花样年华

liked

Translated

3

花样年华

liked

Shiba recently gained many followers due to its giagantic returns. Everyone who was holding few dollars of shiba became a millionaire now. As, an investor bought $8000 worth of shiba in March 2020 is worth around $5.7 billion right now. But we know that these extreme gains will have to kill/destroy something to reach this gains. There are certain things we know and we dont know about the crypto currency trading. We know that it's an unregulated market, thus practically the real value of every coin is zero. So, why these people are millionaires or billionaires?

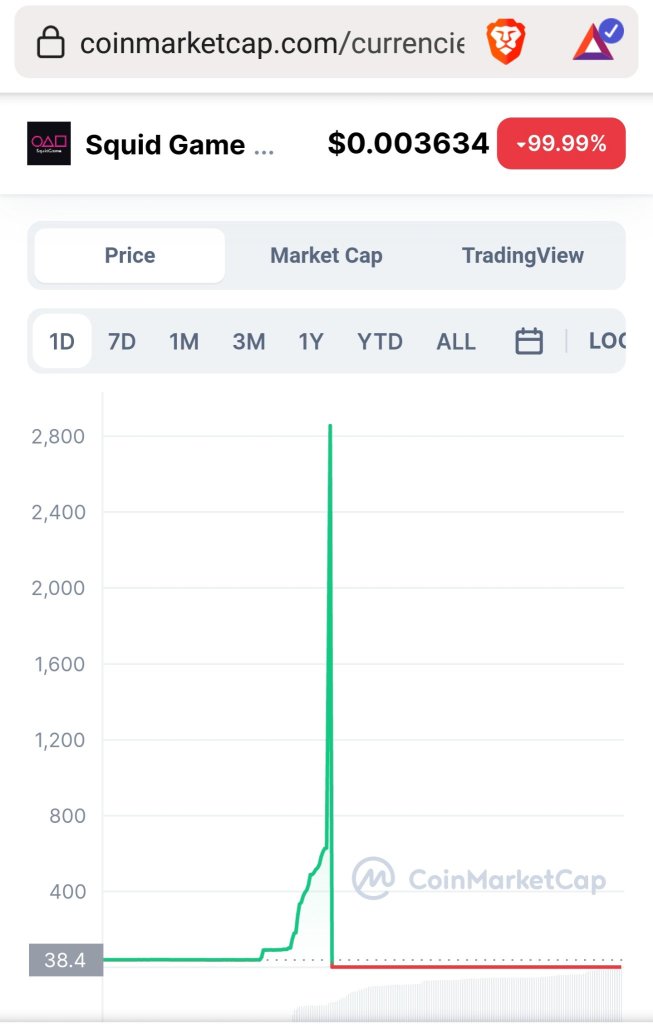

1. Since its publically traded and unregulated, it can be easily manipulated to a point where it reaches to an unimaginably value. Thus, even if the coin is traded at that larger value, it creates an illusion that the coin is worth that amount. But once a larger portion of its quantity hits the market, and all buyers are fulfilled, it hits the ground. For example the recent event of the SQUID game token, it's a genuine token which was created by squid game company creators. It was a good concept, their website also had online squid games. However, creators sold their coins on market because it reached a crazy high amount. Many news sources say that the creators backed out of the project. However, I believe they sold it before leaving.

If someone is holding 30-50% of an asset which was created on a borrowed blockchain network(Binance network) for free without any effort. why wouldn't they not sell it at $2800 per coin which they literally made for $0.

who would bear the loss you might think?

The people who are trading this coin on buyer side starting from $0.1 to upto $2799.99.

