面对大海春暖花开

Set a live reminder

In the first session for 2025 moomoo's market strategist discusses the potential moves that could result from the installation of the new President of the USA. Mr Trump has promised action on his first day in office. Oil and gas stocks, cryptocurrencies, Tesla, and the US and global economies are all on the radar. Join the discussion, ask questions and have your say as we explore the potential market impacts and the possible course of markets over 2025. Feel f...

Ask a strategist - Trump's first day

Jan 14 08:00

236

278

15

No reason.

面对大海春暖花开

voted

$Seatrium (S51.SG)$

possible of hitting $0.11 on 26th february ?

possible of hitting $0.11 on 26th february ?

7

6

面对大海春暖花开

voted

At the beginning of 2022, the FED started the quantitative tightening policy. Since then, the stock market has gone all the way down without any hesitation. But a shocking plot twist happened in the first month of 2023. Almost everything went up crazily.

Some investors are benefiting from the upward trend. However, others with negative expectations might feel like taking a mighty punch right in their faces.

@Johnsh: Powell Pummeling Puts Visual $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$

���������...

Some investors are benefiting from the upward trend. However, others with negative expectations might feel like taking a mighty punch right in their faces.

@Johnsh: Powell Pummeling Puts Visual $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$

���������...

+10

57

78

9

It is sad to have to work for money after the age of 65. If it is to pass the time, enrich life and make interesting friends, then it is worth it.

Translated

1

面对大海春暖花开

voted

Hi, mooers!![]()

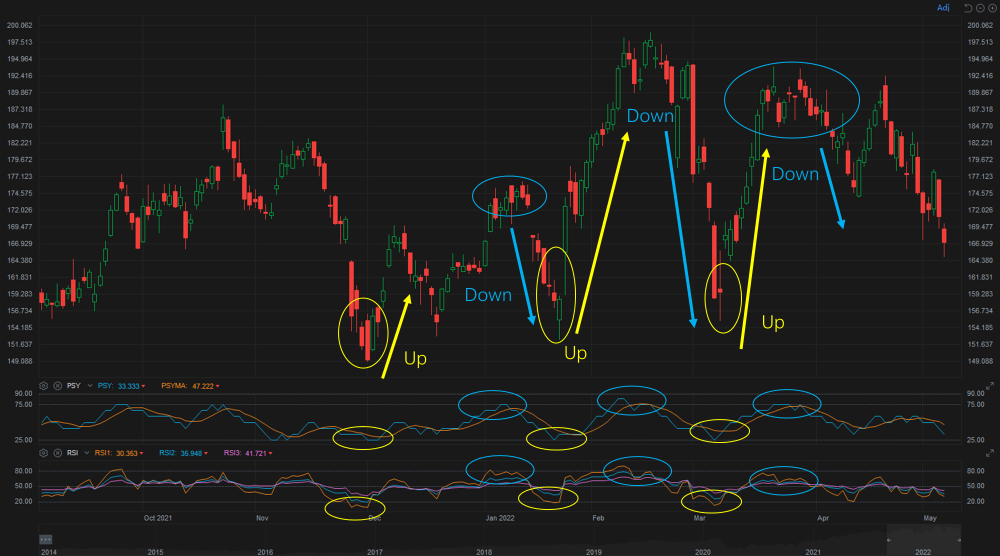

Ready for another big meal for the mind? Scroll down and get your mind full. As mentioned in previous posts, it is risky to use only one indicator to analyze the entry or exit points. The PSY (psychological line) indicator is no exception.![]()

If you only used the PSY indicator, you could miss out on opportunities. Therefore, we need to consider it with other technical indicators to make the entry or exit decisions. Now, follow me and find out how...

Ready for another big meal for the mind? Scroll down and get your mind full. As mentioned in previous posts, it is risky to use only one indicator to analyze the entry or exit points. The PSY (psychological line) indicator is no exception.

If you only used the PSY indicator, you could miss out on opportunities. Therefore, we need to consider it with other technical indicators to make the entry or exit decisions. Now, follow me and find out how...

49

5

15

面对大海春暖花开

commented on

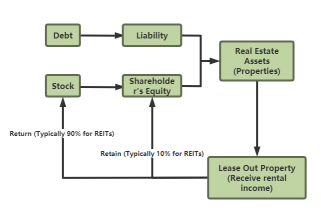

Hey, mooers! At the end of this post, there is a chance for you to win points!![]()

Welcome back to REITs 101, which will level up your REITs investment knowledge with our full educational REIT Investment.

