102546620 hl

liked and commented on

Dear mooers,

We are coming to the end of a very unusual year full of uncertainty. Whether good or bad, we all witnessed the history.

Before you want to see what you can expect in 2022, let's have a little break and take a guess of the closing price of the S&P 500.

A happy ending or a tragedy? Go big or go home? Place your bet NOW!

Win Reward:

Place your bet on the closing price of the $S&P 500 Index(.SPX.US$ (i.e.4800.11) on Friday...

We are coming to the end of a very unusual year full of uncertainty. Whether good or bad, we all witnessed the history.

Before you want to see what you can expect in 2022, let's have a little break and take a guess of the closing price of the S&P 500.

A happy ending or a tragedy? Go big or go home? Place your bet NOW!

Win Reward:

Place your bet on the closing price of the $S&P 500 Index(.SPX.US$ (i.e.4800.11) on Friday...

452

1070

102546620 hl

liked

Influenced by Omicron's variation and the Fed's hawkish policy expectations, the "Christmas market" of US stocks was damaged earlier this week. However, the impact of the epidemic on financial markets is not as serious as that in March 2020.

Overnight, the $S&P 500 Index(.SPX.US$ rose 81.21 points, or 1.8%, to 4649.23. $Nasdaq Composite Index(.IXIC.US$ rose 360.15 points, or 2.4%, to 15341.09. $Dow Jones Industrial Average(.DJI.US$ rose 560.54 points, or 1.6%, to 35492.70. Due to concerns about COVID-19 and the blockade policy, three major U.S. stock indexes fell on the first three trading days.

In terms of individual stocks, technology stocks led the gains. As of the close, $Micron Technology(MU.US$ rose by more than 10%, $WiMi Hologram Cloud(WIMI.US$ rose by 7.48%, $Alibaba(BABA.US$ rose by 6.63%, $NVIDIA(NVDA.US$ rose nearly 4%, $Tesla(TSLA.US$ rose 3.6%, $Meta Platforms(FB.US$ rose 2.69%, $Microsoft(MSFT.US$ rose 2.31%, $Amazon(AMZN.US$ rose 2%, $Apple(AAPL.US$ Rose 1.91%, $Netflix(NFLX.US$ 1.88% and $Alphabet-A(GOOGL.US$ rose 1.32%.

Overnight, the $S&P 500 Index(.SPX.US$ rose 81.21 points, or 1.8%, to 4649.23. $Nasdaq Composite Index(.IXIC.US$ rose 360.15 points, or 2.4%, to 15341.09. $Dow Jones Industrial Average(.DJI.US$ rose 560.54 points, or 1.6%, to 35492.70. Due to concerns about COVID-19 and the blockade policy, three major U.S. stock indexes fell on the first three trading days.

In terms of individual stocks, technology stocks led the gains. As of the close, $Micron Technology(MU.US$ rose by more than 10%, $WiMi Hologram Cloud(WIMI.US$ rose by 7.48%, $Alibaba(BABA.US$ rose by 6.63%, $NVIDIA(NVDA.US$ rose nearly 4%, $Tesla(TSLA.US$ rose 3.6%, $Meta Platforms(FB.US$ rose 2.69%, $Microsoft(MSFT.US$ rose 2.31%, $Amazon(AMZN.US$ rose 2%, $Apple(AAPL.US$ Rose 1.91%, $Netflix(NFLX.US$ 1.88% and $Alphabet-A(GOOGL.US$ rose 1.32%.

8

2

102546620 hl

liked

It's definitely not a good year for me. Got a bad start with $DiDi Global (Delisted)(DIDI.US$ during its IPO, got in at 16 and out 12, can't imagine if I hold on till now.. Then came $Alibaba(BABA.US$ , got some small gains in the range of 180 - 200, but trapped when it down from 180 all the way, got out at 140... Opted in $Palantir(PLTR.US$ and $Sportradar Group AG(SRAD.US$ at 21 - 22, but both went down to 18.. Also see reds in options. Well, reviewed and changed my strategies, from buying lots of options to selling options, from buying dips blindly to watch out for better entries, from staring at the intra day movements to watch YouTube. I learn not to let investment becomes a burden, so long I put in the money that is not meant for any urgent purposes. I still believe what comes down will goes up back so long it's a profitable company.