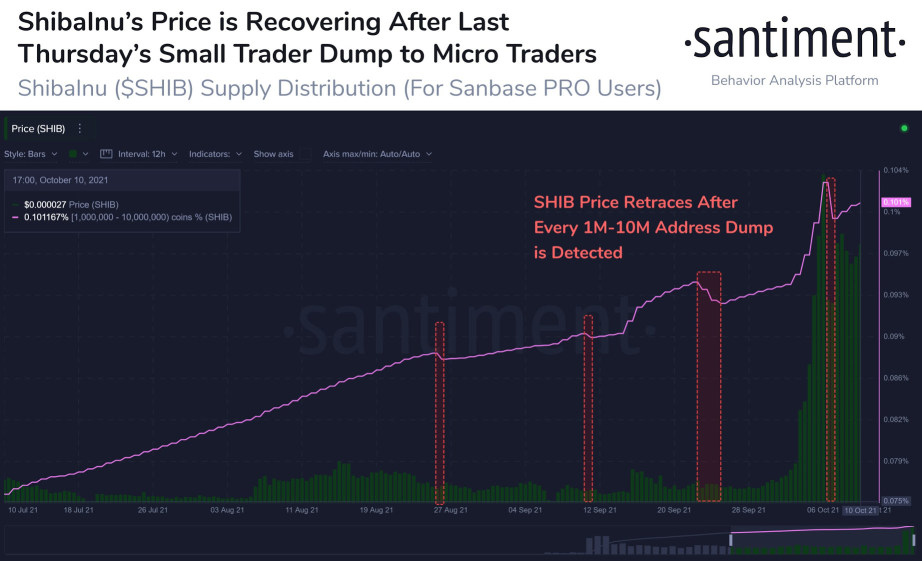

Shiba Inu is also creating a similar environment but more drastically. Since, they are calling people who are buying and holding the coin as "Shiba army". This creates a false interpretation of the market as whoever is holding shiba inu is or will become a millionaire. For example just when shiba reached around 0.00009 someone dumped billions of tokens nearing in millions of dollars only(compared to shiba marketcap)

On 28th of October, you can see a sharp decline from the value of 0.000089 to 0.000058 those were the times, when fewest people sold their shib making millions. But due to the constant shib promotion and FOMO caused among people, SHIB was able to come back to 0.000071. This got shiba a market cap of around 40 billion usd overtaking the USDC and doge.

I expect that if someone who's holding billions of dollar worth of shiba comes and dump it on market because of fear or any possible reason. I believe the SHIB will also crash down like the SQUID token, bankrupting people who are on buy position at the market for SHIB, and the people who are holding it.

However, I do believe that SHIB will be able to cross 0.0001 mark because of the constant advertisements and efforts of shiba army. But I expect there will be some major disadvantages of holding coin for too long after that.

Please understand, trading is not like farming, where the money is purely generated. Trading is a secondary market, where money is only switching hands. The asset it switches hands on gets increased or decreased on values, that is not a universal price of the asset, since 10% of a stock or crypto will not be sold in a same price but 100% of the wheat could. A universal price is defined in a primary market, like commodity or factories(production, tech and ideas). Stocks thought are secondary but are derived from industries which are primary(producing something) or having technology and ideas. So, stocks can be a good alternative of growth in money, but not the crypto assets. I have already mentioned in my previous posts about the USDT coin, like how they ensure that its backed by USD but they dont even have thousand USD for tether savings backend.

Even the ethereum is crazily overpriced. As the suggested transaction price proves the point. For example a bitfinex transaction costed around $33 million to transfer just $100 thousand. This is the transaction hash as a proof.

https://etherscan.io/tx/0x2c9931793876db33b1a9aad123ad4921dfb9cd5e59dbb78ce78f277759587115

Thought, it is a shady play to invest in new crypto or some meme coin. But of you get like millions or even thousands in it, just cash it out before it's too late.

Happy Halloween and happy trading guys!

1. Since its publically traded and unregulated, it can be easily manipulated to a point where it reaches to an unimaginably value. Thus, even if the coin is traded at that larger value, it creates an illusion that the coin is worth that amount. But once a larger portion of its quantity hits the market, and all buyers are fulfilled, it hits the ground. For example the recent event of the SQUID game token, it's a genuine token which was created by squid game company creators. It was a good concept, their website also had online squid games. However, creators sold their coins on market because it reached a crazy high amount. Many news sources say that the creators backed out of the project. However, I believe they sold it before leaving.

If someone is holding 30-50% of an asset which was created on a borrowed blockchain network(Binance network) for free without any effort. why wouldn't they not sell it at $2800 per coin which they literally made for $0.

who would bear the loss you might think?

The people who are trading this coin on buyer side starting from $0.1 to upto $2799.99.

Shiba Inu is also creating a similar environment but more drastically. Since, they are calling people who are buying and holding the coin as "Shiba army". This creates a false interpretation of the market as whoever is holding shiba inu is or will become a millionaire. For example just when shiba reached around 0.00009 someone dumped billions of tokens nearing in millions of dollars only(compared to shiba marketcap)

On 28th of October, you can see a sharp decline from the value of 0.000089 to 0.000058 those were the times, when fewest people sold their shib making millions. But due to the constant shib promotion and FOMO caused among people, SHIB was able to come back to 0.000071. This got shiba a market cap of around 40 billion usd overtaking the USDC and doge.

I expect that if someone who's holding billions of dollar worth of shiba comes and dump it on market because of fear or any possible reason. I believe the SHIB will also crash down like the SQUID token, bankrupting people who are on buy position at the market for SHIB, and the people who are holding it.

