103098239 Jason

liked

Not enough judgment on policy; I've scoured the bottom $TENCENT.HK$ , $BABA-SW.HK$ & $MEITUAN-W.HK$ Although they are still confident about the future of these companies, their future underlying investment logic and profit model may have changed dramatically. The valuation is cheap now but it will probably be cheaper in the future 💸

Translated

17

1

103098239 Jason

liked

The poster child of China's property crisis China Evergrande Group was officially declared in default by credit rating agency S&P Global on Friday after the sprawling firm missed a bond payment earlier this month.

"We assess that China Evergrande Group and its offshore financing arm Tianji Holding Ltd. have failed to make coupon payments for their outstanding U.S.-dollar senior notes," S&P said in a statement.

S&P $SPGI.US$ added that Evergrande had asked for the ratings to be withdrawn following the downgrades to 'selective default' a term ratings firms use to describe a missed payment on a bond, but not necessarily all its bonds.

"Evergrande, Tianji, or the trustee have made no announcement or any confirmation with us on the status of the coupon payments," S&P said. $EGRNY.US$

Part of the content is taken from Yahoo.

"We assess that China Evergrande Group and its offshore financing arm Tianji Holding Ltd. have failed to make coupon payments for their outstanding U.S.-dollar senior notes," S&P said in a statement.

S&P $SPGI.US$ added that Evergrande had asked for the ratings to be withdrawn following the downgrades to 'selective default' a term ratings firms use to describe a missed payment on a bond, but not necessarily all its bonds.

"Evergrande, Tianji, or the trustee have made no announcement or any confirmation with us on the status of the coupon payments," S&P said. $EGRNY.US$

Part of the content is taken from Yahoo.

40

103098239 Jason

liked

2021 is a year of recovery. In Jan 2021, the world is promised with an effective vaccine for Covid and the reopening of economy. Fast forward to Dec 2021, we have battled the Delta variant and now battling the Omicron.

With the Covid as backdrop, the world has been kept busy. Some of the key events in the market include:

* Reddit trying to take on Wall Street. This marks the beginning of meme stocks in a big way. $GME.US$ $AMC.US$

* China and her common prosperity policies which have impacted the Chinese listed companies, especially Chinese Tech. $BABA-SW.HK$ $TENCENT.HK$

* $BTC.CC$ hit all time high of ~$67K and the growing popularity of NFT.

* $Meta Platforms.US$ changed its name to Meta and the entire metaverse ecosystem.

* The sell off of growth stock in Dec (probably still ongoing now). We have seen some of the growth stocks came down more than 50% from its all time high. $SE.US$ $ZM.US$

At a personal level, 2021 has been a year of learning. I shifted my focus from Singapore dividend stocks such as $D05.SG$ to US growth stocks. The learning curve is steep but satisfying. My take away from my investing journey this year:

1. Build strong conviction

Conviction is build after you have done your research. Having a strong conviction about the companies you owned helps you through volatility and prevent panic selling. For example, $PINS.US$ has not done well recently. I went through my checklist and the thesis still looks intact. So despite the draw down, I have decided to hold.

2. Be Patient

Companies need time to execute and that will be reflected in their share price if they execute well. Very often this does not happen overnight. Sometimes the share price may not go up in a straight line, you may have to endure some drawdown before it is up again. It is therefore important to have patience.

By being patient, it help us to find the next 100 baggers.

$AAPL.US$

$AMZN.US$

3. Be humble and keep learning

The more I learn, the more I know that I do not know. Sometimes I thought I have it all covered and Mr Market threw me a curveball.

I am grateful for the great community that @Investing with moomoo @Meta Moo @moomoo Singapore have built, allow us to exchange ideas and learn from one another. We may not agree with all the points, but having an open mind and exchanging ideas will make you a better investor.

@HopeAlways @Mcsnacks H Tupack @GratefulPanda @Dadacai @NANA123 @Mars Mooo

4. Do not FOMO and hindsight is always 20/20

Fear of Missing Out (FOMO) can wipe you out if you tried to chase any of the stocks. I resisted very hard to not jump into $GME.US$.

