笨犇犇犇犇牛

liked

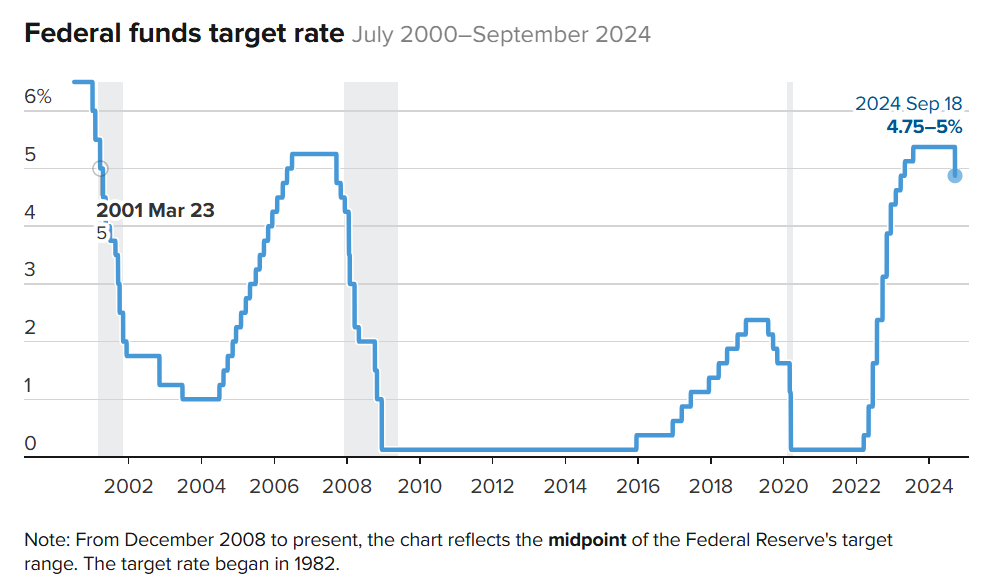

A special, final Q&A for 2024, focusing on the US Federal Reserve's interest rate decision. Feel free to ask your questions below. For each question you post, moomoo will reward you with points. moomoo Australia's market strategist covers investing, trading and all market matters - live. Ask questions, comment, and share your view, as the markets trade.

Ask a strategist - Fed rate decision

Dec 17 08:00

175

187

8

笨犇犇犇犇牛

liked

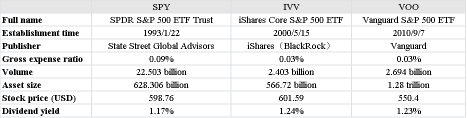

What ETFs track the S & P 500 index?

When considering index investment strategies, especially for large-cap stocks in the U.S. stock market, Exchange-Traded Funds (ETFs) that track the Standard & Poor's 500 Index (S&P 500 Index) are a popular choice among many investors.

The $S&P 500 Index (.SPX.US)$was created by Standard & Poor's in 1957. It is a market-capitalization-weighted index that incl...

When considering index investment strategies, especially for large-cap stocks in the U.S. stock market, Exchange-Traded Funds (ETFs) that track the Standard & Poor's 500 Index (S&P 500 Index) are a popular choice among many investors.

The $S&P 500 Index (.SPX.US)$was created by Standard & Poor's in 1957. It is a market-capitalization-weighted index that incl...

382

118

236

笨犇犇犇犇牛

liked

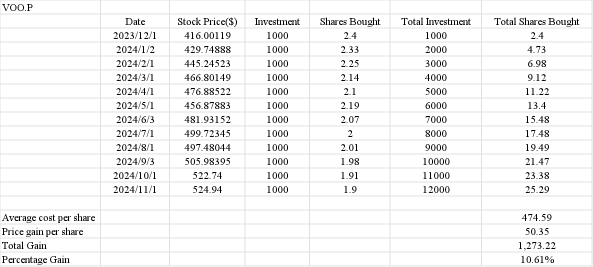

I started with moomoo and officially started investing a year ago. This week, I went from 0.5 million initial capital to 7 million. The moomoo community has many talented people, but the official notification a few days ago told me that I am already an important community user among the Australian Chinese. I have been following closely before, you can see my previous historical messages, always focusing on a few opportunities in the US stock market. $Tesla (TSLA.US)$ In a year, I spend several hours every day watching the stock market, diligence leads to wealth. I have no intention of stopping investing, investing is a long-term subject, and I will continue to express my opinions in the community. (Not investment advice, just casual communication. Adults should take responsibility for their own actions ☕️)

In a year, I spend several hours every day watching the stock market, diligence leads to wealth. I have no intention of stopping investing, investing is a long-term subject, and I will continue to express my opinions in the community. (Not investment advice, just casual communication. Adults should take responsibility for their own actions ☕️)

![]()

![]()

![]()

In a year, I spend several hours every day watching the stock market, diligence leads to wealth. I have no intention of stopping investing, investing is a long-term subject, and I will continue to express my opinions in the community. (Not investment advice, just casual communication. Adults should take responsibility for their own actions ☕️)

Translated

658

183

124

笨犇犇犇犇牛

liked

$MARA Holdings (MARA.US)$ is scheduled to report its third quarter result on 12 Nov after market close.

