Pick 1 : $Novo-Nordisk A/S (NVO.US)$

Pick 2: $ASML Holding (ASML.US)$

Pick 3: $Nike (NKE.US)$

Pick 4: $Adobe (ADBE.US)$

Pick 5: $PepsiCo (PEP.US)$

Pick 2: $ASML Holding (ASML.US)$

Pick 3: $Nike (NKE.US)$

Pick 4: $Adobe (ADBE.US)$

Pick 5: $PepsiCo (PEP.US)$

6

2

约翰の理财库

commented on

Greetings, mooers! Welcome to mooers’ stories, where we feature the inspiring journeys and unique perspectives of our mooers to help you achieve your investment aspirations!💡

Investing is more than just a personal journey—it’s about learning, sharing, and growing together as a community. Today, we’re honored to feature @约翰の理财库, a Financial Services Director with 6 years of experience in the financial ...

Investing is more than just a personal journey—it’s about learning, sharing, and growing together as a community. Today, we’re honored to feature @约翰の理财库, a Financial Services Director with 6 years of experience in the financial ...

174

69

35

约翰の理财库

commented on

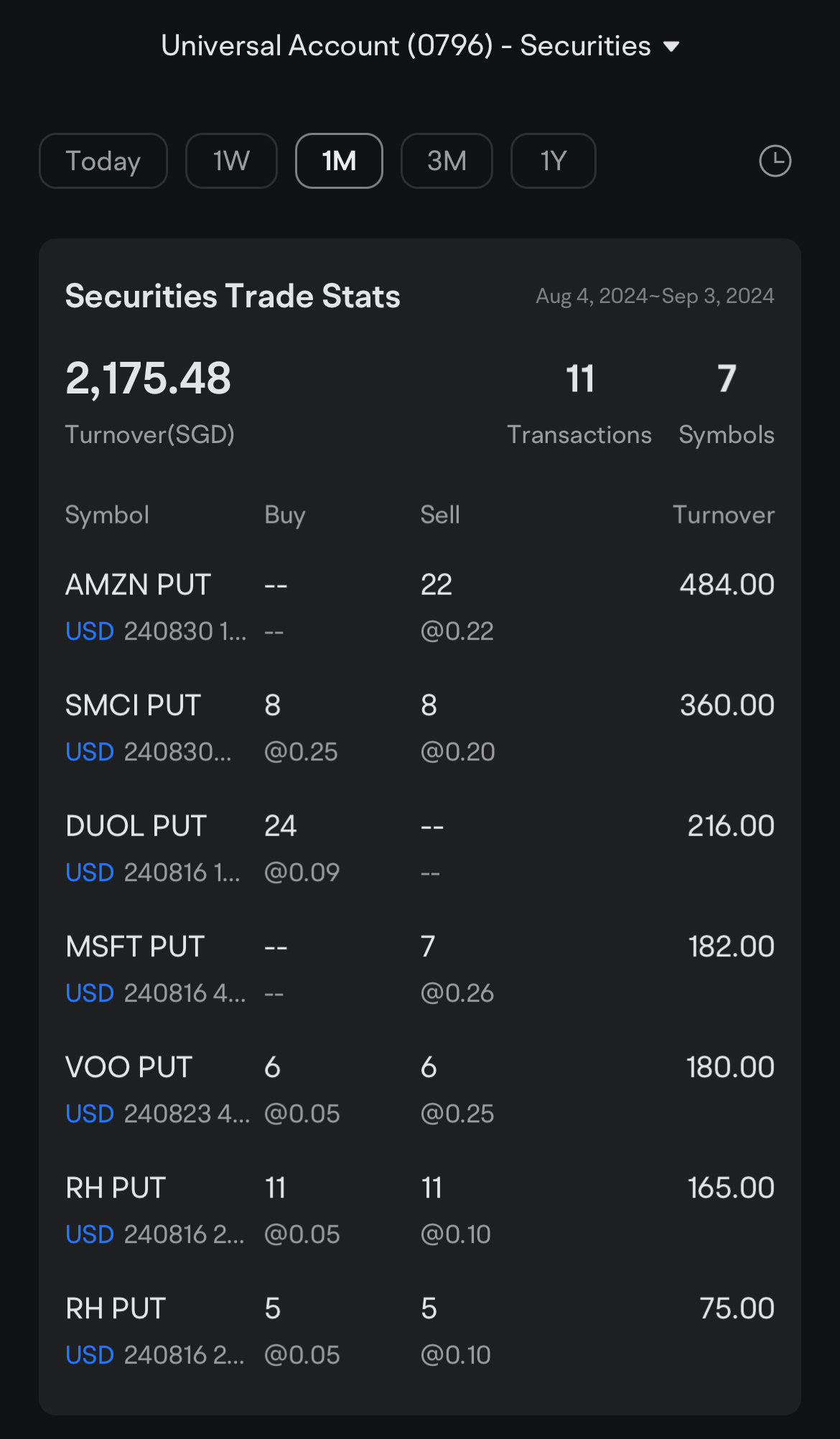

Since I’m on a short vacation today, I’ll take a moment to briefly share how I’ve utilized good implied volatility (IV%) to gain profits through options selling. By strategically selecting options with high IV%, I can secure steady profits with minimal risk. Here’s a breakdown of how I’ve managed to do just that with my recent trades.

1. $Domino's Pizza (DPZ.US)$ Current Price: $409

· Sell Call: Strike $485, Qty 8, Premium $0.51, Total Call Premium: ...

1. $Domino's Pizza (DPZ.US)$ Current Price: $409

· Sell Call: Strike $485, Qty 8, Premium $0.51, Total Call Premium: ...

