超越平凡

Set a live reminder

$Dell Technologies (DELL.US)$

Dell Technologies Q3 FY2025 earnings conference call is scheduled for November 26 at 4:30 PM EDT /November 27 at 5:30 AM SGT /November 27 at 8:30 AM AEDT. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from DELL's Q3 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what management has to say!

Disclaimer:

This presentation...

Dell Technologies Q3 FY2025 earnings conference call is scheduled for November 26 at 4:30 PM EDT /November 27 at 5:30 AM SGT /November 27 at 8:30 AM AEDT. Subscribe to join the live earnings conference with management NOW!

Beat or Miss?

What do you expect from DELL's Q3 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what management has to say!

Disclaimer:

This presentation...

Dell Q3 FY2025 earnings conference call

Nov 27 05:30

8

超越平凡

liked

1

1

超越平凡

voted

Hello Mooers!

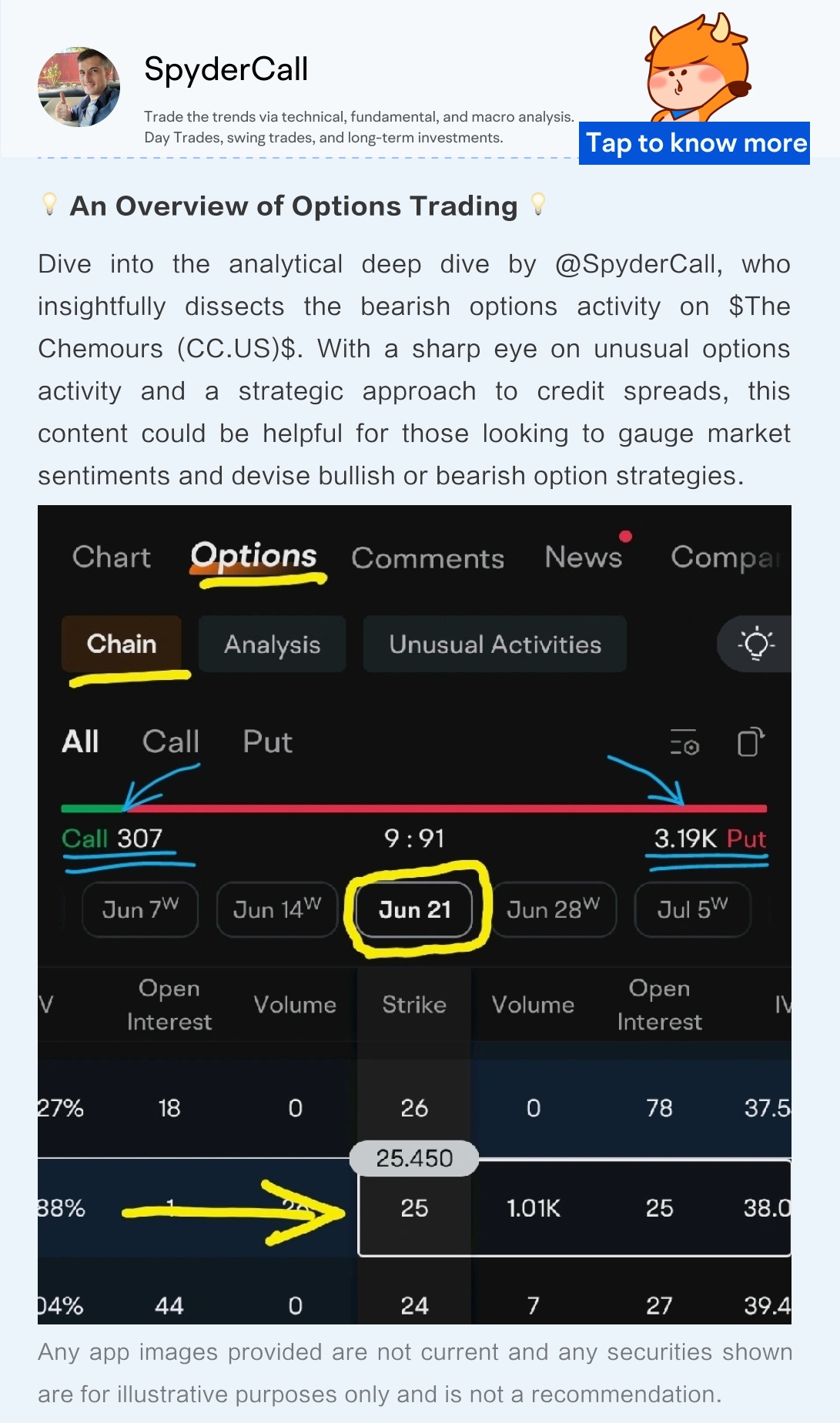

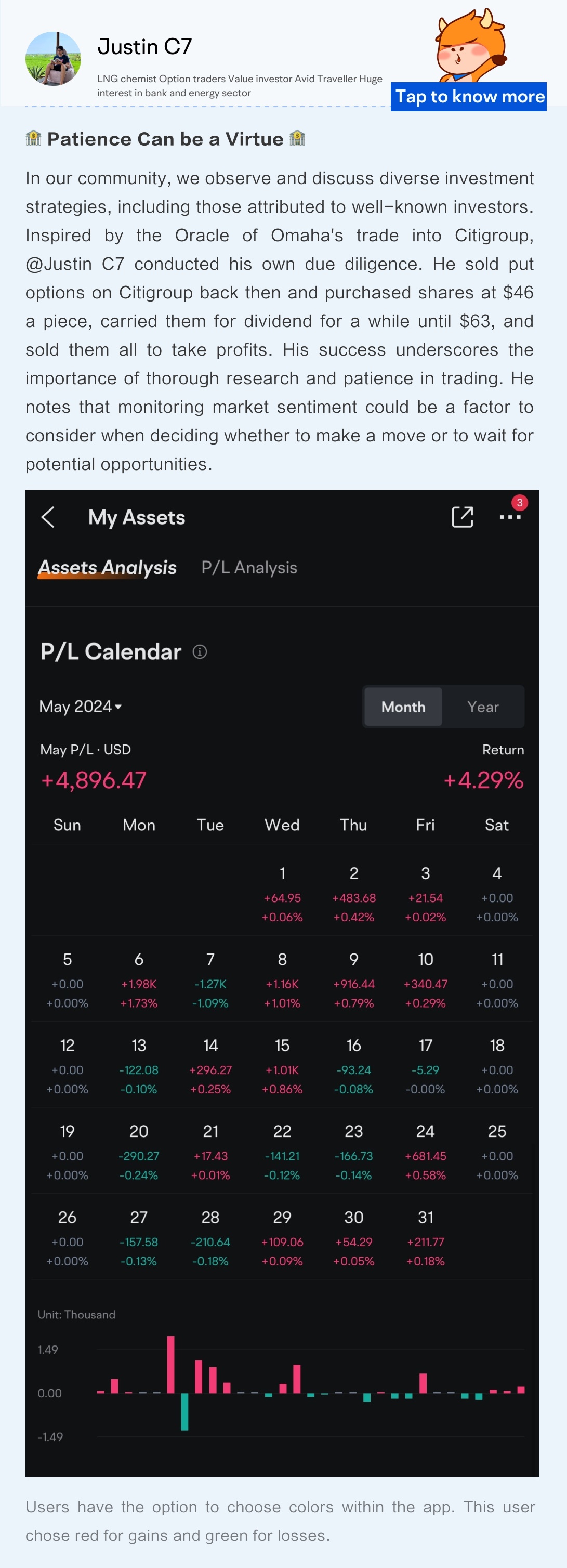

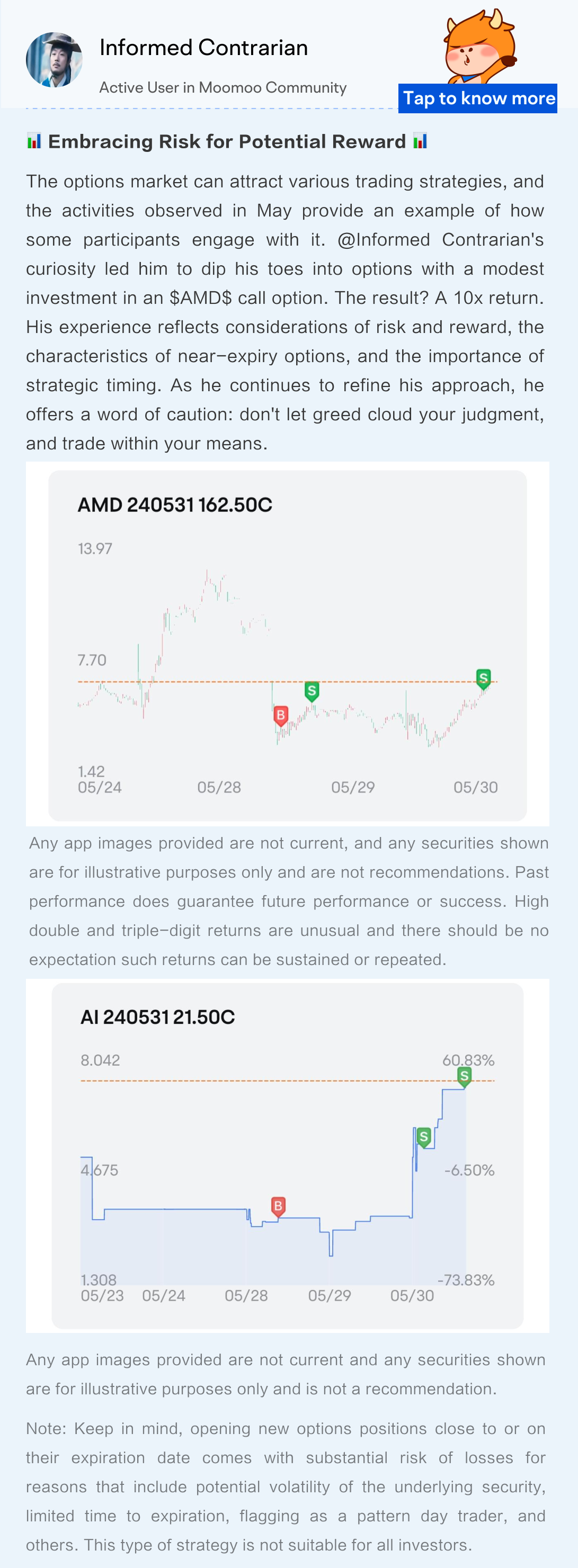

