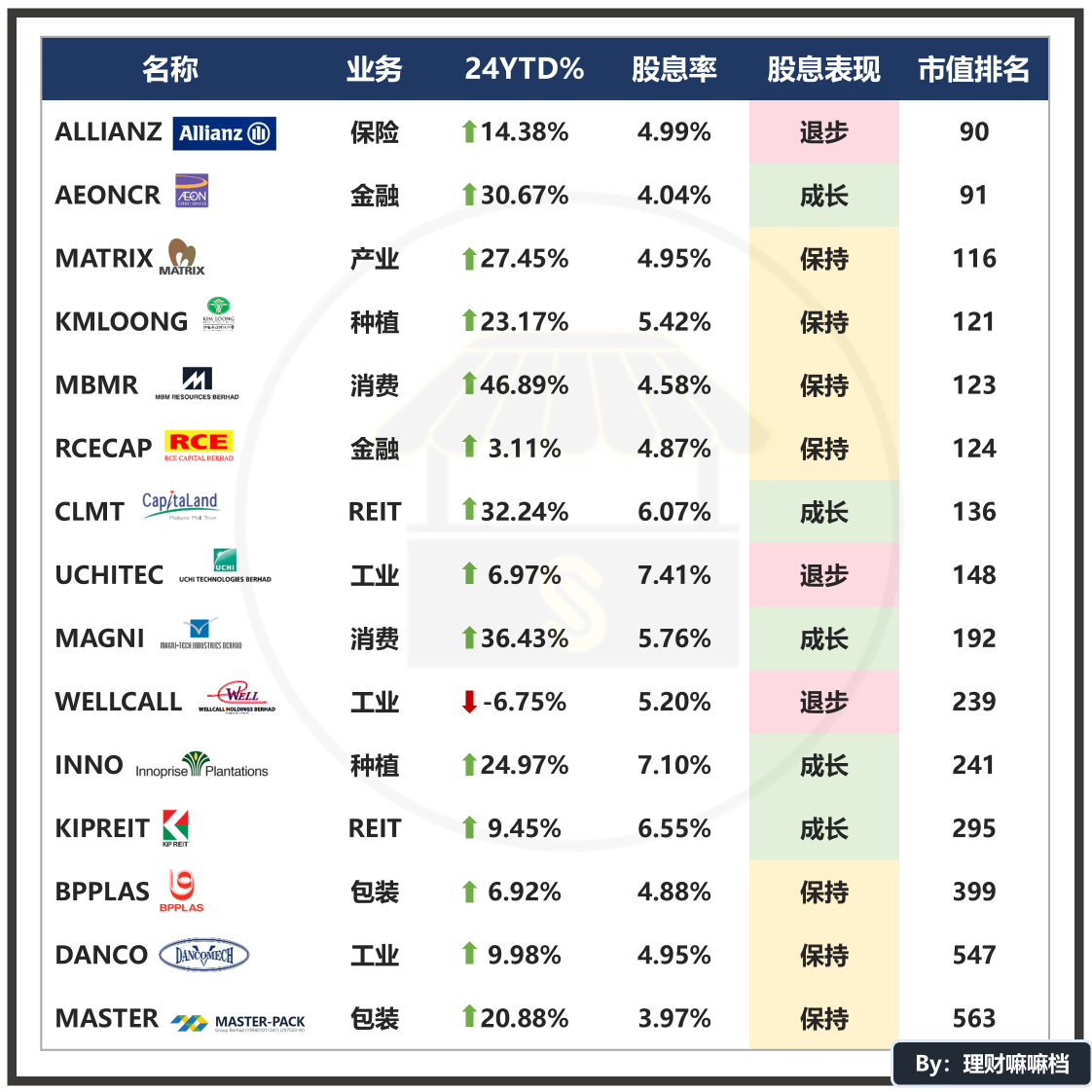

Investing in dividend stocks emphasizes the three words "slow, steady, and patient". These three words may seem simple but few people can actually achieve them, because compared to the thrill of timing the market, this investing approach is truly too boring.

Looking back at the performance of dividend stocks at the end of 2022 (article dated 3 Jan 2023), the average return of the 30 dividend-paying stocks was 7.19%, with a ratio of 20:10 in terms of gains and losses. During the same year, the USA's S&P500 fell by 19.44%, and the Malaysian FBMSCAP fell by 5.30%. Many readers commented that it was just luck, as the dividend stocks happened to perform well at the end of the year.

Looking at the performance of dividend stocks at the end of 2023 (article dated 31 Dec 2023), the average return of the 30 dividend-paying stocks was 13.82%, with a ratio of 23:7 in terms of gains and losses. During the same year, the USA's S&P500 rose by 24.23%, and the Malaysian FBMSCAP rose by 9.57%. Still, many readers commented that it was just luck.

As of October 13, 2024, the average return of the 30 dividend-paying stocks since the beginning of the year is 24.20%, with a ratio of 28:2 in terms of gains and losses. Among these:

18 of them have experienced an increase of 20% or more.

The increase of 6 companies has reached 10% or above.

Only 2 companies have a decrease of more than 5%.

The performance of dividend stocks in 2024 can only be described as unexpectedly good, mainly because these high-dividend, solid companies have become a safe haven for funds in a sluggish market.

The market's downturn in the second half of 2024 mainly occurred...

Looking back at the performance of dividend stocks at the end of 2022 (article dated 3 Jan 2023), the average return of the 30 dividend-paying stocks was 7.19%, with a ratio of 20:10 in terms of gains and losses. During the same year, the USA's S&P500 fell by 19.44%, and the Malaysian FBMSCAP fell by 5.30%. Many readers commented that it was just luck, as the dividend stocks happened to perform well at the end of the year.

Looking at the performance of dividend stocks at the end of 2023 (article dated 31 Dec 2023), the average return of the 30 dividend-paying stocks was 13.82%, with a ratio of 23:7 in terms of gains and losses. During the same year, the USA's S&P500 rose by 24.23%, and the Malaysian FBMSCAP rose by 9.57%. Still, many readers commented that it was just luck.

As of October 13, 2024, the average return of the 30 dividend-paying stocks since the beginning of the year is 24.20%, with a ratio of 28:2 in terms of gains and losses. Among these:

18 of them have experienced an increase of 20% or more.

The increase of 6 companies has reached 10% or above.

Only 2 companies have a decrease of more than 5%.

The performance of dividend stocks in 2024 can only be described as unexpectedly good, mainly because these high-dividend, solid companies have become a safe haven for funds in a sluggish market.

The market's downturn in the second half of 2024 mainly occurred...

Translated

91

2

41

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

牛20240228 : Buying this stock is like gambling, waiting for its performance at the beginning of the year. If it doesn't get out of PN17 by mid-February, I think it's time to run.