葡萄山

commented on

Recently, as expected, the Federal Reserve cut interest rates by 25 basis points, meeting market expectations. However, why is there a slowdown in rate cuts next year? First of all, let me clarify that I will not provide direct answers. For those who are willing to learn, I will provide hints. Please go find the answers and think independently. Interest rate cuts and hikes have different effects. Hikes mainly suppress inflation, while rate cuts mainly have three effects. What are these three effects, you can go do some research. ![]()

Why is the market reacting so strongly to Powell's slowdown in rate cuts? Because of concerns about inflation rebounding. Why? Due to Trump's tariff policies (here you can go ask "orthopedics" to learn how they are formed). If in the future inflation leads the Federal Reserve back to a rate hike path, what impact will this have on the stock market? I know this may be a bit challenging for those without financial knowledge, so I'll give the answer directly. In a situation where the U.S. economy is already in a soft landing, rather than a hard landing or face landing, combined with U.S. tech stocks, especially visible applications of AI starting up recently, as long as the rate of return on tech stocks grows higher than the Fed's rate hikes, tech stocks may show no fear of rate hikes and soar (but the premise is, as I already hinted in the narrative, remember to pay attention to the key points).

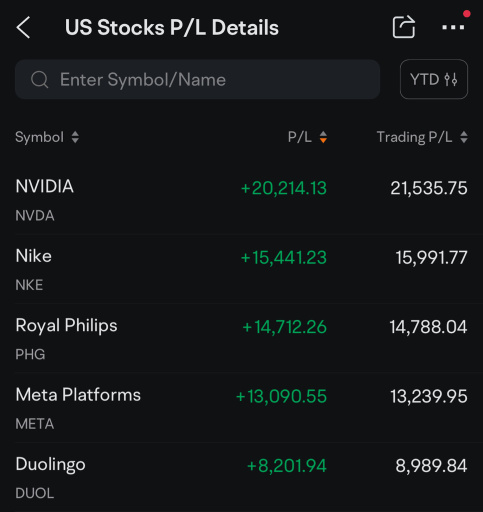

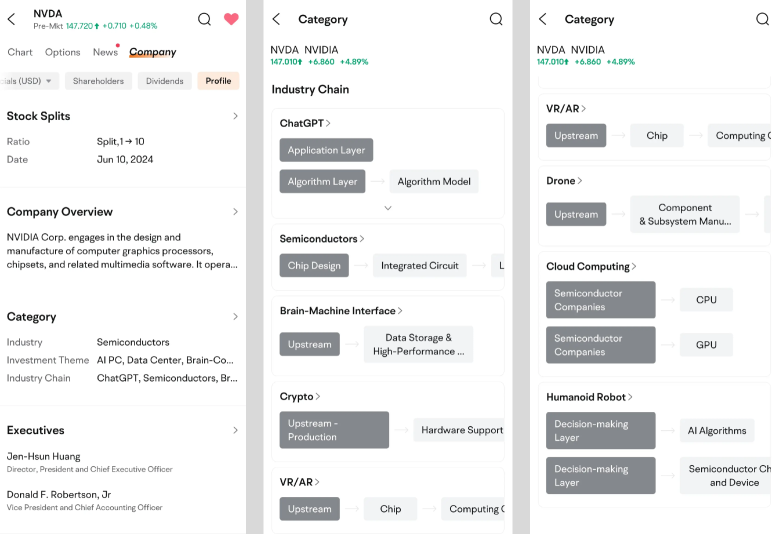

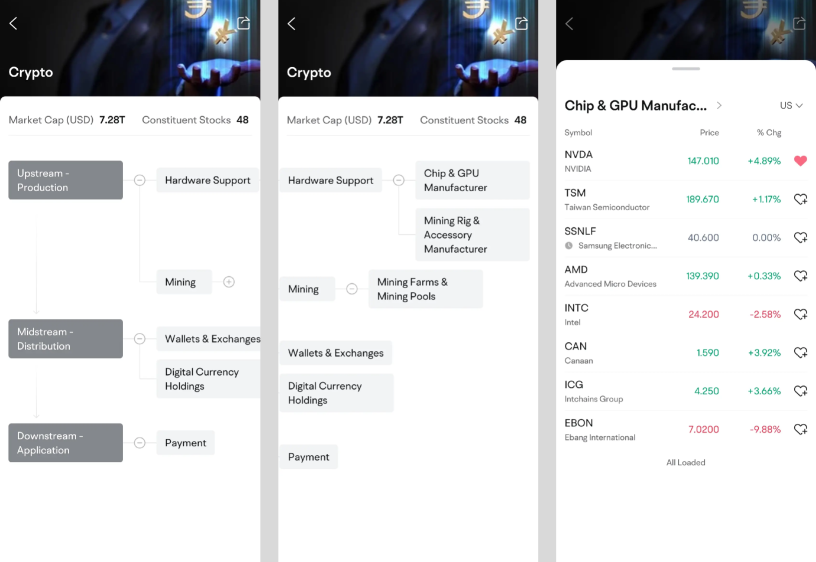

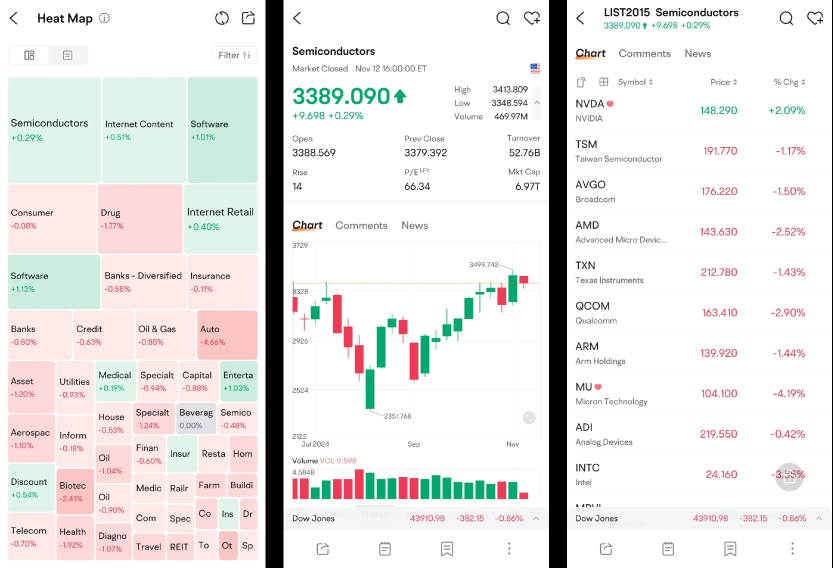

Let's briefly discuss the direction of the large cap. Based on observation and celestial calculations, the technology stocks representing Nasdaq have not met the satisfaction level of increase. Funds will need to be rotated in the future, while individual stock Indicators have been hovering near oversold levels for several days. If you think it's about to fail, I can only hope... $NVIDIA (NVDA.US)$ Indicators have been hovering near oversold levels for a few days. If you think it's about to fail, I can only hope...

Why is the market reacting so strongly to Powell's slowdown in rate cuts? Because of concerns about inflation rebounding. Why? Due to Trump's tariff policies (here you can go ask "orthopedics" to learn how they are formed). If in the future inflation leads the Federal Reserve back to a rate hike path, what impact will this have on the stock market? I know this may be a bit challenging for those without financial knowledge, so I'll give the answer directly. In a situation where the U.S. economy is already in a soft landing, rather than a hard landing or face landing, combined with U.S. tech stocks, especially visible applications of AI starting up recently, as long as the rate of return on tech stocks grows higher than the Fed's rate hikes, tech stocks may show no fear of rate hikes and soar (but the premise is, as I already hinted in the narrative, remember to pay attention to the key points).

