2Ez4Rtz

voted

Which stock will outperform over the next 5 years?

$Adyen N.V. Unsponsored ADR (ADYEY.US)$ $PayPal (PYPL.US)$

$Adyen N.V. Unsponsored ADR (ADYEY.US)$ $PayPal (PYPL.US)$

2

2Ez4Rtz

voted

Rewards

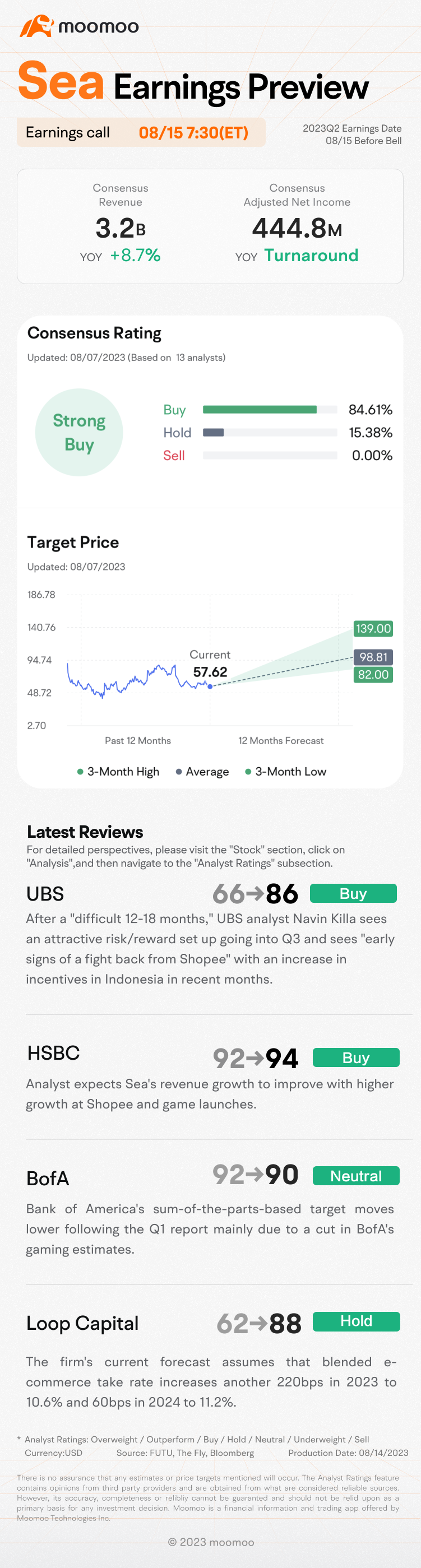

● An equal share of 1,000 points: For mooers who correctly guess SE's closing price range on 15 August ET by 2:30 PM, August 15 ET. (e.g., If 50 mooers make a correct guess, each of them will get 20 points.)

● Exclusive 300 points: For the writer of the top post on analyzing SE's earnings preview as an inspiration reward.

*The selection is based on post quality, originality, and user engagement.

Note: 1. Rewards will be di...

● An equal share of 1,000 points: For mooers who correctly guess SE's closing price range on 15 August ET by 2:30 PM, August 15 ET. (e.g., If 50 mooers make a correct guess, each of them will get 20 points.)

● Exclusive 300 points: For the writer of the top post on analyzing SE's earnings preview as an inspiration reward.

*The selection is based on post quality, originality, and user engagement.

Note: 1. Rewards will be di...

Expand

Expand 31

32

2Ez4Rtz

voted

Columns Disney - No way home?

$Disney (DIS.US)$ released its latest quarterly results.

Even though share prices rallied after results, analysts were worried of the same old problems and also a surprise loss.

So what happened in the latest quarter? Will it be a long-term problem?

1. Revenue grew, but Disney slipped into a surprise loss

Disney's revenue continues to rise and grow, but the surprise that left investors in the lurch is the operating loss.

Disney booked a one-off restructuring and impairment ch...

Even though share prices rallied after results, analysts were worried of the same old problems and also a surprise loss.