34

6

102546620 hl

liked

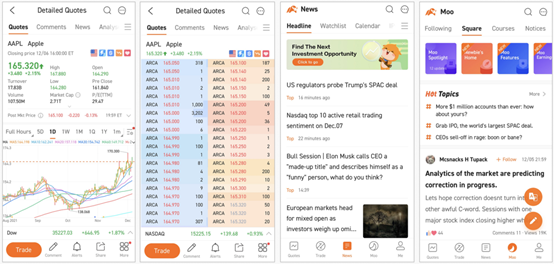

Columns Moomoo to Launch in Australia: Will Offer Australian Investors One-Stop Online Investment Services

Sydney, Dec. 20, 2021 – On December 20, 2021, moomoo, a leading one-stop digital investment platform, announced that it will be launching in Australia. The company will provide Australian investors with premium online investment services. Moomoo has been on a path of exponential international growth and Australia marks its third expansion overseas after a successful launch in US and Singapore. The company made the announcement after its affiliated company secured an Australian Financial Services License granted by the Australian Securities and Investments Commission (ASIC) through an acquisition

As a tech-driven digital investment platform, moomoo’s mission is to make investing easier and more social. After building a strong community of investors and winning awards in the US and Singapore, the company is excited about bringing its services to Australian investors to help them take advantage of all investing opportunities.

Moomoo stands out from other platforms by offering:

- a free online account-opening experience that can be completed in just minutes;

- a combination of powerful technologies spanning stock trading and market data;

- an interactive online community of 17 million investors worldwide;

- tools that enable the community to share their investing insights anytime, anywhere.

Investors can now trade stocks on the platform and access free real-time quotes, in-depth market analysis, and comprehensive financial news coverage.

Moomoo has quickly become a popular tech-driven brokerage platform among local investors since its launch in the US and Singapore. In the US, moomoo has resonated with sophisticated and retail investors alike, with powerful yet user-friendly tools capable of guiding even professional traders toward more informed decisions. In this year, moomoo won the “Best Active Trading App 2021” by Investing Simple, a leading US financial website, and was also nominated for the Benzinga 2021 awards for “Best Trading Technology” and “Best Investment Research Tech”.

Moomoo has attracted over 220,000 registered users and more than 100,000 paying clients in less than three months since entering the Singapore market. Within just six months of its launch, moomoo’s market share of retail investors in Singapore neared 15%. As of Q3, moomoo has become one of the fastest growing one-stop investment platforms in Singapore, constantly holding a place among the top three financial apps as measured by download volume.

Australia marks moomoo’s next stop. Drawing on its successes in the US and Singapore, moomoo is expected to open up a brand-new market in Australia and bring a unique investment experience to local investors.

About Moomoo

Moomoo positions itself as the next-generation one-stop investment platform that integrates investment transactions, up-to-date news, real-time market data, and an active trading community. Moomoo's mission is to provide investors of all levels with an intuitive and powerful investing platform. Moomoo leverages deep technological R&D capabilities and future-focused operating model to constantly improve the user experience and drive industry-wide innovation. For more information, please visit the official website www.moomoo.com/au.

As a tech-driven digital investment platform, moomoo’s mission is to make investing easier and more social. After building a strong community of investors and winning awards in the US and Singapore, the company is excited about bringing its services to Australian investors to help them take advantage of all investing opportunities.

Moomoo stands out from other platforms by offering:

- a free online account-opening experience that can be completed in just minutes;

- a combination of powerful technologies spanning stock trading and market data;

- an interactive online community of 17 million investors worldwide;

- tools that enable the community to share their investing insights anytime, anywhere.

Investors can now trade stocks on the platform and access free real-time quotes, in-depth market analysis, and comprehensive financial news coverage.

Moomoo has quickly become a popular tech-driven brokerage platform among local investors since its launch in the US and Singapore. In the US, moomoo has resonated with sophisticated and retail investors alike, with powerful yet user-friendly tools capable of guiding even professional traders toward more informed decisions. In this year, moomoo won the “Best Active Trading App 2021” by Investing Simple, a leading US financial website, and was also nominated for the Benzinga 2021 awards for “Best Trading Technology” and “Best Investment Research Tech”.

Moomoo has attracted over 220,000 registered users and more than 100,000 paying clients in less than three months since entering the Singapore market. Within just six months of its launch, moomoo’s market share of retail investors in Singapore neared 15%. As of Q3, moomoo has become one of the fastest growing one-stop investment platforms in Singapore, constantly holding a place among the top three financial apps as measured by download volume.

Australia marks moomoo’s next stop. Drawing on its successes in the US and Singapore, moomoo is expected to open up a brand-new market in Australia and bring a unique investment experience to local investors.

About Moomoo

Moomoo positions itself as the next-generation one-stop investment platform that integrates investment transactions, up-to-date news, real-time market data, and an active trading community. Moomoo's mission is to provide investors of all levels with an intuitive and powerful investing platform. Moomoo leverages deep technological R&D capabilities and future-focused operating model to constantly improve the user experience and drive industry-wide innovation. For more information, please visit the official website www.moomoo.com/au.

153

42

102546620 hl

liked

In 2021, moomoo became the place where investors could share their opinions and communicate freely with each other. The frequent interactions between the enthusiastic mooers have positively impacted the community.![]()

![]()

![]() Mooers are moving in the same direction: making profits and improving themselves. It would take a long time and great effort for our dear mooers to achieve these goals. Why don't we take a look at ten of the year's valuable market insights and investing tips?