Let's briefly discuss the direction of the large cap. Based on observation and celestial calculations, the technology stocks representing Nasdaq have not met the satisfaction level of increase. Funds will need to be rotated in the future, while individual stock Indicators have been hovering near oversold levels for several days. If you think it's about to fail, I can only hope... $NVIDIA (NVDA.US)$ Indicators have been hovering near oversold levels for a few days. If you think it's about to fail, I can only hope...

Translated

26

21

5

In Singapore, Christmas is a public holiday where people of all races celebrate together. It is based on the strategy of our political leaders constantly promoting racial harmony and unity, which has led to the Singapore we see today. One of the most admirable aspects of this holiday is the invitation for people of all ethnicities to come together to enjoy festive dishes at home. It also acknowledges the Singaporean government's leadership in guiding the people towards racial harmony, peaceful coexistence, mutual support, and solidarity in facing challenges together.

Translated

1

葡萄山

commented on

Greetings, mooers! Welcome to mooers’ stories, where we feature the inspiring journeys and unique perspectives of our mooers to help you achieve your investment aspirations!💡

Investing is more than just a personal journey—it’s about learning, sharing, and growing together as a community. Today, we’re honored to feature @约翰の理财库, a Financial Services Director with 6 years of experience in the financial ...

Investing is more than just a personal journey—it’s about learning, sharing, and growing together as a community. Today, we’re honored to feature @约翰の理财库, a Financial Services Director with 6 years of experience in the financial ...

168

66

35

葡萄山

voted

Mark your calendars, folks! Nvidia's Q3 earnings drop on November 20, and the market is buzzing with excitement. This could be the quarter that defines 2025 for the AI giant! 🌟

Here’s the setup:

- Nvidia is forecasting $32.5B revenue with a 75% gross margin—that’s insane efficiency for a company of this scale! 💎

- Analysts are even more bullish, predicting $32.94B revenue and $0.74 EPS, which would mean doubling last year’s Q3 revenue. Massive. 📈

O...

