102327691heng

liked

Definitely is a YES.

It's stupid to not change ur plan according to the economy situation. If ur previous plan does not work anymore, then f****** h*** go change ur plan![]() . It's not the time to be stubborn. Stubbornness earn u nothing good.

. It's not the time to be stubborn. Stubbornness earn u nothing good.

![]() After the USD interest rate inversion and the outbreak of the Russian-Ukrainian conflict, how did your funds perform in the past six months?

After the USD interest rate inversion and the outbreak of the Russian-Ukrainian conflict, how did your funds perform in the past six months?

It has been bad for my portfolio![]() . However, I changed my plan since t...

. However, I changed my plan since t...

It's stupid to not change ur plan according to the economy situation. If ur previous plan does not work anymore, then f****** h*** go change ur plan

It has been bad for my portfolio

21

11

102327691heng

reacted to

The past week has been a dark period in the history of crypto, with the total market capitalization of this industry dipping as low as $1.2 trillion for the first time since July 2021. ![]()

![]()

![]() The turmoil, in large part, has been due to the real-time disintegration of $Terra(LUNA.CC$.

The turmoil, in large part, has been due to the real-time disintegration of $Terra(LUNA.CC$.

Last week, Terra has officially stopped block production as the blockchain's native token hit a low of $0.0003, near zero.![]()

![]()

![]()

In a tumble start...

Last week, Terra has officially stopped block production as the blockchain's native token hit a low of $0.0003, near zero.

In a tumble start...

1093

961

102327691heng

liked

$Alibaba(BABA.US$ lifeless

Translated

1

102327691heng

liked

Recently, reports about cashing out by American business leaders have stirred the nerves of investors. It has reached its peak when the CEOs of $Tesla(TSLA.US$and $Microsoft(MSFT.US$ started selling their stock while their company's stock prices were hovering near new records.

$Microsoft(MSFT.US$ Chief Executive Satya Nadella sold about half of his shares in the company last week, reported by Wall Street Journal on Nov. 29.

The filing of Mr. Nadella’s transaction was made public on the Wednesday before the long Thanksgiving weekend. The transaction yielded more than $285 million for Mr. Nadella. This is the single-largest stock sale for Mr. Nadella, according to InsiderScore.

How did the market react?

Interestingly, MSFT has fallen 2% since LAST Wednesday, while $S&P 500 Index(.SPX.US$ has fallen 2.64% over the same period.

Ben Silverman, director of research at InsiderScore, said the sale is similar to Tesla CEO Elon Musk's recent stock sales. Mr. Musk took to Twitter on Nov. 7 pledging to sell 10% of his stockholdings. The Tesla CEO was taking advantage of gains in the company’s stock price, Mr. Silverman said.

$Tesla(TSLA.US$'s stock price has fallen by about 7%, and its market value has shrunk by nearly $100 billion from that point.

Does CEOs’ sell-off mean it’s time to sell?

Action speaks louder than words. Of course, the behavior of business leaders will affect investors' confidence in the company. At least, for better or worse, news usually makes stocks more volatile in the short term.

However, their actions are not always noteworthy.

For one thing, insiders may have their own reason each time they sell stock. As to Nadella, analysts said the move could be related to Washington state instituting a 7% tax for long-term capital gains beginning at the start of next year for anything exceeding $250,000 a year.

For another, insider trading shouldn't be the only source of information, because not every executive is correct each time. In the long run, the best option is to research in-depth.

News about the sale of stocks by executives is reported from time to time. To paint a clearer picture of their effects, let's check the performance of markets and those stocks:

1. The broad market has continuously set new highs since the pandemic.

2. Taking Amazon as an example, after the CEO sold shares, the stock price has still climbed higher.

The same story also applies to $Pfizer(PFE.US$, whose CEO sold stocks last November.

3. It's not all good news. $GameStop(GME.US$ CEO announced to sell stocks in April. Here is how the stock price performed since then.