Mooers are moving in the same direction: making profits and improving themselves. It would take a long time and great effort for our dear mooers to achieve these goals. Why don't we take a look at ten of the year's valuable market insights and investing tips?

Spoiler: There's a chance to get points if you read till the end.

*The selected articles are listed randomly.

![]() ONE: Is investing in Trump's new merger a good idea?

ONE: Is investing in Trump's new merger a good idea?

@HuatLadywrote about his concerns on the merger of Trump's company and a SPAC called the Digital World Acquisition Corp. We have to admit that he has a point!

"Forgive me for predicting that most likely his company's stock will not be viable for long term investment goal."

View more: Will Donald be able to deal his Trump Card?

![]() TWO: What do you think of meme stocks?

TWO: What do you think of meme stocks?

@Machiavellis3rdEyeused vivid language to call for rational investing and remind mooers to watch out for media manipulations. Do you agree with him?

"You ARE ALL MY ALLIES, regardless of your investment choices, politics, religions, colors, sex, or anything else! I say we start learning and adapting to their constantly evolving illegal games (media manipulation, PFOF, CB's) together. Then we will all figure out how to take that cheese - without getting TRAPPED."

View more: When will we get off this bus to CRAZYTOWN?

![]() THREE: What can we learn from the big picture?

THREE: What can we learn from the big picture?

@WYCKOFFPROanalyzed the trend of the Russell 2020 with technical tools. Has the market proved his assumptions?

"The breakout of the Russell 2000 gives the first confirmation of the scenario of possible rotation from big cap stocks to small cap stocks."

View more: A Bargain you can't Ignore — This Laggard Breaks All Time High Last Week

![]() FOUR: Will the strong momentum of recovery stocks fade?

FOUR: Will the strong momentum of recovery stocks fade?

On Nov 5, Pfizer introduced a new COVID-19 antiviral pill that is expected to treat 89% of acutely hospitalized patients and thus reduce the risk of death. @HuatEveranticipated that Pfizer's share price would continue to climb once the FDA approved the new antiviral pill. What do you think?

"They hold the promise of cutting down the risk of severe Covid 19 ailments, hospitalisation stays and even deaths, and if being taken at the early onsets of infection. "

View more: A Breakthrough in Covid 19 Antiviral Pills

![]()

![]() FIVE: EV stocks skyrocketing: Good buy or goodbye?

FIVE: EV stocks skyrocketing: Good buy or goodbye?

@Deviltonconducted an in-depth analysis on one of the most popular stocks, $Rivian, and pointed out that patience is a virtue in trading.

"Human are always impatient, we will always have FOMO if we sit and wait till Friday, scared that it stops falling and starts to rise again. Yet buying all tomo may not allow you to buy at the best price." View more here.

![]() SIX: How do you decide when to buy/sell?

SIX: How do you decide when to buy/sell?

@HopeAlwayssaid that there is no best way to determine when to buy and when to sell the stocks of indexes. The timings depend on investing goals, philosophies, and personal preferences.

"The three main risks are company, valuation and earnings risks. Once we are able to find a stock that that signals low risk based on these three conditions, it is time to buy. Whenever a negative change happens to any of the three conditions, it is time to sell."

View more: Buying and Selling Stocks

![]() SEVEN: How do you know when to stop loss / take profit?

SEVEN: How do you know when to stop loss / take profit?

@Powerhousehas three underlying principles in stopping losses and taking profits. All investors should stay informed and closely observe trends to set price targets.

"For micro, there is a need to determine your present financial risk appetite figuratively. On the macro level, situations may have changed. Determining when is the most precise time to stop loss or take profit of a stock and milk the most out of it is extremely difficult."

View more: Stop the pain, take the happiness

![]() EIGHT: What urges you to press the "trade" button?

EIGHT: What urges you to press the "trade" button?

@Panda2102has done macro research to sort out a list of companies and ranks them from different dimensions.

"The mission statement, the moat, the network effect, the switching cost, low cost advantage, optionality, the ratio for PE, PEG, Cash, Debt, Free Cash flow and the ownership of the company."

View more: Best time to press the trade button

![]() NINE: How to build a portfolio with a windfall of $1 million?

NINE: How to build a portfolio with a windfall of $1 million?

@Mars Mooothinks that the Squid Game Multi-Portfolio comprises four parts: player 456, player 218, player 067, and a liquid one.

"The first portfolio is aimed at potential sectors for diversification and profits. The second is designed to high risk lead high returns. The next one intent on helping on thr way. While the last one shows that cash is king."

View more: The Squid Game Multi-Portfolios Portfolio

![]() TEN: How to profit from short-selling?

TEN: How to profit from short-selling?

@Mcsnacks H Tupackshared that short-selling is highly popular on Wall Street and often carried out by aggressive hedge funds.

"Hedge funds acting through collaborating market makers can create huge numbers of counterfeit shares that can overwhelm buying demand. They have turned it into a casino and everyone knows the house always wins in that scenario."