Here’s the setup:

- Nvidia is forecasting $32.5B revenue with a 75% gross margin—that’s insane efficiency for a company of this scale! 💎

- Analysts are even more bullish, predicting $32.94B revenue and $0.74 EPS, which would mean doubling last year’s Q3 revenue. Massive. 📈

O...

+1

9

3

葡萄山

liked

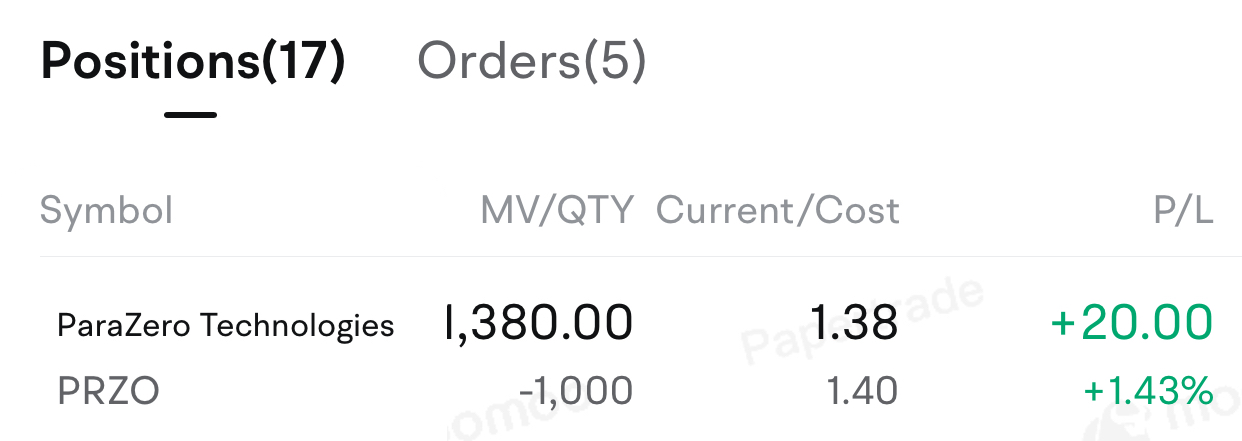

$ParaZero Technologies (PRZO.US)$ short stock : taking advantage of insider purposing to sell and downside volatility goal is 10-40% profit no greed no home run thinking better mental health 😂

1

2

葡萄山

liked and voted

Hello mooers,

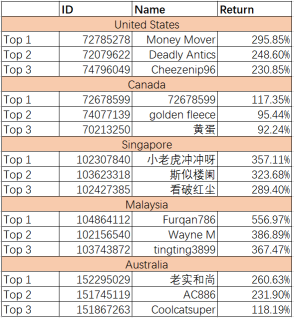

What an incredible journey it has been! Our Global Paper Trading Challenge has officially concluded, and the results are nothing short of spectacular. With participants from across seven markets, let's celebrate the achievements and strides made in these past five weeks.![]()

Challenge Highlights:

The sheer scale of this challenge was monumental, with registrations breaking past 150,000! This milestone is a test...

What an incredible journey it has been! Our Global Paper Trading Challenge has officially concluded, and the results are nothing short of spectacular. With participants from across seven markets, let's celebrate the achievements and strides made in these past five weeks.

Challenge Highlights:

The sheer scale of this challenge was monumental, with registrations breaking past 150,000! This milestone is a test...

85

70

14

葡萄山

voted

Welcome back to "Max Learns to Invest" – our story-driven series that explores moomoo's features through the eyes of Max, our avatar representing new investors like you. Got thoughts or questions? Share them below! We're rewarding 88 points for every comment that provides actionable suggestions or answers to our end-of-article questions. (Offer valid for one week after posting)

Hey mooers! Max here...

Hey mooers! Max here...

71

28

26

葡萄山

voted

Welcome back to "Max Learns to Invest" – our story-driven series that explores moomoo's features through the eyes of Max, our avatar representing new investors like you. Got thoughts or questions? Share them below! We're rewarding 88 points for every comment that provides actionable suggestions or answers to our end-of-article questions. (Offer valid for one week after posting)

Hey mooers, Max ba...

Hey mooers, Max ba...

101

33

28

葡萄山

liked

Can't you guys stop wondering why Warren Buffet keeps his cash position high? He is an old man now with a very conservative strategy.

Everyone has their strategy that works the best for them. The most important thing is to have your own opinion when it comes to investing.

Everyone has their strategy that works the best for them. The most important thing is to have your own opinion when it comes to investing.

7

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

葡萄山 : The effects of interest rate cuts are threefold. Firstly, to reduce inflation, lowering commodity prices. Secondly, to avoid an economic crisis, allowing the economy to land softly and reduce the unemployment rate. Thirdly, to preserve jobs and reduce company layoffs, decrease tax support to help crisis-ridden companies get through difficult times. In such a situation, investors should be more cautious, invest in some high-quality companies, or invest in price-protection investment products. It's also advisable to keep some Cash / Money Market on hand, waiting for investment opportunities.