美股一直牛

commented on

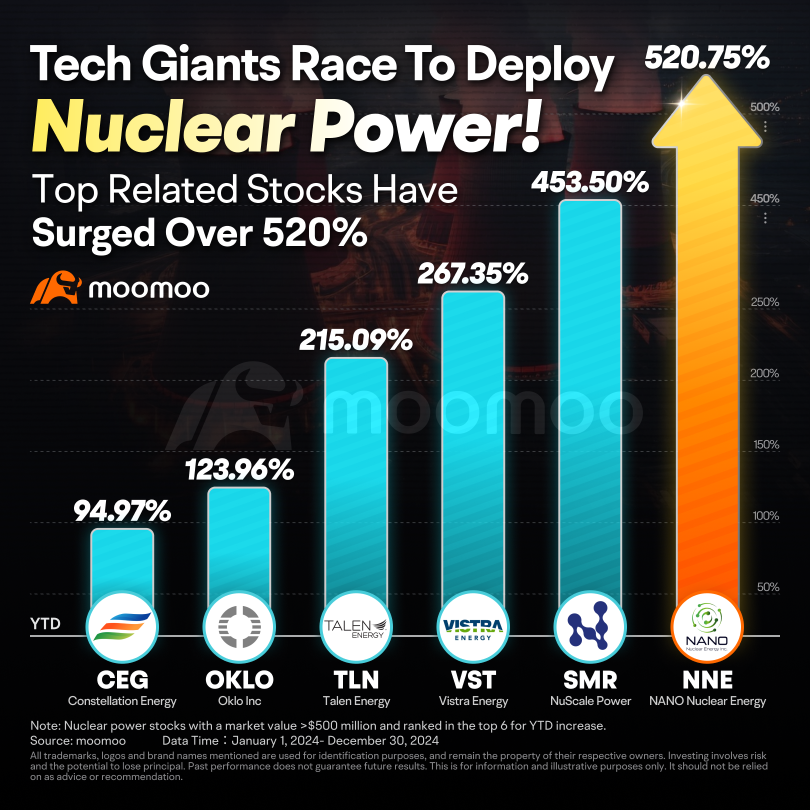

The AI frenzy continues to ramp up, with tech giants racing to deploy nuclear power stocks. This year, Big Techs like $Alphabet-A (GOOGL.US)$, $Microsoft (MSFT.US)$, and $Amazon (AMZN.US)$ have announced direct investments in nuclear power companies or purchases of electricity from them, bringing a long-awaited spring to many nuclear power stocks.

Looking at the year-to-date performance chart, some U.S. nucl...

Looking at the year-to-date performance chart, some U.S. nucl...

86

16

154

$CleanSpark (CLSK.US)$

On December 27, 2024, CleanSpark's Chief Technology Officer Monnig Taylor sold 1,350 shares of common stock at a price of $10.40 per share. The total transaction value was $14,040. This public market transaction was reported as a direct holding transaction.

Even with such low prices, company executives are still selling, this is a rubbish company. While Bitcoin doubled this year, this company dropped by around 50%.

On December 27, 2024, CleanSpark's Chief Technology Officer Monnig Taylor sold 1,350 shares of common stock at a price of $10.40 per share. The total transaction value was $14,040. This public market transaction was reported as a direct holding transaction.

Even with such low prices, company executives are still selling, this is a rubbish company. While Bitcoin doubled this year, this company dropped by around 50%.

Translated

1

美股一直牛

liked

$CleanSpark (CLSK.US)$ fuck this stupid stock!!

3

2

$CleanSpark (CLSK.US)$ This stock is getting weaker and weaker.

