輸贏一瞬間

commented on

$SoFi Technologies (SOFI.US)$ Your God with mercy, hereby i advice all the bulls run as fast as you can...

2

5

輸贏一瞬間

voted

Hi mooers! ![]()

The Federal Reserve is scheduled hold FOMC meeting and press conference on November 7. This is crucial for the future trajectory of the U.S. and global economy.

The Commerce Department's personal consumption expenditures (PCE) price index, closely watched by the Federal Reserve, increased 0.2% month-over-month in September. Excluding food and energy, the September PCE price index rose 0.3% MoM and 2.7% YoY. On ...

The Federal Reserve is scheduled hold FOMC meeting and press conference on November 7. This is crucial for the future trajectory of the U.S. and global economy.

The Commerce Department's personal consumption expenditures (PCE) price index, closely watched by the Federal Reserve, increased 0.2% month-over-month in September. Excluding food and energy, the September PCE price index rose 0.3% MoM and 2.7% YoY. On ...

89

101

8

輸贏一瞬間

voted

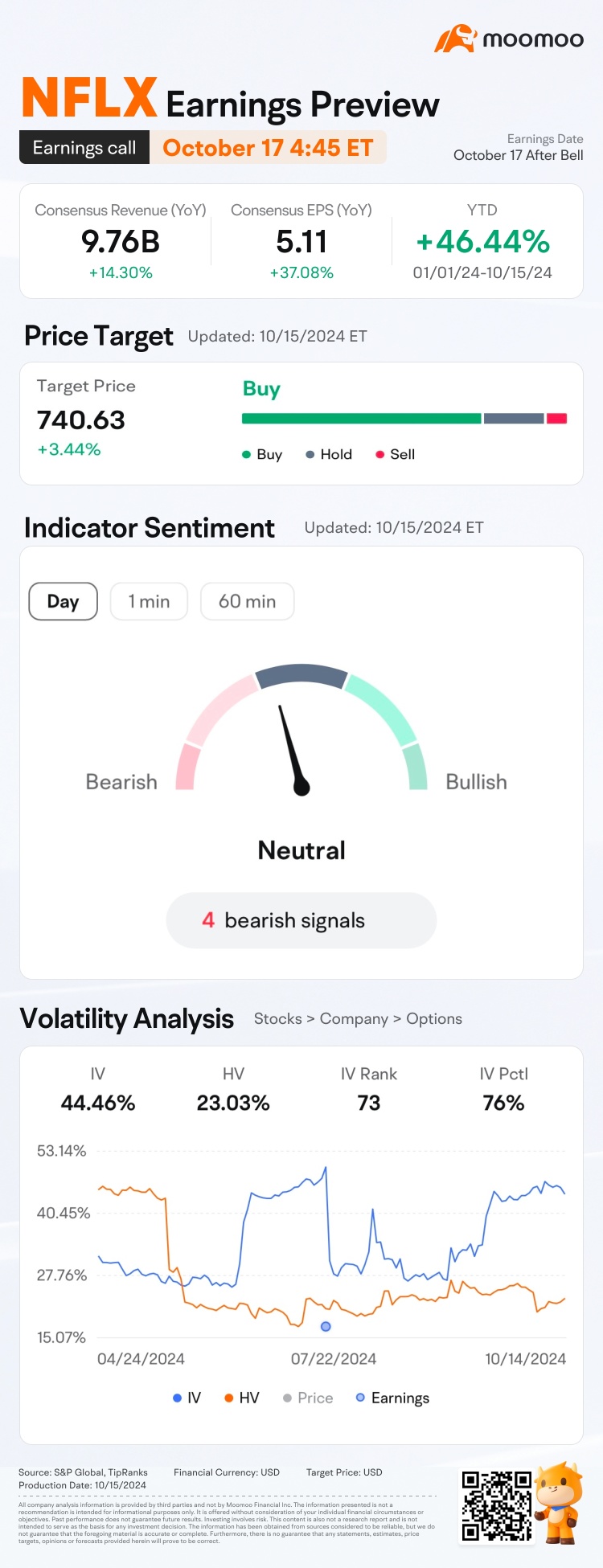

$Netflix (NFLX.US)$ is releasing its Q3 earnings on October 18 after the bell. Netflix's stock price went up over 45% this year![]() , fueled by robust subscription growth.

