追風

liked and voted

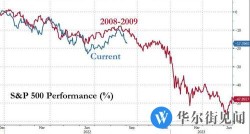

Based on past experience, the stock market usually hits rock bottom. $VIX Index Futures(FEB5) (VXmain.US)$When it reaches above 50!

But in this bear market, the S&P briefly touched a price of 3491, but the VIX has yet to reach 50 or higher (peaking at only 38)! Will this time be different from the past? I think only time can answer that~

However, due to the experiences of the past two years, investors have developed the mentality of investing again, believing that if it drops today, it will rise tomorrow~

It seems that the world is gradually moving away from globalization towards deglobalization!

In addition, with the excessive quantitative easing of the past two years and the current violent interest rate hikes, I personally think that the probability of a financial crisis is somewhat high and difficult to prevent~

Because derivative commodities are so complex, even the trading managers may not know, FED can only wait until things really happen to rescue the market under such circumstances and background!

But whether the worst scenario will happen, no one knows!

Although the personal view is very high probability...

Feel free to leave comments for discussion!

And assuming it really happened, what do you think, audience? $E-mini S&P 500 Futures(MAR5) (ESmain.US)$ $S&P 500 Index (.SPX.US)$ Where will the spot price correct to? And at what point will you be willing to go all in, even bottom fishing at all costs?

Welcome to vote and discuss together~

The voting time will be until the end of this year...

But in this bear market, the S&P briefly touched a price of 3491, but the VIX has yet to reach 50 or higher (peaking at only 38)! Will this time be different from the past? I think only time can answer that~

However, due to the experiences of the past two years, investors have developed the mentality of investing again, believing that if it drops today, it will rise tomorrow~

It seems that the world is gradually moving away from globalization towards deglobalization!

In addition, with the excessive quantitative easing of the past two years and the current violent interest rate hikes, I personally think that the probability of a financial crisis is somewhat high and difficult to prevent~

Because derivative commodities are so complex, even the trading managers may not know, FED can only wait until things really happen to rescue the market under such circumstances and background!

But whether the worst scenario will happen, no one knows!

Although the personal view is very high probability...

Feel free to leave comments for discussion!

And assuming it really happened, what do you think, audience? $E-mini S&P 500 Futures(MAR5) (ESmain.US)$ $S&P 500 Index (.SPX.US)$ Where will the spot price correct to? And at what point will you be willing to go all in, even bottom fishing at all costs?

Welcome to vote and discuss together~

The voting time will be until the end of this year...

Translated

1

追風

liked and voted

Based on past experience, the stock market truly bottoms out when the VIX reaches 50 or higher!

But in this bear market, the S&P briefly touched a price of 3491, but the VIX has yet to reach 50 or higher (peaking at only 38)! Will this time be different from the past? I think only time can answer that~

However, due to the experiences of the past two years, investors have developed the mentality of investing again, believing that if it drops today, it will rise tomorrow~

It seems that the world is gradually moving away from globalization towards deglobalization!

In addition, with the excessive quantitative easing of the past two years and the current violent interest rate hikes, I personally think that the probability of a financial crisis is somewhat high and difficult to prevent~

Because derivative commodities are so complex, even the trading managers may not know, FED can only wait until things really happen to rescue the market under such circumstances and background!

But whether the worst scenario will happen, no one knows!

Although the personal view is very high probability...

Feel free to leave comments for discussion!

And if it really happens, where do you think the S&P spot will correct to? And that level will make you willing to go all in and buy the dip at all costs!?

Welcome to vote and discuss together~

The voting time is until the end of this year, after all, personally, I think the possible time is next year 🤣🤣

$iShares Semiconductor ETF (SOXX.US)$ $NASDAQ 100 Index (.NDX.US)$ $ �������...

But in this bear market, the S&P briefly touched a price of 3491, but the VIX has yet to reach 50 or higher (peaking at only 38)! Will this time be different from the past? I think only time can answer that~

However, due to the experiences of the past two years, investors have developed the mentality of investing again, believing that if it drops today, it will rise tomorrow~

It seems that the world is gradually moving away from globalization towards deglobalization!