27

4

7

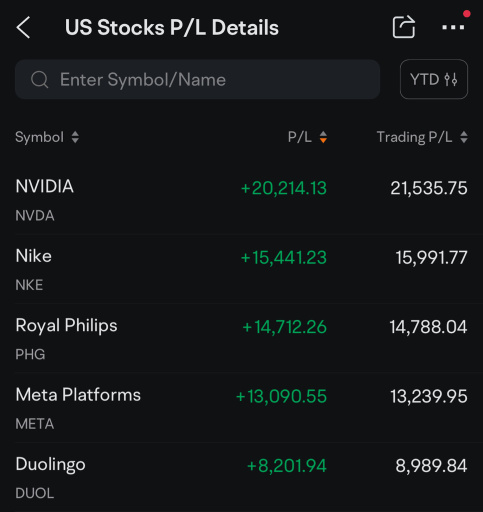

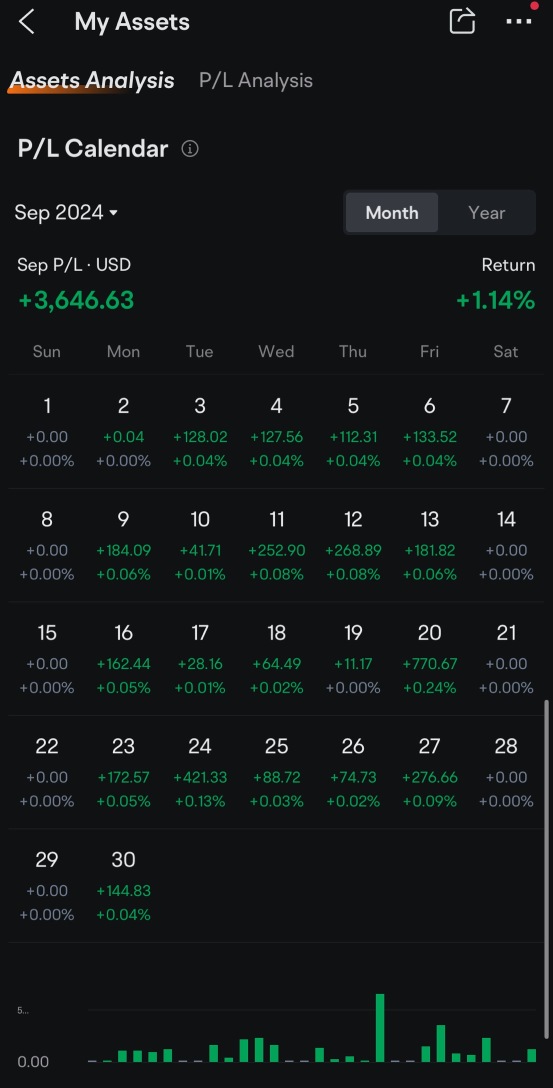

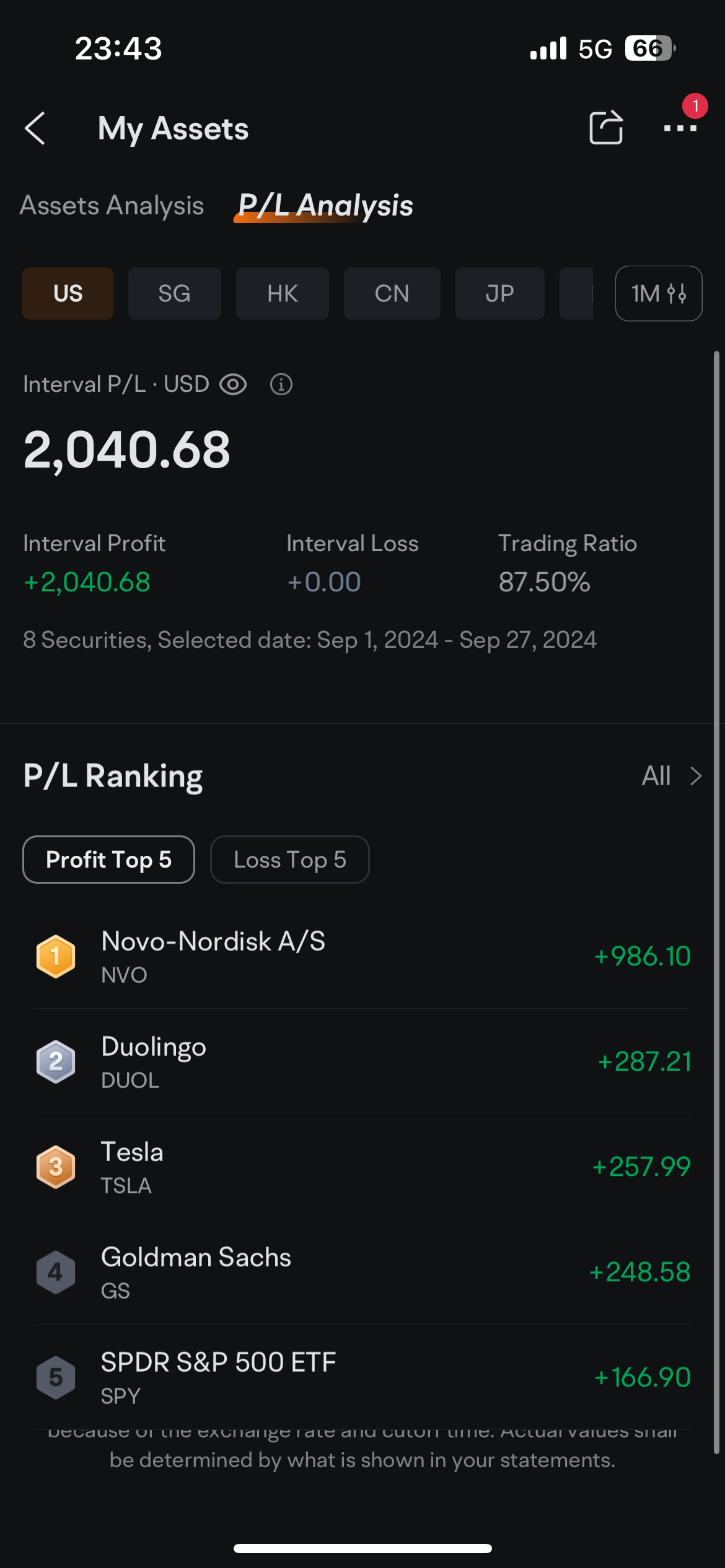

USD dollar is weakening , September surprisingly a positive month for $S&P 500 Index (.SPX.US)$

$NVIDIA (NVDA.US)$ $Duolingo (DUOL.US)$ $Novo-Nordisk A/S (NVO.US)$ $Goldman Sachs (GS.US)$ $Tesla (TSLA.US)$

Currently only 35 hands of option cash secure sell put strike 89.50 expiry in late December 2024

