5D1T2

voted

Yoooooo mooers,

After two exciting rounds of the games, we finally came to the final round of the Easter Contest. The difficulty of the 3rd round is significantly upgraded. The answers to this round's puzzles are financial terms. Join and show them your talent!

Here are several scenarios indicating common financial terms. There is only one correct answer for each puzzle.

Scenario 1:

You found that the price of a commodity in Singapo...

After two exciting rounds of the games, we finally came to the final round of the Easter Contest. The difficulty of the 3rd round is significantly upgraded. The answers to this round's puzzles are financial terms. Join and show them your talent!

Here are several scenarios indicating common financial terms. There is only one correct answer for each puzzle.

Scenario 1:

You found that the price of a commodity in Singapo...

34

120

5D1T2

voted

Spoiler:

At the end of this post, there is a chance for you to win points!

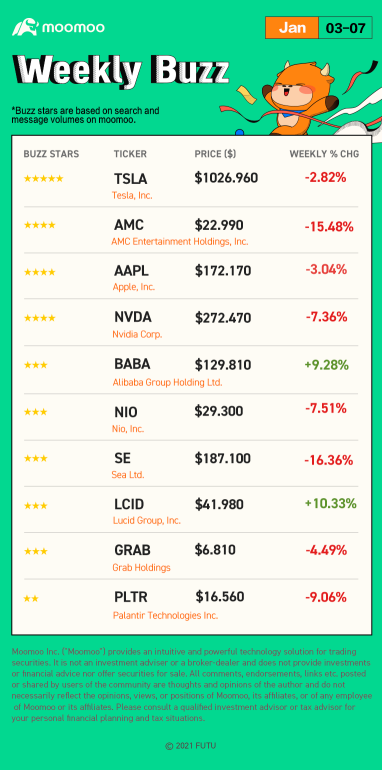

Happy Monday mooers! Welcome back to our first Weekly Buzz in 2022, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Part Ⅰ: Make Your Choices

Part Ⅱ: Buzzing Stocks List & Mooers Comments

Every major index moved downward, ...

At the end of this post, there is a chance for you to win points!

Happy Monday mooers! Welcome back to our first Weekly Buzz in 2022, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of last week! (Nano caps are excluded.)

Part Ⅰ: Make Your Choices

Part Ⅱ: Buzzing Stocks List & Mooers Comments

Every major index moved downward, ...

+11

64

79

5D1T2

liked

A good company can continuously use incremental capital to obtain a high rate of return in an extended period. On the contrary, a bad company will require a continuous large amount of capital investment but has a low rate of return. How to judge the subsequent rate of return of the purchasing company?![]()

![]()

![]()

Buffett said that 2 points are essential:

1. Buy the company that you know

It can predict future cash flow, do the right thing in the ability circle, and avoid major mistakes.

2. Ensure sufficient margin of safety

Good companies that meet the conditions must be bought in heavy positions because few good companies exist. $BRK.A.US$ $BRK.B.US$

The industries and companies that Buffett likes almost certainly still have a competitive advantage in the next 10 or 20 years, and the environment is unlikely to undergo significant changes. $AMC.US$

For example, for a blue-chip such as $AAPL.US$ , if you take a stop loss and do a long-term trend in a large cycle, it will not be stopped until now. From the end of 2008 to now, it has been a trend of rising lows. Even the market with four circuit breakers at the beginning of 2020 not stop. This is the so-called large-period broad stop loss and does not hinder long-term investment.

There is also a survivor's in addition to non-stop loss and payback. Sometimes you see a trader using a specific high-risk method and earning wealthy profits in a year, and the profit margin far exceeds Buffett.

![]() Is it possible?

Is it possible?

Of course possible;

![]() Can it be replicated?

Can it be replicated?

It may not be possible;

![]() Can it last?

Can it last?

Of course not;

Otherwise, the top master in the market would not be Buffett.![]()

![]()

![]()

Don't be messed up by all sorts of large profit orders and information pushes of various stocks. Under the iceberg, more large loss orders unreleased. If you always maintain fully leveraged transactions and do not protect the profits you have already made, you will soon return to the market in most cases. $NVDA.US$ $LCID.US$ $NIO.US$

Trading requires a high degree of self-discipline, persistence, and hard work. It's not that you make money in trading; it's that you have to do these to make money.

Buffett said that 2 points are essential:

1. Buy the company that you know

It can predict future cash flow, do the right thing in the ability circle, and avoid major mistakes.

2. Ensure sufficient margin of safety

Good companies that meet the conditions must be bought in heavy positions because few good companies exist. $BRK.A.US$ $BRK.B.US$

The industries and companies that Buffett likes almost certainly still have a competitive advantage in the next 10 or 20 years, and the environment is unlikely to undergo significant changes. $AMC.US$

For example, for a blue-chip such as $AAPL.US$ , if you take a stop loss and do a long-term trend in a large cycle, it will not be stopped until now. From the end of 2008 to now, it has been a trend of rising lows. Even the market with four circuit breakers at the beginning of 2020 not stop. This is the so-called large-period broad stop loss and does not hinder long-term investment.

