赚些老本

voted

Rewards

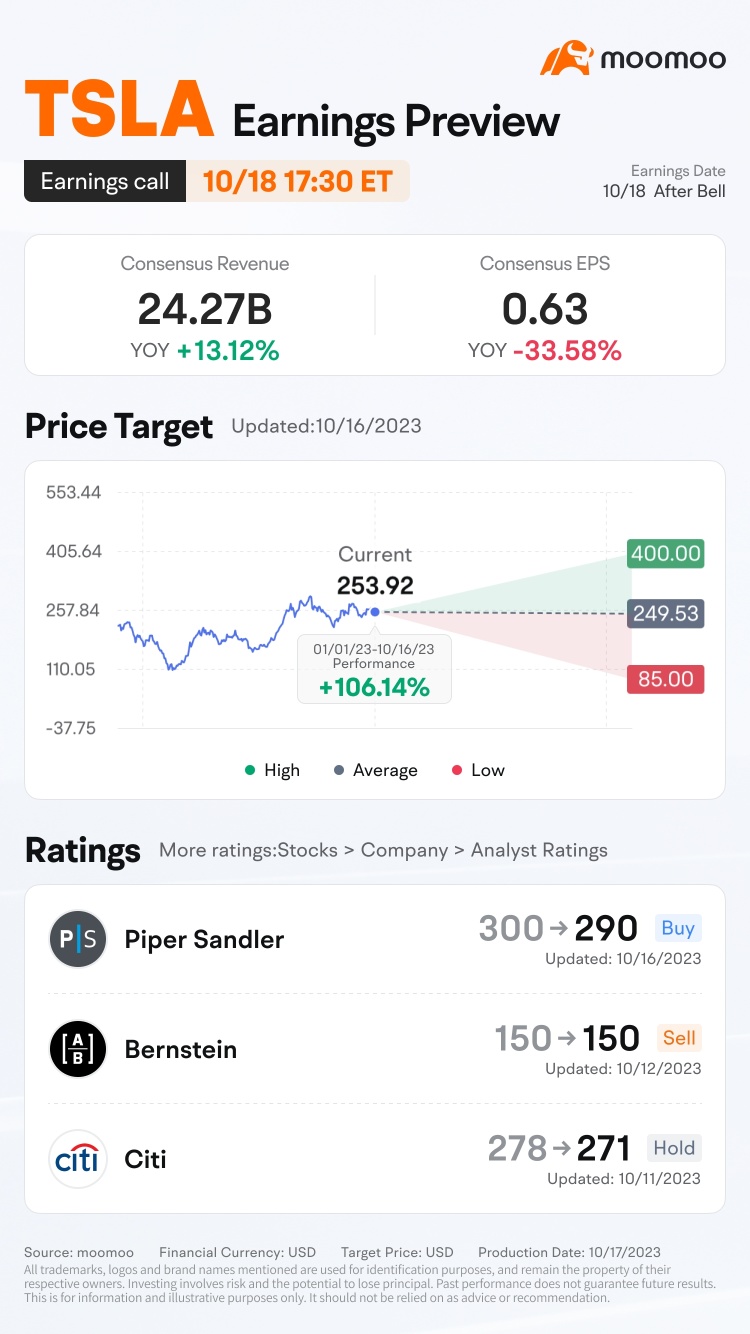

● An equal share of 1,000 points: For mooers who correctly guess TSLA's closing price range on Oct 19 ET by 12:00 AM, Oct 19 ET. (e.g., If 50 mooers make a correct guess, each of them will get 20 points.)

● Exclusive 300 points: For the writer of the top post on analyzing TSLA's earnings preview as an inspiration reward.

Note:

1. Rewards will be distributed within 5-7 working days after the result's announcement. ...

● An equal share of 1,000 points: For mooers who correctly guess TSLA's closing price range on Oct 19 ET by 12:00 AM, Oct 19 ET. (e.g., If 50 mooers make a correct guess, each of them will get 20 points.)

● Exclusive 300 points: For the writer of the top post on analyzing TSLA's earnings preview as an inspiration reward.

Note:

1. Rewards will be distributed within 5-7 working days after the result's announcement. ...

74

90

3

赚些老本

liked

$UOB (U11.SG)$ wait for dip to enter again

32

1

赚些老本

liked

$UOB (U11.SG)$ wonder how it will go before the holidays; whether people will take profit for the celebration of Xmas and new year![]()

20

1

赚些老本

liked

$Uber Technologies (UBER.US)$ JPMorgan Chase issued a research report that it maintains Uber (UBER.US)'s "overweight" rating and lowered its target price from US$72 to US$68.

Xiaomo analyst Doug Anmuth believes that as the economy becomes more digitized, Uber's position in 2022 will be stronger than before the outbreak. However, he expects that "more diverse stock performance will continue," and that the company's business is a bigger factor in normalization after the new crown epidemic.

Anmuth predicts that as many companies face tough competition and move towards normalization, the level of growth will decrease. By 2022, investors will generally prefer e-commerce and subscription-based companies to online advertising companies.

Article excerpted from the US Stock Research Agency

Xiaomo analyst Doug Anmuth believes that as the economy becomes more digitized, Uber's position in 2022 will be stronger than before the outbreak. However, he expects that "more diverse stock performance will continue," and that the company's business is a bigger factor in normalization after the new crown epidemic.

Anmuth predicts that as many companies face tough competition and move towards normalization, the level of growth will decrease. By 2022, investors will generally prefer e-commerce and subscription-based companies to online advertising companies.

Article excerpted from the US Stock Research Agency

68

1

赚些老本

liked

Which of these do people see not doing much next year?

Amazon $Amazon (AMZN.US)$ , Netflix $Netflix (NFLX.US)$ , Blackstone $Blackstone (BX.US)$ , Google $Alphabet-C (GOOG.US)$ , or Facebook $Meta Platforms (FB.US)$ ?

I'm leaning towards Netflix most likely as I am not so enthusiastic about the streaming numbers the more things open up (and was really saved by Squid game), and potentially Amazon just given how much they've underperformed this year. What do people think?![]()

![]()

![]()

![]()

![]()

![]()

Amazon $Amazon (AMZN.US)$ , Netflix $Netflix (NFLX.US)$ , Blackstone $Blackstone (BX.US)$ , Google $Alphabet-C (GOOG.US)$ , or Facebook $Meta Platforms (FB.US)$ ?

I'm leaning towards Netflix most likely as I am not so enthusiastic about the streaming numbers the more things open up (and was really saved by Squid game), and potentially Amazon just given how much they've underperformed this year. What do people think?

3

赚些老本

liked

$Meta Platforms (FB.US)$ Watch when you fly

Translated

6

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)