行走的煤

liked

Earnings Preview

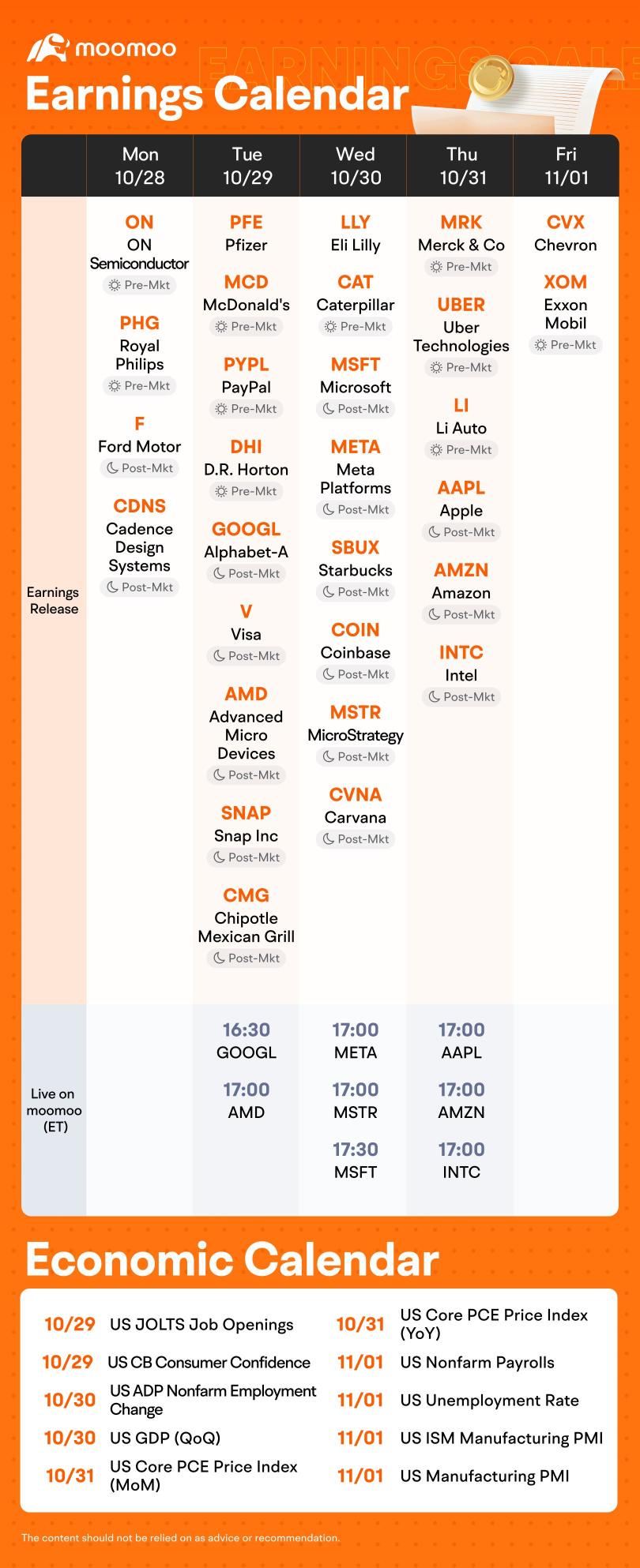

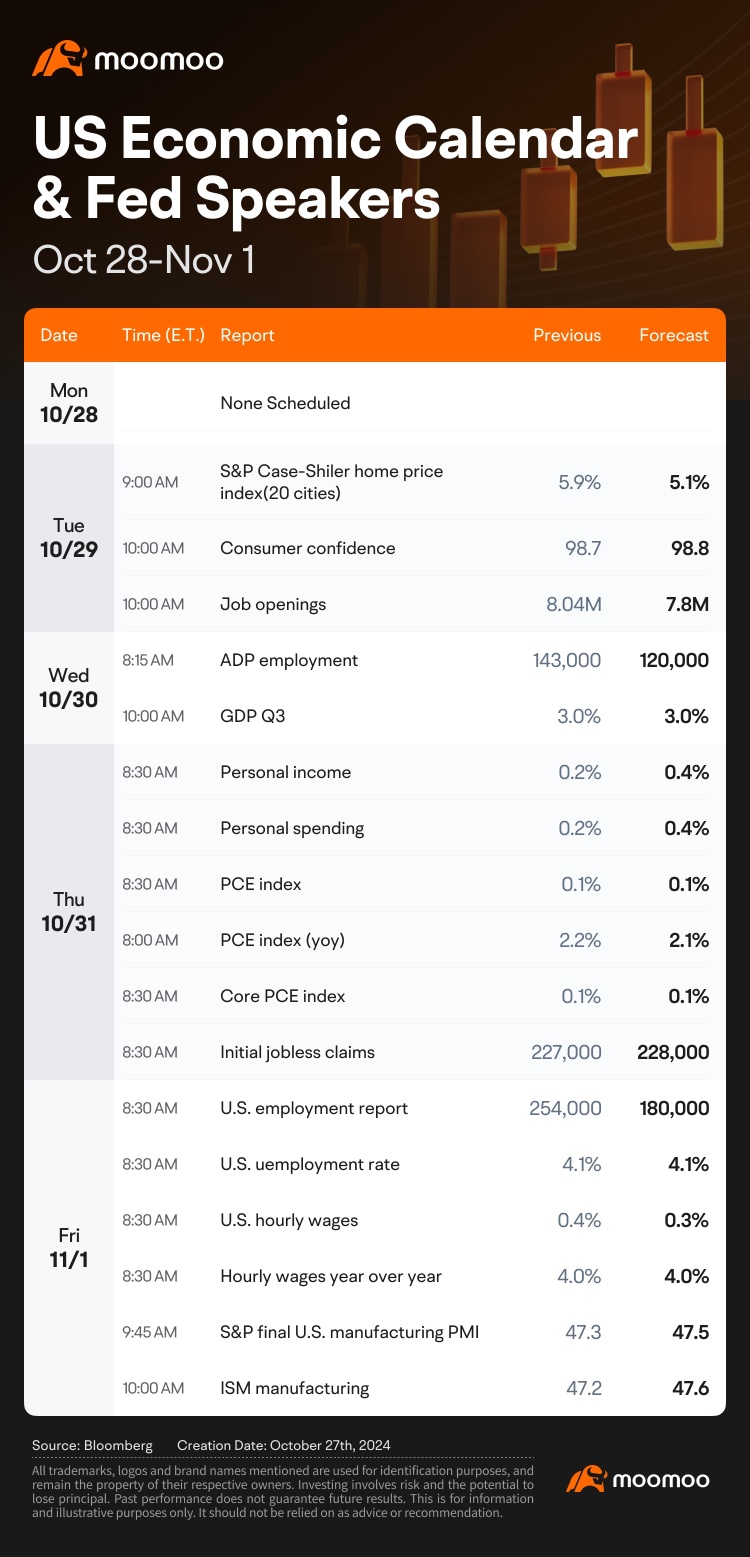

Wall Street is bracing for the most eventful week of news leading up to the election.

Next week, five of the Magnificent Seven companies will announce their earnings. Alphabet will share its results on Tuesday, while Microsoft and Meta Platforms will release theirs on Wednesday. Amazon and Apple are scheduled to report their earnings on Thursday.

Google's parent company, $Alphabet-A (GOOGL.US)$ , is schedul...

Wall Street is bracing for the most eventful week of news leading up to the election.

Next week, five of the Magnificent Seven companies will announce their earnings. Alphabet will share its results on Tuesday, while Microsoft and Meta Platforms will release theirs on Wednesday. Amazon and Apple are scheduled to report their earnings on Thursday.

Google's parent company, $Alphabet-A (GOOGL.US)$ , is schedul...