We have seen MARA stock price go up higher after it announced it added capacity in Ohio in anticipation of more growth. This is even more significant when $Bitcoin (BTC.CC)$ price surge past $85,000 at time of writing.

I am holding onto my position in MARA as I believe that its strategy to boost up its mining capacity when Bitcoin ...

We have seen MARA stock price go up higher after it announced it added capacity in Ohio in anticipation of more growth. This is even more significant when $Bitcoin (BTC.CC)$ price surge past $85,000 at time of writing.

I am holding onto my position in MARA as I believe that its strategy to boost up its mining capacity when Bitcoin ...

+3

150

63

6

笨犇犇犇犇牛

liked

In the early hours of November 6, U.S. local time, Republican presidential candidate Donald Trump announced his victory in the 2024 presidential election. In response to the election outcome, the "Trump Trade" swept across major asset classes, with S&P 500 index futures rising by 2%, the dollar and U.S. Treasury yields increasing, and Bitcoin briefly surpassing $75,000, hitting a historic high!

Trump's policy positions clearly reflect a cons...

Trump's policy positions clearly reflect a cons...

379

118

167

笨犇犇犇犇牛

liked

The U.S. elections are heating up! With only a few days left until Election Day (November 5 local time), Trump and Harris are fiercely competing for votes. Meanwhile, Bitcoin has surpassed $71,000, leading to a general rise in crypto-related stocks. The U.S. elections could become a key catalyst for the crypto market.

![]() Why are cryptos increasingly recognised as an asset class?

Why are cryptos increasingly recognised as an asset class?

The investment value of crypto lies in its gradual incorporation into instituti...

The investment value of crypto lies in its gradual incorporation into instituti...

+4

305

166

57

笨犇犇犇犇牛

liked

DBS, OCBC, and UOB are set to announce their Q3 2024 earnings next week. These three bank giants have outperformed the Straits Times Index (STI), which has risen by 9.91% this year: DBS is the best-performing bank to date (+28.9%), followed by OCBC (+17.8%) and UOB (+14.2%). According to Bloomberg, DBS will release its third-quarter earnings report on November 7, followed by the other two banks on November 8.

Investors are closely mo...

Investors are closely mo...

+2

150

70

51

笨犇犇犇犇牛

liked

Hi, mooers! ![]()

Time has swiftly passed, bringing us to the final quarter of 2024.

When we reflect on the last few months, the standout theme has certainly been the interest rate cut. Which markets have thrived since the Fed's decision? How have your investments adapted to the decreasing interest rates, and what are your strategies moving forward?![]()

Let's dive into your fellow mooers' investment strategies and earnings insights!

Most investors remain s...

Time has swiftly passed, bringing us to the final quarter of 2024.

When we reflect on the last few months, the standout theme has certainly been the interest rate cut. Which markets have thrived since the Fed's decision? How have your investments adapted to the decreasing interest rates, and what are your strategies moving forward?

Let's dive into your fellow mooers' investment strategies and earnings insights!

Most investors remain s...

+5

130

56

12

笨犇犇犇犇牛

liked

Next week could be one of the most exciting times for global stock markets! Two major events— the U.S. election and the US Fed FOMC meeting - could significantly impact market trends.

Before these events, we have an important economic announcement this Friday: the U.S. October Non-Farm Payroll (NFP) report.

1. Why is this Non-Farm Payroll report important?

2. What indicators should investors pay attention to?

3. How should t...

Before these events, we have an important economic announcement this Friday: the U.S. October Non-Farm Payroll (NFP) report.

1. Why is this Non-Farm Payroll report important?

2. What indicators should investors pay attention to?

3. How should t...

292

136

43

笨犇犇犇犇牛

liked

On October 18, a regulatory document revealed that the U.S. Securities and Exchange Commission (SEC) had "accelerated approval" for options linked to three Bitcoin ETFs: $Fidelity Wise Origin Bitcoin Fund (FBTC.US)$ , $ARK 21Shares Bitcoin ETF (ARKB.US)$ , and $Grayscale Bitcoin Trust (GBTC.US)$. Before this, the SEC had already approved options trading for IBIT.

The exchanges will implement conservative position limits of 25,000 contracts on the same side ...

The exchanges will implement conservative position limits of 25,000 contracts on the same side ...

+1

202

86

71

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)