All cash remain in $CSOP USD Money Market Fund (SGXZ96797238.MF)$ and $Fullerton Fund - Fullerton SGD Liquidity Fund (SGXZ40088619.MF)$

All the best![]()

$NVIDIA (NVDA.US)$ $Duolingo (DUOL.US)$ $Novo-Nordisk A/S (NVO.US)$ $Goldman Sachs (GS.US)$ $Tesla (TSLA.US)$

Currently only 35 hands of option cash secure sell put strike 89.50 expiry in late December 2024

All cash remain in $CSOP USD Money Market Fund (SGXZ96797238.MF)$ and $Fullerton Fund - Fullerton SGD Liquidity Fund (SGXZ40088619.MF)$

All the best

loading...

22

约翰の理财库

commented on

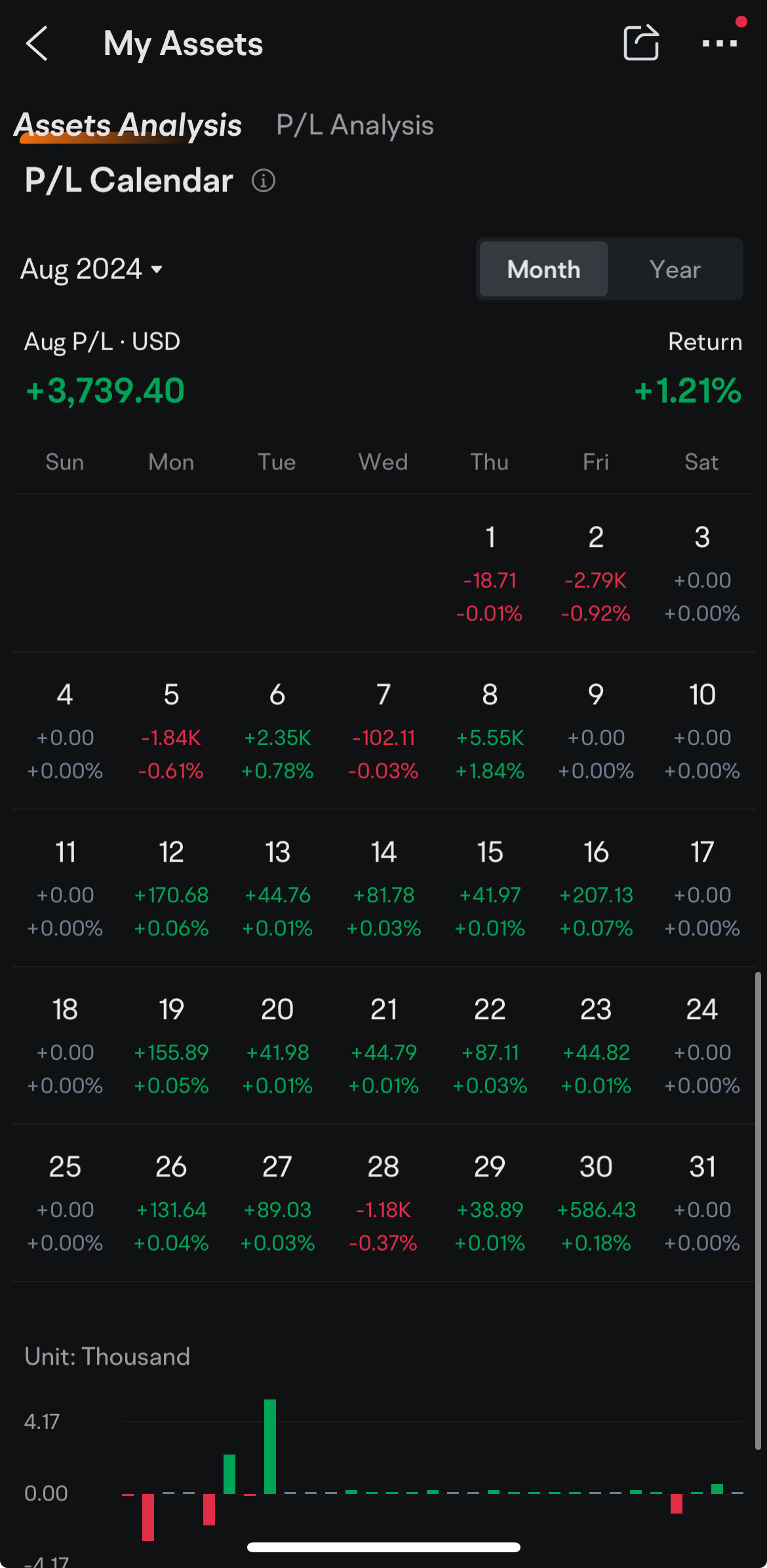

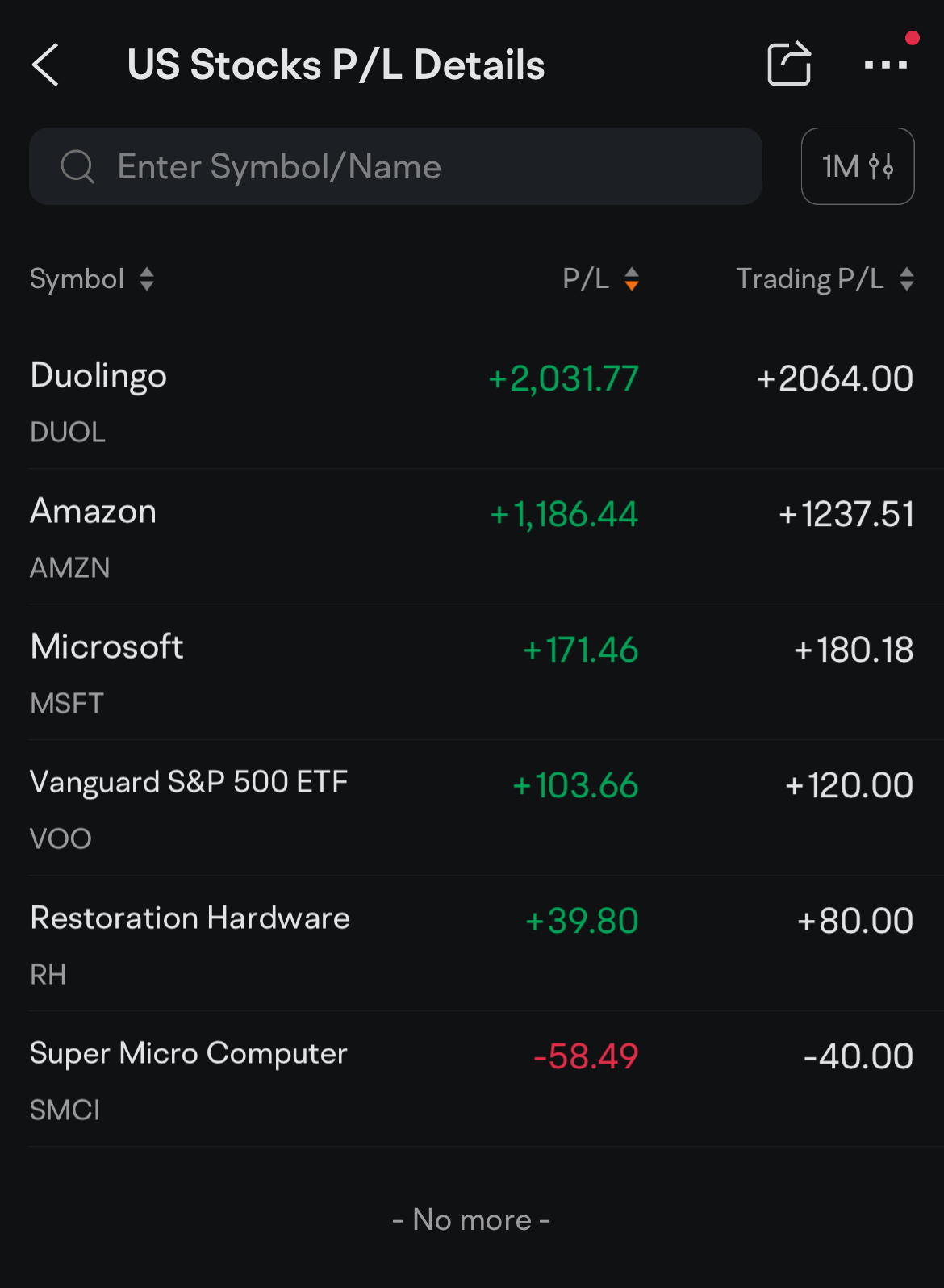

In August, I focused on minimizing volatility by strategically cashing out all my positions and reallocating into a money market fund. This approach allowed me to maintain liquidity while earning a passive daily income of over $40. I selectively engaged in cash-secured put positions on $Duolingo (DUOL.US)$ , $Amazon (AMZN.US)$ $Microsoft (MSFT.US)$ when the implied volatility (IV) presented a favorable risk-to-reward ratio. This cautious stance enabled me to close August ...

+1

44

14

1

No stock position as of Mid July

Target entry upon tech and Nasdaq correction

Nvda 90, Tsla 150, Appl 180, Msft 400

As of 12 July 2024 , continue to hold cash in CSOP money market and only in MOAT ETF

Patience = the key

Target entry upon tech and Nasdaq correction

Nvda 90, Tsla 150, Appl 180, Msft 400

As of 12 July 2024 , continue to hold cash in CSOP money market and only in MOAT ETF

