笑多多

liked and commented on

$First Republic Bank (FRC.US)$ This is called "death by seeing light", how many people who tried to buy at the bottom were bought by others?

Translated

2

6

笑多多

liked

$ProShares UltraPro Short Dow30 ETF (SDOW.US)$ Looks like I might not be able to buy my 28,300 today.

Translated

1

5

笑多多

commented on

$E-mini NASDAQ 100 Futures(MAR5) (NQmain.US)$ $ProShares UltraPro Short QQQ ETF (SQQQ.US)$

$Nasdaq Composite Index (.IXIC.US)$

Both overall CPI and core CPI have accelerated on a month-on-month basis. Isn't this a big blow?

Of course, I have also reduced my position cautiously, just in case...

$Nasdaq Composite Index (.IXIC.US)$

Both overall CPI and core CPI have accelerated on a month-on-month basis. Isn't this a big blow?

Of course, I have also reduced my position cautiously, just in case...

Translated

1

29

笑多多

voted

There's a saying that goes: good things must come to an end.

If we look back at the history of the stock market, it's also the same. The bull market can't last forever, and the bear market will also come to its end one day.

![]() An ideal job will only be ideal for a while.

An ideal job will only be ideal for a while.

@Sam The Greater: $Twitter (Delisted) (TWTR.US)$

@Musk Fan: Twitter employees discover their new pronouns $Twitter (Delisted) (TWTR.US)$

![]() One's role model changed.

One's role model changed.

@Musk Fan: Justin Hammer of EVs

![]() Money in the pocket sometimes di...

Money in the pocket sometimes di...

If we look back at the history of the stock market, it's also the same. The bull market can't last forever, and the bear market will also come to its end one day.

@Sam The Greater: $Twitter (Delisted) (TWTR.US)$

@Musk Fan: Twitter employees discover their new pronouns $Twitter (Delisted) (TWTR.US)$

@Musk Fan: Justin Hammer of EVs

+9

23

19

10

笑多多

commented on

$SPDR Dow Jones Industrial Average Trust (DIA.US)$

The number of components in the Dow is very small, making it easy to manipulate.

Among the top ten holdings, except for Microsoft, $Microsoft (MSFT.US)$ the indexes have all exceeded the upper limit of a reasonable range.

For example, McDonald's, $McDonald's (MCD.US)$ I previously complained that its PE ratio is higher than that of Google and Apple.![]()

![]()

![]() Has McDonald's become a growth stock?

Has McDonald's become a growth stock?

Let's talk about Goldman Sachs. $Goldman Sachs (GS.US)$ With a PE ratio of over 10, it is obviously unreasonable for an investment bank. When the PE ratio was 7 times, I bought it and suffered losses for a while before making a profit. If it drops from 10 times to 7 times without leverage, there is a huge 30% risk, which would be very scary.

Let's talk about $Honeywell (HON.US)$ , $Caterpillar (CAT.US)$ Both are overvalued, with high risk.

Be cautious of the risk, I have already sold my previous holdings at a high price. I am more aggressive and have directly bought $ProShares UltraPro Short Dow30 ETF (SDOW.US)$ As a risk control measure, I still hold $ProShares UltraPro QQQ ETF (TQQQ.US)$ and

$iShares 20+ Year Treasury Bond ETF (TLT.US)$ No one-sided bets.

The number of components in the Dow is very small, making it easy to manipulate.

Among the top ten holdings, except for Microsoft, $Microsoft (MSFT.US)$ the indexes have all exceeded the upper limit of a reasonable range.

For example, McDonald's, $McDonald's (MCD.US)$ I previously complained that its PE ratio is higher than that of Google and Apple.

Let's talk about Goldman Sachs. $Goldman Sachs (GS.US)$ With a PE ratio of over 10, it is obviously unreasonable for an investment bank. When the PE ratio was 7 times, I bought it and suffered losses for a while before making a profit. If it drops from 10 times to 7 times without leverage, there is a huge 30% risk, which would be very scary.

Let's talk about $Honeywell (HON.US)$ , $Caterpillar (CAT.US)$ Both are overvalued, with high risk.

Be cautious of the risk, I have already sold my previous holdings at a high price. I am more aggressive and have directly bought $ProShares UltraPro Short Dow30 ETF (SDOW.US)$ As a risk control measure, I still hold $ProShares UltraPro QQQ ETF (TQQQ.US)$ and

$iShares 20+ Year Treasury Bond ETF (TLT.US)$ No one-sided bets.