View more: The only way for short selling to be profitable is by cheating

This recap takes a deep dive into the market insights and investing tips that inspire us to become better investors. Did you find anything interesting or helpful?

![]() Bonus

Bonus![]()

Please Leave your comments below and @ the mooer whose opinions impress you the most, and explain why they are attractive. The 1st, 10th, 20th, 30th, 40th...(multiples of 10) mooers will be rewarded with 88 points each!

Duration: Now- Dec 28, 2021 11:59 PM SGT

moomoo annual ceremony is happening right now! Check it out here: 2021 in Review: Grow Together to the Moon!

Spoiler: There's a chance to get points if you read till the end.

*The selected articles are listed randomly.

@HuatLadywrote about his concerns on the merger of Trump's company and a SPAC called the Digital World Acquisition Corp. We have to admit that he has a point!

"Forgive me for predicting that most likely his company's stock will not be viable for long term investment goal."

View more: Will Donald be able to deal his Trump Card?

@Machiavellis3rdEyeused vivid language to call for rational investing and remind mooers to watch out for media manipulations. Do you agree with him?

"You ARE ALL MY ALLIES, regardless of your investment choices, politics, religions, colors, sex, or anything else! I say we start learning and adapting to their constantly evolving illegal games (media manipulation, PFOF, CB's) together. Then we will all figure out how to take that cheese - without getting TRAPPED."

View more: When will we get off this bus to CRAZYTOWN?

@WYCKOFFPROanalyzed the trend of the Russell 2020 with technical tools. Has the market proved his assumptions?

"The breakout of the Russell 2000 gives the first confirmation of the scenario of possible rotation from big cap stocks to small cap stocks."

View more: A Bargain you can't Ignore — This Laggard Breaks All Time High Last Week

On Nov 5, Pfizer introduced a new COVID-19 antiviral pill that is expected to treat 89% of acutely hospitalized patients and thus reduce the risk of death. @HuatEveranticipated that Pfizer's share price would continue to climb once the FDA approved the new antiviral pill. What do you think?

"They hold the promise of cutting down the risk of severe Covid 19 ailments, hospitalisation stays and even deaths, and if being taken at the early onsets of infection. "

View more: A Breakthrough in Covid 19 Antiviral Pills

@Deviltonconducted an in-depth analysis on one of the most popular stocks, $Rivian, and pointed out that patience is a virtue in trading.

"Human are always impatient, we will always have FOMO if we sit and wait till Friday, scared that it stops falling and starts to rise again. Yet buying all tomo may not allow you to buy at the best price." View more here.

@HopeAlwayssaid that there is no best way to determine when to buy and when to sell the stocks of indexes. The timings depend on investing goals, philosophies, and personal preferences.

"The three main risks are company, valuation and earnings risks. Once we are able to find a stock that that signals low risk based on these three conditions, it is time to buy. Whenever a negative change happens to any of the three conditions, it is time to sell."

View more: Buying and Selling Stocks

@Powerhousehas three underlying principles in stopping losses and taking profits. All investors should stay informed and closely observe trends to set price targets.

"For micro, there is a need to determine your present financial risk appetite figuratively. On the macro level, situations may have changed. Determining when is the most precise time to stop loss or take profit of a stock and milk the most out of it is extremely difficult."

View more: Stop the pain, take the happiness

@Panda2102has done macro research to sort out a list of companies and ranks them from different dimensions.

"The mission statement, the moat, the network effect, the switching cost, low cost advantage, optionality, the ratio for PE, PEG, Cash, Debt, Free Cash flow and the ownership of the company."

View more: Best time to press the trade button

@Mars Mooothinks that the Squid Game Multi-Portfolio comprises four parts: player 456, player 218, player 067, and a liquid one.

"The first portfolio is aimed at potential sectors for diversification and profits. The second is designed to high risk lead high returns. The next one intent on helping on thr way. While the last one shows that cash is king."

View more: The Squid Game Multi-Portfolios Portfolio

@Mcsnacks H Tupackshared that short-selling is highly popular on Wall Street and often carried out by aggressive hedge funds.

"Hedge funds acting through collaborating market makers can create huge numbers of counterfeit shares that can overwhelm buying demand. They have turned it into a casino and everyone knows the house always wins in that scenario."

View more: The only way for short selling to be profitable is by cheating

This recap takes a deep dive into the market insights and investing tips that inspire us to become better investors. Did you find anything interesting or helpful?

Please Leave your comments below and @ the mooer whose opinions impress you the most, and explain why they are attractive. The 1st, 10th, 20th, 30th, 40th...(multiples of 10) mooers will be rewarded with 88 points each!

Duration: Now- Dec 28, 2021 11:59 PM SGT

moomoo annual ceremony is happening right now! Check it out here: 2021 in Review: Grow Together to the Moon!

