胡说八道之一步

liked

When mentioning Amazon, the first thing that comes to mind for most people may be the world's largest e-commerce platform or the leading AWS cloud computing market. However, this innovative company is quietly entering a completely different field: nuclear power generation.

With the promotion of global Carbon Neutrality goals, clean energy is becoming the focus of global attention. While solar energy and wind energy are popular, their instability and regional limitations have brought nuclear energy back to the center stage. In particular, small modular reactors (SMRs) are attracting more and more companies with their modular design, cost control, and higher safety standards.

Microsoft recently partnered with Constellation Energy to plan the restart of the Three Mile Island nuclear power plant to provide stable power for its Datacenters. Google, on the other hand, has chosen to work with Kairos Power to explore new nuclear energy solutions for its Global Datacenters. Amazon is clearly not willing to fall behind. According to PBS News, it has become the largest investor in the Hanford Nuclear Project in Washington state, an initiative to build four small modular nuclear reactors with a total capacity of 320 megawatts. In the future, this plan could even expand to 12 reactors, with a total capacity of nearly 960 megawatts, equivalent to the output level of a traditional large nuclear power plant.

For Amazon, this is not only about providing stable power to the AWS Datacenters in the Northwest, but also a potential long-term strategic investment. Current Global Datacenters consume astonishing amounts of electricity, and...

With the promotion of global Carbon Neutrality goals, clean energy is becoming the focus of global attention. While solar energy and wind energy are popular, their instability and regional limitations have brought nuclear energy back to the center stage. In particular, small modular reactors (SMRs) are attracting more and more companies with their modular design, cost control, and higher safety standards.

Microsoft recently partnered with Constellation Energy to plan the restart of the Three Mile Island nuclear power plant to provide stable power for its Datacenters. Google, on the other hand, has chosen to work with Kairos Power to explore new nuclear energy solutions for its Global Datacenters. Amazon is clearly not willing to fall behind. According to PBS News, it has become the largest investor in the Hanford Nuclear Project in Washington state, an initiative to build four small modular nuclear reactors with a total capacity of 320 megawatts. In the future, this plan could even expand to 12 reactors, with a total capacity of nearly 960 megawatts, equivalent to the output level of a traditional large nuclear power plant.

For Amazon, this is not only about providing stable power to the AWS Datacenters in the Northwest, but also a potential long-term strategic investment. Current Global Datacenters consume astonishing amounts of electricity, and...

Translated

3

2

胡说八道之一步

liked

In 2024, one of the focal points of the stock market is undoubtedly the trend of stock splits. From Nvidia to Broadcom, and then to Super Micro Computer, the 10:1 split of these technology giants not only significantly lowers the stock price threshold but also allows investors to enjoy a significant premium in the 12 months following the split. As these giants complete their "split shows," investors can't help but begin to speculate: who will be the star of the split in 2025?

Among many speculations, Meta Platforms undoubtedly occupies the spotlight. As the global social media dominator, Meta is not only one of the "Magnificent Seven" (seven major technology giants) but also the only member that has not experienced a stock split. After its stock price surged to $620 (as of December 10, 2024), the topic of whether to split or not has also gained popularity.

The business model of Meta is almost textbook-level in terms of attracting money. Despite the market's hot discussion of AI technology, the core of Meta's revenue still comes from advertising. In the first three quarters of 2024, out of its $116.1 billion revenue, as much as $113.8 billion came from the advertising business. Platforms like Facebook, Instagram, WhatsApp, Threads attracted a total of 3.29 billion daily active users, making it not only the largest social empire in human history but also the most indispensable traffic entrance for global advertisers. Me...

Among many speculations, Meta Platforms undoubtedly occupies the spotlight. As the global social media dominator, Meta is not only one of the "Magnificent Seven" (seven major technology giants) but also the only member that has not experienced a stock split. After its stock price surged to $620 (as of December 10, 2024), the topic of whether to split or not has also gained popularity.