, fueled by robust subscription growth.

Need more details of their earning release? >> Unlock insights with NFLX Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q2 2024 earnings release, shares of $Netflix (NFLX.US)$ have seen an increase of 8.62%.![]() How wil...

How wil...

Need more details of their earning release? >> Unlock insights with NFLX Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q2 2024 earnings release, shares of $Netflix (NFLX.US)$ have seen an increase of 8.62%.

Expand

Expand 87

103

10

輸贏一瞬間

voted

Hi, mooers!

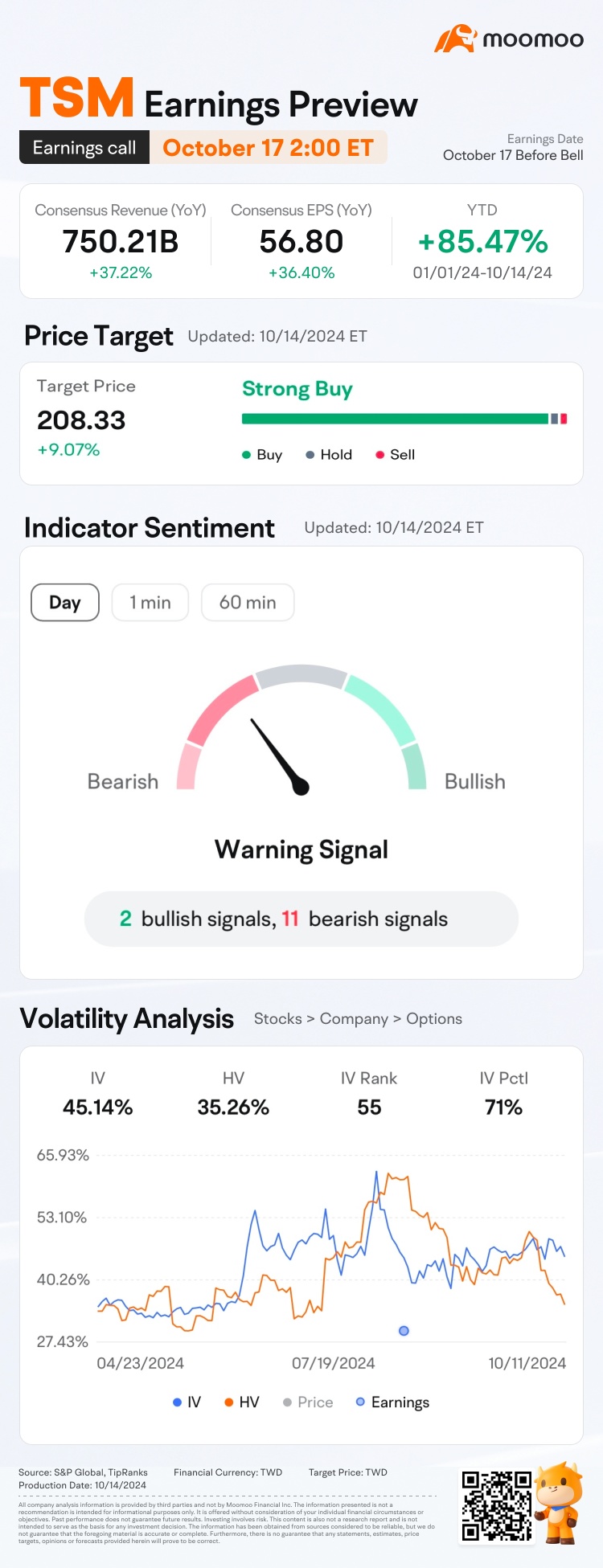

$Taiwan Semiconductor (TSM.US)$ is releasing its Q3 2024 earnings on October 17 before the bell. Unlock insights with TSM Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q2 2024 earnings release, shares of $Taiwan Semiconductor (TSM.US)$ have seen an increase of 11.42%.![]() How will the market react to the upcoming results? Make your guess now!