In addition, with the excessive quantitative easing of the past two years and the current violent interest rate hikes, I personally think that the probability of a financial crisis is somewhat high and difficult to prevent~

Because derivative commodities are so complex, even the trading managers may not know, FED can only wait until things really happen to rescue the market under such circumstances and background!

But whether the worst scenario will happen, no one knows!

Although the personal view is very high probability...

Feel free to leave comments for discussion!

And if it really happens, where do you think the S&P spot will correct to? And that level will make you willing to go all in and buy the dip at all costs!?

Welcome to vote and discuss together~

The voting time is until the end of this year, after all, personally, I think the possible time is next year 🤣🤣

$iShares Semiconductor ETF (SOXX.US)$ $NASDAQ 100 Index (.NDX.US)$ $ �������...

Translated

1

追風

liked

May I ask everyone, is the valuation of SOXX currently within a reasonable range?

What price is considered expensive? And what price is considered cheap?

$NASDAQ 100 Index (.NDX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $S&P 500 Index (.SPX.US)$

What price is considered expensive? And what price is considered cheap?

$NASDAQ 100 Index (.NDX.US)$ $Dow Jones Industrial Average (.DJI.US)$ $S&P 500 Index (.SPX.US)$

Translated

1

追風

liked

May I ask everyone, is the valuation of SOXX currently within a reasonable range?

What price is considered expensive? What price is considered cheap?

$E-mini NASDAQ 100 Futures(MAR5) (NQmain.US)$ $E-mini Dow Futures(MAR5) (YMmain.US)$ $E-mini S&P 500 Futures(MAR5) (ESmain.US)$

What price is considered expensive? What price is considered cheap?

$E-mini NASDAQ 100 Futures(MAR5) (NQmain.US)$ $E-mini Dow Futures(MAR5) (YMmain.US)$ $E-mini S&P 500 Futures(MAR5) (ESmain.US)$

Translated

1

追風

liked

May I ask everyone, is the valuation of SOXX currently within a reasonable range?

What price is considered expensive? What price is considered cheap?

$iShares Semiconductor ETF (SOXX.US)$ $VanEck Semiconductor ETF (SMH.US)$ $Direxion Daily Semiconductor Bull 3x Shares ETF (SOXL.US)$

What price is considered expensive? What price is considered cheap?

$iShares Semiconductor ETF (SOXX.US)$ $VanEck Semiconductor ETF (SMH.US)$ $Direxion Daily Semiconductor Bull 3x Shares ETF (SOXL.US)$

Translated

1

追風

commented on

$Direxion Daily Semiconductor Bear 3x Shares ETF (SOXS.US)$ Just ask, how much do you guys cost?

Translated

6

追風

liked

$Direxion Daily Semiconductor Bull 3x Shares ETF (SOXL.US)$

SOXL has been destroyed in just the past week, ceding a third of its value.

The long-term outlook for semis remains strong but faces headwinds near term.

SOXL is very oversold and looks ready to bounce.

The latest selling episode in the markets - which feels like about the 900th such episode this year - has crushed high-growth/high-valuation sectors once again. Perhaps no one sector better exempl...

SOXL has been destroyed in just the past week, ceding a third of its value.

The long-term outlook for semis remains strong but faces headwinds near term.

SOXL is very oversold and looks ready to bounce.

The latest selling episode in the markets - which feels like about the 900th such episode this year - has crushed high-growth/high-valuation sectors once again. Perhaps no one sector better exempl...

8

1

追風

liked

If. $Direxion Daily Semiconductor Bull 3x Shares ETF (SOXL.US)$ $ProShares UltraPro QQQ ETF (TQQQ.US)$ $ProShares UltraPro S&P500 ETF (UPRO.US)$ If encountered 08, what will be the result?

Translated

2

2

追風

commented on and voted

$VIX Index Futures(FEB5) (VXmain.US)$ $E-mini NASDAQ 100 Futures(MAR5) (NQmain.US)$ $E-mini Dow Futures(MAR5) (YMmain.US)$

How do you think the big plate is going to go tonight?

How do you think the big plate is going to go tonight?

Translated

3

22

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)