阿栗妹

commented on

Happy Monday, July 1st, the start of the year's second half and third quarter.

Indexes traded higher Monday, while overall, there were more declining equities than advancing. Just after the 4 pm close, the $Dow Jones Industrial Average (.DJI.US)$ climbed 0.13%, while the $S&P 500 Index (.SPX.US)$ climbed 0.27% after hitting a fresh all-time high Friday at the close of the first half of the year.

The $Nasdaq Composite Index (.IXIC.US)$ similarly hit al...

Indexes traded higher Monday, while overall, there were more declining equities than advancing. Just after the 4 pm close, the $Dow Jones Industrial Average (.DJI.US)$ climbed 0.13%, while the $S&P 500 Index (.SPX.US)$ climbed 0.27% after hitting a fresh all-time high Friday at the close of the first half of the year.

The $Nasdaq Composite Index (.IXIC.US)$ similarly hit al...

96

20

阿栗妹

Set a live reminder

$JPMorgan (JPM.US)$

JPMorgan Q1 2024 earnings conference call is scheduled for April 12 at 8:30 AM ET /April 12 at 8:30 PM SGT/April 13 at 11:30 PM AEST. Subscribe NOW to join the live earnings conference and hear directly from JPMorgan's management!

Beat or Miss?

What do you expect from JPMorgan's Q1 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what JPMorgan's management has to say!

Disclaimer:

This presentation is for information and educat...

JPMorgan Q1 2024 earnings conference call is scheduled for April 12 at 8:30 AM ET /April 12 at 8:30 PM SGT/April 13 at 11:30 PM AEST. Subscribe NOW to join the live earnings conference and hear directly from JPMorgan's management!

Beat or Miss?

What do you expect from JPMorgan's Q1 earnings? Will the company beat or miss the estimates? Make sure to click the "Book" button to get what JPMorgan's management has to say!

Disclaimer:

This presentation is for information and educat...

JPMorgan Q1 2024 earnings conference call

Apr 12 07:30

8

阿栗妹

reacted to

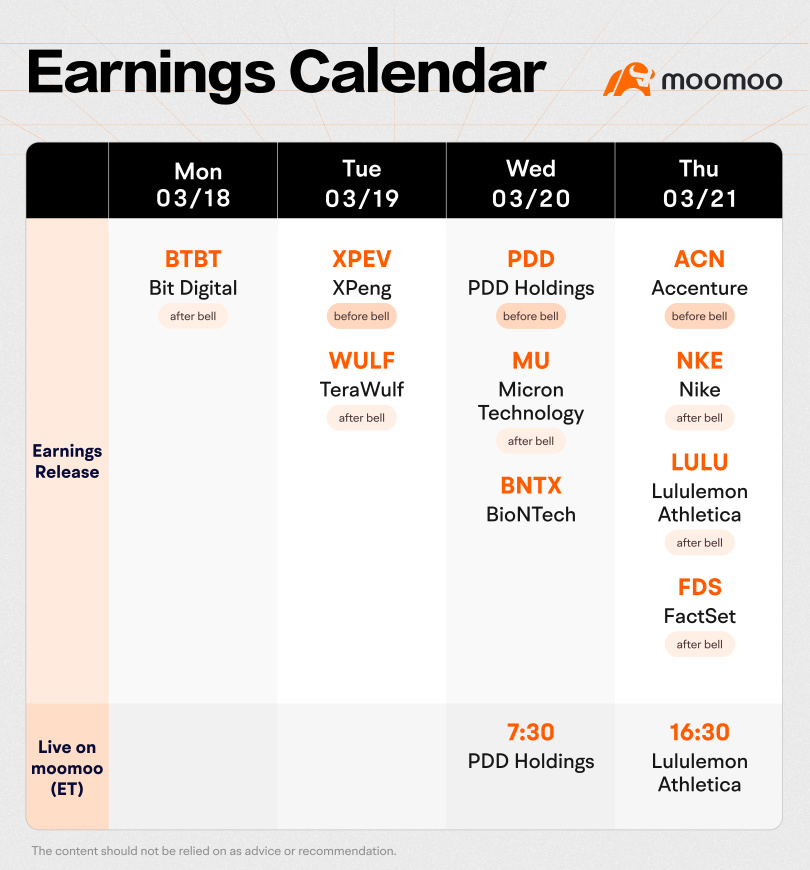

This week sees a reduced slate of earnings reports, with the focus turning to the Federal Reserve meeting.

Monday will see $Bit Digital (BTBT.US)$ set the tone for the week, followed by announcements from $XPeng (XPEV.US)$ and $TeraWulf (WULF.US)$ on Tuesday. Wednesday's lineup features $PDD Holdings (PDD.US)$, $Micron Technology (MU.US)$, and $BioNTech (BNTX.US)$, while Thursday's roster includes $Accenture (ACN.US)$, ��������...

Monday will see $Bit Digital (BTBT.US)$ set the tone for the week, followed by announcements from $XPeng (XPEV.US)$ and $TeraWulf (WULF.US)$ on Tuesday. Wednesday's lineup features $PDD Holdings (PDD.US)$, $Micron Technology (MU.US)$, and $BioNTech (BNTX.US)$, while Thursday's roster includes $Accenture (ACN.US)$, ��������...

+3

56

7

阿栗妹

reacted to

What is the Fed's balance sheet?

What the Federal Reserve buys is an asset, which is shown in itsbalance sheet. The Fed's assets consist primarily of U.S. Treasury notes, bonds and agency mortgage-backed securities (MBS).

- The balance sheet can be used to achieve the Fed's monetary policy.

- When the Fed purchase asset, it signals an easy monetary policy to support the economy.

- Conversely, the sale of Fed assets is a policy tightening approach tha...

What the Federal Reserve buys is an asset, which is shown in itsbalance sheet. The Fed's assets consist primarily of U.S. Treasury notes, bonds and agency mortgage-backed securities (MBS).

- The balance sheet can be used to achieve the Fed's monetary policy.

- When the Fed purchase asset, it signals an easy monetary policy to support the economy.

- Conversely, the sale of Fed assets is a policy tightening approach tha...

+2

7

1

阿栗妹

liked

The 10-year Treasury note yield slipped further on Monday, as the final full trading week of 2023 gets underway.

Traders continue to digest the unexpectedly dovish tone of the U.S. Federal Reserve last week. The central bank held its key interest rate steady and revealed that policymakers were penciling in at least three rate cuts next year — marking a more aggressive series of cuts than what was previously hinted.

The yield on the 10-y...

Traders continue to digest the unexpectedly dovish tone of the U.S. Federal Reserve last week. The central bank held its key interest rate steady and revealed that policymakers were penciling in at least three rate cuts next year — marking a more aggressive series of cuts than what was previously hinted.

The yield on the 10-y...

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)