The business model of Meta is almost textbook-level in terms of attracting money. Despite the market's hot discussion of AI technology, the core of Meta's revenue still comes from advertising. In the first three quarters of 2024, out of its $116.1 billion revenue, as much as $113.8 billion came from the advertising business. Platforms like Facebook, Instagram, WhatsApp, Threads attracted a total of 3.29 billion daily active users, making it not only the largest social empire in human history but also the most indispensable traffic entrance for global advertisers. Me...

Translated

loading...

6

2

胡说八道之一步

liked

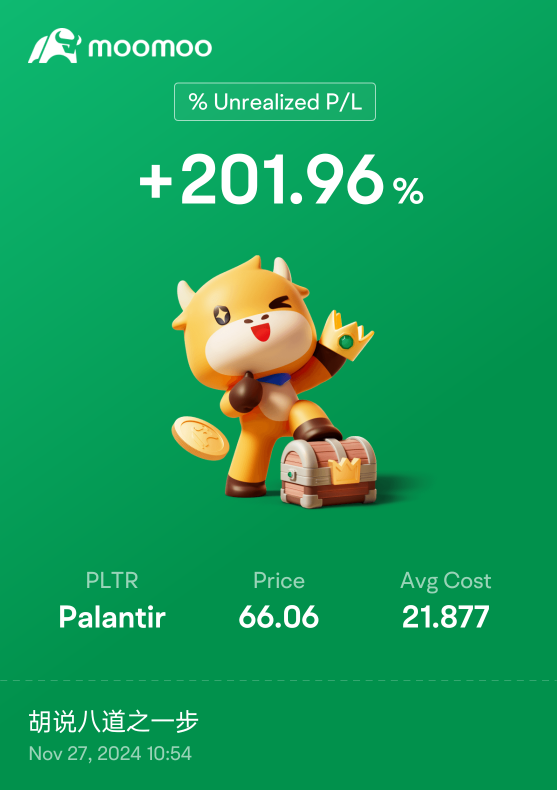

2024 was a brilliant year for Palantir Technologies (PLTR -5.08%). As one of the key platforms driving the wave of artificial intelligence (AI), this company has attracted a lot of attention. Its stock price has soared by more than 300% this year, and it is also ranked in the S&P 500 index.

However, 2024 is coming to an end, and Palantir probably still has one last “killer weapon” hidden. Next, let's discuss why December 13 is significant for Palantir investors and whether this is a good time to buy the stock. December 13, another important moment for Palantir?

This year, December 13th coincides with Friday. Although “Black Friday” is often associated with bad luck and superstition, there may be more good news for Palantir's investors. Next Friday, the Nasdaq 100 index will be readjusted. This means that a new batch of companies will be included in this high-profile index to replace stocks that are no longer eligible.

This is significant for Palantir, as the NASDAQ 100 generally represents high-growth stocks and potential opportunities to surpass the S&P 500. As early as September 6, Palantir announced its official entry into the S&P 500 index. Since that day, by the close of trading on December 5, its stock price had soared 1...

However, 2024 is coming to an end, and Palantir probably still has one last “killer weapon” hidden. Next, let's discuss why December 13 is significant for Palantir investors and whether this is a good time to buy the stock. December 13, another important moment for Palantir?

This year, December 13th coincides with Friday. Although “Black Friday” is often associated with bad luck and superstition, there may be more good news for Palantir's investors. Next Friday, the Nasdaq 100 index will be readjusted. This means that a new batch of companies will be included in this high-profile index to replace stocks that are no longer eligible.

This is significant for Palantir, as the NASDAQ 100 generally represents high-growth stocks and potential opportunities to surpass the S&P 500. As early as September 6, Palantir announced its official entry into the S&P 500 index. Since that day, by the close of trading on December 5, its stock price had soared 1...

