103605988a

commented on

$Arcadium Lithium (ALTM.US)$ best time to sell now!

1

7

103605988a

liked

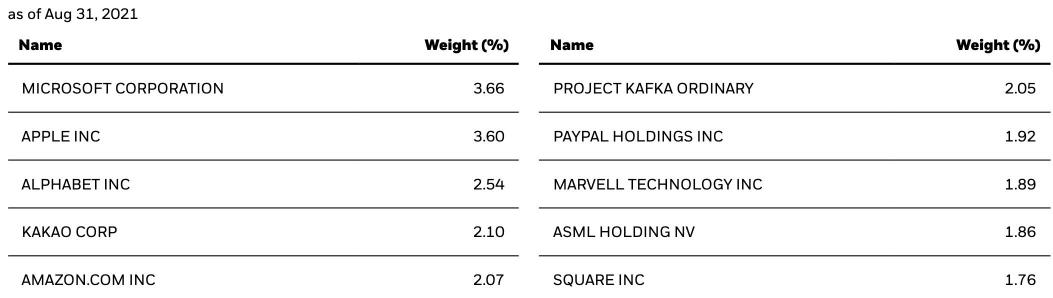

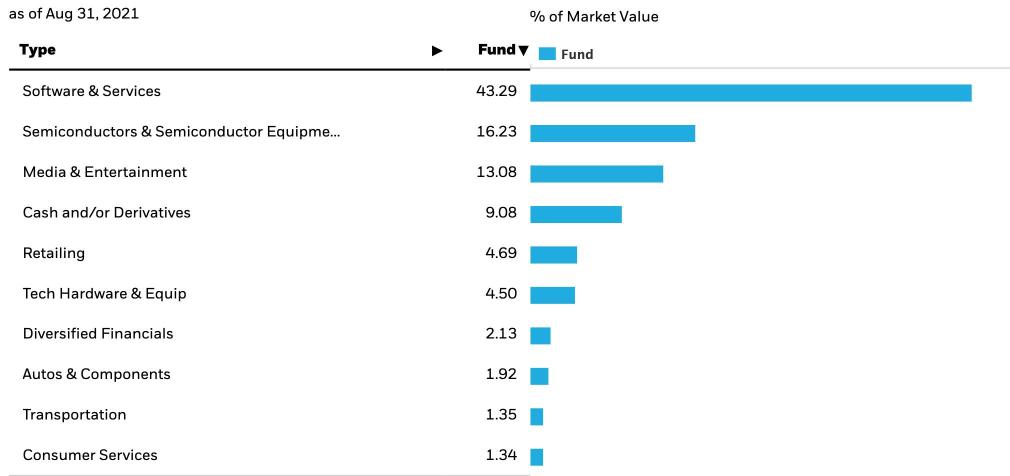

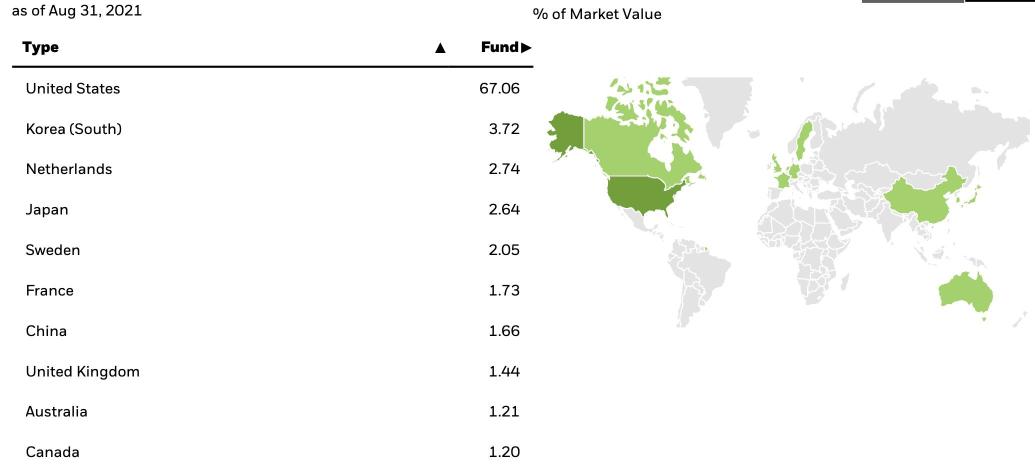

$BlackRock Science and Technology Trust (BST.US)$ is a science and technology fund with the largest investment firm in the world that aims to generate income and growth for holders. The expense ratio is inflated, but historical returns are also inflated; beating out one of the most popular tech growth funds QQQ. If you saw my last post on DIVO, you will see similarities in the sense that both DIVO & BST provide 5% dividend yields with solid growth over time. DIVO is diversified pretty evenly across the ten sectors of the S&P 500 while BST is specifically a science and technology fund. This explains BST's great returns since its inception in 2014 as we have been in a bull run lead by tech growth. Whether that will continue is anyone's guess. If you are more risk adverse BST probably is not the best choice. However, it is clear that BST has proven itself as a beast for both dividend income and growth in the science and technology space.