Do you remember the question we left in the last post >> REITs 101: A brief history of REITs?

![]() Question :

Question :

What's the name of Singapore's first REIT?

Answer: SingMall Property Trust

Did you get it right? Congratulations to those mooers who got it right and won 50 poi...

Welcome back to REITs 101, which will level up your REITs investment knowledge with our full educational REIT Investment.

Do you remember the question we left in the last post >> REITs 101: A brief history of REITs?

What's the name of Singapore's first REIT?

Answer: SingMall Property Trust

Did you get it right? Congratulations to those mooers who got it right and won 50 poi...

25

8

17

面对大海春暖花开

voted

Whether you admit it or not.

Investing and a relationship have something in common.

![]() Sometimes they trick you

Sometimes they trick you

@Yassien: $AMC Entertainment (AMC.US)$ Imagine putting money on an investment that requires gimmicks like playing games with sentiment and fake tickers which still do nothing to make a moaz happen. Actually says a lot about ape integrity. They want to deceive people in order to make their money.

![]() Sometimes it's sweet (which is useless...

Sometimes it's sweet (which is useless...

Investing and a relationship have something in common.

@Yassien: $AMC Entertainment (AMC.US)$ Imagine putting money on an investment that requires gimmicks like playing games with sentiment and fake tickers which still do nothing to make a moaz happen. Actually says a lot about ape integrity. They want to deceive people in order to make their money.

+9

61

61

17

After entering at a high level, hold on, and buy again after a 20% decline. If it continues to decline, then continue to buy. However, the premise is that this stocks is worth holding, considering everything from the company's financial report to the analysis rating and expected target price of various securities firms. If the stock selection is incorrect, then cut losses in time and unwind the position at a high price.

Translated

面对大海春暖花开

liked

Stock rebound may continue in Asia; bonds decline

A global rebound in stocks may continue in Asia on Wednesday as investor sentiment improves after being roiled by uncertainty over the omicron virus strain and stimulus outlook.

Futures for Japan and Hong Kong rose, while Australian shares edged up. U.S. contracts fluctuated after the $S&P 500 Index (.SPX.US)$ snapped three days of declines and the technology-heavy $NASDAQ 100 Index (.NDX.US)$ climbed more than 2%. A gauge of Chinese shares traded in the U.S. surged about 7%.

Turkey markets rocked anew amid stock slump, record lira swings

Gyrations in Turkey's stocks and the lira signal volatility is here to stay, even after the government laid out emergency measures to bolster the currency.

The Borsa Istanbul 100 Index's 7.9% decline on Tuesday triggered yet another circuit breaker, as it headed for the biggest three-day loss in more than two decades. The currency whipsawed between gains and losses, after soaring as much as 20% against the U.S. dollar, sending both three-month and one-year volatility to all-time peaks.

Tuesday's market bounce could lead to a record 2022, Oppenheimer's top strategist says

Despite Covid-19 omicron risks, Oppenheimer Asset Management's John Stoltzfus suggests Tuesday's market bounce is real.

"We believe in it. We think investors should as well," the firm's chief investment strategist told CNBC,"The selling that we've seen over the last few days was overdone. Fundamentals are getting better going forward. Stocks are responding to that fact."

Crypto funds explode in boom year marked by first U.S. bitcoin ETF

Even beyond the launch of the first U.S. Bitcoin futures ETF, cryptocurrency funds notched some notable global milestones in 2021.

The number of crypto-tracking investment vehicles worldwide more than doubled to 80 from just 35 at the end of 2020, according to Bloomberg Intelligence data. Assets soared to $63 billion, compared to $24 billion at the start of the year.

Musk tweet fund adminstrator isn't filing statements, judge says

A judge is questioning the status of a $40 million fund that was established from fines paid by Elon Musk and $Tesla (TSLA.US)$ over controversial tweets.

The firm appointed in May to administer distributions from the fund, set up by the U.S. SEC for harmed investors, hasn' filed required accounting statements, U.S. District Judge Alison Nathan said in an order Tuesday. She directed Rust Consulting to submit a status report by Jan. 7.

U.S. share buybacks hit record while capex lags pre-crisis level

Share repurchases more than doubled from a year earlier for S&P 500 companies to an all-time high of $234.6 billion, according to data released Tuesday from S&P Dow Jones Indices. Meanwhile, capital expenditures increased 21% to $189 billion, which is still down 3% from the final three months of 2019 before the pandemic shutdown the economy.

Part of the reason could be related to the pandemic, as a shift in consumer demand has fueled lots of uncertainty for businesses and makes it difficult for companies to plan ahead.

