#AMD 130 continues to add positions, next stop 120

Translated

Trump's team plans to prioritize the regulation of self-driving cars.

It seems Musk's recent persistent efforts have paid off with Trump.

When Trump speaks with foreign leaders, he is there, and recently saw him sitting next to him at a UFC match, becoming his closest advisor.

Foreign media are all waiting to see when the bromance between these two brothers will break out 🤣

It seems Musk's recent persistent efforts have paid off with Trump.

When Trump speaks with foreign leaders, he is there, and recently saw him sitting next to him at a UFC match, becoming his closest advisor.

Foreign media are all waiting to see when the bromance between these two brothers will break out 🤣

Translated

Some netizens worry that Trump's presidency will have an impact on semiconductor chip stocks.

Based on the experience of the previous trade war, Trump's character as a businessman, for example, he always starts by announcing a 30% tariff, then negotiates with the other party, and the actual tariffs implemented may not necessarily be 30%, but may include other additional conditions, such as setting up factories in the USA.

Since the start of Trump's tariff war, many factories have begun to shift their focus outside of China, like Apple choosing Vietnam and India. The continuous lockdowns and zero-COVID efforts in China in recent years have further accelerated the shift of factories.

Actually, TSM also has factories in the usa, and the yield has improved. TSM has also brought many Taiwanese engineers to the usa.

Overall, regardless of who takes office, confronting china is a consensus of the two parties in the usa.

If the news comes out that semiconductor stocks are falling, I will buy on the dips.

But according to the current script, if the news comes out and instead starts bearish until the end of the rise, it means the market has fully priced in.

Semiconductor stocks that I personally pay attention to include TSM, AVGO, AMD, NVDA, etc.

Moomoo开户链接 🔗

https://bit.ly/Mrgeleexmoo

#川普

#Semiconductors

#moomoo

Based on the experience of the previous trade war, Trump's character as a businessman, for example, he always starts by announcing a 30% tariff, then negotiates with the other party, and the actual tariffs implemented may not necessarily be 30%, but may include other additional conditions, such as setting up factories in the USA.

Since the start of Trump's tariff war, many factories have begun to shift their focus outside of China, like Apple choosing Vietnam and India. The continuous lockdowns and zero-COVID efforts in China in recent years have further accelerated the shift of factories.

Actually, TSM also has factories in the usa, and the yield has improved. TSM has also brought many Taiwanese engineers to the usa.

Overall, regardless of who takes office, confronting china is a consensus of the two parties in the usa.

If the news comes out that semiconductor stocks are falling, I will buy on the dips.

But according to the current script, if the news comes out and instead starts bearish until the end of the rise, it means the market has fully priced in.

Semiconductor stocks that I personally pay attention to include TSM, AVGO, AMD, NVDA, etc.

Moomoo开户链接 🔗

https://bit.ly/Mrgeleexmoo

#川普

#Semiconductors

#moomoo

Translated

9

蛤蜊先生-帮女儿存股

liked and commented on

For my daughter's US stock portfolio, it will mainly consist of ETFs, and occasionally I will look for high-quality stocks that have been significantly undervalued to buy.

Companies currently in the portfolio

1. qqq

IWM is a small cap index.

Crowdstrike is a cybersecurity stocks.

AMD is other stocks.

Apple is apple.

APPL Apple stocks are free.

QQQ regularly adds positions, with a mechanism to eliminate the weak and retain the strong in the large cap, continuously removing poor performers and bringing in the good ones, so it is possible to participate in the strongest technology companies in the U.S. stock market in the long term.

IWM is a small cap indexes, mainly due to the serious disconnection of valuations between small cap and large cap stocks seen earlier, coupled with the Fed's initiation of an interest rate cut cycle, so it is expected that small cap stocks will perform well later. However, from the beginning of the year until now, it has been trading flat, until recently seeing some trends emerging after Trump's reelection.

Crowdstrike has always been focused on cybersecurity stocks, until recently, a bearish news caused a gap down, I bought in during the sharp decline, and now the stock price is slowly recovering. Cybersecurity is like buying health supplements, taking them may not necessarily be effective, but not taking them and regretting when something goes wrong later.

AMD's recent financial report also dropped badly. I looked at the financial report and there's actually no major issue, just that the market expectations were too optimistic. It dropped to around 140, so I took advantage and bought some at a lower price, and it has recently rebounded.

For the companies in my portfolio, my first choice for regular purchases is QQQ, followed by IWM, and I only consider others if there are opportunities to buy low.

This portfolio pursues stable growth, as long as around 10% per year...

Companies currently in the portfolio

1. qqq

IWM is a small cap index.

Crowdstrike is a cybersecurity stocks.

AMD is other stocks.

Apple is apple.

APPL Apple stocks are free.

QQQ regularly adds positions, with a mechanism to eliminate the weak and retain the strong in the large cap, continuously removing poor performers and bringing in the good ones, so it is possible to participate in the strongest technology companies in the U.S. stock market in the long term.

IWM is a small cap indexes, mainly due to the serious disconnection of valuations between small cap and large cap stocks seen earlier, coupled with the Fed's initiation of an interest rate cut cycle, so it is expected that small cap stocks will perform well later. However, from the beginning of the year until now, it has been trading flat, until recently seeing some trends emerging after Trump's reelection.

Crowdstrike has always been focused on cybersecurity stocks, until recently, a bearish news caused a gap down, I bought in during the sharp decline, and now the stock price is slowly recovering. Cybersecurity is like buying health supplements, taking them may not necessarily be effective, but not taking them and regretting when something goes wrong later.

AMD's recent financial report also dropped badly. I looked at the financial report and there's actually no major issue, just that the market expectations were too optimistic. It dropped to around 140, so I took advantage and bought some at a lower price, and it has recently rebounded.

