104558173 AS CHECL80

liked

Review of index components over the past six months, Jinwuda is definitely on the list, and 99 Speed Mart is striving to climb up.

As the new round of review of index components approaches, analysts believe that Jinwuda will definitely make it onto the list. $GAMUDA (5398.MY)$ 99 Speed Mart needs to keep working hard, while Genting, the two giants, may face the unfortunate fate of being eliminated. $99SMART (5326.MY)$ G Genting, the two giants, may face the unfortunate fate of being eliminated. $GENTING (3182.MY)$& $GENM (4715.MY)$ may face the unfortunate fate of being eliminated.

The Industrial Investment Bank research analyst stated in the report: "Based on the latest market cap rankings, we expect currently ranked 20th Jin Wu Da to have a sure victory, while 99 Speed Mart, ranked 27th, is still 2 billion ringgit market cap away from being selected."

The last time Jin Wu Da became a component stock was on September 20, 2010, replacing Tanjong, which was privatized at the time.

Analysts believe that if 99 Speed Mart's stock price can rise to 2.50 ringgit, it will have the opportunity to be included in the component stocks, with the current stock price around 2.30 ringgit.

云顶双雄恐出局

On the other hand, at the end of the component stock class, $GENTING (3182.MY)$ and $GENM (4715.MY)$ there is a risk of being kicked out of the list.

However, if 99 Speed Mart fails to reach the 25th place, it...

As the new round of review of index components approaches, analysts believe that Jinwuda will definitely make it onto the list. $GAMUDA (5398.MY)$ 99 Speed Mart needs to keep working hard, while Genting, the two giants, may face the unfortunate fate of being eliminated. $99SMART (5326.MY)$ G Genting, the two giants, may face the unfortunate fate of being eliminated. $GENTING (3182.MY)$& $GENM (4715.MY)$ may face the unfortunate fate of being eliminated.

The Industrial Investment Bank research analyst stated in the report: "Based on the latest market cap rankings, we expect currently ranked 20th Jin Wu Da to have a sure victory, while 99 Speed Mart, ranked 27th, is still 2 billion ringgit market cap away from being selected."

The last time Jin Wu Da became a component stock was on September 20, 2010, replacing Tanjong, which was privatized at the time.

Analysts believe that if 99 Speed Mart's stock price can rise to 2.50 ringgit, it will have the opportunity to be included in the component stocks, with the current stock price around 2.30 ringgit.

云顶双雄恐出局

On the other hand, at the end of the component stock class, $GENTING (3182.MY)$ and $GENM (4715.MY)$ there is a risk of being kicked out of the list.

However, if 99 Speed Mart fails to reach the 25th place, it...

Translated

25

1

104558173 AS CHECL80

voted

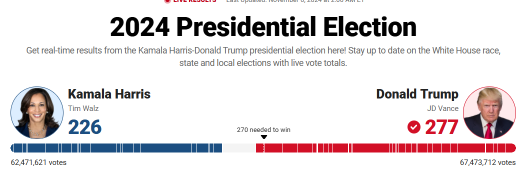

Trump Set To Be 47th President of U.S. 👀

$Trump Media & Technology (DJT.US)$ is up nearly 11% in pre-market trading, and $Tesla (TSLA.US)$ is riding the wave too, closing yesterday with a nearly 4% gain and now up over 13% in pre-market. Those mooers are really cashing in! 💰 What are your thoughts on the U.S. election? Are you continuing to bet on Trump-related trades? @FumooFu @easygoing Lyon @异仁傑 @103474176 @The Warlock @103871673 @FumooFu @msyisha

You're...

$Trump Media & Technology (DJT.US)$ is up nearly 11% in pre-market trading, and $Tesla (TSLA.US)$ is riding the wave too, closing yesterday with a nearly 4% gain and now up over 13% in pre-market. Those mooers are really cashing in! 💰 What are your thoughts on the U.S. election? Are you continuing to bet on Trump-related trades? @FumooFu @easygoing Lyon @异仁傑 @103474176 @The Warlock @103871673 @FumooFu @msyisha

You're...