The bottom line

1. The CEO's sell-off may help you predict the future volatility of stock prices in the short term.

2. There is no obvious correlation between long-term stock performance and CEO selling.

3. Insider trading should not be the only source of information. Before making wise investment decisions, we should rely on in-depth research to check the company’s financial statements, annual reports, and other public opinions.

As a rule, value investors generally prefer to invest in high-quality companies with fair prices. The question is, how to identify the value of a company?

Click to our newly unveiled courses: How to invest in stocks: Quick-Start Guide.

Welcome to Courses in Moo Community, we help you trade like a pro.

$S&P 500 Index(.SPX.US$ $Dow Jones Industrial Average(.DJI.US$ $Nasdaq Composite Index(.IXIC.US$

$Microsoft(MSFT.US$ Chief Executive Satya Nadella sold about half of his shares in the company last week, reported by Wall Street Journal on Nov. 29.

The filing of Mr. Nadella’s transaction was made public on the Wednesday before the long Thanksgiving weekend. The transaction yielded more than $285 million for Mr. Nadella. This is the single-largest stock sale for Mr. Nadella, according to InsiderScore.

How did the market react?

Interestingly, MSFT has fallen 2% since LAST Wednesday, while $S&P 500 Index(.SPX.US$ has fallen 2.64% over the same period.

Ben Silverman, director of research at InsiderScore, said the sale is similar to Tesla CEO Elon Musk's recent stock sales. Mr. Musk took to Twitter on Nov. 7 pledging to sell 10% of his stockholdings. The Tesla CEO was taking advantage of gains in the company’s stock price, Mr. Silverman said.

$Tesla(TSLA.US$'s stock price has fallen by about 7%, and its market value has shrunk by nearly $100 billion from that point.

Does CEOs’ sell-off mean it’s time to sell?

Action speaks louder than words. Of course, the behavior of business leaders will affect investors' confidence in the company. At least, for better or worse, news usually makes stocks more volatile in the short term.

However, their actions are not always noteworthy.

For one thing, insiders may have their own reason each time they sell stock. As to Nadella, analysts said the move could be related to Washington state instituting a 7% tax for long-term capital gains beginning at the start of next year for anything exceeding $250,000 a year.

For another, insider trading shouldn't be the only source of information, because not every executive is correct each time. In the long run, the best option is to research in-depth.

News about the sale of stocks by executives is reported from time to time. To paint a clearer picture of their effects, let's check the performance of markets and those stocks:

1. The broad market has continuously set new highs since the pandemic.

2. Taking Amazon as an example, after the CEO sold shares, the stock price has still climbed higher.

The same story also applies to $Pfizer(PFE.US$, whose CEO sold stocks last November.

3. It's not all good news. $GameStop(GME.US$ CEO announced to sell stocks in April. Here is how the stock price performed since then.

The bottom line

1. The CEO's sell-off may help you predict the future volatility of stock prices in the short term.

2. There is no obvious correlation between long-term stock performance and CEO selling.

3. Insider trading should not be the only source of information. Before making wise investment decisions, we should rely on in-depth research to check the company’s financial statements, annual reports, and other public opinions.

As a rule, value investors generally prefer to invest in high-quality companies with fair prices. The question is, how to identify the value of a company?

Click to our newly unveiled courses: How to invest in stocks: Quick-Start Guide.

Welcome to Courses in Moo Community, we help you trade like a pro.

$S&P 500 Index(.SPX.US$ $Dow Jones Industrial Average(.DJI.US$ $Nasdaq Composite Index(.IXIC.US$

+5

98

28

102327691heng

reacted to

There's a saying that goes: "The present you is made up by all the decisions you've made in the past."

In that case, would you like to look back on all mooers' votes before and find out what "made you" or led to your paper gain/loss now?

On Aug. 5, Daily Poll asked about "What's the future of automakers?"

What's the future of automakers? Click to see>>

63% of mooers chose "New brands like Tesla"

Only 15% of mooers chose "Traditional brands like GM"

22% of mooers chose "I'm so broke" (WTF lol )

On Aug. 30, Rivian filed for its upcoming IPO. Daily Poll asked about "How do you feel about the new competitor?"