So what happened in the latest quarter? Will it be a long-term problem?

1. Revenue grew, but Disney slipped into a surprise loss

Disney's revenue continues to rise and grow, but the surprise that left investors in the lurch is the operating loss.

Disney booked a one-off restructuring and impairment ch...

+1

18

2Ez4Rtz

voted

had bought some REITs earlier with the aim of getting regular passive dividend income but when the interest rates went up, REITs prices started falling to match their higher investment risks over the T-bills and fixed deposits interest rates which had risen and my principal losses now exceeded the dividends I received and so I'm in the red sitting on paper loss..

nevertheless we see that they have started to recover slightly in the last couple of months in the possibility o...

nevertheless we see that they have started to recover slightly in the last couple of months in the possibility o...

7

7

2Ez4Rtz

voted

A fake in basketball is when a player pretends to either shoot, move or pass and does a different action in order to separate themselves from their defender. Sometimes, we can also see the stock market making fake moves, like people doing them on the basketball field. A sudden up and down is somehow deceptive. Investors should see through the intention and roll with the punches.

@SOARMAN: This week in a nutshell… $SPDR S&P 500 ETF (SPY.US)$

@Adolphn: Markets will...

@SOARMAN: This week in a nutshell… $SPDR S&P 500 ETF (SPY.US)$

@Adolphn: Markets will...

+8

40

30

2Ez4Rtz

voted

Hello Mooers, ![]()

Welcome back!![]()

Here are the U.S. CPI values for the past 6 months.

![]() Mar 2022: 8.5%

Mar 2022: 8.5%

![]() Apr 2022: 8.3%

Apr 2022: 8.3%

![]() May 2022: 8.6%

May 2022: 8.6%

![]() Jun 2022: 9.1%

Jun 2022: 9.1%

![]() Jul 2022: 8.5%

Jul 2022: 8.5%

![]() Aug 2022: 8.3%

Aug 2022: 8.3%

So, what value do you think that Sep 2022 CPI will be?

(You may choose more than 1.)

(* The U.S. CPI data are scheduled to be released on October 13, 2022, at 8:30 A.M. EST.)

Last but not least, remember to show your support by follow, like, share and comment on this post.![]()

Interest...

Welcome back!

Here are the U.S. CPI values for the past 6 months.

So, what value do you think that Sep 2022 CPI will be?

(You may choose more than 1.)

(* The U.S. CPI data are scheduled to be released on October 13, 2022, at 8:30 A.M. EST.)

Last but not least, remember to show your support by follow, like, share and comment on this post.

Interest...

5

2Ez4Rtz

voted

All investors around the world will be watching Jerome Powell's speech tomorrow.

Check the link above to see how I predicted the short term bounce off of a previous consolidation zone on the SPY. The link will give you a better description, but I have the pictures from the link illustrating the bounce off of a previous consolidation zone directly below. The link also has a great explanation on the correlati...

Check the link above to see how I predicted the short term bounce off of a previous consolidation zone on the SPY. The link will give you a better description, but I have the pictures from the link illustrating the bounce off of a previous consolidation zone directly below. The link also has a great explanation on the correlati...

+1

20

14

2Ez4Rtz

voted

All of the major indices have been in a major downtrend since last November. All of them are also near resistance of the long term price channel they have been traveling down within. Many people are waiting for the market to pick a direction here. Will the major indices break out to the upside? Or will there be a major rejection to the downside which would basically keep us within this long-term downward price channel?

In the first three charts below you can see futu...

In the first three charts below you can see futu...

+7

8

13

2Ez4Rtz

voted

There’s a popular saying in the stock market that equities generally go up on an escalator and down in an elevator. However, with the incredible parabolic move we’ve seen in $Magic Empire Global (MEGL.US)$ , investors have found out what can happen when a stock skips the elevator and takes off in a rocket. Today, MEGL stock lost around 90% of its value as momentum very clearly shifted to the downside in this stock.

Thus, perhaps the magic is over.

Magi...

Thus, perhaps the magic is over.

Magi...

9

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)