445

39

102546620 hl

liked

I had been using moo moo to experiment with strategies I've learn such as scalping, and options strategies such as WHEEL and LEAPS, since the fees are much lower. The biggest learning I had was from using options strategies for my investments. This is my story of how I mitigated a bad timing trade with $Palantir(PLTR.US$.

So when the stock price had started to drop hard, I found the price to be attractive and wanted to get some shares of it. so I sold a put option at 22, collecting usd120 of premium. 22 was a price I'm willing pay for the shares anyway so why not earn more from the premium.

However the share price keeps dropping as the interest rate and inflation risk kept the whole market in a sea of red. the stock kept dropping day after day and finally today it is at about 18. I was going to have to buy 100 PLTR at 22 this Friday due to the put option I sold. Today I decided that buying at 22 isn't a good deal for me so I decided to roll down and out instead. So I bought back the put and sold another put with a strike of 21 instead. doing so I earned another usd107 (100 from a lower strike price and 7 from premiums), on top of the usd120 I've gotten earlier on.

With that I have given PLTR some time to recover. If the price is still unfavourable when it is near expiration, I can roll it again and get more premium, while not being "forced" to buy the share at a "bad" price. Or I can just let the option get exercised and buy the share at 21 instead. Accounting for the premium I recieve that means the shares technically cost only 19.8 (21.00-1.20).

All in all, I learnt and experienced the power of applying option strategies to help enhance my investment journey. Hope it will help you too.

Adding some tickers so that they might be able to see if this strategy is helpful for them when investing. $Grab Holdings(GRAB.US$ $Futu Holdings Ltd(FUTU.US$ $Tesla(TSLA.US$ $UP Fintech(TIGR.US$ $Alibaba(BABA.US$ $C3.ai(AI.US$ $Robinhood(HOOD.US$ $Coinbase(COIN.US$ $Advanced Micro Devices(AMD.US$ $Taiwan Semiconductor(TSM.US$ $Disney(DIS.US$ $Alphabet-A(GOOGL.US$ $Apple(AAPL.US$ $NIO Inc(NIO.US$ $Starbucks(SBUX.US$ $Qualcomm(QCOM.US$ $Sea(SE.US$ $DocuSign(DOCU.US$ $Lucid Group(LCID.US$ $Sono Group(SEV.US$ $Rivian Automotive(RIVN.US$ $Applied Materials(AMAT.US$ $DiDi Global (Delisted)(DIDI.US$ $NVIDIA(NVDA.US$ $Intel(INTC.US$ $Unity Software(U.US$ $JPMorgan(JPM.US$ $Bank of America(BAC.US$ $American Airlines(AAL.US$ $WallStreetBets(LIST2555.US$ $Berkshire Hathaway-B(BRK.B.US$ $Citigroup(C.US$ $AT&T(T.US$ $Discovery-A.(DISCA.US$ $Netflix(NFLX.US$ $Uber Technologies(UBER.US$ $Realty Income(O.US$ $Naked Brand(NAKD.US$ $AMC Entertainment(AMC.US$ $GameStop(GME.US$ $TripAdvisor(TRIP.US$

So when the stock price had started to drop hard, I found the price to be attractive and wanted to get some shares of it. so I sold a put option at 22, collecting usd120 of premium. 22 was a price I'm willing pay for the shares anyway so why not earn more from the premium.

However the share price keeps dropping as the interest rate and inflation risk kept the whole market in a sea of red. the stock kept dropping day after day and finally today it is at about 18. I was going to have to buy 100 PLTR at 22 this Friday due to the put option I sold. Today I decided that buying at 22 isn't a good deal for me so I decided to roll down and out instead. So I bought back the put and sold another put with a strike of 21 instead. doing so I earned another usd107 (100 from a lower strike price and 7 from premiums), on top of the usd120 I've gotten earlier on.

With that I have given PLTR some time to recover. If the price is still unfavourable when it is near expiration, I can roll it again and get more premium, while not being "forced" to buy the share at a "bad" price. Or I can just let the option get exercised and buy the share at 21 instead. Accounting for the premium I recieve that means the shares technically cost only 19.8 (21.00-1.20).

All in all, I learnt and experienced the power of applying option strategies to help enhance my investment journey. Hope it will help you too.