Hindsight is a common feeling when we invest. Sometimes I did not buy a stock and it rocket and vice versa. I tell myself that hindsight is 20/20 and I can’t catch all the winners. Looking forward is better than regretting what have happened.

5. Have a journal

It can be an old fashioned notebook, Microsoft word, video or a post in Moomoo.

Have a journal and record my investing journey helps to crystallize my thoughts. I wrote down my reason of starting or exiting a position, my target and my thoughts.

With the virus living among us, 2021 has not been easy. We have certainly grown in resilient and hope that the resilience can be also shown in our investing journey.

Wish that 2022 will be a better year for all of us.

Cheers![]()

![]()

![]()

With the Covid as backdrop, the world has been kept busy. Some of the key events in the market include:

* Reddit trying to take on Wall Street. This marks the beginning of meme stocks in a big way. $GME.US$ $AMC.US$

* China and her common prosperity policies which have impacted the Chinese listed companies, especially Chinese Tech. $BABA-SW.HK$ $TENCENT.HK$

* $BTC.CC$ hit all time high of ~$67K and the growing popularity of NFT.

* $Meta Platforms.US$ changed its name to Meta and the entire metaverse ecosystem.

* The sell off of growth stock in Dec (probably still ongoing now). We have seen some of the growth stocks came down more than 50% from its all time high. $SE.US$ $ZM.US$

At a personal level, 2021 has been a year of learning. I shifted my focus from Singapore dividend stocks such as $D05.SG$ to US growth stocks. The learning curve is steep but satisfying. My take away from my investing journey this year:

1. Build strong conviction

Conviction is build after you have done your research. Having a strong conviction about the companies you owned helps you through volatility and prevent panic selling. For example, $PINS.US$ has not done well recently. I went through my checklist and the thesis still looks intact. So despite the draw down, I have decided to hold.

2. Be Patient

Companies need time to execute and that will be reflected in their share price if they execute well. Very often this does not happen overnight. Sometimes the share price may not go up in a straight line, you may have to endure some drawdown before it is up again. It is therefore important to have patience.

By being patient, it help us to find the next 100 baggers.

$AAPL.US$

$AMZN.US$

3. Be humble and keep learning

The more I learn, the more I know that I do not know. Sometimes I thought I have it all covered and Mr Market threw me a curveball.

I am grateful for the great community that @Investing with moomoo @Meta Moo @moomoo Singapore have built, allow us to exchange ideas and learn from one another. We may not agree with all the points, but having an open mind and exchanging ideas will make you a better investor.

@HopeAlways @Mcsnacks H Tupack @GratefulPanda @Dadacai @NANA123 @Mars Mooo

4. Do not FOMO and hindsight is always 20/20

Fear of Missing Out (FOMO) can wipe you out if you tried to chase any of the stocks. I resisted very hard to not jump into $GME.US$.

Hindsight is a common feeling when we invest. Sometimes I did not buy a stock and it rocket and vice versa. I tell myself that hindsight is 20/20 and I can’t catch all the winners. Looking forward is better than regretting what have happened.

5. Have a journal

It can be an old fashioned notebook, Microsoft word, video or a post in Moomoo.

Have a journal and record my investing journey helps to crystallize my thoughts. I wrote down my reason of starting or exiting a position, my target and my thoughts.

With the virus living among us, 2021 has not been easy. We have certainly grown in resilient and hope that the resilience can be also shown in our investing journey.

Wish that 2022 will be a better year for all of us.

Cheers

191

13

103098239 Jason

liked

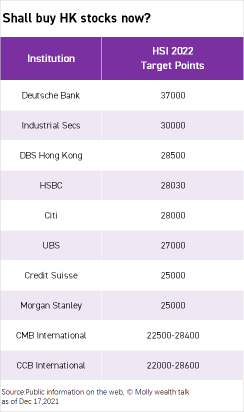

The Hong Kong stock market has pulled back obviously in 2021, with the HSI currently down over 14% cumulatively, underperforming major global stock indices, so should investors be optimistic next year?

With many institutions releasing their 2022 outlooks, the voices favouring the performance of Chinese assets are getting stronger, including bullish views on Hong Kong stocks, and a number of institutions give optimistic forecasts for the HSI's point next year.