Translated

17

5

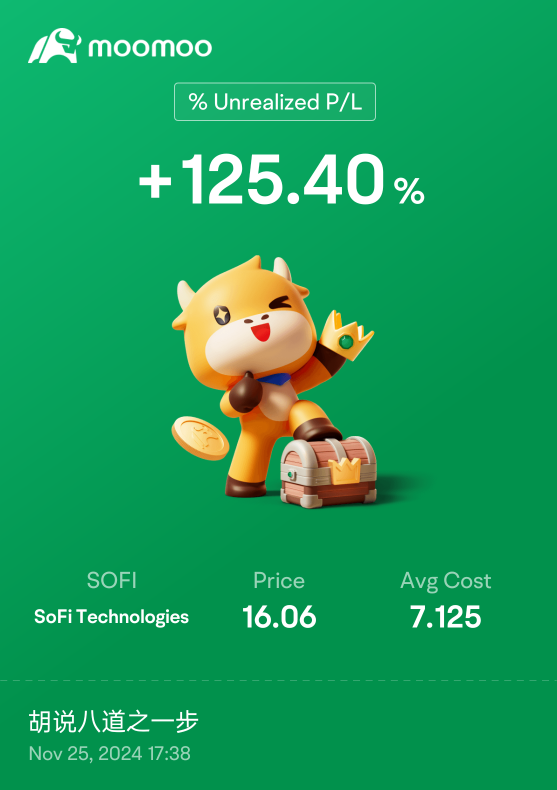

Thanks to S&P Global Market Intelligence for providing the data. This maneuver mainly relied on three strategies: delivering an impressive third-quarter performance report at the end of October; boosting investor confidence with its lending business; and the post-presidential election economic recovery and market expectations of interest rate cuts, which fueled the bullish sentiment.

SoFi, as a company from its IPO several years ago until now, can be considered a "stimulus stock". It disrupted traditional banks, attracted a large number of young social media fans, but also because it was labeled as a "risky technology stock", experienced ups and downs like a roller coaster. However, now SoFi has finally turned the tide. With four consecutive quarters of GAAP net income, it has finally proven itself. Moreover, the management confidently states that this profitability trend will continue.

Sounds good, right? But there is a small twist. In recent years, the market's sentiment towards SoFi has been somewhat complex, mainly because its main business is lending, and loan revenue has been under pressure. Although lending is SoFi's "cornerstone", the management had long realized that you cannot put all your eggs in one basket, so they began aggressively expanding their platform business. The third-quarter financial report shows that SoFi's financial services business grew by 102% year-on-year, with an incredibly strong momentum. SoFi is now not just a lender; it also provides various digital financial services such as banks accounts, investments, insurance, and more...

SoFi, as a company from its IPO several years ago until now, can be considered a "stimulus stock". It disrupted traditional banks, attracted a large number of young social media fans, but also because it was labeled as a "risky technology stock", experienced ups and downs like a roller coaster. However, now SoFi has finally turned the tide. With four consecutive quarters of GAAP net income, it has finally proven itself. Moreover, the management confidently states that this profitability trend will continue.

Sounds good, right? But there is a small twist. In recent years, the market's sentiment towards SoFi has been somewhat complex, mainly because its main business is lending, and loan revenue has been under pressure. Although lending is SoFi's "cornerstone", the management had long realized that you cannot put all your eggs in one basket, so they began aggressively expanding their platform business. The third-quarter financial report shows that SoFi's financial services business grew by 102% year-on-year, with an incredibly strong momentum. SoFi is now not just a lender; it also provides various digital financial services such as banks accounts, investments, insurance, and more...