Adding some tickers so that they might be able to see if this strategy is helpful for them when investing. $Grab Holdings(GRAB.US$ $Futu Holdings Ltd(FUTU.US$ $Tesla(TSLA.US$ $UP Fintech(TIGR.US$ $Alibaba(BABA.US$ $C3.ai(AI.US$ $Robinhood(HOOD.US$ $Coinbase(COIN.US$ $Advanced Micro Devices(AMD.US$ $Taiwan Semiconductor(TSM.US$ $Disney(DIS.US$ $Alphabet-A(GOOGL.US$ $Apple(AAPL.US$ $NIO Inc(NIO.US$ $Starbucks(SBUX.US$ $Qualcomm(QCOM.US$ $Sea(SE.US$ $DocuSign(DOCU.US$ $Lucid Group(LCID.US$ $Sono Group(SEV.US$ $Rivian Automotive(RIVN.US$ $Applied Materials(AMAT.US$ $DiDi Global (Delisted)(DIDI.US$ $NVIDIA(NVDA.US$ $Intel(INTC.US$ $Unity Software(U.US$ $JPMorgan(JPM.US$ $Bank of America(BAC.US$ $American Airlines(AAL.US$ $WallStreetBets(LIST2555.US$ $Berkshire Hathaway-B(BRK.B.US$ $Citigroup(C.US$ $AT&T(T.US$ $Discovery-A.(DISCA.US$ $Netflix(NFLX.US$ $Uber Technologies(UBER.US$ $Realty Income(O.US$ $Naked Brand(NAKD.US$ $AMC Entertainment(AMC.US$ $GameStop(GME.US$ $TripAdvisor(TRIP.US$

loading...

69

25

102546620 hl

liked

Columns Is Grab a Worthwhile Investment?

$Grab Holdings(GRAB.US$ $DiDi Global (Delisted)(DIDI.US$ $Sea(SE.US$

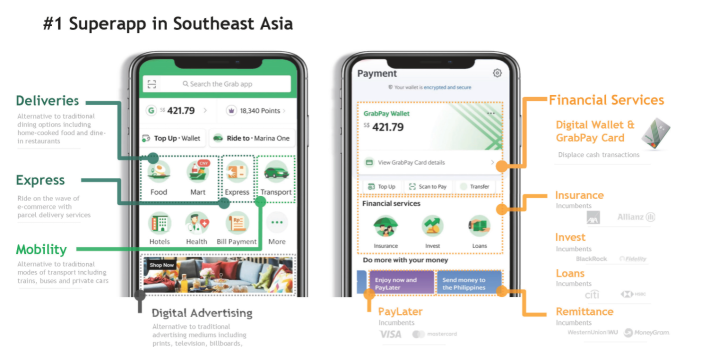

Grab is very much part of our life if you reside in South East Asia- be it hailing a Grab taxi, ordering food from Grab food, arranging a courier service and now even catering to our insurance and financial needs. They have the title of being the SuperApp in South East Asia.

Recently, they have just launched their stock listing in Nasdaq through the merger with Altimeter Growth Corp which is a special purpose acquisition company (SPAC) valuing the deal at $40 billion. Grab raised $4.5 billion with this merger.

Truth be told, we were never interested in Grab as an investment, especially so with headlines of them losing billions per year plastered through different media outlets. Nonetheless, with this stock listing, we decided to understand the company better and see if a turnaround is in sight.

Grab Business Model

Source: Form 8k- Altimeter Growth Corp

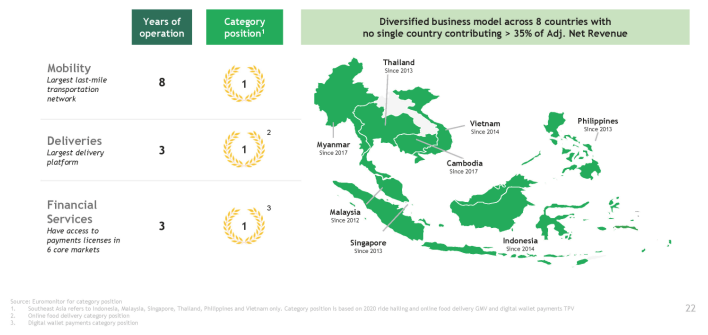

Grab was started in Malaysia as MyTeksi in 2012 and within a span of 9 years, their business has now expanded tremendously to include 4 main categories. They are namely:

Their coverage now covers the 8 countries in South East Asia as illustrated from the diagram above.

Profitability Track Record

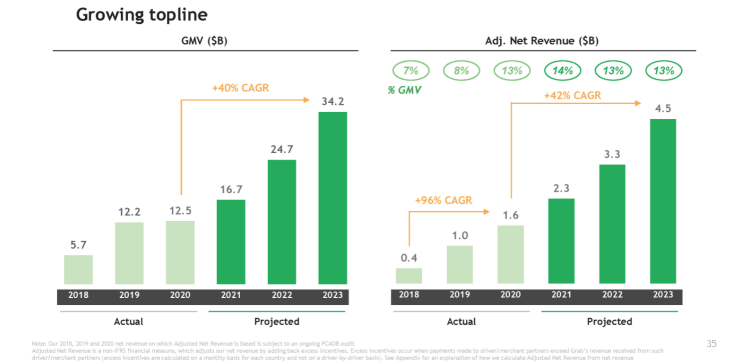

Source: Form 8-K- Altimeter Growth Corp

The investor presentation has been hyping about the huge growth in topline and bright outlook. However, huge sales without visible profits would not be a sustainable business model. It has been bleeding from huge cash burn since its inception. Over the period from 2018-2020, it has a total net loss of 9.2 billion dollars. It would be over 10 billion if we factor in 2021.

