陳國铭

voted

Today $S&P 500 Index (.SPX.US)$started sliding backwards with the Mag7 following the dip. $Apple (AAPL.US)$ started strong but the outlooks seems choppy today. ![]()

All eyes on $NVIDIA (NVDA.US)$ ER which will show profits beating estimates. But is it enough? Unless the new product shows more orders or gains. It may not be enough for the Market.![]()

$Tesla (TSLA.US)$ & $Amazon (AMZN.US)$ with the biggest dip so far over 1.7% and 1.3% respectively.![]()

Don’t panic and stay with your strategy....

All eyes on $NVIDIA (NVDA.US)$ ER which will show profits beating estimates. But is it enough? Unless the new product shows more orders or gains. It may not be enough for the Market.

$Tesla (TSLA.US)$ & $Amazon (AMZN.US)$ with the biggest dip so far over 1.7% and 1.3% respectively.

Don’t panic and stay with your strategy....

+1

17

1

陳國铭

voted

Here’s a post draft for today’s market movement:

![]() Today’s market saw mixed emotions and movement! While $Amazon (AMZN.US)$ managed to stay green with a modest gain of +0.88%, many tech giants like $Tesla (TSLA.US)$, $NVIDIA (NVDA.US)$, and $Alphabet-A (GOOGL.US)$ are experiencing pullbacks. Tesla, in particular, dropped -0.46%, and Nvidia and Google were also in the red by -0.96% and -1.35% respectively.

Today’s market saw mixed emotions and movement! While $Amazon (AMZN.US)$ managed to stay green with a modest gain of +0.88%, many tech giants like $Tesla (TSLA.US)$, $NVIDIA (NVDA.US)$, and $Alphabet-A (GOOGL.US)$ are experiencing pullbacks. Tesla, in particular, dropped -0.46%, and Nvidia and Google were also in the red by -0.96% and -1.35% respectively.

Are we witnessing a necessary correction or a signal for caution?![]() With RSI l...

With RSI l...

Are we witnessing a necessary correction or a signal for caution?

20

1

陳國铭

voted

Today’s market sees some varied movements across major stocks, with a notable pullback from $Tesla (TSLA.US)$ which is down by -3.52%, now sitting at $337.68. After recent highs, this dip has everyone watching closely, wondering if it’s a temporary correction or the start of a more cautious phase for TSLA.

$NVIDIA (NVDA.US)$ is holding steady, up by +0.75%, and $Meta Platforms (META.US)$ is seeing a solid gain of +1.43%. Oth...

$NVIDIA (NVDA.US)$ is holding steady, up by +0.75%, and $Meta Platforms (META.US)$ is seeing a solid gain of +1.43%. Oth...

25

2

1

陳國铭

voted

Hi mooers! ![]()

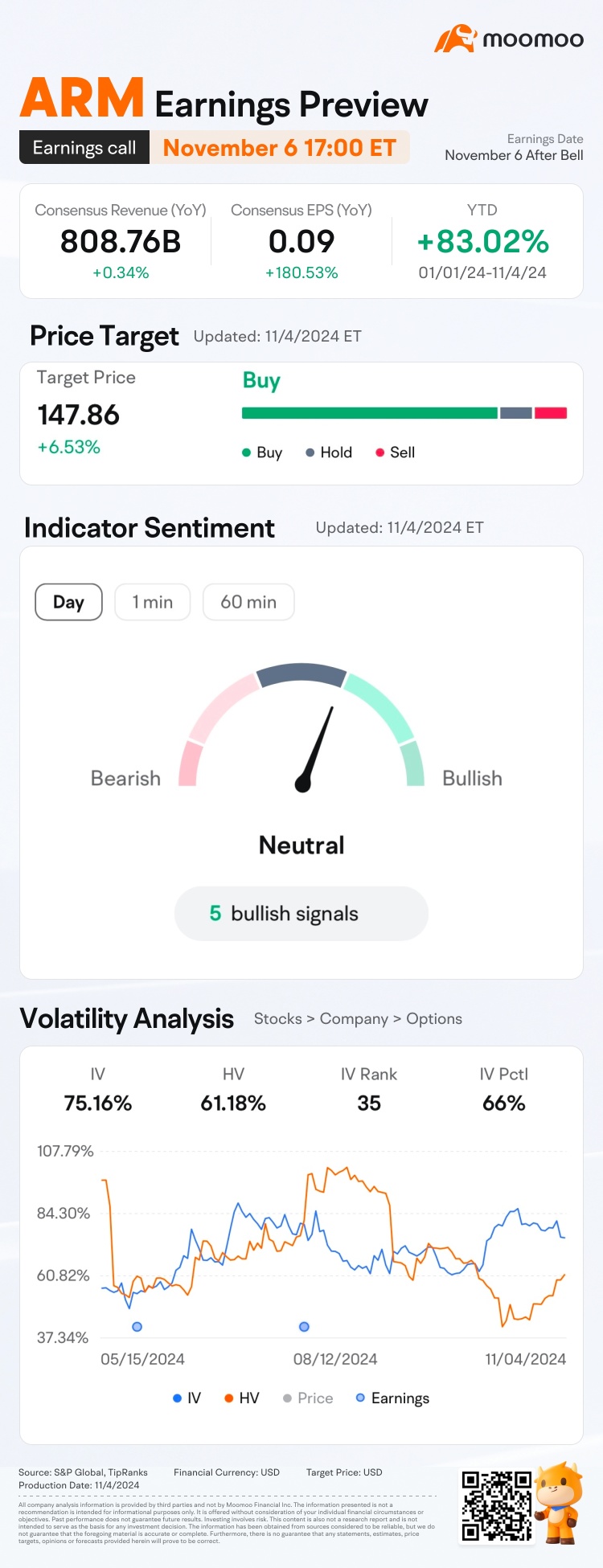

$Arm Holdings (ARM.US)$ is releasing its Q2 FY2025 earnings on November 6 after the bell. Unlock insights with ARM Earnings Hub>>

With AI and semiconductor sector heating up, ARM has seen its share price rise over 80% in 2024![]() . The chip designer's EPS is expected to grow 180.53%, by analysts' consensus. What outlook would the company's management provide? Subscribe to @Moo Live and book the conference call!

. The chip designer's EPS is expected to grow 180.53%, by analysts' consensus. What outlook would the company's management provide? Subscribe to @Moo Live and book the conference call!

For the deta...

$Arm Holdings (ARM.US)$ is releasing its Q2 FY2025 earnings on November 6 after the bell. Unlock insights with ARM Earnings Hub>>

With AI and semiconductor sector heating up, ARM has seen its share price rise over 80% in 2024

For the deta...

24

22

2

$Palantir (PLTR.US)$ looking towards $25-$30,this week 🤝⭐

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)