102285623

liked

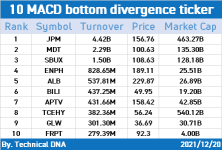

Technical DNA collects 10 most-traded bottom divergence tickers from stocks with market cap of more than $2B, aiming to help investors look for good investment opportunities. ![]()

![]()

![]() $JPMorgan (JPM.US)$ $Medtronic (MDT.US)$ $Starbucks (SBUX.US)$ $Enphase Energy (ENPH.US)$ $Albemarle (ALB.US)$ $Bilibili (BILI.US)$ $Aptiv PLC (APTV.US)$ $Tencent (TCEHY.US)$ $Corning (GLW.US)$ $Freshpet (FRPT.US)$

$JPMorgan (JPM.US)$ $Medtronic (MDT.US)$ $Starbucks (SBUX.US)$ $Enphase Energy (ENPH.US)$ $Albemarle (ALB.US)$ $Bilibili (BILI.US)$ $Aptiv PLC (APTV.US)$ $Tencent (TCEHY.US)$ $Corning (GLW.US)$ $Freshpet (FRPT.US)$

What is MACD divergence?![]()

![]()

![]()

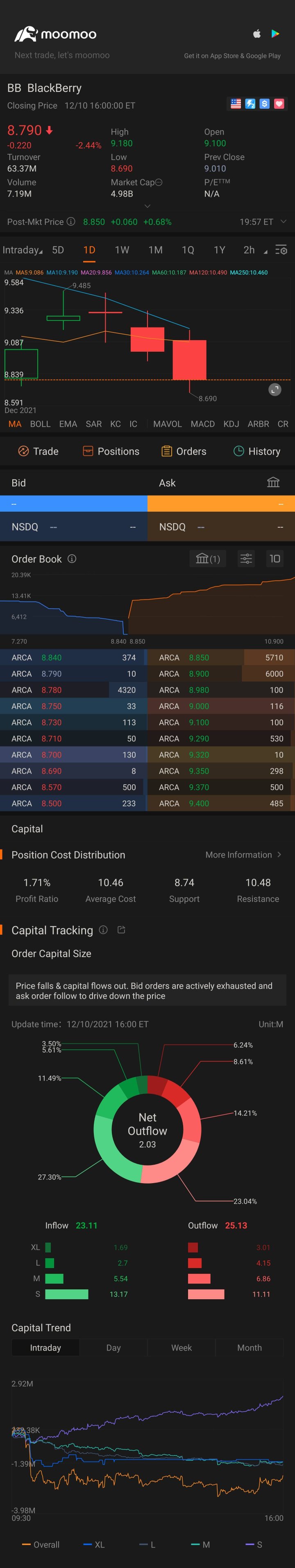

The 'MACD divergence' is a situation where the price creates higher tops and the MACD creates a raw of lower tops, or the price creates a lower bottom and the MACD creates higher bottoms. MACD divergence after a significant uptrend indicates that the buyers are losing power and MACD divergence after downtrend indicates the sellers losing power.

Therefore, the indicator 'MACD bottom divergence' aims to find stocks that are likely to go up in the future.

Tips: As shown in the pic, the indicator could be useful in short-term investment, so don't hold the stocks too long if you buy them on the indicator. Sell them in time when you make a profit!

Learn More: How to trade using MACD indicator?

What is MACD divergence?

The 'MACD divergence' is a situation where the price creates higher tops and the MACD creates a raw of lower tops, or the price creates a lower bottom and the MACD creates higher bottoms. MACD divergence after a significant uptrend indicates that the buyers are losing power and MACD divergence after downtrend indicates the sellers losing power.

Therefore, the indicator 'MACD bottom divergence' aims to find stocks that are likely to go up in the future.

Tips: As shown in the pic, the indicator could be useful in short-term investment, so don't hold the stocks too long if you buy them on the indicator. Sell them in time when you make a profit!

Learn More: How to trade using MACD indicator?

44

102285623

liked

13

4

102285623

liked

$Starbucks (SBUX.US)$ Food safety issues were found at over a dozen Starbucks outlets in the eastern Chinese city of Suzhou, regulators said on Tuesday, a day after the U.S. coffee chain was criticized for violations at two other outlets in another city.

$Meta Platforms (FB.US)$ $Apple (AAPL.US)$ $Amazon (AMZN.US)$ The Digital Markets Act (DMA), unveiled by EU antitrust chief Margrethe Vestager last December, sets out a list of dos and don'ts for U.S. tech giants designated as online gatekeepers with fines up to 10% of global turnover for violations, a global first.

$Meta Platforms (FB.US)$ $Apple (AAPL.US)$ $Amazon (AMZN.US)$ The Digital Markets Act (DMA), unveiled by EU antitrust chief Margrethe Vestager last December, sets out a list of dos and don'ts for U.S. tech giants designated as online gatekeepers with fines up to 10% of global turnover for violations, a global first.

36

1

102285623

liked

$Invesco QQQ Trust (QQQ.US)$ $S&P 500 Index (.SPX.US)$ Thoughts?

“Reported inflation is understated. Owners’ Equivalent Rent (OER) relies on owner surveys to estimate inflation in housing costs. This is an extremely imprecise metric. The single family rental market provides more accurate data. OER in today’s reported core CPI was 3.5% YoY.

The largest owners of nationwide single family rentals are reporting 17% YoY rent increases. OER is 30% of the Core CPI calculation and 24% of reported CPI. Using the more empirical measure in the calculation increases today’s Core CPI from 4.9% to 9.0% and CPI from 6.8% to 10.1%

Housing inflation is unlikely to abate based on supply and demand trends. The inflation that households are actually experiencing is raging and well in excess of reported gov’t statistics.”

“Reported inflation is understated. Owners’ Equivalent Rent (OER) relies on owner surveys to estimate inflation in housing costs. This is an extremely imprecise metric. The single family rental market provides more accurate data. OER in today’s reported core CPI was 3.5% YoY.

The largest owners of nationwide single family rentals are reporting 17% YoY rent increases. OER is 30% of the Core CPI calculation and 24% of reported CPI. Using the more empirical measure in the calculation increases today’s Core CPI from 4.9% to 9.0% and CPI from 6.8% to 10.1%

Housing inflation is unlikely to abate based on supply and demand trends. The inflation that households are actually experiencing is raging and well in excess of reported gov’t statistics.”

184

11

102285623

liked

$Nokia Oyj (NOK.US)$ hopeless

17

1

102285623

liked

52

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)