Translated

16

胡说八道之一步

reacted to and commented on

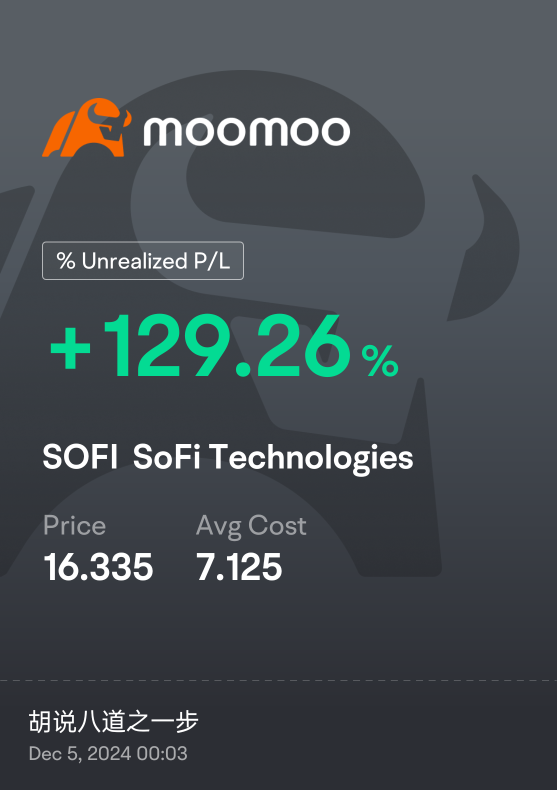

Hello everyone! I am Hu Shuo Badao Yibu, and my investment journey began in 2019. At that time, I met a mentor named Alex, who benefited me greatly. He is a mentor at VI Colleges in Singapore. He taught me a phrase that I remember to this day: 'The best investment is in yourself.' Additionally, he helped me understand the importance of emotional stability in investments.

In early 2020, the global stock market plummeted due to the impact of the pandemic, marking the first real-life 'battle' on my investment journey. Losses were discouraging, but through continuous learning and strengthening my emotional management skills, I gradually found my pace, eventually stabilizing and reaping significant returns in the later phase. This experience made me realize that investment is not just about financial competition but also a test of psychological resilience.

Possibly due to being a Libra, my investment style tends to be conservative, but occasionally I take some small risks (which only account for less than 10% of my investment portfolio). I believe in diversified investments while insisting on investing only in areas I understand. My favorite strategy is the Recycle Capital Strategy, which not only reduces risks but also offers peace of mind. What's great is that I prefer long-term investments, so I don't have to watch the stock market every day and can live more relaxed!

Currently, I use moomoo as my primary investment platform, which is the fourth platform I have used (previously used eToro, T...

In early 2020, the global stock market plummeted due to the impact of the pandemic, marking the first real-life 'battle' on my investment journey. Losses were discouraging, but through continuous learning and strengthening my emotional management skills, I gradually found my pace, eventually stabilizing and reaping significant returns in the later phase. This experience made me realize that investment is not just about financial competition but also a test of psychological resilience.

Possibly due to being a Libra, my investment style tends to be conservative, but occasionally I take some small risks (which only account for less than 10% of my investment portfolio). I believe in diversified investments while insisting on investing only in areas I understand. My favorite strategy is the Recycle Capital Strategy, which not only reduces risks but also offers peace of mind. What's great is that I prefer long-term investments, so I don't have to watch the stock market every day and can live more relaxed!

Currently, I use moomoo as my primary investment platform, which is the fourth platform I have used (previously used eToro, T...

Translated

loading...

121

23

17

胡说八道之一步

commented on

In 2024, Palantir Technologies has become one of the brightest stars in the stock market. As of now, its stock price has risen by about 275%. Such amazing returns naturally attract numerous investors and prompt many to search for the next "Palantir", especially in the current hot field of artificial intelligence (AI). Recently, SoundHound AI has been considered as one of the stocks with similar potential. So, is it really possible for SoundHound AI to become the next Palantir?

From the company name itself, SoundHound AI's core business is closely related to "sound". The company has developed an AI-based voice recognition technology that can convert voice input into data formats usable by AI. This technology has been applied in multiple fields, such as fast-food chain drive-thrus, in-car voice assistants, and banking services.

This is just the beginning, one can imagine, accurate voice input has a great demand in various application scenarios of AI models, which has brought tremendous growth opportunities for SoundHound AI's business. In the third quarter of 2024, SoundHound AI achieved $25 million in revenue, an 89% year-on-year growth. Although compared to Palantir's $0.725 billion...