Translated

美股一直牛

liked

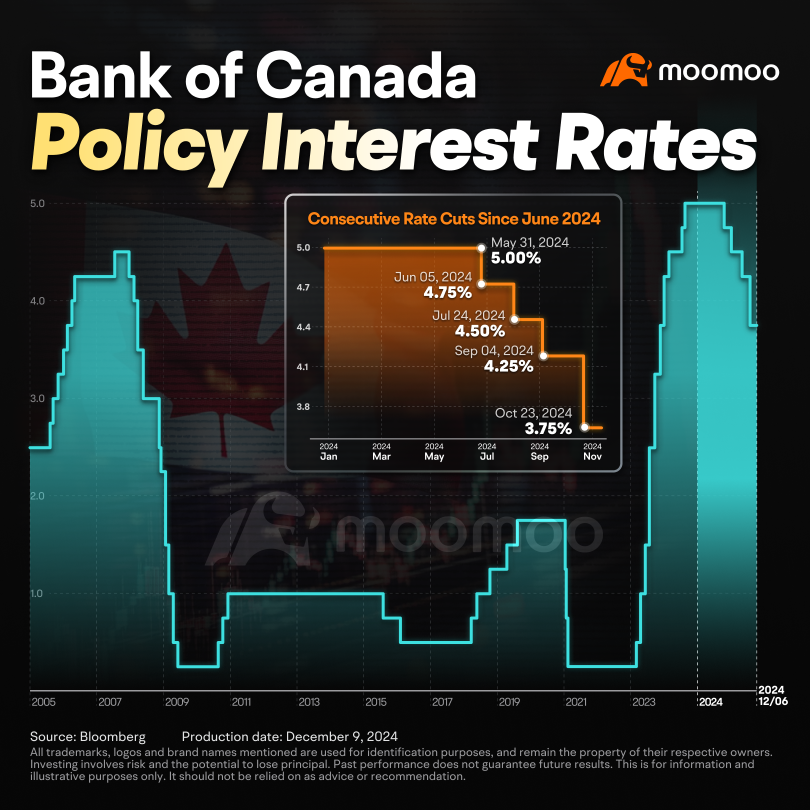

In October, the Bank of Canada (BoC) delivered a jumbo-sized cut, bringing the policy interest rate from 4.25% to 3.75%. This marks the fourth consecutive drop in interest rates since June and represents the BoC's largest rate cut since March 2020. The rate has not been this low since December 2022.

As the BoC prepares to announce its fifth and final interest rate decision of the year on December 11th, most economists are anticipating another cut. T...

As the BoC prepares to announce its fifth and final interest rate decision of the year on December 11th, most economists are anticipating another cut. T...

+6

9

3

4

美股一直牛

liked

Last week's review 👉🏻Market review + position holdings (18/11-22/11 2024)

Market behavior this week:

$NASDAQ 100 Index (.NDX.US)$ Distributed on Monday;

$S&P 500 Index (.SPX.US)$ And $Russell 2000 Index (.RUT.US)$ Accumulating on Monday.

rut>spx>ndx.

NDX has filled the gap above, current price above the 10MA, SPX and RUT both reached historical highs; biotechnology continues to rebound, current price returning to the previous large cap range, semiconductors attempting to rebound, current strength still appears weak, BTC continues to consolidate around 100,000 levels.

Weekly Charts:

The NDX and SPX continue to run smoothly in the second phase, while the RUT has entered the early stage of the second phase.

Market breadth:

Maintaining the green while gradually getting stronger.

Weekly Notes:

In the system's internal trading list, AFRM, TSLA, GME, UPST have slightly downgraded RS; GOVX has low RS with a tendency for more downgrades.

Market Sentiment:

AAII's bullish sentiment continues to cool, even slightly leaning towards bearish sentiment, with a small increase in the market feedback on Friday.

The fear index remains greedy, with the SPX price and options branch being extremely greedy.

Current positions held:

Among them, VERA, TVTX, INOD, and BTCT have already...

Market behavior this week:

$NASDAQ 100 Index (.NDX.US)$ Distributed on Monday;

$S&P 500 Index (.SPX.US)$ And $Russell 2000 Index (.RUT.US)$ Accumulating on Monday.

rut>spx>ndx.

NDX has filled the gap above, current price above the 10MA, SPX and RUT both reached historical highs; biotechnology continues to rebound, current price returning to the previous large cap range, semiconductors attempting to rebound, current strength still appears weak, BTC continues to consolidate around 100,000 levels.

Weekly Charts:

The NDX and SPX continue to run smoothly in the second phase, while the RUT has entered the early stage of the second phase.

Market breadth:

Maintaining the green while gradually getting stronger.

Weekly Notes:

In the system's internal trading list, AFRM, TSLA, GME, UPST have slightly downgraded RS; GOVX has low RS with a tendency for more downgrades.

Market Sentiment:

AAII's bullish sentiment continues to cool, even slightly leaning towards bearish sentiment, with a small increase in the market feedback on Friday.

The fear index remains greedy, with the SPX price and options branch being extremely greedy.

Current positions held:

Among them, VERA, TVTX, INOD, and BTCT have already...

Translated

+31

41

1

will replace my cellphone

$MARA Holdings (MARA.US)$ This kind of company that does not care about shareholder rights, only knows continuous bloodsucking by issuing more shares, I can only cut losses and never touch them again. The management xx.

Translated

7

6

美股一直牛

voted

Hi, mooers!

Welcome back to Maple Market Challenge!

First, let’s examine last week’s vote: What do you like about Air Canada? A whopping 82% of mooers like the stock price soaring after earnings, while just 18% like the actual flying experience.![]() Really? Don’t just take our word for it—head to the comments for some entertaining insights!

Really? Don’t just take our word for it—head to the comments for some entertaining insights!

All of our mooers who voted will receive 10 poin...

Welcome back to Maple Market Challenge!

First, let’s examine last week’s vote: What do you like about Air Canada? A whopping 82% of mooers like the stock price soaring after earnings, while just 18% like the actual flying experience.

All of our mooers who voted will receive 10 poin...

21

26

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

美股一直牛 : It seems that the research and production of Nuclear Power have received significant attention, while the upstream Uranium mines have not performed well.