How will the market react to the upcoming results? Make your guess now!

Rewards

● An equal share of 5,000 ...

$Taiwan Semiconductor (TSM.US)$ is releasing its Q3 2024 earnings on October 17 before the bell. Unlock insights with TSM Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q2 2024 earnings release, shares of $Taiwan Semiconductor (TSM.US)$ have seen an increase of 11.42%.

Rewards

● An equal share of 5,000 ...

Expand

Expand 134

212

16

Translated

1

$THETA (9075.MY)$

Keep dropping

Keep dropping

Translated

輸贏一瞬間

commented on

輸贏一瞬間

commented on

Order flow continues to rise, top glove is expected to turn profitable in the 2025 fiscal year.

(Kuala Lumpur, 10th) Top glove $TOPGLOV (7113.MY)$ In the 2024 fiscal year, the loss of top glove narrowed significantly. With the order flow continuing to rise, the management is bullish on achieving profitability in the 2025 fiscal year.

Lim Kwee Soong, the director of top glove, said at today's online performance briefing that with the current sales growth momentum, the company believes achieving profitability in the 2025 fiscal year is feasible.

In the latest quarterly performance announced, sales volume increased by 91% year-on-year, with North America's sales volume skyrocketing by 117% from the previous quarter, accounting for 17% of the total sales.

However, he stated that this is mainly due to reduced inventory leading to restocking, rather than the effect of US tariffs.

Looking back at previous reports, the US significantly increased tariffs on Chinese commodities, including gloves, with the tax rate set to rise to 50% starting in 2025, further increasing to 100% in 2026; compared to the earlier proposal of a 25% tariff increase in 2026.

"The sales resulting from the tariff effect will partially manifest in the first quarter of the 2025 fiscal year, which is this November, with more effects to be seen in the following quarter, as at that time, China's (medical glove) sales to the USA will cease completely."

Top Glove's executive chairman Tan Sri Lim Wee Chai added that this will significantly impact the sales of Chinese glove manufacturers, who may try to ship as much as possible by the end of the year, while on the other hand, (US tariffs) will benefit glove manufacturers from other countries.

When asked if they are worried about competition...

(Kuala Lumpur, 10th) Top glove $TOPGLOV (7113.MY)$ In the 2024 fiscal year, the loss of top glove narrowed significantly. With the order flow continuing to rise, the management is bullish on achieving profitability in the 2025 fiscal year.

Lim Kwee Soong, the director of top glove, said at today's online performance briefing that with the current sales growth momentum, the company believes achieving profitability in the 2025 fiscal year is feasible.

In the latest quarterly performance announced, sales volume increased by 91% year-on-year, with North America's sales volume skyrocketing by 117% from the previous quarter, accounting for 17% of the total sales.

However, he stated that this is mainly due to reduced inventory leading to restocking, rather than the effect of US tariffs.

Looking back at previous reports, the US significantly increased tariffs on Chinese commodities, including gloves, with the tax rate set to rise to 50% starting in 2025, further increasing to 100% in 2026; compared to the earlier proposal of a 25% tariff increase in 2026.

"The sales resulting from the tariff effect will partially manifest in the first quarter of the 2025 fiscal year, which is this November, with more effects to be seen in the following quarter, as at that time, China's (medical glove) sales to the USA will cease completely."

Top Glove's executive chairman Tan Sri Lim Wee Chai added that this will significantly impact the sales of Chinese glove manufacturers, who may try to ship as much as possible by the end of the year, while on the other hand, (US tariffs) will benefit glove manufacturers from other countries.

When asked if they are worried about competition...

Translated

39

7

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

輸贏一瞬間 Kyrios : I saw the Bulls' Jordan is here, six championships flying.