Overall, these institutional investors generally believe that the Hong Kong stock market has been digested most risk after continued adjustments and that the current valuation is reasonable as well as attractive.

$Hang Seng Index.HK$ $Hang Seng China Enterprises Index.HK$ $Hang Seng TECH Index.HK$ $TENCENT.HK$ $MEITUAN-W.HK$ $HKEX.HK$ $BYD COMPANY.HK$

With many institutions releasing their 2022 outlooks, the voices favouring the performance of Chinese assets are getting stronger, including bullish views on Hong Kong stocks, and a number of institutions give optimistic forecasts for the HSI's point next year.

Overall, these institutional investors generally believe that the Hong Kong stock market has been digested most risk after continued adjustments and that the current valuation is reasonable as well as attractive.

$Hang Seng Index.HK$ $Hang Seng China Enterprises Index.HK$ $Hang Seng TECH Index.HK$ $TENCENT.HK$ $MEITUAN-W.HK$ $HKEX.HK$ $BYD COMPANY.HK$

133

11

103098239 Jason

liked

Tencent Resumes of some apps after ChinaMiit's Relaxation Guidance Measures; QQ Music Guidance 11.0.5 version (IOS) in App Store.

Tencent's app has begun to resume updates, and QQ Music iOS version 11.0.5 was first released. This is also Tencent's first Tencent product update since the Ministry of Industry and Information Technology adopted transitional administrative guidance measures on November 24 this year. (IT House)

$TENCENT.HK$

$TCEHY.US$

Tencent's app has begun to resume updates, and QQ Music iOS version 11.0.5 was first released. This is also Tencent's first Tencent product update since the Ministry of Industry and Information Technology adopted transitional administrative guidance measures on November 24 this year. (IT House)

$TENCENT.HK$

$TCEHY.US$

Translated

30

103098239 Jason

liked

$GRAB.US$ will only touch it back when it market cap less than usd20bil.

7

1

103098239 Jason

liked

Hello everyone, I'm Old Lee

The morning market was stimulated by the economic meeting minutes of the weekend's optimistic expectations, and the high expectations directly stimulated the Hang Seng market to open higher for a while, and the Shanghai Composite Index also rushed through 3700 points at one point.

That's what I often call the expected force. Because the market is never a barometer of the economy, but a barometer of expectations.

Today, the Hang Seng Index rushed higher and encountered pressure to fall, but the big rebound trend did not end, but the current rebound is a rebound after the new low, because the amount of energy is insufficient and needs to be confirmed.

But now the fundamental environment is improving, coupled with this year's decline is relatively large, so the correction expectation here is much greater than the probability of continuing to fall, so today's friends who chase high do not have to worry too much,

Technically, the daily line is subject to the pressure of the central axis of the descending channel, and there is a possibility of retracement if it cannot be broken in the short term, but the large structure is still in the rebound cycle, and the lower support 23800 can be sucked low, waiting to stand above the 24300 pressure and open up a new rebound space

Individual stocks

$TENCENT.HK$ Tencent and the $MEITUAN-W.HK$ US group continue to rebound, short-term rush up and down, but the overall rebound structure is still there, waiting for the Hang Seng Index to start the resonance rise after the second rebound, the current two stocks are on the left side, mainly low suction, Tencent uplink channel 460 support, MEG below the support near 238, the shock market do not chase up.

$BYD COMPANY.HK$ BYD has recently been a weak shock, for it or to maintain the previous view, short-term capital differentiation is more serious, need to pay attention to 280 this uptrend line and downtrend line watershed, if it falls below the short-term head space, there is a need to accelerate the adjustment.

$PING AN.HK$ Ping An's current rebound strength is still not strong, it is difficult to get out of this low area at present, but from the inside of the plate, there are signs of strengthening, and Huaxia Happiness has recently been stronger, if the profit is empty, Ping An will immediately rebound upwards to repair the decline, and the odds are very high, the technical support 55 is not broken is still seen, if it falls below the previous low near 50, bold low suck waiting for fundamental changes.