See images below for BST's Top 10 Holdings, Sector Breakdown, and Geographical Exposure

See images below for BST's Top 10 Holdings, Sector Breakdown, and Geographical Exposure

5

103605988a

liked

$MYEG (0138.MY)$ those newbie, I'll offer the following words:

1. Trust only your own analysis. Don't blindly follow what other ppl say.

when choosing your stock counters, the following must be checked :

- financials (topline, bottom line, debt, cash flow, Divident increasing ?)

- fundamentals ( past performance & future potential)

- daily trading volume

- TA

- short term & long term trendline

2. know that market is irrational from now till 1st week of Nov. trying to be logical in an irrational ...

1. Trust only your own analysis. Don't blindly follow what other ppl say.

when choosing your stock counters, the following must be checked :

- financials (topline, bottom line, debt, cash flow, Divident increasing ?)

- fundamentals ( past performance & future potential)

- daily trading volume

- TA

- short term & long term trendline

2. know that market is irrational from now till 1st week of Nov. trying to be logical in an irrational ...

20

2

103605988a

liked

$NVIDIA (NVDA.US)$

Nvidia investors have recently experienced a challenging integration period due to concerns about investments in AI. The market may be concerned about the progress of the delayed release of the Blackwell AI chip.

Nvidia's revenue growth is expected to normalize. However, the market may not fully realize the growth opportunities from sovereign AI and enterprise adoption.

Nvidia's PEG (price-to-earnings growth ratio) has dropped to an attractive level, indicating that the market may already reflect significant pessimism.

Nvidia investors have endured pressure during a prolonged integration period as the market reassesses whether the 'AI father' can continue to deliver outstanding performance. In the recent earnings release, Nvidia's guidance was not enough to inspire market confidence, resulting in a failure to sustain its astonishing performance. Coupled with the unexpected delay of the Blackwell architecture chip, the market may need further evidence to continue to be bullish on Nvidia for the fiscal year 2025.

In Nvidia's second quarter performance comments, management emphasized its confidence, stating that Nvidia's customers have begun testing the Blackwell chip. However, due to the complexity of its design, there is an increased execution risk, particularly in collaborating with its foundry partner Taiwan Semiconductor (TSMC) to achieve stable production yield. Despite this, Nvidia remains committed to its current generation Hopper architecture...

Nvidia investors have recently experienced a challenging integration period due to concerns about investments in AI. The market may be concerned about the progress of the delayed release of the Blackwell AI chip.

Nvidia's revenue growth is expected to normalize. However, the market may not fully realize the growth opportunities from sovereign AI and enterprise adoption.

Nvidia's PEG (price-to-earnings growth ratio) has dropped to an attractive level, indicating that the market may already reflect significant pessimism.

Nvidia investors have endured pressure during a prolonged integration period as the market reassesses whether the 'AI father' can continue to deliver outstanding performance. In the recent earnings release, Nvidia's guidance was not enough to inspire market confidence, resulting in a failure to sustain its astonishing performance. Coupled with the unexpected delay of the Blackwell architecture chip, the market may need further evidence to continue to be bullish on Nvidia for the fiscal year 2025.

In Nvidia's second quarter performance comments, management emphasized its confidence, stating that Nvidia's customers have begun testing the Blackwell chip. However, due to the complexity of its design, there is an increased execution risk, particularly in collaborating with its foundry partner Taiwan Semiconductor (TSMC) to achieve stable production yield. Despite this, Nvidia remains committed to its current generation Hopper architecture...

Translated

23

2

3

103605988a

Set a live reminder

Dear Mooers,

Are you ready to take your investment knowledge to the next level? We’re excited to invite you to our upcoming live stream event: “Understanding and Investing in ETFs Listed on Bursa Malaysia”.

Participate in this live stream, you will have a chance to receive 88 moomoo points!

In this comprehensive live stream, we’ll guide you through everything you need to know about Exchange Traded Funds (ETFs) and how you can leverage them...

Are you ready to take your investment knowledge to the next level? We’re excited to invite you to our upcoming live stream event: “Understanding and Investing in ETFs Listed on Bursa Malaysia”.

Participate in this live stream, you will have a chance to receive 88 moomoo points!

In this comprehensive live stream, we’ll guide you through everything you need to know about Exchange Traded Funds (ETFs) and how you can leverage them...

Unlock the Secrets of ETFs with Our Upcoming Live Stream!

Sep 4 20:00

289

103

16

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)