米株マン

liked and commented on

From the continued easing by the new Bank of Japan Governor Ueda, and Buffett's positive comments on buying in Japan, the landscape has completely changed, hasn't it?

From the crisis of Silicon Valley Bank's bankruptcy to the complete resurrection of my assets, thank you.![]()

I won't increase my purchases today, but if the price drops, I will implement the strategy of buying (learning to buy when the Nikkei drops).

From the crisis of Silicon Valley Bank's bankruptcy to the complete resurrection of my assets, thank you.

I won't increase my purchases today, but if the price drops, I will implement the strategy of buying (learning to buy when the Nikkei drops).

Translated

米株マン

liked

☑️ A gradual economic downturn is expected in the second half of this year.

☑️ PCE 2.8% and core CPI 3.5% are expected this year.

☑️ To control inflation, it is necessary for real GDP to be below trend at certain times.

☑️ Due to revisions in price data, the degree of disinflation is smaller than previously believed, and inflation still remains quite high.

Considering additional monetary policies to reduce long-term inflation expectations.

⭐️Overview: Accepting economic downturn in the second half of this year (from 3Q onwards) and emphasizing the effect of inflation suppression. There are concerns about the long-term inflation expectations remaining high, so new tightening measures are being considered while maintaining a tightening stance, even though credit contraction is expected. Will there be a sale of MBS?

☑️ PCE 2.8% and core CPI 3.5% are expected this year.

☑️ To control inflation, it is necessary for real GDP to be below trend at certain times.

☑️ Due to revisions in price data, the degree of disinflation is smaller than previously believed, and inflation still remains quite high.

Considering additional monetary policies to reduce long-term inflation expectations.

⭐️Overview: Accepting economic downturn in the second half of this year (from 3Q onwards) and emphasizing the effect of inflation suppression. There are concerns about the long-term inflation expectations remaining high, so new tightening measures are being considered while maintaining a tightening stance, even though credit contraction is expected. Will there be a sale of MBS?

Translated

22

1

米株マン

liked

✅ Exchange rate

⚫︎The dollar is falling

⚫︎Following the slowing growth of CPI, it has been increasingly speculated that the FRB will stop tightening after deciding to raise rates in May.

○Voice from the market

⚫︎With the overall inflation rate dropping more than expected, the view that the rate hike will basically end after one more increase has been supported.

⚫︎This does not necessarily indicate the end of inflation yet.

- Bond.

Yield decreases.

After a rate hike in May, there is a possibility that the financial tightening may temporarily pause.

○Voice from the market

I do not believe that the CPI will correct the FRB's trajectory.

With easing price pressures and signs of labor market stabilization, a temporary sense of security is likely to spread in the market.

It is positive news, but it does not mean the end of tightening.

✅Stock

Decline.

From the FOMC minutes, it was revealed that a Federal Reserve official expressed concerns about liquidity crisis at local banks.

The FOMC minutes concluded that ultimately, prioritizing inflation response is necessary.

○Voice from the market

It became clear in the minutes that the Federal Reserve remains concerned about bank crises and high prices.

The inflation trend became even clearer in the PPI on the 13th...

⚫︎The dollar is falling

⚫︎Following the slowing growth of CPI, it has been increasingly speculated that the FRB will stop tightening after deciding to raise rates in May.

○Voice from the market

⚫︎With the overall inflation rate dropping more than expected, the view that the rate hike will basically end after one more increase has been supported.

⚫︎This does not necessarily indicate the end of inflation yet.

- Bond.

Yield decreases.

After a rate hike in May, there is a possibility that the financial tightening may temporarily pause.

○Voice from the market

I do not believe that the CPI will correct the FRB's trajectory.

With easing price pressures and signs of labor market stabilization, a temporary sense of security is likely to spread in the market.

It is positive news, but it does not mean the end of tightening.

✅Stock

Decline.

From the FOMC minutes, it was revealed that a Federal Reserve official expressed concerns about liquidity crisis at local banks.

The FOMC minutes concluded that ultimately, prioritizing inflation response is necessary.

○Voice from the market

It became clear in the minutes that the Federal Reserve remains concerned about bank crises and high prices.

The inflation trend became even clearer in the PPI on the 13th...

Translated

3

米株マン

reacted to

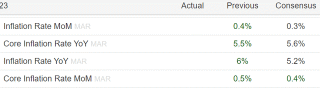

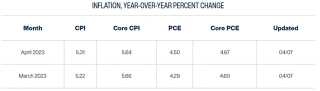

The CPI expectations for March

I have been warning that the disinflationary trend from "peak inflation" in 2022 is likely to be short lived.

Let's look at the inflation expectations for March, to be releas...

+3

10

1

米株マン

commented on

What kind of company is Ark Investment

Ark Investment Inc. was founded in 2014 and is an institutional investor headquartered in Florida, USA. Cathy Wood, the founder of the company, prefixed the company name with ARK (arc), which means ark. The company's assets under management as of the end of December 2022 were 11.54 billion dollars, down 2.81 billion dollars from the end of the previous quarter.