$CITIC SEC.HK$ CITIC Securities rushed up and down today, belongs to the short-term AH linkage appeared to fall short-term bulls profits, but the general direction still exists the possibility of continuing to rise, the fundamental listing belongs to the registration system of good brokers, and the year's rise is not large, short-term can wait to step back near 20 low suction mainly, after all, the moving average deviation is relatively high, the next look at the 22 this mark, if the breakthrough, a new round of rise is about to begin.

The morning market was stimulated by the economic meeting minutes of the weekend's optimistic expectations, and the high expectations directly stimulated the Hang Seng market to open higher for a while, and the Shanghai Composite Index also rushed through 3700 points at one point.

That's what I often call the expected force. Because the market is never a barometer of the economy, but a barometer of expectations.

Today, the Hang Seng Index rushed higher and encountered pressure to fall, but the big rebound trend did not end, but the current rebound is a rebound after the new low, because the amount of energy is insufficient and needs to be confirmed.

But now the fundamental environment is improving, coupled with this year's decline is relatively large, so the correction expectation here is much greater than the probability of continuing to fall, so today's friends who chase high do not have to worry too much,

Technically, the daily line is subject to the pressure of the central axis of the descending channel, and there is a possibility of retracement if it cannot be broken in the short term, but the large structure is still in the rebound cycle, and the lower support 23800 can be sucked low, waiting to stand above the 24300 pressure and open up a new rebound space

Individual stocks

$TENCENT.HK$ Tencent and the $MEITUAN-W.HK$ US group continue to rebound, short-term rush up and down, but the overall rebound structure is still there, waiting for the Hang Seng Index to start the resonance rise after the second rebound, the current two stocks are on the left side, mainly low suction, Tencent uplink channel 460 support, MEG below the support near 238, the shock market do not chase up.

$BYD COMPANY.HK$ BYD has recently been a weak shock, for it or to maintain the previous view, short-term capital differentiation is more serious, need to pay attention to 280 this uptrend line and downtrend line watershed, if it falls below the short-term head space, there is a need to accelerate the adjustment.

$PING AN.HK$ Ping An's current rebound strength is still not strong, it is difficult to get out of this low area at present, but from the inside of the plate, there are signs of strengthening, and Huaxia Happiness has recently been stronger, if the profit is empty, Ping An will immediately rebound upwards to repair the decline, and the odds are very high, the technical support 55 is not broken is still seen, if it falls below the previous low near 50, bold low suck waiting for fundamental changes.

$CITIC SEC.HK$ CITIC Securities rushed up and down today, belongs to the short-term AH linkage appeared to fall short-term bulls profits, but the general direction still exists the possibility of continuing to rise, the fundamental listing belongs to the registration system of good brokers, and the year's rise is not large, short-term can wait to step back near 20 low suction mainly, after all, the moving average deviation is relatively high, the next look at the 22 this mark, if the breakthrough, a new round of rise is about to begin.

+3

80

1

103098239 Jason

liked

My youtube channel:

https://www.youtube.com/channel/UCAPWOEQKCpCWmzKkdo7v-iw/

I am currently working on a short video on Kuaishou results review and its price performance. Subscribe to my youtube channel if you like to be updated promptly on the release of my video.

$KUAISHOU-W.HK$ $BILI.US$ $BILIBILI-W.HK$ $HUYA.US$ $DOYU.US$ $NTES.US$ $TENCENT.HK$ $BABA.US$ $JD.US$ $JD-SW.HK$ $MPNGF.US$ $MEITUAN-W.HK$ $PDD.US$

As always, this should not be construed as any investment or trading advice.

https://www.youtube.com/channel/UCAPWOEQKCpCWmzKkdo7v-iw/

I am currently working on a short video on Kuaishou results review and its price performance. Subscribe to my youtube channel if you like to be updated promptly on the release of my video.

$KUAISHOU-W.HK$ $BILI.US$ $BILIBILI-W.HK$ $HUYA.US$ $DOYU.US$ $NTES.US$ $TENCENT.HK$ $BABA.US$ $JD.US$ $JD-SW.HK$ $MPNGF.US$ $MEITUAN-W.HK$ $PDD.US$

As always, this should not be construed as any investment or trading advice.

76

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)