+3

134

33

60

行走的煤

liked

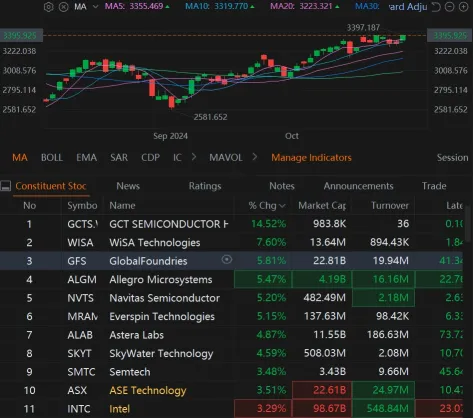

The market slipped into a fall Friday alongside autumn leaves in Jersey City after another heavy week of earnings. Next week, investors are watching for an even bigger earnings week with less than two weeks to the U.S. election. Watch for reports from $Apple (AAPL.US)$, $Meta Platforms (META.US)$, $Microsoft (MSFT.US)$, and $Amazon (AMZN.US)$, and dozens more industry giants. Next week will also see a labor market report.

Just past ...

Just past ...

58

16

11

行走的煤

voted

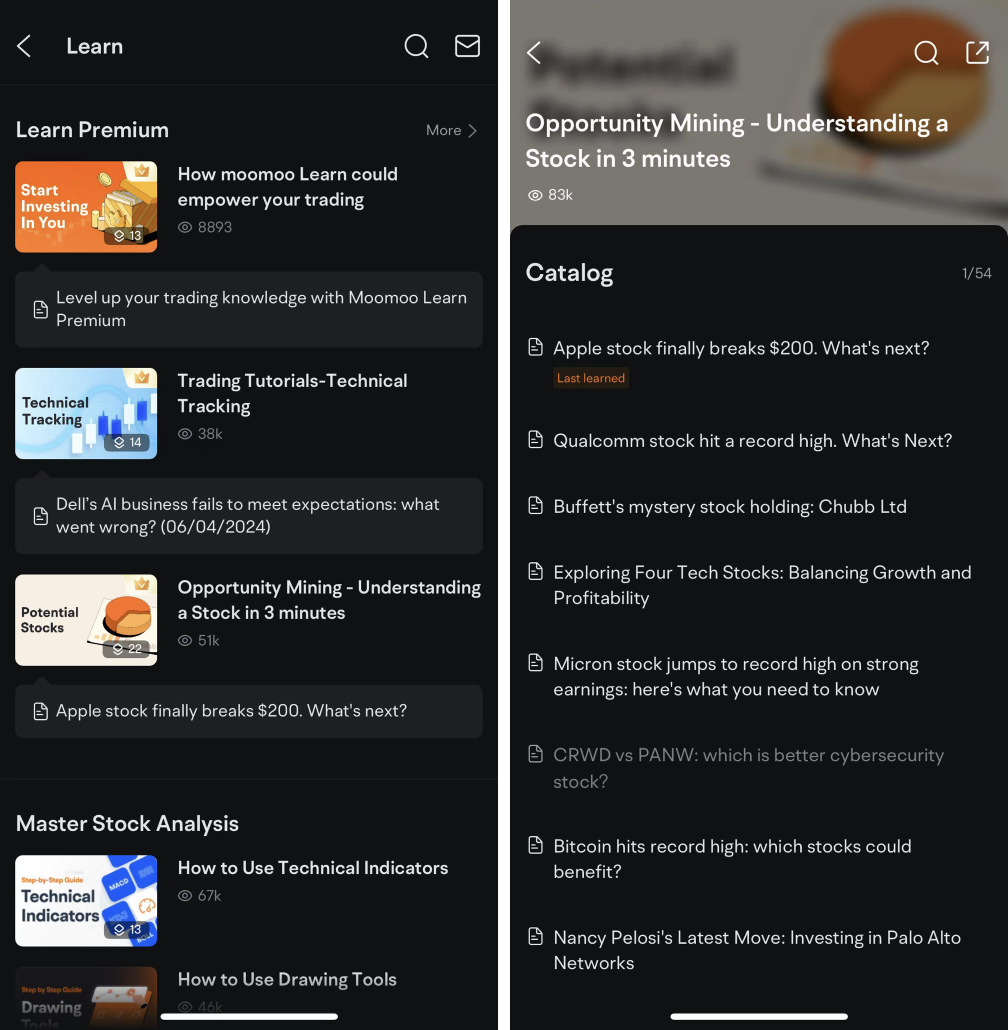

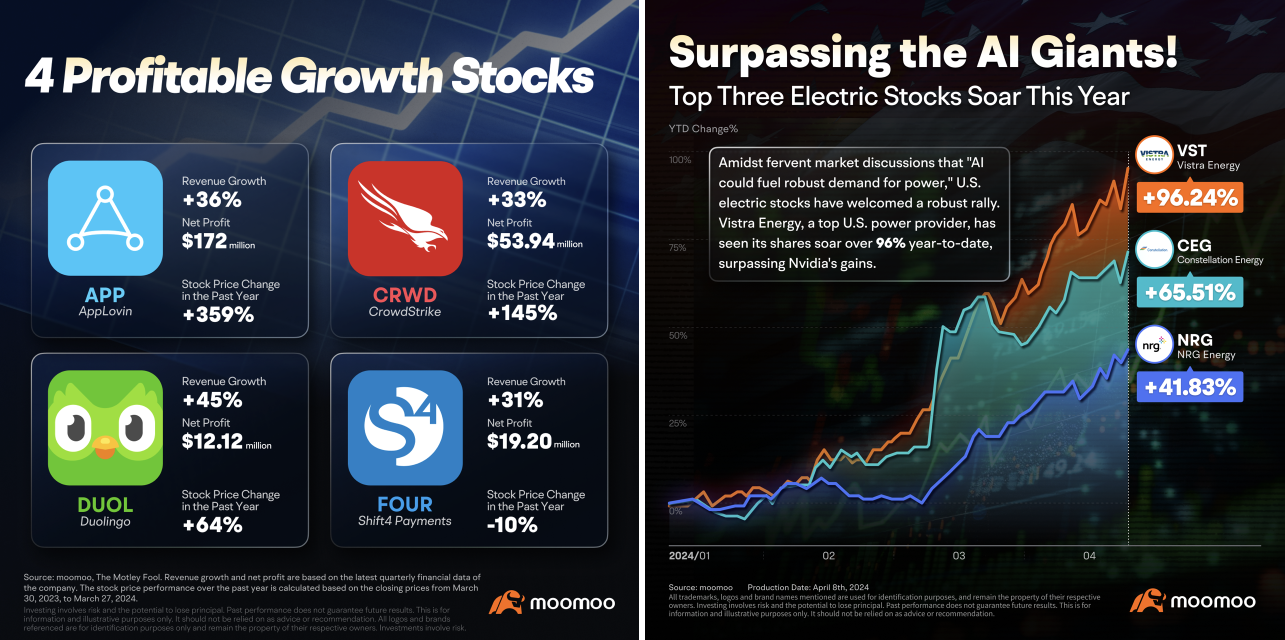

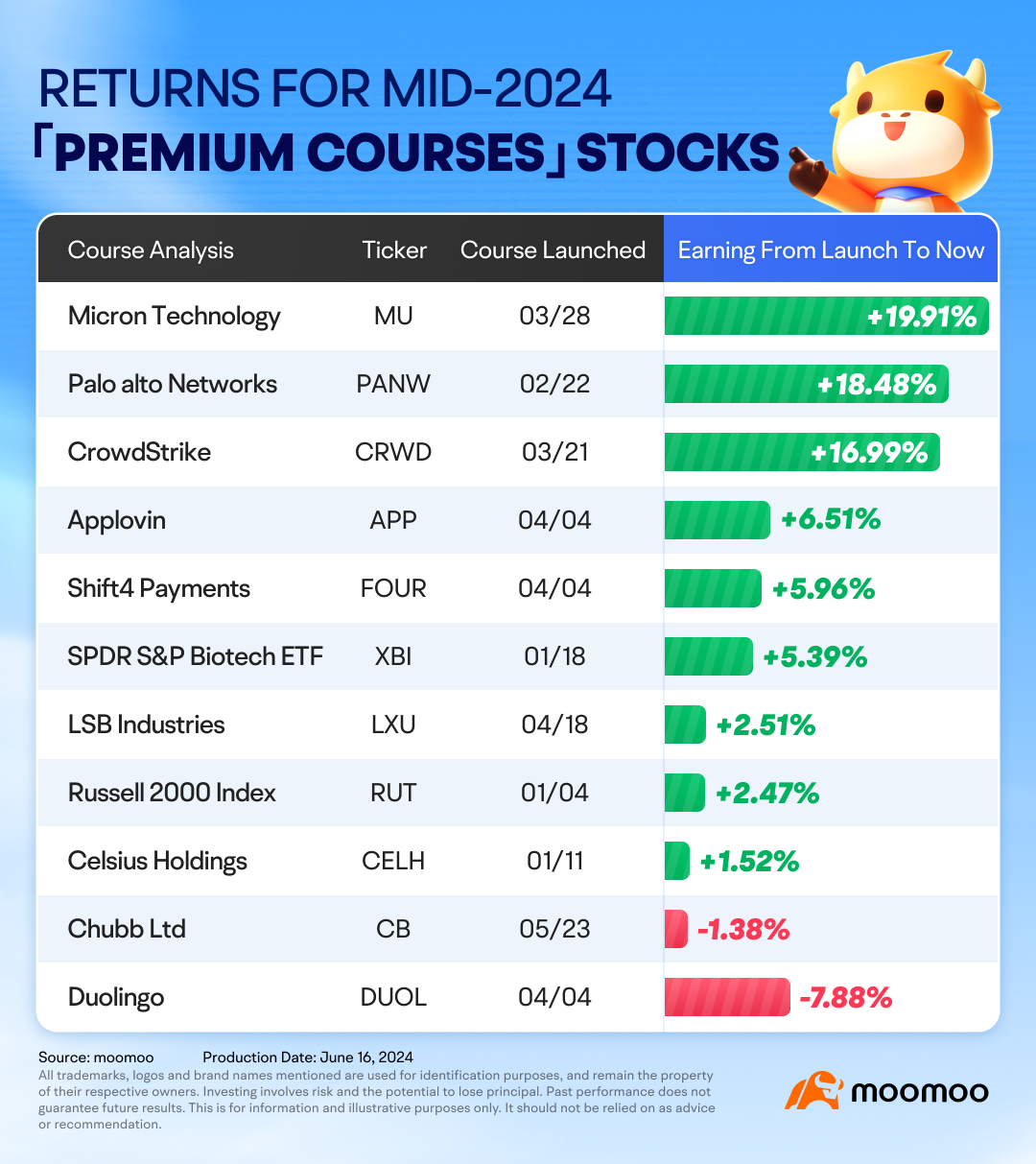

The U.S. stock market has hit new highs again! Congrats!👏 If you started investing in the US market at the beginning of the year and haven't made any major mistakes, you've probably seen some gains! 🎉

As we hit the mid-year mark, let's take a look back at our Premium Learning journey. Driven by AI and major tech stocks, the $S&P 500 Index (.SPX.US)$ and $Nasdaq Composite Index (.IXIC.US)$ have repeatedly reached new highs over...

As we hit the mid-year mark, let's take a look back at our Premium Learning journey. Driven by AI and major tech stocks, the $S&P 500 Index (.SPX.US)$ and $Nasdaq Composite Index (.IXIC.US)$ have repeatedly reached new highs over...