The only division that is turning profitable would be their mobility business but it is only on an Ebita basis- net profit is still negative. Grab guidance is for the overall business to be Ebita positive in 2023.

Top Class Investors- Convertible Preference Shares

Source: Form 8-k-Altimeter Growth Corp

Grab have an illustrious world-class blue-chip base of investors since its incorporation. The investors have put in slightly over 10 billion dollars and most of it is in redeemable convertible preference shares.

Grab has almost fully utilised the funds for their business. This gives it the need for them to do up the stock listing as the redeemable date for the preference shares would be in 2023. With the stock listing, the preference shares would all be converted to equity. Hence, it fully eliminates the redemption risk associated with its convertible redeemable preference shares.

Moreover, the listing would aid their profitability. The interest expenses associated with these preference shares was 1.4 billion dollars in 2020 which would not be a drag to profitability going forward.

Obstacles Ahead

Grab is in a tough businesses environment such as food/groceries delivery and ride-hailing. Didi with a 90% share of the China market is not able to turn in a profit. This gives us perspectives on the challenges ahead. Also, major food delivery companies such as Delivery Hero (Food Panda Parent) and Deliveroo, are still burning cash despite Covid 19 being a positive catalyst for the sector.

Adding on, these companies have been loss-making since day 1 and some have been around for more than a decade. The conclusion we can come to would be the industry is tough which is akin to Berkshire Hathaway when Buffet first invested in it.

Nonetheless, with a super-app concept, you will need recurring clients that would access your app on a daily basis. With that, Grab could try to pitch higher-margin products to them that will balance out the profitability profile for the whole business.

Lastly, the fragmentation of SEA would be a hindrance to scaling the business. Every country will need separate clearance and the rule of law is different. So for a product launch, it will be more tedious across the region. For a super-app like Meituan, they could definitely scale up their business more efficiently in China than Grab in SEA.

However, if Grab is able to overcome this limitation effectively, it will be a great moat for them.

Bright Sparks

The venture into Fintech which could potentially crave out higher margins would be Grab's answer to a path towards profitability. They are into microloans, peddling insurance and remittance services to their clients' and drivers' bases.

From their guidance, the next few sectors Grab would likely add to their super app would be e-commerce and travel.

They have clinch a digital banking license in Singapore through a joint venture with Singtel. However, it is prudent to note that Singtel's track record on the digital front have been lacklustre. Also, the incumbents would not let their eyes off the ball in the digital banking arena.

The advancement of AI Machines such as drones could also provide a path to sustained profitability if things pan out well. We believe they could greatly reduce their operating cost with drones being their main delivery mode.

Summing Up

Grab is one of the iconic names that have been part of everyone's life over the past 9 years. The completion of a successful listing in Nasdaq gives investors an opportunity to partake and participate in this growth story.

However, given the lack of financial metrics in terms of positive operating cash flow and likely further huge cash burns ahead before brighter days. It is investing with a vision that things would pan out well. There will only be the first dose of EBITA positive results in 2023 based on management's guidance, this is a tall order from an investor point of view.

We have no doubt there will be good growth in terms of revenue through their business plan but it is very likely they are going to be in the red of at least a billion dollars per year for the near term outlook.

This is after considering the savings in interest paid to convertible preference shares holders who would have their shares converted to common equity.

We have to monitor their business performance and execution going forward and hope to see progressive improvement in their financial metrics.

Their latest round of infusion of capital in 2019 valued the company at 16 billion dollars but their recent stock issuance is at a valuation of 40 billion dollars, which is a 2.5 x jump in valuation in just two years. It is no surprise it drops almost 20% at the close of the first trading day.

With growth stocks not being the theme of the moment- with across the broad substantial correction- we will give Grab a miss for now and revisit their investing merits once they see improvement in the profitability front.

Article by: www.thebigfatwhale.com

Grab is very much part of our life if you reside in South East Asia- be it hailing a Grab taxi, ordering food from Grab food, arranging a courier service and now even catering to our insurance and financial needs. They have the title of being the SuperApp in South East Asia.

Recently, they have just launched their stock listing in Nasdaq through the merger with Altimeter Growth Corp which is a special purpose acquisition company (SPAC) valuing the deal at $40 billion. Grab raised $4.5 billion with this merger.

Truth be told, we were never interested in Grab as an investment, especially so with headlines of them losing billions per year plastered through different media outlets. Nonetheless, with this stock listing, we decided to understand the company better and see if a turnaround is in sight.

Grab Business Model

Source: Form 8k- Altimeter Growth Corp

Grab was started in Malaysia as MyTeksi in 2012 and within a span of 9 years, their business has now expanded tremendously to include 4 main categories. They are namely:

Their coverage now covers the 8 countries in South East Asia as illustrated from the diagram above.