Patience = the key

13

2

2

约翰の理财库

commented on

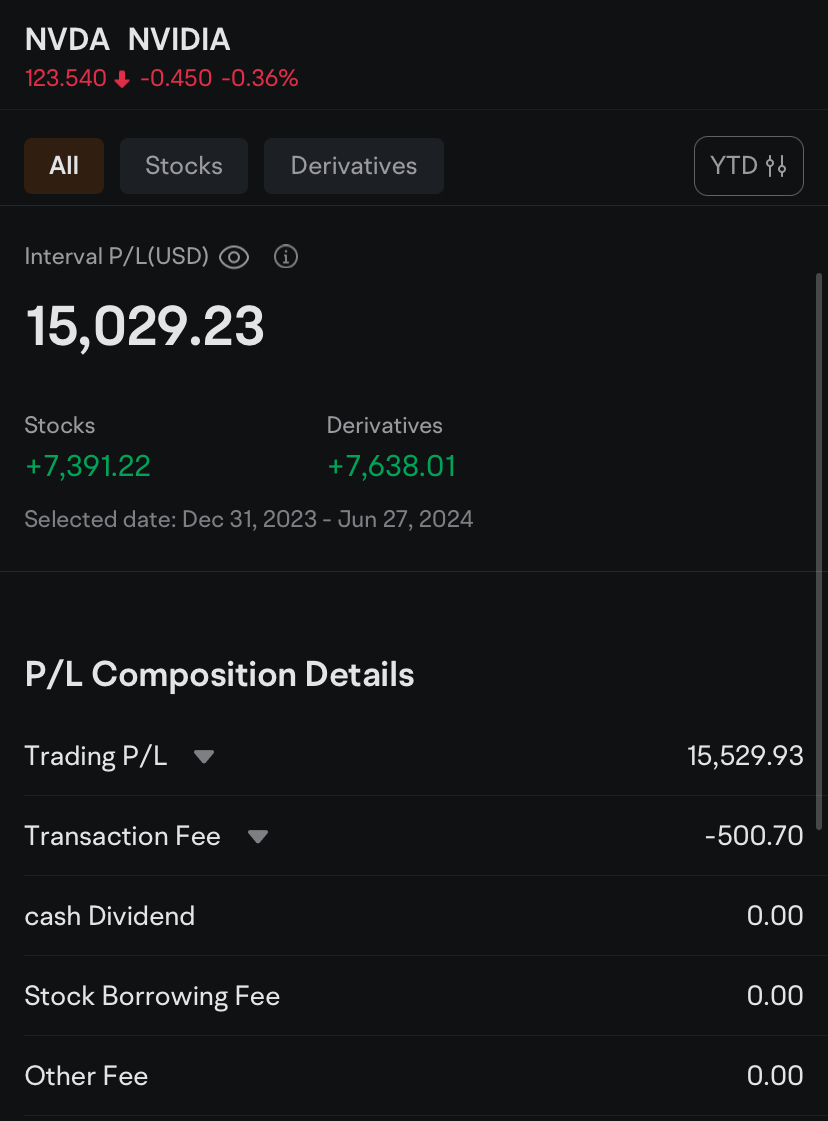

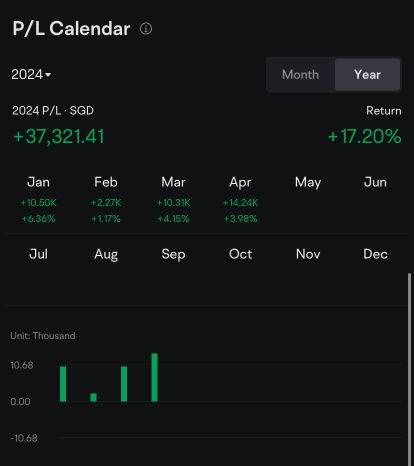

The first half of 2024 has been a consistently profitable period for my investments, largely driven by my disciplined and strategic responses to earnings reports and news ![]() . And by carefully analyzing financial statements and market sentiment, I have been able to profit significantly from selling options and employing strangle strategies. Additionally, buying stocks ahead of anticipated positive news and earnings reports has proven to be highly effective! ...

. And by carefully analyzing financial statements and market sentiment, I have been able to profit significantly from selling options and employing strangle strategies. Additionally, buying stocks ahead of anticipated positive news and earnings reports has proven to be highly effective! ...

+4

149

47

35

约翰の理财库

commented on

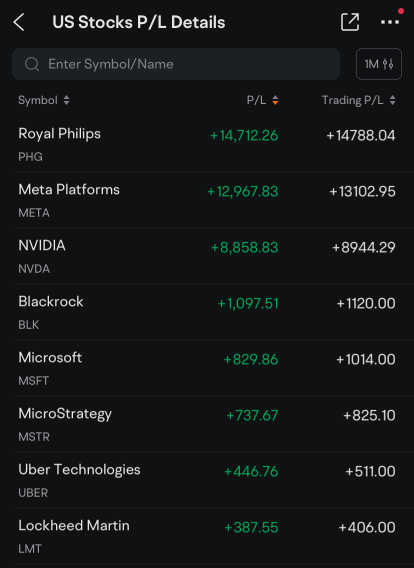

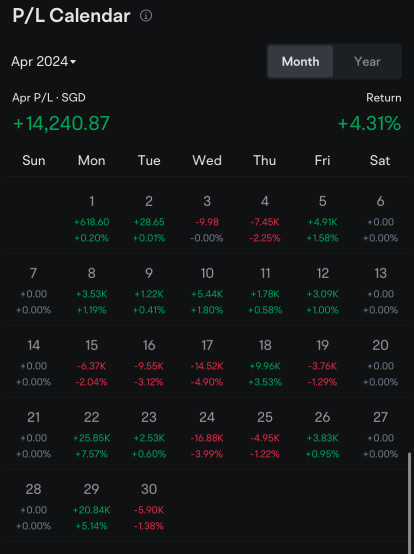

April was a dynamic and volatile month for my portfolio. My investment strategies yielded a profit of SGD 14,240 (USD 7,463), which is a 4.31% money-weighted monthly gain (3.98% simple-gain). The Quarterly earnings and interest rate uncertainty drove high implied volatility, presenting opportunities for premium gains from put selling. The market's reaction to Q1 earnings allowed me to capitalize on well-timed entries.

I make it a point to be transparen...

I make it a point to be transparen...

+2

95

35

13

1. Don’t trust someone who only shares a paper portfolio instead of a real portfolio.

- Paper portfolios are simulations that lack real capital, meaning they don't reflect the psychological pressures and market dynamics of actual trading. This can be misleading as it may only pretend to demonstrate an investor's skill and decision-making in real market scenarios, not their true ability to handle real investments.

2. Don’t trust investors or traders who manage le...

- Paper portfolios are simulations that lack real capital, meaning they don't reflect the psychological pressures and market dynamics of actual trading. This can be misleading as it may only pretend to demonstrate an investor's skill and decision-making in real market scenarios, not their true ability to handle real investments.

2. Don’t trust investors or traders who manage le...

48

3

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)