走在致富途中的小牛牛

Set a live reminder

[Synopsis]

With the global market transitions since the start of 2024, how can an active investor possibly capture these pivotal turns and evolutions for their investment strategy? With the final live webinar for our mid-year funds series, learn how investors like yourselves can potentially leverage on Income strategies to navigate the changes on a global scale with our experts from PIMCO and Moomoo Singapore. Join us and you may be rewarded with qu...

With the global market transitions since the start of 2024, how can an active investor possibly capture these pivotal turns and evolutions for their investment strategy? With the final live webinar for our mid-year funds series, learn how investors like yourselves can potentially leverage on Income strategies to navigate the changes on a global scale with our experts from PIMCO and Moomoo Singapore. Join us and you may be rewarded with qu...

A Pivotal Year: Strategies for Capturing Income

Jun 28 04:00

24

3

走在致富途中的小牛牛

Set a live reminder

[Synopsis]

Mid-2024 - where are we for Asia's Fixed Income space? What is the outlook and how can investors utilise the potential window of opportunities in the current global market context? We delve deeper into possible strategies you may leverage on for Fixed Income, so join us to find out more on the analysis as we transition into the second half of the year with our experts from UOB Asset Management. Come learn with us and stand a chance to win some...

Mid-2024 - where are we for Asia's Fixed Income space? What is the outlook and how can investors utilise the potential window of opportunities in the current global market context? We delve deeper into possible strategies you may leverage on for Fixed Income, so join us to find out more on the analysis as we transition into the second half of the year with our experts from UOB Asset Management. Come learn with us and stand a chance to win some...

Asia Fixed Income: A Window of Opportunity

Jun 28 02:00

7

2

走在致富途中的小牛牛

Set a live reminder

[Synopsis]

With the US interest rate cycle transitions since the start of 2024 - where are we now given there is no rate cutes in 2024 by the Fed? How can investors potentially benefit and what can we expect from the US market going into the second half of the year? Find out more in the latest live webinar with our expert from CSOP Asset Management. Join us and you might be rewarded with some giveaways and quiz questions.@olivehiggo

[Speake...

With the US interest rate cycle transitions since the start of 2024 - where are we now given there is no rate cutes in 2024 by the Fed? How can investors potentially benefit and what can we expect from the US market going into the second half of the year? Find out more in the latest live webinar with our expert from CSOP Asset Management. Join us and you might be rewarded with some giveaways and quiz questions.@olivehiggo

[Speake...

US Interest rate cycle overview by CSOP Asset Management

Jun 27 04:00

8

2

走在致富途中的小牛牛

Set a live reminder

[Synopsis]

As we head into the mid-year, what is the assessment of the current economy and will interest rates take a turn? With a year of global elections, US rate changes, continued geopolitical risks, and potential stablization of the Chinese market - learn the analysis as we hit the emergence of a new season with our expert from Fullerton Fund Management. Tune in as well for potential quiz giveaways and stand a chance to be rewarded f...

As we head into the mid-year, what is the assessment of the current economy and will interest rates take a turn? With a year of global elections, US rate changes, continued geopolitical risks, and potential stablization of the Chinese market - learn the analysis as we hit the emergence of a new season with our expert from Fullerton Fund Management. Tune in as well for potential quiz giveaways and stand a chance to be rewarded f...

Emergence of a new season, in current interest rates cycle

Jun 27 02:00

7

1

1

走在致富途中的小牛牛

Set a live reminder

[Synopsis]

Kickstarting our live webinar fund series for 2024, we check-in with technology stocks and beyond - covering insights into the global market outlook, potential "controlled stabilisation" of the China market and potential strategies to employ beyond the Technology rally. Tune in and stand a chance to be rewarded for being with us on the show as we learn the analysis from our experts at Fidelity International. Olivia Higgins will guide you toward...

Kickstarting our live webinar fund series for 2024, we check-in with technology stocks and beyond - covering insights into the global market outlook, potential "controlled stabilisation" of the China market and potential strategies to employ beyond the Technology rally. Tune in and stand a chance to be rewarded for being with us on the show as we learn the analysis from our experts at Fidelity International. Olivia Higgins will guide you toward...

Beyond the Technology rally, what's next?

Jun 26 22:00

9

2

走在致富途中的小牛牛

liked

Today marks the 3rd month-niversary of leaving a toxic job environment. Leaving without another job lined up, yet it was without hesitation or stress. Leaving was therapeutic instead. So today is the 3rd month of being "unemployed". The 3rd month of not seeing a regular paycheck hitting my bank account.

The milestones in your life

Thankfully, I have my side hustles, dividend and options premiums to ...