However, I do believe that SHIB will be able to cross 0.0001 mark because of the constant advertisements and efforts of shiba army. But I expect there will be some major disadvantages of holding coin for too long after that.

Please understand, trading is not like farming, where the money is purely generated. Trading is a secondary market, where money is only switching hands. The asset it switches hands on gets increased or decreased on values, that is not a universal price of the asset, since 10% of a stock or crypto will not be sold in a same price but 100% of the wheat could. A universal price is defined in a primary market, like commodity or factories(production, tech and ideas). Stocks thought are secondary but are derived from industries which are primary(producing something) or having technology and ideas. So, stocks can be a good alternative of growth in money, but not the crypto assets. I have already mentioned in my previous posts about the USDT coin, like how they ensure that its backed by USD but they dont even have thousand USD for tether savings backend.

Even the ethereum is crazily overpriced. As the suggested transaction price proves the point. For example a bitfinex transaction costed around $33 million to transfer just $100 thousand. This is the transaction hash as a proof.

https://etherscan.io/tx/0x2c9931793876db33b1a9aad123ad4921dfb9cd5e59dbb78ce78f277759587115

Thought, it is a shady play to invest in new crypto or some meme coin. But of you get like millions or even thousands in it, just cash it out before it's too late.

Happy Halloween and happy trading guys!

