碧珍何

liked

Weekly market recap

Stocks are coming off a losing week after last month's consumer price index made its largest annual increase in more than three decades. The major averages snapped a five-week winning streak.

The $.DJI.US$ dipped 0.6% and the $.SPX.US$ eased 0.3% last week. The tech-focused $.IXIC.US$ was the main underperformer, dropping 0.7% as rising bond yields dented growth pockets of the market.

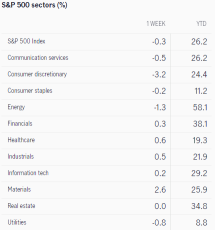

Here's a look at the return of S&P 500 sectors

This week ahead in focus

Third-quarter earnings season is entering the period when retailers dominate the daily reports. Big names will include Advance Auto Parts on Monday, followed by Walmart and Home Depot on Tuesday. Then Target, Lowe's, and TJX report on Wednesday and Alibaba Group Holding go on Thursday.

Non-retail highlights on the earnings calendar this week will include Lucid Group and Tyson Foods on Monday, Nvidia and Cisco Systems on Wednesday, and Applied Materials on Thursday.

Economic data releases this week include the Census Bureau's October retail-sales report on Tuesday and the Conference Board's Leading Economic Index for October on Thursday. Both are forecast to have climbed 0.8% from September.

Monday 11/15

$AAP.US$ , $LCID.US$ , $TSN.US$ , and $WMG.US$ release quarterly results.

$ADP.US$ hosts its 2021 investor day in Roseland, N.J.

Tuesday 11/16

$WMT.US$ reports third-quarter fiscal-2022 earnings before the opening bell. Shares of the retail behemoth have trailed the S&P 500 by 21 percentage points this year, despite Walmart raising full-year guidance.

$HD.US$ and $TDG.US$ report earnings.

$CBOE.US$, $ENPH.US$, $HIG.US$, and $QCOM.US$ hold their annual investor days.

$BMY.US$ hosts an investor meeting in New York. CEO Giovanni Caforio will discuss the company's drug pipeline and strategic opportunities.

The National Association of Home Builders releases its NAHB/Wells Fargo Housing Market Index for November. Consensus estimate is for an 80 reading, even with the October figure. The index is off about 10% from its peak late last year, but home builders remain bullish on the housing market.

The Census Bureau reports on retail-sales spending for October. Expectations are for 0.8% month-over-month increase in retail sales. Excluding autos, spending is seen rising 0.9% This compares with gains of 0.7% and 0.8%, respectively, in September.

Wednesday 11/17

$CSCO.US$ , $LOW.US$ , $NVDA.US$ , $TGT.US$ , and $TJX.US$ announce quarterly results.

The Census Bureau reports new residential construction data for October. Economists forecast that privately owned housing starts will increase 2.2% to a seasonally adjusted annual rate of 1.59 million.

Thursday 11/18

$BABA.US$ , $AMAT.US$ , $INTU.US$ , $JD.US$ , $ROST.US$ , and $WDAY.US$ hold conference calls to discuss earnings.

$CTSH.US$ , $IR.US$ , and $SYK.US$ host investor meetings.

$JNJ.US$ holds an investor meeting to discuss its pharmaceuticals business.

Liberty Media hosts its annual investor meeting in New York. Companies presenting at the event are a mix of those owned by Liberty and those in which Liberty has a sizable stake, including the Atlanta Braves, $CHTR.US$, $LYV.US$, and $TRIP.US$.

The Conference Board releases its Leading Economic Index for October. The consensus call is for a 0.8% monthly gain, to a 118.4 reading. The Conference Board is currently projecting a 5.7% GDP growth rate this year.

Friday 11/19

$FL.US$ reports earnings for its fiscal third quarter.

Source: CNBC, Dow Jones Newswires, jhinvestments

Stocks are coming off a losing week after last month's consumer price index made its largest annual increase in more than three decades. The major averages snapped a five-week winning streak.

The $.DJI.US$ dipped 0.6% and the $.SPX.US$ eased 0.3% last week. The tech-focused $.IXIC.US$ was the main underperformer, dropping 0.7% as rising bond yields dented growth pockets of the market.

Here's a look at the return of S&P 500 sectors

This week ahead in focus

Third-quarter earnings season is entering the period when retailers dominate the daily reports. Big names will include Advance Auto Parts on Monday, followed by Walmart and Home Depot on Tuesday. Then Target, Lowe's, and TJX report on Wednesday and Alibaba Group Holding go on Thursday.

Non-retail highlights on the earnings calendar this week will include Lucid Group and Tyson Foods on Monday, Nvidia and Cisco Systems on Wednesday, and Applied Materials on Thursday.

Economic data releases this week include the Census Bureau's October retail-sales report on Tuesday and the Conference Board's Leading Economic Index for October on Thursday. Both are forecast to have climbed 0.8% from September.

Monday 11/15

$AAP.US$ , $LCID.US$ , $TSN.US$ , and $WMG.US$ release quarterly results.

$ADP.US$ hosts its 2021 investor day in Roseland, N.J.

Tuesday 11/16

$WMT.US$ reports third-quarter fiscal-2022 earnings before the opening bell. Shares of the retail behemoth have trailed the S&P 500 by 21 percentage points this year, despite Walmart raising full-year guidance.

$HD.US$ and $TDG.US$ report earnings.

$CBOE.US$, $ENPH.US$, $HIG.US$, and $QCOM.US$ hold their annual investor days.

$BMY.US$ hosts an investor meeting in New York. CEO Giovanni Caforio will discuss the company's drug pipeline and strategic opportunities.

The National Association of Home Builders releases its NAHB/Wells Fargo Housing Market Index for November. Consensus estimate is for an 80 reading, even with the October figure. The index is off about 10% from its peak late last year, but home builders remain bullish on the housing market.

The Census Bureau reports on retail-sales spending for October. Expectations are for 0.8% month-over-month increase in retail sales. Excluding autos, spending is seen rising 0.9% This compares with gains of 0.7% and 0.8%, respectively, in September.

Wednesday 11/17

$CSCO.US$ , $LOW.US$ , $NVDA.US$ , $TGT.US$ , and $TJX.US$ announce quarterly results.

The Census Bureau reports new residential construction data for October. Economists forecast that privately owned housing starts will increase 2.2% to a seasonally adjusted annual rate of 1.59 million.

Thursday 11/18

$BABA.US$ , $AMAT.US$ , $INTU.US$ , $JD.US$ , $ROST.US$ , and $WDAY.US$ hold conference calls to discuss earnings.

$CTSH.US$ , $IR.US$ , and $SYK.US$ host investor meetings.

$JNJ.US$ holds an investor meeting to discuss its pharmaceuticals business.

Liberty Media hosts its annual investor meeting in New York. Companies presenting at the event are a mix of those owned by Liberty and those in which Liberty has a sizable stake, including the Atlanta Braves, $CHTR.US$, $LYV.US$, and $TRIP.US$.

The Conference Board releases its Leading Economic Index for October. The consensus call is for a 0.8% monthly gain, to a 118.4 reading. The Conference Board is currently projecting a 5.7% GDP growth rate this year.

Friday 11/19

$FL.US$ reports earnings for its fiscal third quarter.

Source: CNBC, Dow Jones Newswires, jhinvestments

+2

167

10

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)