+5

437

226

34

行走的煤

Set a live reminder

[Synopsis]

With the global market transitions since the start of 2024, how can an active investor possibly capture these pivotal turns and evolutions for their investment strategy? With the final live webinar for our mid-year funds series, learn how investors like yourselves can potentially leverage on Income strategies to navigate the changes on a global scale with our experts from PIMCO and Moomoo Singapore. Join us and you may be rewarded with qu...

With the global market transitions since the start of 2024, how can an active investor possibly capture these pivotal turns and evolutions for their investment strategy? With the final live webinar for our mid-year funds series, learn how investors like yourselves can potentially leverage on Income strategies to navigate the changes on a global scale with our experts from PIMCO and Moomoo Singapore. Join us and you may be rewarded with qu...

A Pivotal Year: Strategies for Capturing Income

Jun 28 17:00

24

3

行走的煤

Set a live reminder

[Synopsis]

Mid-2024 - where are we for Asia's Fixed Income space? What is the outlook and how can investors utilise the potential window of opportunities in the current global market context? We delve deeper into possible strategies you may leverage on for Fixed Income, so join us to find out more on the analysis as we transition into the second half of the year with our experts from UOB Asset Management. Come learn with us and stand a chance to win some...

Mid-2024 - where are we for Asia's Fixed Income space? What is the outlook and how can investors utilise the potential window of opportunities in the current global market context? We delve deeper into possible strategies you may leverage on for Fixed Income, so join us to find out more on the analysis as we transition into the second half of the year with our experts from UOB Asset Management. Come learn with us and stand a chance to win some...

Asia Fixed Income: A Window of Opportunity

Jun 28 15:00

7

2

行走的煤

Set a live reminder

[Synopsis]

With the US interest rate cycle transitions since the start of 2024 - where are we now given there is no rate cutes in 2024 by the Fed? How can investors potentially benefit and what can we expect from the US market going into the second half of the year? Find out more in the latest live webinar with our expert from CSOP Asset Management. Join us and you might be rewarded with some giveaways and quiz questions.@olivehiggo

[Speake...

With the US interest rate cycle transitions since the start of 2024 - where are we now given there is no rate cutes in 2024 by the Fed? How can investors potentially benefit and what can we expect from the US market going into the second half of the year? Find out more in the latest live webinar with our expert from CSOP Asset Management. Join us and you might be rewarded with some giveaways and quiz questions.@olivehiggo

[Speake...

US Interest rate cycle overview by CSOP Asset Management

Jun 27 17:00

8

2

行走的煤

Set a live reminder

[Synopsis]

As we head into the mid-year, what is the assessment of the current economy and will interest rates take a turn? With a year of global elections, US rate changes, continued geopolitical risks, and potential stablization of the Chinese market - learn the analysis as we hit the emergence of a new season with our expert from Fullerton Fund Management. Tune in as well for potential quiz giveaways and stand a chance to be rewarded f...

As we head into the mid-year, what is the assessment of the current economy and will interest rates take a turn? With a year of global elections, US rate changes, continued geopolitical risks, and potential stablization of the Chinese market - learn the analysis as we hit the emergence of a new season with our expert from Fullerton Fund Management. Tune in as well for potential quiz giveaways and stand a chance to be rewarded f...

Emergence of a new season, in current interest rates cycle

Jun 27 15:00

7

1

1

行走的煤

Set a live reminder

[Synopsis]

Kickstarting our live webinar fund series for 2024, we check-in with technology stocks and beyond - covering insights into the global market outlook, potential "controlled stabilisation" of the China market and potential strategies to employ beyond the Technology rally. Tune in and stand a chance to be rewarded for being with us on the show as we learn the analysis from our experts at Fidelity International. Olivia Higgins will guide you toward...

Kickstarting our live webinar fund series for 2024, we check-in with technology stocks and beyond - covering insights into the global market outlook, potential "controlled stabilisation" of the China market and potential strategies to employ beyond the Technology rally. Tune in and stand a chance to be rewarded for being with us on the show as we learn the analysis from our experts at Fidelity International. Olivia Higgins will guide you toward...

Beyond the Technology rally, what's next?

Jun 27 11:00

9

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)