Rivian, the EV maker backed by Amazon and Ford has filed for its IPO. Click to see>>

11% of mooers chose "a threat to other EV makers."

12% of mooers chose "nah, bye bye soon."

77% of mooers chose "strong background, keep watching."

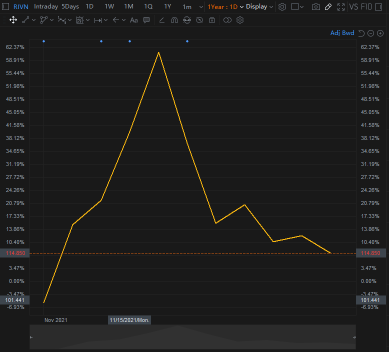

Let's take a look at their one year performance:

$Tesla(TSLA.US$

$Rivian Automotive(RIVN.US$

$Lucid Group(LCID.US$

New EV brands do deliver strong growth on their stock price.

However, traditional brands are doing great as well.

$Ford Motor(F.US$

$General Motors(GM.US$

Even though they were doing well and also showed an upward trend in stock price.

The EV battlefield: Oldest automakers are on fire. Click to see>>

Still, only 13% of mooers think GM and F will win the battle 10 years later.

63% of the mooers were convinced that TSLA is the G.O.A.T.

And here come the questions:

Do you think you were right then?

Or what made you change your mind?

You May Aalso Like:

Daily Poll: Battery issue drains Rivian stock.

Daily Poll: The "EV Big Three."

+3

97

3

102327691heng

liked

Hi mooers, it's good to see you guys again in MooHumor!

It's almost the end of the year. How's your November? After a long and challenging year, are you still hanging in there? People usually face repeating patterns in life and get bored of it. Bringing a sense of ceremony to your everyday life can be a beautiful way to ignite your passion. Some mooers know how to use small rituals to bring themselves happiness. Let them show you how they celebrate their special days and memorable moment.

As usual, vote first plz~

Here we go~

@Deezy_McCheezy: $Longeveron(LGVN.US$ im already ready for Friday. Volume wil tell you all you need to know in 36 hrs. If there us enough, a push to $43 is eminent and will retest $45 again. Dont they say 3rd time is a charm

@Steven Scripps: Only have one share I got at 100$ but I'm just glad to be part of team $GameStop(GME.US$

@Smoke-A-Shotgun: $AMC Entertainment(AMC.US$

@Questionable Invts: $AMC Entertainment(AMC.US$ Have happy Thanksgiving from Citadel LLC. Yeah, resistance wasn't 41, 40, or even 39 its 38.

@UFTWY: $GameStop(GME.US$ Purely for a feeling and belief.

@YuQing1688: ALL I NEED $AMC Entertainment(AMC.US$

@Aydin Yilmaz: About $Progenity(PROG.US$

@DayleyTrades: $AMC Entertainment(AMC.US$

@Apollod Wed: $Aptevo Therapeutics(APVO.US$ and $Longeveron(LGVN.US$ best tiny floater squeeze plays of 2021

@demntia: dip before the rip $AMC Entertainment(AMC.US$

@Revelations 6

This week, we'd like to invite you to comment below and tell about: How do you bring a sense of ceremony to your everyday life or Trading life?

We will select 20 TOP COMMENTS by next Monday.

Winners will get 88 points by next week, with which you can exchange gifts at Reward Club.

*Comments within this week will be counted.

You may post:

● A related meme in gif or jpeg

● Your real-life experience

● Other creative ways to show your sense of humor

That's all. Peace![]()

![]()

![]()

It's almost the end of the year. How's your November? After a long and challenging year, are you still hanging in there? People usually face repeating patterns in life and get bored of it. Bringing a sense of ceremony to your everyday life can be a beautiful way to ignite your passion. Some mooers know how to use small rituals to bring themselves happiness. Let them show you how they celebrate their special days and memorable moment.