As May 2024 fades into memory, we reflect on a market landscape that was as electrifying as it was unpredictable. Starting with the annual information imparted at the Berkshire Hathaway shareholders' meeting, where Warren Buffett continued to champion the art of value investing, the month soon picked up momentum with the resurgence of "Meme Stocks," reminding us of the potential influence and associated volatility of trading moveme...

As May 2024 fades into memory, we reflect on a market landscape that was as electrifying as it was unpredictable. Starting with the annual information imparted at the Berkshire Hathaway shareholders' meeting, where Warren Buffett continued to champion the art of value investing, the month soon picked up momentum with the resurgence of "Meme Stocks," reminding us of the potential influence and associated volatility of trading moveme...

+6

85

37

8

超越平凡

voted

You can't always be on the high all the time. That's just plain delusional. ![]()

![]()

Currently the share is touching above the 50MA testing for breakout or break support. My justification is from the inverse daily hammer indicator.

$NVIDIA (NVDA.US)$

If it holds I'm seeing a 129 to 130 on a Monday. Condition that the volume of a Long green in premarket intraday.

If it doesn't I may see a pullback to 118 - 121. A buy in the dip opportunity. Condition a huge sell volume.

$NVIDIA (NVDA.US)$

���������...

Currently the share is touching above the 50MA testing for breakout or break support. My justification is from the inverse daily hammer indicator.

$NVIDIA (NVDA.US)$

If it holds I'm seeing a 129 to 130 on a Monday. Condition that the volume of a Long green in premarket intraday.

If it doesn't I may see a pullback to 118 - 121. A buy in the dip opportunity. Condition a huge sell volume.

$NVIDIA (NVDA.US)$

���������...

15

4

4

超越平凡

voted

Columns [Options ABC] Zero days to expiration (0DTE) options: a strategy for the bold or a voyage into risk?

Hello everyone and welcome back to moomoo. I'm options explorer![]() .

.

In today's [Options ABC], we'll be taking a look at the Zero Days to Expiration Options (0DTE).

