The profit scared me, but the key is knowing that being in cash also has returns, so I feel very peaceful.![]() This product is quite good👍

This product is quite good👍

Translated

1

股海面包

voted

Hello Mooers! ![]()

This August 2023, $Futu Holdings Ltd (FUTU.US)$ MooMoo have an exciting promotion for your moolah in your MooMoo Cash Plus. Mooers can get 5.8% p.a. guaranteed returns for 30 days after fulfill either one of them:

![]() Up to SGD 143 for S$30k MooMoo Cash Plus subscription after deposit S$10k and perform 5 buy trades.

Up to SGD 143 for S$30k MooMoo Cash Plus subscription after deposit S$10k and perform 5 buy trades.

![]() Up to SGD 380 for S$80k MooMoo Cash Plus subscription afte...

Up to SGD 380 for S$80k MooMoo Cash Plus subscription afte...

This August 2023, $Futu Holdings Ltd (FUTU.US)$ MooMoo have an exciting promotion for your moolah in your MooMoo Cash Plus. Mooers can get 5.8% p.a. guaranteed returns for 30 days after fulfill either one of them:

13

14

股海面包

liked

$E-mini NASDAQ 100 Futures(DEC4) (NQmain.US)$ Too fierce...

Translated

2

11

股海面包

liked

$Nasdaq Composite Index (.IXIC.US)$ This garbage Powell is really good at it, going back and forth. If he hadn't been dovish before, kept being hawkish, the market wouldn't have to go through the long and painful process of boiling frogs in warm water. What this garbage is saying now won't be trusted by the market either. Under the leadership of this garbage, the Fed's credibility has been lost almost entirely.

Translated

4

股海面包

liked

Current situation:

1. Stocks are trading like the Fed won't pivot

2. Bonds are trading like the Fed pivoted

3. Gold is trading like inflation is 15%

4. Crude oil is trading like we are in a recession

5. $CBOE Volatility S&P 500 Index (.VIX.US)$ is trading like we are in a bull market

Things still don't add up.

$Nasdaq Composite Index (.IXIC.US)$ $Invesco QQQ Trust (QQQ.US)$ $ProShares UltraPro Short QQQ ETF (SQQQ.US)$ $Dow Jones Industrial Average (.DJI.US)$ $SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ $Apple (AAPL.US)$

1. Stocks are trading like the Fed won't pivot

2. Bonds are trading like the Fed pivoted

3. Gold is trading like inflation is 15%

4. Crude oil is trading like we are in a recession

5. $CBOE Volatility S&P 500 Index (.VIX.US)$ is trading like we are in a bull market

Things still don't add up.

$Nasdaq Composite Index (.IXIC.US)$ $Invesco QQQ Trust (QQQ.US)$ $ProShares UltraPro Short QQQ ETF (SQQQ.US)$ $Dow Jones Industrial Average (.DJI.US)$ $SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ $Apple (AAPL.US)$

20

3

股海面包

commented on

$ProShares Ultra VIX Short-Term Futures ETF (UVXY.US)$ I'm speechless. When the large cap rises and it falls, there may be understandable reasons. When the large cap falls, it falls as well.![]()

Translated

1

4

股海面包

voted

Spoiler:

At the end of this post, there is a chance for you to win points!

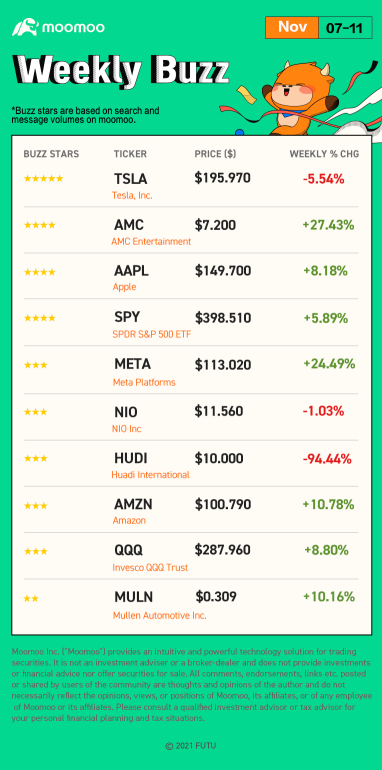

Happy Monday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Make Your Choices

Buzzing Stocks List & Mooers Comments

Every cloud has a silver lining. The S&P 500 posted its best week since June, adding...

At the end of this post, there is a chance for you to win points!

Happy Monday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Make Your Choices

Buzzing Stocks List & Mooers Comments

Every cloud has a silver lining. The S&P 500 posted its best week since June, adding...

+1

55

53

股海面包

commented on

When to start investing? The standard answer you heard is probably NOW!

This is true to some extent, but if we dig a bit deeper, a better interpretation might be: the best time to start learning about investing is NOW, but the best time to invest is when an asset's market value is below intrinsic value.

Amid such a sharp pullback from last December, some investors have cashed in on their money, waiting for the"right" moment to enter trades again. F...

This is true to some extent, but if we dig a bit deeper, a better interpretation might be: the best time to start learning about investing is NOW, but the best time to invest is when an asset's market value is below intrinsic value.

Amid such a sharp pullback from last December, some investors have cashed in on their money, waiting for the"right" moment to enter trades again. F...

122

1210

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)