Translated

5

6

笑多多

commented on

$Tesla (TSLA.US)$ Tesla resistance is approx at 140. i would buy in at 143 or so but if it falls though 140, the next resistance will be approx at 93 and will be my 2nd buy in will be at 95.

1

3

笑多多

commented on

$Tesla (TSLA.US)$ Shareholders are afraid that Musk will sell another $8 billion in stocks to acquire Twitter, but Musk said he is considering repurchasing $10 billion 🤣 Are you relieved now? ...And every time Musk sells stocks, he says it's the last time.

Translated

2

5

笑多多

commented on

$DiDi Global (Delisted) (DIDI.US)$ I really can't control my hand at 6.58! Try copying less, to be honest, I really shouldn't have acted!

Translated

2

笑多多

commented on

$PayPal (PYPL.US)$ The volume has decreased, if there is another decline, it will be a trap for the shorts, and it is possible to gradually build a position.

Translated

10

6

笑多多

voted

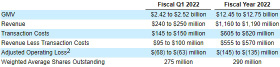

BNPL (Buy Now Pay Later)is growing in popularity globally. On Sep 9, $Affirm Holdings (AFRM.US)$ , leading BNPL company, released its Q4 FY21 earnings thatbeats the estimates, following a surge of 20% in stock price during post-market.

Let's take a quick look at some key takeaways.

Operating Highlights

GMV ( Gross merchandise volume) for Q4 FY21 was $2.5 billion, an increase of106%; GMV for fiscal year 2021 was $8.3 billion, an increase of79%.

Active merchants grew by412%to nearly 29,000; Active consumers grew97%to 7.1 million.

Transactions per active consumer increased8%to approximately 2.3.

Financial Highlights

Total revenue was $261.8 million, a71%increase, driven by increases in network revenue and interest income.

Net loss for the Q4 2021 was $128.2 million compared to net income of $34.8 million in Q4 2020.

Business Highlights

In August 2021, the Company announced a non-exclusive partnership with $Affirm Holdings (AFRM.US)$to offer Affirm's flexible payment solutions, and Amazon plans to make Affirm morebroadly availableto its customers.

In June 2021, the Company advanced itsexclusive partnershipwith $Shopify (SHOP.US)$ by making Affirm's Shop Pay Installments available to all eligible Shopify merchants in the US.

Financial Outlook

The company gives apositive outlook. In FY22, Affirm expects GMV to grow faster than revenue. The outlook also reflects its strategy to drivegrowth in its network through continued investment, prioritizing increased investments in both its product and engineering teams, while also increasing its brand and direct response marketing efforts.

These investments are expected to benefit the Company'sproduct innovation capabilities and brand awareness in support of its long-term growth objectives.

Click to see the original report>>

What’s your thoughtson Affirm's Q4 FY21 earnings? Is there any number or move thathits you? Is now a good time to buy or sell?

We can't wait to see your comments.

Let's take a quick look at some key takeaways.

Operating Highlights

GMV ( Gross merchandise volume) for Q4 FY21 was $2.5 billion, an increase of106%; GMV for fiscal year 2021 was $8.3 billion, an increase of79%.

Active merchants grew by412%to nearly 29,000; Active consumers grew97%to 7.1 million.

Transactions per active consumer increased8%to approximately 2.3.

Financial Highlights

Total revenue was $261.8 million, a71%increase, driven by increases in network revenue and interest income.

Net loss for the Q4 2021 was $128.2 million compared to net income of $34.8 million in Q4 2020.

Business Highlights

In August 2021, the Company announced a non-exclusive partnership with $Affirm Holdings (AFRM.US)$to offer Affirm's flexible payment solutions, and Amazon plans to make Affirm morebroadly availableto its customers.

In June 2021, the Company advanced itsexclusive partnershipwith $Shopify (SHOP.US)$ by making Affirm's Shop Pay Installments available to all eligible Shopify merchants in the US.

Financial Outlook

The company gives apositive outlook. In FY22, Affirm expects GMV to grow faster than revenue. The outlook also reflects its strategy to drivegrowth in its network through continued investment, prioritizing increased investments in both its product and engineering teams, while also increasing its brand and direct response marketing efforts.

These investments are expected to benefit the Company'sproduct innovation capabilities and brand awareness in support of its long-term growth objectives.

Click to see the original report>>

What’s your thoughtson Affirm's Q4 FY21 earnings? Is there any number or move thathits you? Is now a good time to buy or sell?

We can't wait to see your comments.

33

13

5

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

笑多多 : The teacher made a reasonable statement