There is also a survivor's in addition to non-stop loss and payback. Sometimes you see a trader using a specific high-risk method and earning wealthy profits in a year, and the profit margin far exceeds Buffett.

Of course possible;

It may not be possible;

Of course not;

Otherwise, the top master in the market would not be Buffett.

Don't be messed up by all sorts of large profit orders and information pushes of various stocks. Under the iceberg, more large loss orders unreleased. If you always maintain fully leveraged transactions and do not protect the profits you have already made, you will soon return to the market in most cases. $NVDA.US$ $LCID.US$ $NIO.US$

Trading requires a high degree of self-discipline, persistence, and hard work. It's not that you make money in trading; it's that you have to do these to make money.

37

28

5D1T2

liked

Today's stock market adjustments aren't any news; the tax supplement via is the big news. The national dilemma reflected behind Via's tax payment is what matters most.

Actually, it's just four words. Finance is tight

The tax avoidance method used by Via is the current mainstream tax avoidance law, including Fan Bingbing, who was also taxed in the same way back then. If you are familiar with tax planning, you should know that they all use tax approval methods to form shell companies to launder high income into approval and taxation. After such an operation, it is possible that the final profit of 100 million dollars only needs to be paid 5 points in tax. However, if you file your taxes normally and truthfully, when corporate income tax and personal income tax are removed, you won't be able to get away with 45 points.

Who can't get along with money? A normal person would pay 45 points in taxes. Except for the wages stated by business executives. The reason it was fine before is an accident now. It is because the country has to implement the national policy of common prosperity and return the tax avoidance money from high-income people.

Are you saying Via broke the law? It's definitely against the law, but in the past it was just a bug; people didn't investigate it, and local governments kept their eyes open and closed. But now it's different from the past. The rich who want to act on d's will are the leaders in these traffic fields. Formerly a movie star, now a live streaming celebrity. Plus, human society is for high-income cohort, whether at home or abroad. Crackdown on the rich. Although the poor don't get a dime, they are very happy to eat melons.

So what does common wealth have to do with stock market investment? The relationship is huge. If you want to see the country's determination to achieve common prosperity, what do you emphasize?

Fair! Fair! Still damn fair!

Therefore, the future of many industries will be cut off by the national policy of fairness, and some expectations have been cut off. In particular, platform-based companies that use traffic to make money, such as Alibaba, Douyin Headline, or Meituan, and other Internet-related industries.

Who is the smartest of these platforms? It's a TikTok headline.

I've said it and you'll understand. If you haven't used Douyin, you've probably heard of it, Classmate Zhang. In just a few months, there were 20 million fans filming Life in the Countryside. The People's Daily has made a special review. Some analyses are that professional shooting techniques are popular, while others are that people are tired of watching the high life in the city and yearn for the countryside.

It's all wrong.

This is the most obvious case under the common wealth policy. It is to create opportunities for grassroots. Only when grassroots have an opportunity can it mean that most ordinary people also have a chance to become the next student Zhang. Douyin knows national policies too well, alleviates poverty, helps farmers, and starts grassroots short video businesses. In the future, we will also support a large number of students Zhang to show off the various opportunities and livelihoods in rural areas with huge traffic. If you happen to be a short video entrepreneur or live e-commerce operator, you should see this trend. This is the policy direction conveyed by D's will. Going to the countryside to start a business in the future is the best outlet. Whether it's e-commerce in rural areas or ecotourism, it's a good direction for the future.

However, D's will must also allow banks to reduce the benefits of fixed income products and fully popularize equity assets. It's also a way to get rich together. Only when ordinary people also have opportunities to grow their wealth can this society be healthy. Instead of rich people getting richer through stock market investments, ordinary people don't see opportunities.

The national policy for common prosperity requires a thorough understanding in order to seize the opportunities that belong to you in the next 20 years. At the same time, we also need to think about how many billion dollars is Via's income, and her share of tax burden is still less than that of people with a few thousand wages?

Is that reasonable?

OK, let's talk about this briefly. If you're interested, we can talk about how much the world, Jingyu, and national policies can change our lives later $TENCENT.HK$ $BABA-SW.HK$ $MEITUAN-W.HK$

Actually, it's just four words. Finance is tight

The tax avoidance method used by Via is the current mainstream tax avoidance law, including Fan Bingbing, who was also taxed in the same way back then. If you are familiar with tax planning, you should know that they all use tax approval methods to form shell companies to launder high income into approval and taxation. After such an operation, it is possible that the final profit of 100 million dollars only needs to be paid 5 points in tax. However, if you file your taxes normally and truthfully, when corporate income tax and personal income tax are removed, you won't be able to get away with 45 points.