+7

61

19

104558173 AS CHECL80

liked

6

104558173 AS CHECL80

liked

Although falling limit down today, First Digital: the company remains strong.

(Kuala Lumpur, 3rd day) First Digital $PERTAMA (8532.MY)$ After a continuous 7-day decline, following a steep 18% drop yesterday, today it fell limit down and received an Unusual Market Activity (UMA) query from Bursa Malaysia, but the company stated that they were not aware of the stock price movement.

The Executive Director of First Digital, Sabri Abdullah, stated through a press release that the company is unaware of the recent reasons for the stock price decline, yet they remain strong and capable of achieving sustainable growth.

"We have also completed a strategic cost reduction plan, and streamlined our operations to ensure a healthy cash flow."

He further added that the company now operates more efficiently and does not require external funding.

First Digital closed at the limit down on Thursday, with the stock price plunging 48 sen or 30% to 1.12 ringgit, the lowest level since August 2022.

Subsequently, Bursa Malaysia issued a UMA inquiry, requesting the company to explain the reasons for the sharp drop in stock price, and immediately disclose whether they are aware of any reasons leading to the trading activity.

The stock has been falling for several days since September 26, with the company's market cap evaporating by approximately 434 million ringgit.

On Wednesday, Transport Minister Wee Ka Siong announced the cancellation of the mandatory use of the national digital identity (MyDigital ID) for users of the MyJPJ application, which was originally scheduled.

In July, First Digital secured the contract for the MyDigital ID online guidance service.

Source of information: Nanyang Siang Pau.

Disclaimer: This content is for reference and educational purposes only...

(Kuala Lumpur, 3rd day) First Digital $PERTAMA (8532.MY)$ After a continuous 7-day decline, following a steep 18% drop yesterday, today it fell limit down and received an Unusual Market Activity (UMA) query from Bursa Malaysia, but the company stated that they were not aware of the stock price movement.

The Executive Director of First Digital, Sabri Abdullah, stated through a press release that the company is unaware of the recent reasons for the stock price decline, yet they remain strong and capable of achieving sustainable growth.

"We have also completed a strategic cost reduction plan, and streamlined our operations to ensure a healthy cash flow."

He further added that the company now operates more efficiently and does not require external funding.

First Digital closed at the limit down on Thursday, with the stock price plunging 48 sen or 30% to 1.12 ringgit, the lowest level since August 2022.

Subsequently, Bursa Malaysia issued a UMA inquiry, requesting the company to explain the reasons for the sharp drop in stock price, and immediately disclose whether they are aware of any reasons leading to the trading activity.

The stock has been falling for several days since September 26, with the company's market cap evaporating by approximately 434 million ringgit.

On Wednesday, Transport Minister Wee Ka Siong announced the cancellation of the mandatory use of the national digital identity (MyDigital ID) for users of the MyJPJ application, which was originally scheduled.

In July, First Digital secured the contract for the MyDigital ID online guidance service.

Source of information: Nanyang Siang Pau.

Disclaimer: This content is for reference and educational purposes only...

Translated

10

2

104558173 AS CHECL80

voted

I always remind myself to review my trades and strategies each quarter. ![]()

It helps me to be disciplined, to check my positions and make adjustments timely.![]()

Securities Position: Looking good with gradual profits![]()

Asset Distribution:

For me my Golden Ratio (Stocks/Funds) was previously 20/80. Seems like I’ve moved towards 50/50 with my bullishness on $NVIDIA (NVDA.US)$ .![]()

Currency Exposure:

40/60 is sufficient for my golden ratio for trading in US market.![]()

YTD Return:

56% So ...

It helps me to be disciplined, to check my positions and make adjustments timely.

Securities Position: Looking good with gradual profits

Asset Distribution:

For me my Golden Ratio (Stocks/Funds) was previously 20/80. Seems like I’ve moved towards 50/50 with my bullishness on $NVIDIA (NVDA.US)$ .

Currency Exposure:

40/60 is sufficient for my golden ratio for trading in US market.

YTD Return:

56% So ...

+3

34

13

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)