From the company name itself, SoundHound AI's core business is closely related to "sound". The company has developed an AI-based voice recognition technology that can convert voice input into data formats usable by AI. This technology has been applied in multiple fields, such as fast-food chain drive-thrus, in-car voice assistants, and banking services.

This is just the beginning, one can imagine, accurate voice input has a great demand in various application scenarios of AI models, which has brought tremendous growth opportunities for SoundHound AI's business. In the third quarter of 2024, SoundHound AI achieved $25 million in revenue, an 89% year-on-year growth. Although compared to Palantir's $0.725 billion...

Translated

loading...

18

4

2

胡说八道之一步

liked

Meta Platforms (NASDAQ: META), as the world's largest social media company, has seen its stock price rise by nearly 660% over the past decade. This growth has been driven by the rapid expansion of its core apps (Facebook, Instagram, Messenger, and WhatsApp) and a significant increase in advertising revenue. Currently, Meta and Google, under Alphabet (NASDAQ: GOOG, GOOGL), have formed an almost monopolistic duopoly in the digital advertising markets of several countries.

In contrast, Alphabet's stock price has risen by about 500% over the past decade. This growth has been primarily driven by Google's search engine, YouTube, and cloud computing platform. These services, along with market-leading products like the Chrome browser, Android operating system, and Gmail, provide a wealth of data for its core advertising business. However, Google is at a disadvantage in cloud infrastructure competition and has failed to leverage its dominant position in the search market to launch a sustainable successful social media platform. Additionally, Google faces challenges such as the rise of generative AI search engines (like OpenAI's SearchGPT), antitrust investigations, and demands from the U.S. Department of Justice (DOJ) to divest its Chrome business.

As of now, Meta's market cap is $1.4 trillion...

In contrast, Alphabet's stock price has risen by about 500% over the past decade. This growth has been primarily driven by Google's search engine, YouTube, and cloud computing platform. These services, along with market-leading products like the Chrome browser, Android operating system, and Gmail, provide a wealth of data for its core advertising business. However, Google is at a disadvantage in cloud infrastructure competition and has failed to leverage its dominant position in the search market to launch a sustainable successful social media platform. Additionally, Google faces challenges such as the rise of generative AI search engines (like OpenAI's SearchGPT), antitrust investigations, and demands from the U.S. Department of Justice (DOJ) to divest its Chrome business.

As of now, Meta's market cap is $1.4 trillion...

Translated

loading...

15

1

5

On the gene therapy track, Cabana Life Sciences (CABA) is becoming the focus of investors' attention. Recently, as its core therapy enters a critical clinical stage, the company's stock price has seen a short-term rise. However, the financial data has sparked contradictory views on its future in the market.

Financial Data Analysis: Pressure from High R&D Investment.

According to CABA's latest third-quarter earnings report: As of this quarter, CABA has not yet realized product revenue, and its main source of revenue is research and development milestone payments from partners, reaching $25 million, a 30% year-on-year increase. As for research and development expenses this quarter, R&D expenses were $0.105 billion, accounting for 75% of total expenses, nearly a 40% increase compared to the same period last year. This reflects the company's key investment in its core products such as CABA-101 and CABA-202.

However, the company's operation losses reached $90 million, indicating that its high-cost model remains a huge challenge.

In terms of cash, the current cash and cash equivalents amount to approximately $0.22 billion, which, according to management forecasts, is sufficient to support the company's operations until mid-2025.

CABA's business model typically exhibits the characteristic of "high investment, low income", which is not uncommon in biotechnology companies, but also indicates its high risk. Investors need to pay attention to the following risks:

1. Financial pressure: Although the current cash reserves are sufficient to support short-term operations, if the core therapy fails to launch on schedule, the company may face financial pressure.

Financial Data Analysis: Pressure from High R&D Investment.

According to CABA's latest third-quarter earnings report: As of this quarter, CABA has not yet realized product revenue, and its main source of revenue is research and development milestone payments from partners, reaching $25 million, a 30% year-on-year increase. As for research and development expenses this quarter, R&D expenses were $0.105 billion, accounting for 75% of total expenses, nearly a 40% increase compared to the same period last year. This reflects the company's key investment in its core products such as CABA-101 and CABA-202.