![]() Wordcount: 1200

Wordcount: 1200

![]() Target Audience: Investors interested in Zero Days to Expiration Option (0DTE).

Target Audience: Investors interested in Zero Days to Expiration Option (0DTE).

![]() Main Content: What is the Zero Days to Expiration Option? What's its pros and cons? How to trade Zero Days to Expiration Options?

Main Content: What is the Zero Days to Expiration Option? What's its pros and cons? How to trade Zero Days to Expiration Options?

Zero-day...

In today's [Options ABC], we'll be taking a look at the Zero Days to Expiration Options (0DTE).

Zero-day...

![[Options ABC] Zero days to expiration (0DTE) options: a strategy for the bold or a voyage into risk?](https://ussnsimg.moomoo.com/sns_client_feed/77777077/20240521/1716278404353-7a38b00ac7.png/thumb?area=100&is_public=true)

![[Options ABC] Zero days to expiration (0DTE) options: a strategy for the bold or a voyage into risk?](https://ussnsimg.moomoo.com/sns_client_feed/77777077/20240521/1716277884670-d12c282937.webp/thumb?area=100&is_public=true)

![[Options ABC] Zero days to expiration (0DTE) options: a strategy for the bold or a voyage into risk?](https://ussnsimg.moomoo.com/sns_client_feed/77777077/20240521/1716276715461-179e18db09.webp/thumb?area=100&is_public=true)

67

15

36

超越平凡

voted

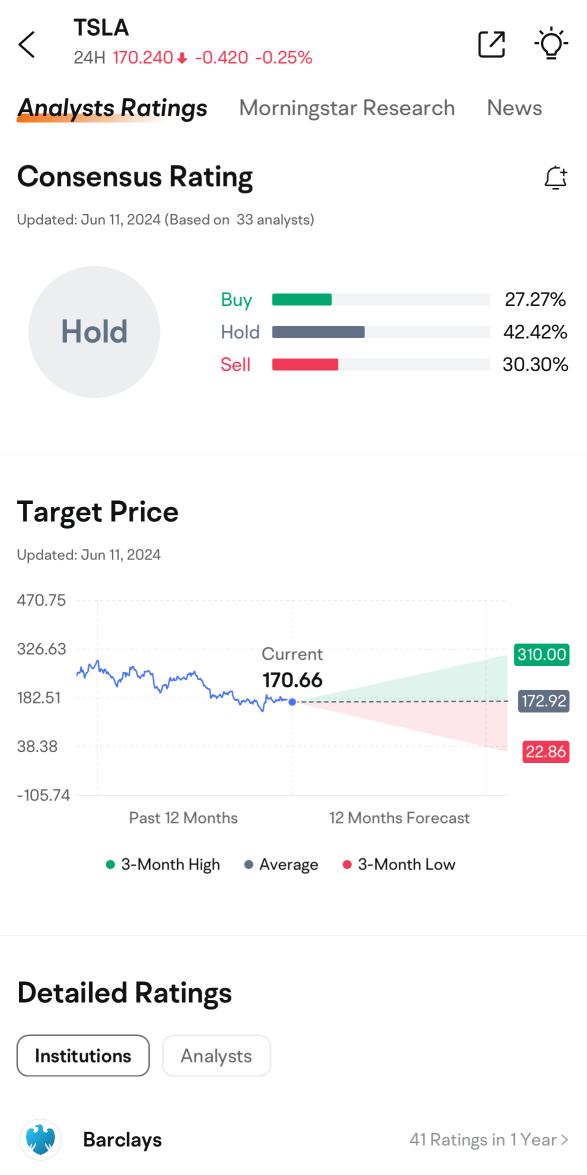

$Tesla (TSLA.US)$ is set to hold its annual shareholder meeting on June 13, with investors voting on whether to reapprove CEO Elon Musk's $55.8 billion pay package. The AGM outcome could affect Tesla's future trajectory and reveal shareholder sentiments on crucial governance matters. How will TSLA's annual meeting results drive its share price? Make your guess now! ![]()

![]()

![]()

![]() Rewards

Rewards

● An equal share of 10,000 points: For mooers ...

● An equal share of 10,000 points: For mooers ...

197

363

12

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)