Who can't get along with money? A normal person would pay 45 points in taxes. Except for the wages stated by business executives. The reason it was fine before is an accident now. It is because the country has to implement the national policy of common prosperity and return the tax avoidance money from high-income people.

Are you saying Via broke the law? It's definitely against the law, but in the past it was just a bug; people didn't investigate it, and local governments kept their eyes open and closed. But now it's different from the past. The rich who want to act on d's will are the leaders in these traffic fields. Formerly a movie star, now a live streaming celebrity. Plus, human society is for high-income cohort, whether at home or abroad. Crackdown on the rich. Although the poor don't get a dime, they are very happy to eat melons.

So what does common wealth have to do with stock market investment? The relationship is huge. If you want to see the country's determination to achieve common prosperity, what do you emphasize?

Fair! Fair! Still damn fair!

Therefore, the future of many industries will be cut off by the national policy of fairness, and some expectations have been cut off. In particular, platform-based companies that use traffic to make money, such as Alibaba, Douyin Headline, or Meituan, and other Internet-related industries.

Who is the smartest of these platforms? It's a TikTok headline.

I've said it and you'll understand. If you haven't used Douyin, you've probably heard of it, Classmate Zhang. In just a few months, there were 20 million fans filming Life in the Countryside. The People's Daily has made a special review. Some analyses are that professional shooting techniques are popular, while others are that people are tired of watching the high life in the city and yearn for the countryside.

It's all wrong.

This is the most obvious case under the common wealth policy. It is to create opportunities for grassroots. Only when grassroots have an opportunity can it mean that most ordinary people also have a chance to become the next student Zhang. Douyin knows national policies too well, alleviates poverty, helps farmers, and starts grassroots short video businesses. In the future, we will also support a large number of students Zhang to show off the various opportunities and livelihoods in rural areas with huge traffic. If you happen to be a short video entrepreneur or live e-commerce operator, you should see this trend. This is the policy direction conveyed by D's will. Going to the countryside to start a business in the future is the best outlet. Whether it's e-commerce in rural areas or ecotourism, it's a good direction for the future.

However, D's will must also allow banks to reduce the benefits of fixed income products and fully popularize equity assets. It's also a way to get rich together. Only when ordinary people also have opportunities to grow their wealth can this society be healthy. Instead of rich people getting richer through stock market investments, ordinary people don't see opportunities.

The national policy for common prosperity requires a thorough understanding in order to seize the opportunities that belong to you in the next 20 years. At the same time, we also need to think about how many billion dollars is Via's income, and her share of tax burden is still less than that of people with a few thousand wages?

Is that reasonable?

OK, let's talk about this briefly. If you're interested, we can talk about how much the world, Jingyu, and national policies can change our lives later $TENCENT.HK$ $BABA-SW.HK$ $MEITUAN-W.HK$

Translated

60

6

5D1T2

liked

5D1T2

liked

13

10

5D1T2

liked

$.NDX.US$ $.SPX.US$ $.DJI.US$ What to expect of the markets next week? Is the santa rally coming? Or postponed? Markets mixed signals! Some have bearish signals while others have bullish signals! Watch my video to find out!

Stay ahead of the market by watching the video and knowing all your entry and exit points. Also know which stocks are showing bearish signals to stay defensive and which stocks have bullish signals to prepare for an early entry!

Most will not take time out to watch the video. But those who take the time, I believe you will get something out of it at the end.

Stocks tagged below all have their technical analysis done in the video!

As always, trade safe & invest wise!

$QQQ.US$ $SPY.US$ $DIA.US$ $Meta Platforms.US$ $TSLA.US$ $AAPL.US$ $AMD.US$ $NVDA.US$ $PLTR.US$ $FUTU.US$ $KWEB.US$ $BABA.US$ $NIO.US$ $SE.US$ $ESmain.US$ $NQmain.US$ $YMmain.US$

Stay ahead of the market by watching the video and knowing all your entry and exit points. Also know which stocks are showing bearish signals to stay defensive and which stocks have bullish signals to prepare for an early entry!

Most will not take time out to watch the video. But those who take the time, I believe you will get something out of it at the end.

Stocks tagged below all have their technical analysis done in the video!

As always, trade safe & invest wise!

$QQQ.US$ $SPY.US$ $DIA.US$ $Meta Platforms.US$ $TSLA.US$ $AAPL.US$ $AMD.US$ $NVDA.US$ $PLTR.US$ $FUTU.US$ $KWEB.US$ $BABA.US$ $NIO.US$ $SE.US$ $ESmain.US$ $NQmain.US$ $YMmain.US$

180

25

5D1T2

liked

Translated

67

1

5D1T2

liked

up up up

10

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)