闇夜

reacted to and commented on

$CROSSTEC (03893.HK)$ Seeing many platforms urging people to buy, is it time to consider shorting? High price, worth pondering..

Translated

3

1

Path: Detailed Information > Setting Icon > Similar Charts

This feature allows you to generate similar charts for comparison. For example, stocks with downward rebounds, trading range breakouts, and rising trend stocks. This helps you quickly understand the current trends of similar stocks, making it easier for you to find similar stocks!

This feature allows you to generate similar charts for comparison. For example, stocks with downward rebounds, trading range breakouts, and rising trend stocks. This helps you quickly understand the current trends of similar stocks, making it easier for you to find similar stocks!

Translated

1

闇夜

commented on and voted

Yoooo mooers![]()

![]()

![]()

How are you doing recently?

Mmmmmm...No kidding, let's get back to business.

![]() Welcome back to mooShool Summer Camp S6! Learning will never betray us, get some real-talk man!

Welcome back to mooShool Summer Camp S6! Learning will never betray us, get some real-talk man!

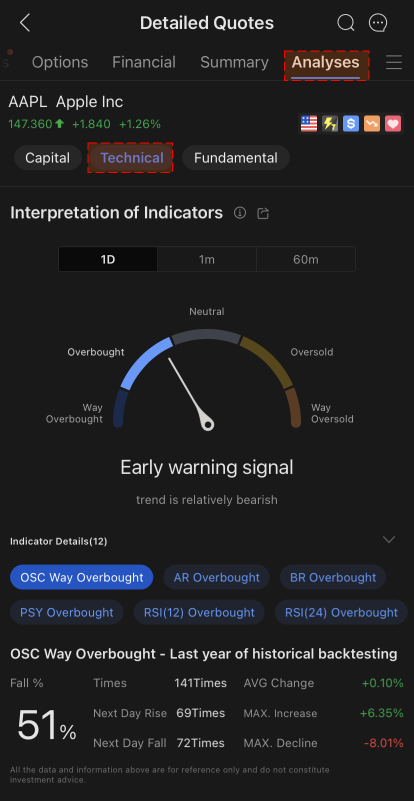

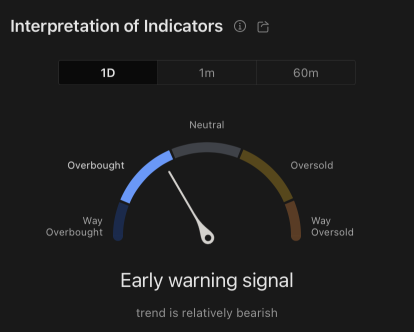

![]() Have you ever explored the feature of Interpretation of Indicators on moomoo? It's a surprisingly useful tool especially for newbies. It interpretes the complex technical indicators into a simple graph and summarizes the market situation of the s...

Have you ever explored the feature of Interpretation of Indicators on moomoo? It's a surprisingly useful tool especially for newbies. It interpretes the complex technical indicators into a simple graph and summarizes the market situation of the s...

How are you doing recently?

Mmmmmm...No kidding, let's get back to business.

+1

183

156

Chip distribution, English “Position Cost Distribution”

How to view: Detailed Offer - Locate Cost Allocation

Simply put, chip distribution. It lets you know the “purchase price” of investors and the “total holding/distribution” of “each price point” for the “day”.

Based on checking the chip distribution over a period of time (for example, month/quarter/ half a year/year), you can set a more “safe” purchase price/point for the stocks you are about to buy.

1. Anticipate future trends

If the current total chips are distributed at the “low price/low level”, and (i) there are no investors with a high number of shareholds/chip distribution above, then when this stock matches the upward trend of good news/performance, the resistance it will encounter will be very small, and the “probability of increase” of this stock will greatly increase. Because no one will sell stocks at this time until the investor's profitable price is reached (10%/20%/50%/100% or more).

Conversely, if you are currently buying at the price, (ii) you find investors with high shareholds/chip distribution above, then the resistance to rise will be relatively greater. Investors who have been locked up before may sell stocks when the stock price reaches a locked position above (high holding price), creating an intangible pressure.

2. For example - “low price/low end”

i. If the current stock price is ¥10 and this price is the lowest point that investors think (for example, refer to financial reports or P/E or trend lines)

ii. However, most of the total chips are distributed around ¥9-¥11, so the price of ¥10 can probably be considered a good “opening/opening/buying” price.

III. Whereas...

How to view: Detailed Offer - Locate Cost Allocation

Simply put, chip distribution. It lets you know the “purchase price” of investors and the “total holding/distribution” of “each price point” for the “day”.

Based on checking the chip distribution over a period of time (for example, month/quarter/ half a year/year), you can set a more “safe” purchase price/point for the stocks you are about to buy.

1. Anticipate future trends

If the current total chips are distributed at the “low price/low level”, and (i) there are no investors with a high number of shareholds/chip distribution above, then when this stock matches the upward trend of good news/performance, the resistance it will encounter will be very small, and the “probability of increase” of this stock will greatly increase. Because no one will sell stocks at this time until the investor's profitable price is reached (10%/20%/50%/100% or more).

Conversely, if you are currently buying at the price, (ii) you find investors with high shareholds/chip distribution above, then the resistance to rise will be relatively greater. Investors who have been locked up before may sell stocks when the stock price reaches a locked position above (high holding price), creating an intangible pressure.

2. For example - “low price/low end”

i. If the current stock price is ¥10 and this price is the lowest point that investors think (for example, refer to financial reports or P/E or trend lines)

ii. However, most of the total chips are distributed around ¥9-¥11, so the price of ¥10 can probably be considered a good “opening/opening/buying” price.

III. Whereas...

Translated

+2

5

2

闇夜

commented on

Options, the English term for '期权'. It aims to increase personal profits based on the principle of leverage. Simply put, it's about risking a small amount to gain big.

Unusual options activity, the English term for '期权异动'. Unusual options activity refers to a large volume of trades occurring within a short period, leading to a significant surge or drop in options/stocks. Unlike stocks, all options trades are publicly disclosed and displayed on the options chain. By observing unusual options activity on the options chain, we can determine the potential surge/drop in stocks.

Since the majority of unusual options activity is driven by institutions, who possess sufficient information, thorough research, and substantial funds to make purchases, basing stock price predictions on the direction of unusual options activity can be somewhat helpful.

These anomalies occur within a very short timeframe. By tracking/following unusual options activity, it provides us with a reference for potential 'surges/drops' in the stock market.

Unusual options activity, the English term for '期权异动'. Unusual options activity refers to a large volume of trades occurring within a short period, leading to a significant surge or drop in options/stocks. Unlike stocks, all options trades are publicly disclosed and displayed on the options chain. By observing unusual options activity on the options chain, we can determine the potential surge/drop in stocks.

Since the majority of unusual options activity is driven by institutions, who possess sufficient information, thorough research, and substantial funds to make purchases, basing stock price predictions on the direction of unusual options activity can be somewhat helpful.

These anomalies occur within a very short timeframe. By tracking/following unusual options activity, it provides us with a reference for potential 'surges/drops' in the stock market.

Translated

117

34

$Safe Bulkers (SB.US)$ Will it be the next trend? Financial reports await!

Translated

1

闇夜

commented on

$RCM Technologies (RCMT.US)$ will this uptrend continues..Let's mark on this stock!

5

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

闇夜 : CPI drops

闇夜 : Good news?

闇夜 : Good news come should sell stock?

闇夜 : Bad news come then buy stock?

闇夜 : Run run run

View more comments...