+1

30

3

花样年华

liked

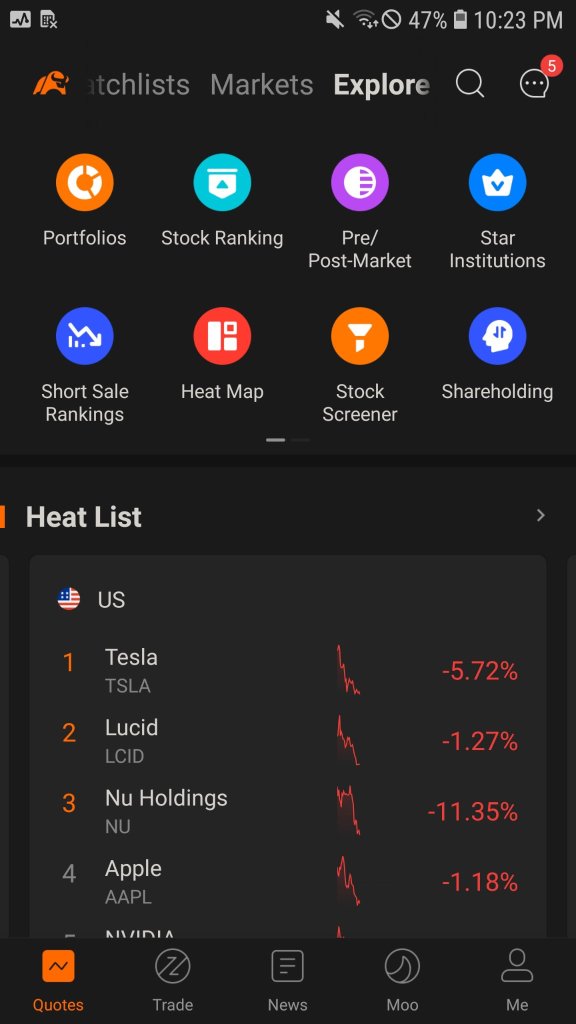

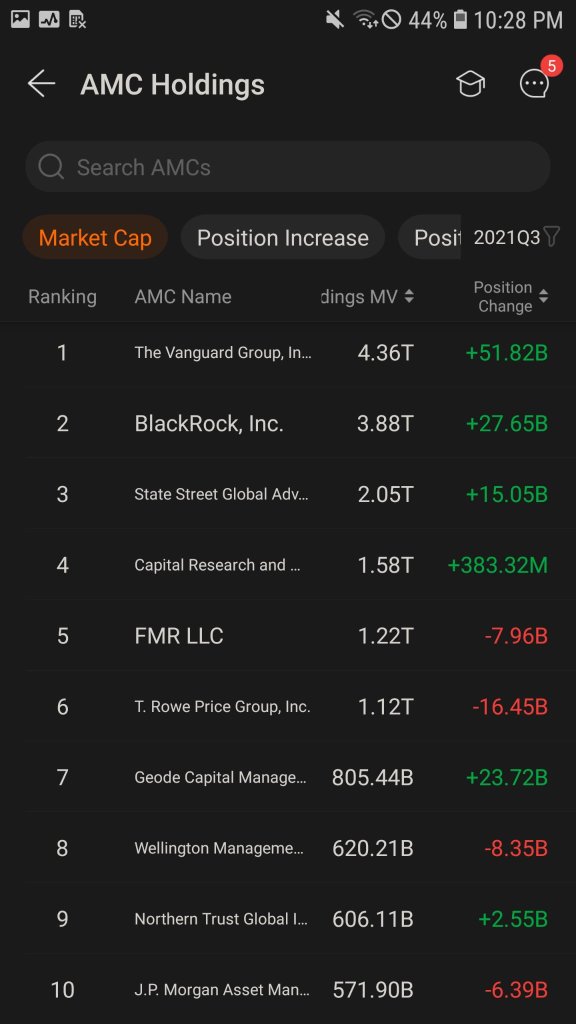

How to use the star institutions in the most effective way possible with the data provided by Moomoo

First let's see where we can find star institutions. if you are in the main page in moomoo you can see the top is scrollable on left side, which has few more options.

Here when you click on the explore option you will see star institutions AMC(Asset Management Companies) not the stock amc.

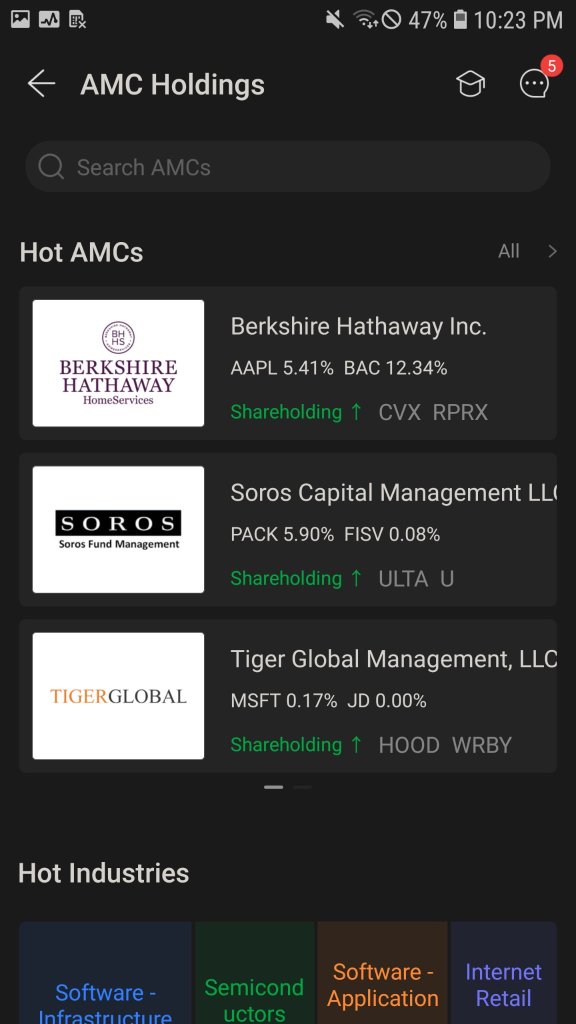

Here you will see the top AMC holdings and their investment option. There is a small option "All" on the top right corner of the hot AMCs. You can click and open that option.

if you scroll down a bit lower you will be able to see the top AMC of United states with their holdings and their position changes with their total investment funds, Normally it is in trillions.

Here we can have the maximum use of this option. After scrolling down, you can see the top 10 institutions. These top institutions have tens of trillions of dollars which can practically move the market in any direction. We know the basic knowledge that the stock increases when the money flows in and decreases when the money flows out.

So, If you can study these top institutional positional changes of stocks you can predict the actions the company is taking and can make use it to your advantage in buying/selling stock or buying /selling options.

let's take the vanguard fund as an example.

if you click on the vanguard group in AMC list you will see the current percent holdings of vanguard group. From here if you scroll a bit left you will see the prior proportion and the current proportion of the stock in this fund. We can see that the fund increased the number of stocks in thoer portfolio, example $Apple(AAPL.US$ and $Microsoft(MSFT.US$. From here we can assume the fund is securing shares of these companies, that indicates they will most probably go up in price, because of shortage of stocks in market. since vanguard fund's 0.14% change is equal to $5 billion(calculated by multiplying it with vanguard market cap) in stocks of Apple. which can make a huge impact in the stock supply. which in turn increases the demand and price of the stock.

Similarly we can look at the top 5 (top 10 for more precision in your results) to have their positional changes on a particular stock. If we multiply these changes of the particular stock with the fund's marketcap we will get a final result.

Important: some increases their positions and some decreases their positions, Hence we add the increasing positions and subtract the decreasing positional changes.