As usual, vote first plz~

Here we go~

@Deezy_McCheezy: $Longeveron(LGVN.US$ im already ready for Friday. Volume wil tell you all you need to know in 36 hrs. If there us enough, a push to $43 is eminent and will retest $45 again. Dont they say 3rd time is a charm

@Steven Scripps: Only have one share I got at 100$ but I'm just glad to be part of team $GameStop(GME.US$

@Smoke-A-Shotgun: $AMC Entertainment(AMC.US$

@Questionable Invts: $AMC Entertainment(AMC.US$ Have happy Thanksgiving from Citadel LLC. Yeah, resistance wasn't 41, 40, or even 39 its 38.

@UFTWY: $GameStop(GME.US$ Purely for a feeling and belief.

@YuQing1688: ALL I NEED $AMC Entertainment(AMC.US$

@Aydin Yilmaz: About $Progenity(PROG.US$

@DayleyTrades: $AMC Entertainment(AMC.US$

@Apollod Wed: $Aptevo Therapeutics(APVO.US$ and $Longeveron(LGVN.US$ best tiny floater squeeze plays of 2021

@demntia: dip before the rip $AMC Entertainment(AMC.US$

@Revelations 6

This week, we'd like to invite you to comment below and tell about: How do you bring a sense of ceremony to your everyday life or Trading life?

We will select 20 TOP COMMENTS by next Monday.

Winners will get 88 points by next week, with which you can exchange gifts at Reward Club.

*Comments within this week will be counted.

You may post:

● A related meme in gif or jpeg

● Your real-life experience

● Other creative ways to show your sense of humor

That's all. Peace

+9

244

37

102327691heng

liked

The apparent short squeeze that began last week in $Longeveron(LGVN.US$ is continuing on Wednesdays as the share price has been up 122%.

Among speculative biotech stocks, Longeveron continues to outperform the market by a wide margin. Trading at only $3 per share a week ago, shares of LGVN stock has skyrocketed to more than $40 per share.

Some investors relate the upward trend with the FDA approval of their Lomacel-B drug for a Rare Pediatric Disease. But is that the main reason?

Some people said this stock is like $Progenity(PROG.US$ 's bigger younger brother.

Do you agree? Are you going to make any move?

Source:

LGVN Stock: 7 Things to Know as Longeveron Rockets 100% Higher

Among speculative biotech stocks, Longeveron continues to outperform the market by a wide margin. Trading at only $3 per share a week ago, shares of LGVN stock has skyrocketed to more than $40 per share.

Some investors relate the upward trend with the FDA approval of their Lomacel-B drug for a Rare Pediatric Disease. But is that the main reason?

Some people said this stock is like $Progenity(PROG.US$ 's bigger younger brother.

Do you agree? Are you going to make any move?

Source:

LGVN Stock: 7 Things to Know as Longeveron Rockets 100% Higher

114

2

102327691heng

liked

$Netflix(NFLX.US$ Netflix is in the uptrend and currently, price has been pushed to the upside, after touching the ascending trend line and also the first support zone (S1).

On the other hand, the last 4H candle has been closed a little lower, below the trend line .

We still don’t know if this is a fake breakout or not… we should wait for the current 4H candle to see if it will be closed below the last candle and also below S1 or it will be closed above them.

If price closes a bearish candle below S1, we can expect more downside move and retrace around the second support zone (S2) which is around $615.

If price could close a bullish candle above S1, we can expect a rise towards the last high which is $690, and in the case of an upside breakout on that level, the next target would be $740

On the other hand, the last 4H candle has been closed a little lower, below the trend line .

We still don’t know if this is a fake breakout or not… we should wait for the current 4H candle to see if it will be closed below the last candle and also below S1 or it will be closed above them.

If price closes a bearish candle below S1, we can expect more downside move and retrace around the second support zone (S2) which is around $615.

If price could close a bullish candle above S1, we can expect a rise towards the last high which is $690, and in the case of an upside breakout on that level, the next target would be $740

65

12

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)