Profitability Track Record

Source: Form 8-K- Altimeter Growth Corp

The investor presentation has been hyping about the huge growth in topline and bright outlook. However, huge sales without visible profits would not be a sustainable business model. It has been bleeding from huge cash burn since its inception. Over the period from 2018-2020, it has a total net loss of 9.2 billion dollars. It would be over 10 billion if we factor in 2021.

The only division that is turning profitable would be their mobility business but it is only on an Ebita basis- net profit is still negative. Grab guidance is for the overall business to be Ebita positive in 2023.

Top Class Investors- Convertible Preference Shares

Source: Form 8-k-Altimeter Growth Corp

Grab have an illustrious world-class blue-chip base of investors since its incorporation. The investors have put in slightly over 10 billion dollars and most of it is in redeemable convertible preference shares.

Grab has almost fully utilised the funds for their business. This gives it the need for them to do up the stock listing as the redeemable date for the preference shares would be in 2023. With the stock listing, the preference shares would all be converted to equity. Hence, it fully eliminates the redemption risk associated with its convertible redeemable preference shares.

Moreover, the listing would aid their profitability. The interest expenses associated with these preference shares was 1.4 billion dollars in 2020 which would not be a drag to profitability going forward.

Obstacles Ahead

Grab is in a tough businesses environment such as food/groceries delivery and ride-hailing. Didi with a 90% share of the China market is not able to turn in a profit. This gives us perspectives on the challenges ahead. Also, major food delivery companies such as Delivery Hero (Food Panda Parent) and Deliveroo, are still burning cash despite Covid 19 being a positive catalyst for the sector.

Adding on, these companies have been loss-making since day 1 and some have been around for more than a decade. The conclusion we can come to would be the industry is tough which is akin to Berkshire Hathaway when Buffet first invested in it.

Nonetheless, with a super-app concept, you will need recurring clients that would access your app on a daily basis. With that, Grab could try to pitch higher-margin products to them that will balance out the profitability profile for the whole business.

Lastly, the fragmentation of SEA would be a hindrance to scaling the business. Every country will need separate clearance and the rule of law is different. So for a product launch, it will be more tedious across the region. For a super-app like Meituan, they could definitely scale up their business more efficiently in China than Grab in SEA.

However, if Grab is able to overcome this limitation effectively, it will be a great moat for them.

Bright Sparks

The venture into Fintech which could potentially crave out higher margins would be Grab's answer to a path towards profitability. They are into microloans, peddling insurance and remittance services to their clients' and drivers' bases.

From their guidance, the next few sectors Grab would likely add to their super app would be e-commerce and travel.

They have clinch a digital banking license in Singapore through a joint venture with Singtel. However, it is prudent to note that Singtel's track record on the digital front have been lacklustre. Also, the incumbents would not let their eyes off the ball in the digital banking arena.

The advancement of AI Machines such as drones could also provide a path to sustained profitability if things pan out well. We believe they could greatly reduce their operating cost with drones being their main delivery mode.

Summing Up

Grab is one of the iconic names that have been part of everyone's life over the past 9 years. The completion of a successful listing in Nasdaq gives investors an opportunity to partake and participate in this growth story.

However, given the lack of financial metrics in terms of positive operating cash flow and likely further huge cash burns ahead before brighter days. It is investing with a vision that things would pan out well. There will only be the first dose of EBITA positive results in 2023 based on management's guidance, this is a tall order from an investor point of view.

We have no doubt there will be good growth in terms of revenue through their business plan but it is very likely they are going to be in the red of at least a billion dollars per year for the near term outlook.

This is after considering the savings in interest paid to convertible preference shares holders who would have their shares converted to common equity.

We have to monitor their business performance and execution going forward and hope to see progressive improvement in their financial metrics.

Their latest round of infusion of capital in 2019 valued the company at 16 billion dollars but their recent stock issuance is at a valuation of 40 billion dollars, which is a 2.5 x jump in valuation in just two years. It is no surprise it drops almost 20% at the close of the first trading day.

With growth stocks not being the theme of the moment- with across the broad substantial correction- we will give Grab a miss for now and revisit their investing merits once they see improvement in the profitability front.

Article by: www.thebigfatwhale.com

+4

58

3

102546620 hl

liked

$Sono Group(SEV.US$ This stock is forcing speculators to be long term investors. I am being forced to hold long term. So, I just hold. Hope one day it will give me positive return. I will wait.

26

102546620 hl

liked

Bought $BANK OF CHINA(03988.HK$ for diversify, we see it as treasury bond.

After all it beat all US/EU/JP/CN/SG Bond and most of the retirement fund.

Support please comment 1,

Disagreed commnent 2.

After all it beat all US/EU/JP/CN/SG Bond and most of the retirement fund.

Support please comment 1,

Disagreed commnent 2.

52

4

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)