股市老韭菜

commented on

Translated

6

6

股市老韭菜

liked

$Hang Seng Index (800000.HK)$ $KUAISHOU-W (01024.HK)$ $TENCENT (00700.HK)$ This is the worst time for the market, and the best time to invest. Hong Kong stocks are at a historically low level. In order to derive the bottom of Hong Kong stocks, the Hong Kong Stock Connect was launched. Funds are allocated 1/3 of Hong Kong shares and 2/3A shares. Make a summary of today's Hong Kong stocks and keep records.

1. First investment in Hong Kong stocks, half-time purchase of Hong Kong stock property stocks with a special Hong Kong stock account, Country Garden Service+Sunac Shares+Xuhui Yongsheng Service. Hong Kong stocks fell further, and property prices fell even harsher. Respect market choices, sell at a short-term loss of 25%-30%, and continue to choose more flexible Hong Kong stock stocks. (Big ball No. 2)

2. The A-share pharmaceutical industry began to rise with favorable policy support. The Hong Kong stock Cansino Biotech refused to continue to fall. Over a year, its market value fell by more than 90%. There was no major problem with fundamentals. The market already fully reflected pessimistic expectations. The trading volume was good. It was judged that there was a chance of a rebound. Full position purchases had an average purchase cost of about 45. Stimulated by news of the launch of the Cansino inhaled vaccine in Shanghai, Cansino Biotech's stock price skyrocketed in the short term and became the leader of the recent rebound in Hong Kong stocks. On November 4, the stock price rose by more than 70% on the same day. At a high level, they were all sold in batches, and instead bought Weimei, which was originally optimistic.

3. The reason for buying Weimei is that the fundamentals are getting better, yet the stock price has fallen by more than 90% following the Hong Kong stock market. Tencent's stock price has fallen to the bottom of around 200,...

1. First investment in Hong Kong stocks, half-time purchase of Hong Kong stock property stocks with a special Hong Kong stock account, Country Garden Service+Sunac Shares+Xuhui Yongsheng Service. Hong Kong stocks fell further, and property prices fell even harsher. Respect market choices, sell at a short-term loss of 25%-30%, and continue to choose more flexible Hong Kong stock stocks. (Big ball No. 2)

2. The A-share pharmaceutical industry began to rise with favorable policy support. The Hong Kong stock Cansino Biotech refused to continue to fall. Over a year, its market value fell by more than 90%. There was no major problem with fundamentals. The market already fully reflected pessimistic expectations. The trading volume was good. It was judged that there was a chance of a rebound. Full position purchases had an average purchase cost of about 45. Stimulated by news of the launch of the Cansino inhaled vaccine in Shanghai, Cansino Biotech's stock price skyrocketed in the short term and became the leader of the recent rebound in Hong Kong stocks. On November 4, the stock price rose by more than 70% on the same day. At a high level, they were all sold in batches, and instead bought Weimei, which was originally optimistic.

3. The reason for buying Weimei is that the fundamentals are getting better, yet the stock price has fallen by more than 90% following the Hong Kong stock market. Tencent's stock price has fallen to the bottom of around 200,...

Translated

3

股市老韭菜

liked

$Microsoft (MSFT.US)$ $Tesla (TSLA.US)$ $Amazon (AMZN.US)$ 理性,客观,概率

投资者尽可能摒弃一些日常中的一些思维惯性,

普通投资者往往潜意识中充满着这些词:可

能,大概,也许,差不多,没想到,要是怎么样然后会怎样,有意无意总是把亏损的原因怪

在市场行情不好千万不要有这种思维,日常中可以,投资上绝对不可以哪怕是损一分

钱也是意味着这笔投资的失败,哪怕是你做得再对没赚钱就是投资结果不对,过程再正

有什么用,每一次下单都是投资者自己作出来的决定,所以不要怪自身以外的因素,多反省,

这样就会形成非常良好的反馈。

首先,去掉了模棱两可的思维模式,那么你下单自然每次都会深思熟虑,不再随意。

其次,不再把每次失误潜意识去转移客观,自然反省,那么时间久了,自然能力越来越好,

因为每次充分反省后,同样的错误不可能犯两次的而普通投资者可能反复犯错,甚至他自

己都知道概率不高,就是管不住自己的手.

把投资当成玩不行,当成赌更不行,是建立在客观,理性,概率上,胜率上的决定,同时

考虑最差的结果两者充分结合后的一种可接受的投资结果。

投资者尽可能摒弃一些日常中的一些思维惯性,

普通投资者往往潜意识中充满着这些词:可

能,大概,也许,差不多,没想到,要是怎么样然后会怎样,有意无意总是把亏损的原因怪

在市场行情不好千万不要有这种思维,日常中可以,投资上绝对不可以哪怕是损一分

钱也是意味着这笔投资的失败,哪怕是你做得再对没赚钱就是投资结果不对,过程再正

有什么用,每一次下单都是投资者自己作出来的决定,所以不要怪自身以外的因素,多反省,

这样就会形成非常良好的反馈。

首先,去掉了模棱两可的思维模式,那么你下单自然每次都会深思熟虑,不再随意。

其次,不再把每次失误潜意识去转移客观,自然反省,那么时间久了,自然能力越来越好,

因为每次充分反省后,同样的错误不可能犯两次的而普通投资者可能反复犯错,甚至他自

己都知道概率不高,就是管不住自己的手.