The milestones in your life

Thankfully, I have my side hustles, dividend and options premiums to ...

115

124

30

走在致富途中的小牛牛

voted

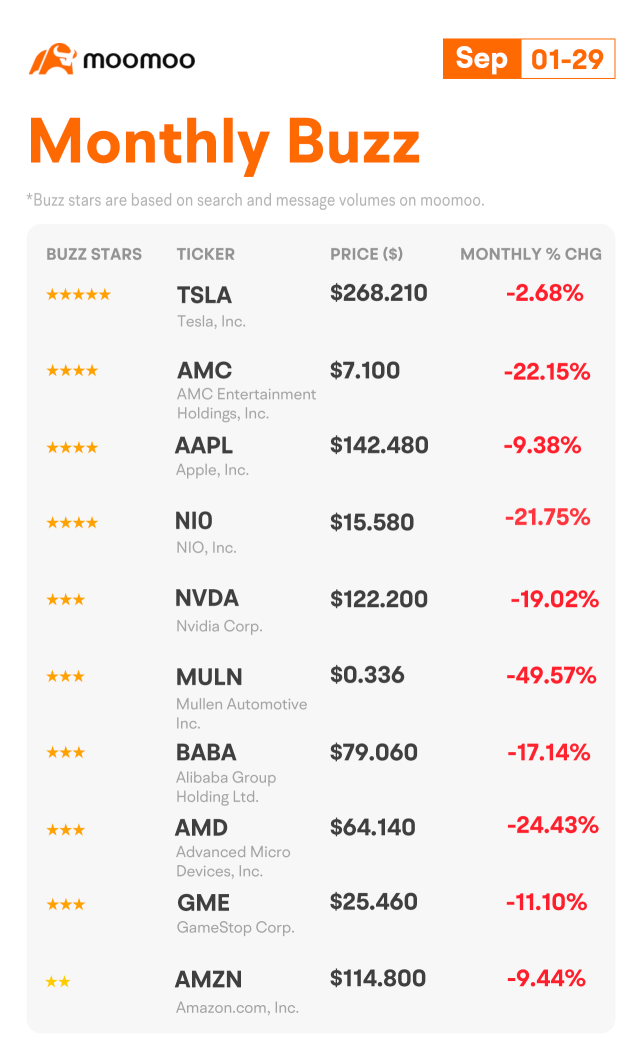

Hey, mooers!

Welcome back to Monthly Buzz.

Such a tough September, right? Historically, September has been the worst month of the year for stocks. It has been called the "September effect". Data from CFRA, a market research firm, shows that only two months, February and September, have averaged negative returns for the stock market since 1945 (Source: ). Can the following buzzing stocks break the spell? Let's check it out!

Buzzing Stocks List...

Welcome back to Monthly Buzz.

Such a tough September, right? Historically, September has been the worst month of the year for stocks. It has been called the "September effect". Data from CFRA, a market research firm, shows that only two months, February and September, have averaged negative returns for the stock market since 1945 (Source: ). Can the following buzzing stocks break the spell? Let's check it out!

Buzzing Stocks List...

33

1

13

走在致富途中的小牛牛

voted

$ARK Innovation ETF (ARKK.US)$ Cathie Wood says market is pretty close to a bottom, tech stocks will hit trough and recover first. Ark Invest's Cathie Wood said Tuesday technology stocks will hit the bottom before the broader market, repeating a historical trend from past crises.

Ark Invest’s ARKK Cathie Wood says the market is pretty close to a bottom, tech stocks will hit a trough and recover ...

Ark Invest’s ARKK Cathie Wood says the market is pretty close to a bottom, tech stocks will hit a trough and recover ...

7

2

走在致富途中的小牛牛

liked

Dear mooers,

Happy Chinese New Year!

Regardless of who you are with and where you are, moomoo wishes you a new year full of luck, happiness, achievement, and prosperity.

moomoo thank you for your continuous company. We hope to accompany you further in your investing journey!

Once again, we wish you and your family a lucky, happy, healthy, and prosperous lunar new year!

Team moomoo

Happy Chinese New Year!

Regardless of who you are with and where you are, moomoo wishes you a new year full of luck, happiness, achievement, and prosperity.

moomoo thank you for your continuous company. We hope to accompany you further in your investing journey!

Once again, we wish you and your family a lucky, happy, healthy, and prosperous lunar new year!

Team moomoo

131

51

10

走在致富途中的小牛牛

liked

$Grab Holdings (GRAB.US)$ IPO stocks are always volatile. Can't take the up and downs better don't buy.

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)