Finally, it will be a good idea to also look at the market cap of the stock for example microsoft has a market cap of 1.6T and thus having a change of 5 billion can have a normal impact on the stock. However, stocks with smaller marketcap but the positional changes in billions can have a very high impact of stock prices.

Or if you dont want to work too hard. In the hot AMC page, if you scroll a bit low you will see the hot stocks and their positional changes in the amc. Here you can directly choose to pick the stocks to buy or stock in the market.

Happy trading

Here when you click on the explore option you will see star institutions AMC(Asset Management Companies) not the stock amc.

Here you will see the top AMC holdings and their investment option. There is a small option "All" on the top right corner of the hot AMCs. You can click and open that option.

if you scroll down a bit lower you will be able to see the top AMC of United states with their holdings and their position changes with their total investment funds, Normally it is in trillions.

Here we can have the maximum use of this option. After scrolling down, you can see the top 10 institutions. These top institutions have tens of trillions of dollars which can practically move the market in any direction. We know the basic knowledge that the stock increases when the money flows in and decreases when the money flows out.

So, If you can study these top institutional positional changes of stocks you can predict the actions the company is taking and can make use it to your advantage in buying/selling stock or buying /selling options.

let's take the vanguard fund as an example.

if you click on the vanguard group in AMC list you will see the current percent holdings of vanguard group. From here if you scroll a bit left you will see the prior proportion and the current proportion of the stock in this fund. We can see that the fund increased the number of stocks in thoer portfolio, example $Apple(AAPL.US$ and $Microsoft(MSFT.US$. From here we can assume the fund is securing shares of these companies, that indicates they will most probably go up in price, because of shortage of stocks in market. since vanguard fund's 0.14% change is equal to $5 billion(calculated by multiplying it with vanguard market cap) in stocks of Apple. which can make a huge impact in the stock supply. which in turn increases the demand and price of the stock.

Similarly we can look at the top 5 (top 10 for more precision in your results) to have their positional changes on a particular stock. If we multiply these changes of the particular stock with the fund's marketcap we will get a final result.

Important: some increases their positions and some decreases their positions, Hence we add the increasing positions and subtract the decreasing positional changes.

Finally, it will be a good idea to also look at the market cap of the stock for example microsoft has a market cap of 1.6T and thus having a change of 5 billion can have a normal impact on the stock. However, stocks with smaller marketcap but the positional changes in billions can have a very high impact of stock prices.

Or if you dont want to work too hard. In the hot AMC page, if you scroll a bit low you will see the hot stocks and their positional changes in the amc. Here you can directly choose to pick the stocks to buy or stock in the market.

Happy trading

+1

26

3

花样年华

liked

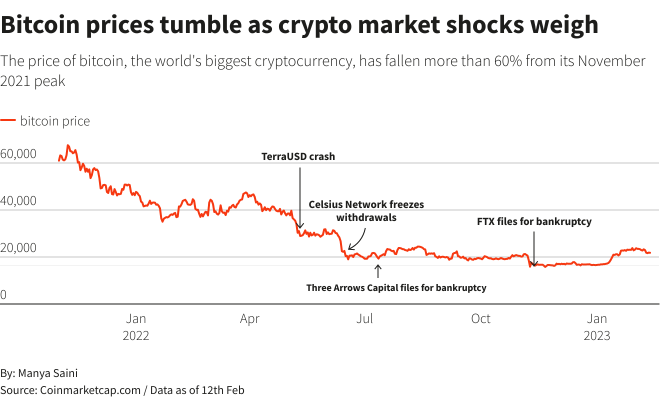

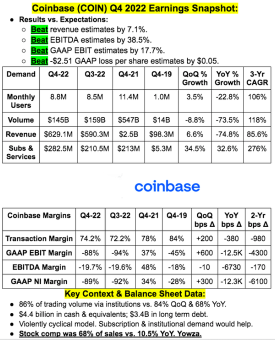

$Coinbase(COIN.US$ reported a fourth-quarter loss on Tuesday, as trading volume at the cryptocurrency exchange came under pressure from an industry-wide downturn triggered by a string of high-profile bankruptcies.

The digital assets market suffered from dour sentiment over the last year, but the biggest blow to the sector came from the bankruptcy of Sam Bankman-Fried's major crypto exchange FTX in November.

"In the wake of FT...

The digital assets market suffered from dour sentiment over the last year, but the biggest blow to the sector came from the bankruptcy of Sam Bankman-Fried's major crypto exchange FTX in November.

"In the wake of FT...

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)