把投资当成玩不行,当成赌更不行,是建立在客观,理性,概率上,胜率上的决定,同时

考虑最差的结果两者充分结合后的一种可接受的投资结果。

1

股市老韭菜

liked

In stock trading, if you don't chase highs and sell lows in the short term, you will be ahead of 50% of people.

If you operate in the medium to long term, reducing frequent trading, you will surpass 70% of people.

If you further use fundamental analysis to select stocks and choose excellent companies in sunrise industries, you will surpass 90% of people.

If you combine entering at the bottom of the monthly chart, you will surpass almost 95% of people.

If you further avoid monotony, diversify your positions, you will surpass almost 98% of people.

If you have idle money for stock trading, without using leverage, in the long run, you will definitely surpass over 99% of people...

Planning to adhere to the above points repeatedly, achieving financial freedom is just a matter of time. $Amazon (AMZN.US)$ $Tesla (TSLA.US)$ $Microsoft (MSFT.US)$

If you operate in the medium to long term, reducing frequent trading, you will surpass 70% of people.

If you further use fundamental analysis to select stocks and choose excellent companies in sunrise industries, you will surpass 90% of people.

If you combine entering at the bottom of the monthly chart, you will surpass almost 95% of people.

If you further avoid monotony, diversify your positions, you will surpass almost 98% of people.

If you have idle money for stock trading, without using leverage, in the long run, you will definitely surpass over 99% of people...

Planning to adhere to the above points repeatedly, achieving financial freedom is just a matter of time. $Amazon (AMZN.US)$ $Tesla (TSLA.US)$ $Microsoft (MSFT.US)$

Translated

10

1

股市老韭菜

liked

$SPDR S&P 500 ETF (SPY.US)$

yall have a good weekend. small account growing on the moo

yall have a good weekend. small account growing on the moo

6

股市老韭菜

commented on

Looking at the weekly K-line chart, it seems that it is about to break the previous low point. Especially with the MACD and KDJ crossing downward again. Be cautious.

$Apple (AAPL.US)$

$Apple (AAPL.US)$

Translated

Expand

Expand 4

股市老韭菜

commented on

Year-to-Date Performance:

1. $Meta Platforms (META.US)$ : -73%

2. $Amazon (AMZN.US)$ : -46%

3. $Apple (AAPL.US)$ : -23%

4. $Netflix (NFLX.US)$ : -55%

5. $Alphabet-A (GOOGL.US)$ : -40%

6. $Tesla (TSLA.US)$ : -46%

7. $PayPal (PYPL.US)$ : -61%

8. $Nike (NKE.US)$ : -45%

9. $NVIDIA (NVDA.US)$ : -58%

Over 90% of tech stocks are now in bear market territory.

This is beginning to look worse than 2001.

1. $Meta Platforms (META.US)$ : -73%

2. $Amazon (AMZN.US)$ : -46%

3. $Apple (AAPL.US)$ : -23%

4. $Netflix (NFLX.US)$ : -55%

5. $Alphabet-A (GOOGL.US)$ : -40%

6. $Tesla (TSLA.US)$ : -46%

7. $PayPal (PYPL.US)$ : -61%

8. $Nike (NKE.US)$ : -45%

9. $NVIDIA (NVDA.US)$ : -58%

Over 90% of tech stocks are now in bear market territory.

This is beginning to look worse than 2001.

7

6

股市老韭菜

liked

Markets to pay attention to as an investor:

• Fintech

• Esports

• Robotics

• Cannabis

• Blockchain

• Electric cars

• Online education

• Big data analytics

These industries are only going to get bigger. $Amazon (AMZN.US)$ $Tesla (TSLA.US)$ $Coinbase (COIN.US)$ $Invesco QQQ Trust (QQQ.US)$ $SPDR S&P 500 ETF (SPY.US)$

• Fintech

• Esports

• Robotics

• Cannabis

• Blockchain

• Electric cars

• Online education

• Big data analytics

These industries are only going to get bigger. $Amazon (AMZN.US)$ $Tesla (TSLA.US)$ $Coinbase (COIN.US)$ $Invesco QQQ Trust (QQQ.US)$ $SPDR S&P 500 ETF (SPY.US)$

4

股市老韭菜

liked and commented on

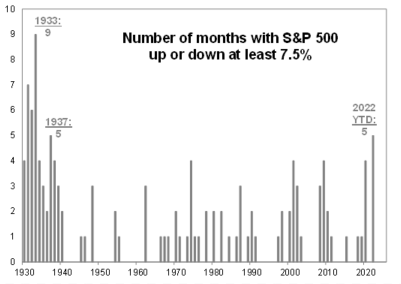

Have you wondered: what is the number of months in 2022 that the $S&P 500 Index (.SPX.US)$ has been UP or DOWN at least 7.5%?

5 times! Not much, a lot, an outlier ?

Well, that is the most (at par) since 1937! That is since pretty much everybody started investing & trading. One more occurrence in November/December and we have one for the history books in 2022 ... let that sink in!

Choppy market, trying to time it ?

$Tesla (TSLA.US)$ $Apple (AAPL.US)$

5 times! Not much, a lot, an outlier ?

Well, that is the most (at par) since 1937! That is since pretty much everybody started investing & trading. One more occurrence in November/December and we have one for the history books in 2022 ... let that sink in!

Choppy market, trying to time it ?

$Tesla (TSLA.US)$ $Apple (AAPL.US)$

4

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

股市老韭菜 102869948coco : There is bound to be a wave of rise.