For the companies in my portfolio, my first choice for regular purchases is QQQ, followed by IWM, and I only consider others if there are opportunities to buy low.

This portfolio pursues stable growth, as long as around 10% per year...

Translated

22

6

2

蛤蜊先生-帮女儿存股

reacted to

This morning, I read an article summarizing the recent interview of the legendary investor Drunkenmiller, and one investment concept that I quite agree with is "Buy first, analyze later."

In the stock market, there are many good stocks and investments, but often when we discover a stock, the first thing we do is research its fundamentals. By the time you spend 1-2 months in-depth research, the stock has already taken off, and you will lament missing out on this company. It's a common occurrence for many fundamental investors to spend energy but not make much money.

I remember when I first started investing in US stocks, I adopted this buy first, analyze later approach. Putting skin into the game first gives you more motivation to research.

Most of the first batch of funds I use are allocated to 10-20% of the headquarters, ensuring that even if the stop-loss sell occurs, it will not cause catastrophic losses.

If the company's fundamentals are sound after research and the stock price continues to fall, continue to add positions. Anyway, I don't know how the stock price will trend, so if it rises, I will profit; if it falls, I can gradually add positions and reduce holdings, being able to attack and defend as needed.

Over the past year, I have also started to position myself on moomoo in this way, mainly to invest in US stocks for my daughter. I transfer a sum of money regularly every month, then slowly build the position, whether for her future education fund, for traveling and broadening her horizons, or if she wants to continue to research and analyze and buy her favorite stocks in the future, she can do whatever she wants when she grows up.

Daughter's portfolio YTD +2...

In the stock market, there are many good stocks and investments, but often when we discover a stock, the first thing we do is research its fundamentals. By the time you spend 1-2 months in-depth research, the stock has already taken off, and you will lament missing out on this company. It's a common occurrence for many fundamental investors to spend energy but not make much money.

I remember when I first started investing in US stocks, I adopted this buy first, analyze later approach. Putting skin into the game first gives you more motivation to research.

Most of the first batch of funds I use are allocated to 10-20% of the headquarters, ensuring that even if the stop-loss sell occurs, it will not cause catastrophic losses.

If the company's fundamentals are sound after research and the stock price continues to fall, continue to add positions. Anyway, I don't know how the stock price will trend, so if it rises, I will profit; if it falls, I can gradually add positions and reduce holdings, being able to attack and defend as needed.

Over the past year, I have also started to position myself on moomoo in this way, mainly to invest in US stocks for my daughter. I transfer a sum of money regularly every month, then slowly build the position, whether for her future education fund, for traveling and broadening her horizons, or if she wants to continue to research and analyze and buy her favorite stocks in the future, she can do whatever she wants when she grows up.

Daughter's portfolio YTD +2...

Translated

10

1

蛤蜊先生-帮女儿存股

Set a live reminder

$Tesla (TSLA.US)$Robotaxi Day is scheduled for October 10 at 10:00 PM ET /October 11 at 10:00 AM SGT /October 11 at 12:00 AM AEST. Subscribe to join the live NOW!

This event will reveal Tesla's most anticipated robotaxi plans and designs. Elon Musk tweeted, with the title, "We, Robot" that it would be "one for the history books."

While you grab your spot, dive into our fun guessing game with prizes just for mooers!

![]() How to Play:

How to Play:

1. Leave Your Predictions: What themes or product...

This event will reveal Tesla's most anticipated robotaxi plans and designs. Elon Musk tweeted, with the title, "We, Robot" that it would be "one for the history books."

While you grab your spot, dive into our fun guessing game with prizes just for mooers!

1. Leave Your Predictions: What themes or product...

Tesla Robotaxi Day

Oct 11 10:00

67

50

33

蛤蜊先生-帮女儿存股

liked

This is a fund that I create for my daughter’s education.

1

蛤蜊先生-帮女儿存股

voted

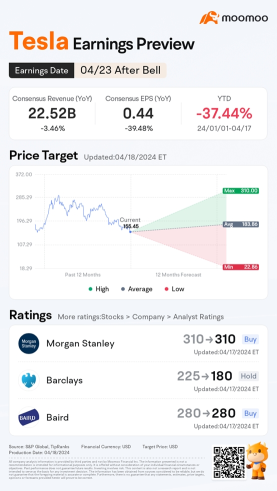

Tesla is releasing its Q1 2024 earnings after the market closes on April 23.

Since its Q4 earnings release, shares of $Tesla (TSLA.US)$ have seen a decrease of 29%.![]() Overall earnings estimates have been revised lower since the company's last earnings release. How will the market react to the upcoming results? Make your guess now!

Overall earnings estimates have been revised lower since the company's last earnings release. How will the market react to the upcoming results? Make your guess now! ![]()

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range ...

Since its Q4 earnings release, shares of $Tesla (TSLA.US)$ have seen a decrease of 29%.

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range ...

144

371

34

蛤蜊先生-帮女儿存股

Set a live reminder

Tesla Q1 2024 earnings conference call is scheduled for April 23, 5:30 PM ET /April 24, 5:30 AM SGT/April 24 at 8:30 AM AEST. Subscribe NOW to join the live earnings conference and hear directly from Tesla's management!

Beat or Miss?

What do you expect from Tesla's Q1 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what Tesla's management has to say!

Disclaimer:

This presentation is for informational and educational use only and is not a recom...

Beat or Miss?

What do you expect from Tesla's Q1 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what Tesla's management has to say!

Disclaimer:

This presentation is for informational and educational use only and is not a recom...

特斯拉 2024 Q1 业绩电话会

Apr 24 05:30

17

1

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)