However, the company's operation losses reached $90 million, indicating that its high-cost model remains a huge challenge.

In terms of cash, the current cash and cash equivalents amount to approximately $0.22 billion, which, according to management forecasts, is sufficient to support the company's operations until mid-2025.

CABA's business model typically exhibits the characteristic of "high investment, low income", which is not uncommon in biotechnology companies, but also indicates its high risk. Investors need to pay attention to the following risks:

1. Financial pressure: Although the current cash reserves are sufficient to support short-term operations, if the core therapy fails to launch on schedule, the company may face financial pressure.

Translated

loading...

19

胡说八道之一步

commented on

Have you ever heard of a company that is considered a "secret weapon" by the USA government and jokingly referred to by investors as the "Tesla of the data world"? That's right, it's Palantir Technologies (PLTR). Despite carrying the "mysterious label" since its inception, it has now caused a stir in the investment community. Some say it is the pioneer of the AI revolution, while others question whether it is an "overhyped stock". So, is PLTR an "upgrade" or a "gamble"? Today, let's talk about this company.

When talking about the "story" of PLTR, not mentioning its assistance to the USA government in epidemic prevention and control would be like talking about the Three-Body Problem without mentioning the Dark Forest. In 2020, using its Gotham platform, PLTR assisted the Centers for Disease Control and Prevention (CDC) in analyzing epidemic data and predicting epidemic trends in real-time. This not only saved countless lives but also showcased the enormous potential of data analysis in the public domain. Looking at the figures: In the 2023 fiscal year, PLTR achieved an 18% revenue growth rate, with free cash flow reaching 0.443 billion US dollars, accounting for a significant 22%. What's even more noteworthy is its profitability turnaround, shifting from previous losses to entering the GAAP profit phase, indicating that PLTR has found its rhythm in commercialization and sustainable development.

If PLTR is called the "Three-Body company" in the AI field, it is not an exaggeration. Why? Because it is both aloof and complex: its core technology is difficult to replicate...

When talking about the "story" of PLTR, not mentioning its assistance to the USA government in epidemic prevention and control would be like talking about the Three-Body Problem without mentioning the Dark Forest. In 2020, using its Gotham platform, PLTR assisted the Centers for Disease Control and Prevention (CDC) in analyzing epidemic data and predicting epidemic trends in real-time. This not only saved countless lives but also showcased the enormous potential of data analysis in the public domain. Looking at the figures: In the 2023 fiscal year, PLTR achieved an 18% revenue growth rate, with free cash flow reaching 0.443 billion US dollars, accounting for a significant 22%. What's even more noteworthy is its profitability turnaround, shifting from previous losses to entering the GAAP profit phase, indicating that PLTR has found its rhythm in commercialization and sustainable development.

If PLTR is called the "Three-Body company" in the AI field, it is not an exaggeration. Why? Because it is both aloof and complex: its core technology is difficult to replicate...