Super-luxury home sales surge across U.S., rising 35% in 2021

In 2021, at least 40 residential properties sold for more than $50 million in the U.S., according to data compiled by the appraiser Miller Samuel. Fueled by a booming stock market, low interest rates, and a pandemic-era's heightened emphasis on home life, prices for luxury houses have risen to stratospheric heights across the country.

UK offers 1 billion pounds to firms hit hardest by Omicron

Britain has announced £1 billion of extra support for businesses hit hardest by the wave of Omicron variant coronavirus cases. Finance minister Rishi Sunak said he would "respond proportionately and appropriately" if further Covid restrictions are imposed.

Under the support announced on Tuesday, hospitality and leisure firms in England will be eligible for grants of up to 6,000 pounds for each of their premises, accounting for almost 700 million pounds of the new package.

Source: Bloomberg, CNBC

A global rebound in stocks may continue in Asia on Wednesday as investor sentiment improves after being roiled by uncertainty over the omicron virus strain and stimulus outlook.

Futures for Japan and Hong Kong rose, while Australian shares edged up. U.S. contracts fluctuated after the $S&P 500 Index (.SPX.US)$ snapped three days of declines and the technology-heavy $NASDAQ 100 Index (.NDX.US)$ climbed more than 2%. A gauge of Chinese shares traded in the U.S. surged about 7%.

Turkey markets rocked anew amid stock slump, record lira swings

Gyrations in Turkey's stocks and the lira signal volatility is here to stay, even after the government laid out emergency measures to bolster the currency.

The Borsa Istanbul 100 Index's 7.9% decline on Tuesday triggered yet another circuit breaker, as it headed for the biggest three-day loss in more than two decades. The currency whipsawed between gains and losses, after soaring as much as 20% against the U.S. dollar, sending both three-month and one-year volatility to all-time peaks.

Tuesday's market bounce could lead to a record 2022, Oppenheimer's top strategist says

Despite Covid-19 omicron risks, Oppenheimer Asset Management's John Stoltzfus suggests Tuesday's market bounce is real.

"We believe in it. We think investors should as well," the firm's chief investment strategist told CNBC,"The selling that we've seen over the last few days was overdone. Fundamentals are getting better going forward. Stocks are responding to that fact."

Crypto funds explode in boom year marked by first U.S. bitcoin ETF

Even beyond the launch of the first U.S. Bitcoin futures ETF, cryptocurrency funds notched some notable global milestones in 2021.

The number of crypto-tracking investment vehicles worldwide more than doubled to 80 from just 35 at the end of 2020, according to Bloomberg Intelligence data. Assets soared to $63 billion, compared to $24 billion at the start of the year.

Musk tweet fund adminstrator isn't filing statements, judge says

A judge is questioning the status of a $40 million fund that was established from fines paid by Elon Musk and $Tesla (TSLA.US)$ over controversial tweets.

The firm appointed in May to administer distributions from the fund, set up by the U.S. SEC for harmed investors, hasn' filed required accounting statements, U.S. District Judge Alison Nathan said in an order Tuesday. She directed Rust Consulting to submit a status report by Jan. 7.

U.S. share buybacks hit record while capex lags pre-crisis level

Share repurchases more than doubled from a year earlier for S&P 500 companies to an all-time high of $234.6 billion, according to data released Tuesday from S&P Dow Jones Indices. Meanwhile, capital expenditures increased 21% to $189 billion, which is still down 3% from the final three months of 2019 before the pandemic shutdown the economy.

Part of the reason could be related to the pandemic, as a shift in consumer demand has fueled lots of uncertainty for businesses and makes it difficult for companies to plan ahead.

Super-luxury home sales surge across U.S., rising 35% in 2021

In 2021, at least 40 residential properties sold for more than $50 million in the U.S., according to data compiled by the appraiser Miller Samuel. Fueled by a booming stock market, low interest rates, and a pandemic-era's heightened emphasis on home life, prices for luxury houses have risen to stratospheric heights across the country.

UK offers 1 billion pounds to firms hit hardest by Omicron

Britain has announced £1 billion of extra support for businesses hit hardest by the wave of Omicron variant coronavirus cases. Finance minister Rishi Sunak said he would "respond proportionately and appropriately" if further Covid restrictions are imposed.

Under the support announced on Tuesday, hospitality and leisure firms in England will be eligible for grants of up to 6,000 pounds for each of their premises, accounting for almost 700 million pounds of the new package.

Source: Bloomberg, CNBC

94

7

13

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)