As a result of repeated intensive investments in companies with “disruptive innovation,” the average annual investment return from 2014 to 2021 for the Arc Innovation ETF under the umbrella of the company rose to 39%, and a return rate of more than three times that of the S&P 500 during the same period was recorded.

Under such circumstances, the Wall Street Journal issued a report in 2022/12 stating that “the Ark Innovation ETF has fallen 63% since entering 2022 until now, and has fallen 78% from its peak in 2021/2.” Regarding poor management of ETFs under the company's umbrella, Mr. Wood defended his own investment strategy, saying “we have set an investment period of 5 years.”

Ark Investment portfolio top 10 (2022 4Q...

Ark Investment Inc. was founded in 2014 and is an institutional investor headquartered in Florida, USA. Cathy Wood, the founder of the company, prefixed the company name with ARK (arc), which means ark. The company's assets under management as of the end of December 2022 were 11.54 billion dollars, down 2.81 billion dollars from the end of the previous quarter.

As a result of repeated intensive investments in companies with “disruptive innovation,” the average annual investment return from 2014 to 2021 for the Arc Innovation ETF under the umbrella of the company rose to 39%, and a return rate of more than three times that of the S&P 500 during the same period was recorded.

Under such circumstances, the Wall Street Journal issued a report in 2022/12 stating that “the Ark Innovation ETF has fallen 63% since entering 2022 until now, and has fallen 78% from its peak in 2021/2.” Regarding poor management of ETFs under the company's umbrella, Mr. Wood defended his own investment strategy, saying “we have set an investment period of 5 years.”

Ark Investment portfolio top 10 (2022 4Q...

Translated

+6

5

1

ChatGPT and Dall·E2 themselves are excellent AI models. However, looking back on past history, no matter how advanced they are in terms of technology, there is no doubt that companies that will catch up with OpenAI will appear one after another as time passes. However, even so, it seems that Microsoft values the “autonomy” of OpenAI and intends to strategically work on the “fruits” (research results) born from it into its own products.

The “additional investment on the scale of several billion dollars” announced in January 2023 seems to be an extension of the past two investments. There is no explanation of the investment scheme from Microsoft or OpenAI, but when various reports from overseas are synthesized, the investment scheme is as follows.

- Microsoft invested billions of dollars (up to $10 billion) over several years

- Microsoft will receive 75% of the profits generated by OpenAI until the return on investment is completed

- After the return on investment, Microsoft can acquire up to 49% of OpenAI's shares

In addition, OpenAI's various AI platforms have been ported to Microsoft's cloud platform “Azure”, and learning programs...

The “additional investment on the scale of several billion dollars” announced in January 2023 seems to be an extension of the past two investments. There is no explanation of the investment scheme from Microsoft or OpenAI, but when various reports from overseas are synthesized, the investment scheme is as follows.

- Microsoft invested billions of dollars (up to $10 billion) over several years

- Microsoft will receive 75% of the profits generated by OpenAI until the return on investment is completed

- After the return on investment, Microsoft can acquire up to 49% of OpenAI's shares

In addition, OpenAI's various AI platforms have been ported to Microsoft's cloud platform “Azure”, and learning programs...

Translated

1

1

Where are Meta's growth opportunities?

ARPU in the Asia-Pacific region and elsewhere has been steadily increasing over the years, and Facebook penetration in these countries is still below 25%. If the population of Asia and Africa continues to increase, there is a possibility that ARPU in these regions will grow significantly.

Nonetheless, Meta must continue to invest heavily in research and development in order to continue to be a representative platform for social media.

Another growth factor is probably Reality Labs. In recent years, Meta has invested heavily in virtual reality and augmented reality hardware and software, such as virtual reality headsets such as Quest and online platforms such as Horizon World.

If this technology gets on track and becomes widespread, Meta can be a leader in this new economy and a cash-generating machine. Also, it is possible to re-establish its position as a “cool” enterprise that attracts young users. But will Reality Labs succeed? I still don't understand that.

ARPU in the Asia-Pacific region and elsewhere has been steadily increasing over the years, and Facebook penetration in these countries is still below 25%. If the population of Asia and Africa continues to increase, there is a possibility that ARPU in these regions will grow significantly.

Nonetheless, Meta must continue to invest heavily in research and development in order to continue to be a representative platform for social media.

Another growth factor is probably Reality Labs. In recent years, Meta has invested heavily in virtual reality and augmented reality hardware and software, such as virtual reality headsets such as Quest and online platforms such as Horizon World.

If this technology gets on track and becomes widespread, Meta can be a leader in this new economy and a cash-generating machine. Also, it is possible to re-establish its position as a “cool” enterprise that attracts young users. But will Reality Labs succeed? I still don't understand that.

Translated

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

米株マン : It looks like preparations are being made for distribution @現地

米株マン : The staff seems to be doing their best around the equipment, so I'm pressing down on time

米株マン : I wonder if it came

米株マン : That's interesting

米株マン : That's interesting

View more comments...