Translated

22

3

1

胡说八道之一步

liked

$SoFi Technologies (SOFI.US)$

SoFi, the company that once struggled in the fintech industry, recently ushered in its 'turnaround year'. In the third quarter of 2024, SoFi achieved profitability for the first time, with a net income of 61 million USD, far exceeding the 0.277 billion USD loss in the same period last year. This change marks the company's transition from a heavily burdened startup to a track of profitability and stable growth. Its total revenue reached 0.697 billion USD, a 30% increase from last year. This growth is not just a number, it indicates that SoFi is reaping the fruits of many years of technological innovation and market layout. The company's financial services and technology platform business also achieved over 50% growth, indicating that its ecosystem is becoming more mature, capable of offering more financial products and services than ever before. However, SoFi's profitability is not accidental. In addition to its own technological innovation and optimized cost structure, the policy changes in the financial industry during Trump's second term also provided greater opportunities for SoFi. The Trump administration relaxed regulations, supported the development of fintech, and created a favorable policy environment for innovative enterprises like SoFi. In this macro environment, SoFi has attracted an increasing number of users through its comprehensive financial platform, especially millennials and Gen Z, who prefer to manage and invest their wealth digitally. In the third quarter of this year, SoFi's memberships reached 9.4 million, a 35% increase compared to last year. This growth is closely related to its product innovation, especially zero-commission investment trades, high-yield savings accounts, and convenient personal loan services, which have become important factors in expanding its user base. Faced with fluctuations in the US economy, more and more consumers are choosing digital platforms like SoFi to manage their finances instead of relying on traditional banks. The stock market has responded positively to SoFi's performance. After the financial report was released, SoFi's stock price jumped to $15.60, with a year-to-date increase of nearly 150%. Investors are confident in its future growth potential, with some analysts even raising the target price to $16. All of these demonstrate the market's high recognition of SoFi's profitability and growth prospects. With the improvement in profitability, SoFi has raised its expectations for full-year performance, expecting adjusted revenue to be between 2.535 billion and 2.55 billion USD, exceeding previous forecasts. This optimistic outlook is not only due to SoFi's steady development, but also reflects its precise grasp of future financial market opportunities. Overall, SoFi's transformation provides a valuable example for the fintech industry. From loss to profit, from innovation to expansion, it not only proves the viability of its business model, but also demonstrates how digital financial platforms can establish a presence in rapidly changing markets. With the support of the Trump administration's policies, SoFi is poised to continue leading the fintech field and become an important player in the industry.

SoFi, the company that once struggled in the fintech industry, recently ushered in its 'turnaround year'. In the third quarter of 2024, SoFi achieved profitability for the first time, with a net income of 61 million USD, far exceeding the 0.277 billion USD loss in the same period last year. This change marks the company's transition from a heavily burdened startup to a track of profitability and stable growth. Its total revenue reached 0.697 billion USD, a 30% increase from last year. This growth is not just a number, it indicates that SoFi is reaping the fruits of many years of technological innovation and market layout. The company's financial services and technology platform business also achieved over 50% growth, indicating that its ecosystem is becoming more mature, capable of offering more financial products and services than ever before. However, SoFi's profitability is not accidental. In addition to its own technological innovation and optimized cost structure, the policy changes in the financial industry during Trump's second term also provided greater opportunities for SoFi. The Trump administration relaxed regulations, supported the development of fintech, and created a favorable policy environment for innovative enterprises like SoFi. In this macro environment, SoFi has attracted an increasing number of users through its comprehensive financial platform, especially millennials and Gen Z, who prefer to manage and invest their wealth digitally. In the third quarter of this year, SoFi's memberships reached 9.4 million, a 35% increase compared to last year. This growth is closely related to its product innovation, especially zero-commission investment trades, high-yield savings accounts, and convenient personal loan services, which have become important factors in expanding its user base. Faced with fluctuations in the US economy, more and more consumers are choosing digital platforms like SoFi to manage their finances instead of relying on traditional banks. The stock market has responded positively to SoFi's performance. After the financial report was released, SoFi's stock price jumped to $15.60, with a year-to-date increase of nearly 150%. Investors are confident in its future growth potential, with some analysts even raising the target price to $16. All of these demonstrate the market's high recognition of SoFi's profitability and growth prospects. With the improvement in profitability, SoFi has raised its expectations for full-year performance, expecting adjusted revenue to be between 2.535 billion and 2.55 billion USD, exceeding previous forecasts. This optimistic outlook is not only due to SoFi's steady development, but also reflects its precise grasp of future financial market opportunities. Overall, SoFi's transformation provides a valuable example for the fintech industry. From loss to profit, from innovation to expansion, it not only proves the viability of its business model, but also demonstrates how digital financial platforms can establish a presence in rapidly changing markets. With the support of the Trump administration's policies, SoFi is poised to continue leading the fintech field and become an important player in the industry.

Translated

14

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)