AhOngOng

Set a live reminder

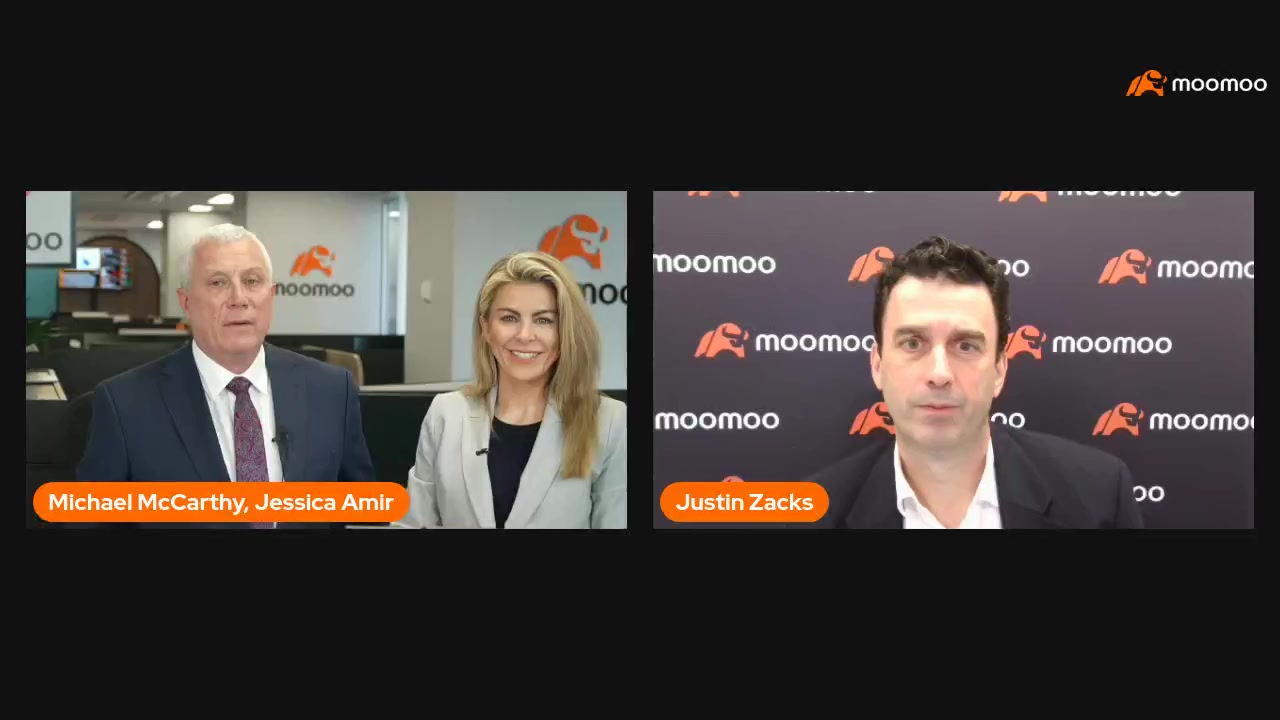

Missed the live? Watch the replay now and join Justin, Michael and Jessica as they dives deep into US rate cuts!

701

1018

29

AhOngOng

commented on

Do you use emoji in your daily life? ![]()

![]() Everything can be expressed with emoji, and any number of emoji can form countless complex puzzles.

Everything can be expressed with emoji, and any number of emoji can form countless complex puzzles.

You only need to decipher each string of permutations and combinations to get the hidden information!![]()

Guessing stocks by emoji is a fun and simple quiz! You need to guess the Singapore stocks or SREITs it represents based on the emoji combination!

For example, 📞📱📶📡🌍may represent $Singtel (Z74.SG)$, ...

You only need to decipher each string of permutations and combinations to get the hidden information!

Guessing stocks by emoji is a fun and simple quiz! You need to guess the Singapore stocks or SREITs it represents based on the emoji combination!

For example, 📞📱📶📡🌍may represent $Singtel (Z74.SG)$, ...

+1

90

395

10

AhOngOng

commented on

The past week has been a dark period in the history of crypto, with the total market capitalization of this industry dipping as low as $1.2 trillion for the first time since July 2021. ![]()

![]()

![]() The turmoil, in large part, has been due to the real-time disintegration of $Terra (LUNA.CC)$.

The turmoil, in large part, has been due to the real-time disintegration of $Terra (LUNA.CC)$.

Last week, Terra has officially stopped block production as the blockchain's native token hit a low of $0.0003, near zero.![]()

![]()

![]()

In a tumble start...

Last week, Terra has officially stopped block production as the blockchain's native token hit a low of $0.0003, near zero.

In a tumble start...

1093

961

241

AhOngOng

reacted to and commented on

Singapore real estate investment trusts can benefit from their safe-haven status during a time of market volatility as the U.S. Fed raises interest rates, analysts from DBS say in a research note.

The Fed's clarity on its rate-rise trajectory will likely lead to more price stability for Singapore REITs, they say.

What are Real Estate Investment Trusts (REITs)?

Real Estate Investment Trusts (REITs) are funds that invest in a port...

The Fed's clarity on its rate-rise trajectory will likely lead to more price stability for Singapore REITs, they say.

What are Real Estate Investment Trusts (REITs)?

Real Estate Investment Trusts (REITs) are funds that invest in a port...

1537

1277

382

AhOngOng

liked

Meta Platforms (FB) $Meta Platforms (FB.US)$

This one shouldn’t come as a surprise. The company formerly known as Facebook is one of the main reasons why everyone is talking about metaverse today.

Shares have climbed 24% this year to $326 apiece. If that’s too steep, you can use a popular investing app to buy fractions of shares with as much money as you are willing to spend.

Nvidia (NVDA) $NVIDIA (NVDA.US)$

Nvidia shares have more than doubled year-to-date.

And since the company is famous for its powerful graphics chips, Cramer sees Nvidia as a key metaverse play.

In the three months ended Oct. 31, Nvidia’s revenue soared 50% year-over-year to a record $7.1 billion. Adjusted earnings came in at $1.17 per share, up 60% from a year ago.

Roblox (RBLX) $Roblox (RBLX.US)$

This game developer enables users to make block-based worlds and games without needing to know how to code. It also allows creators to get paid through an in-game currency called Robux.

In Q3, the platform had 47.3 million average daily active users, up 31% year-over-year. Revenue rose 102% year-over-year to $509.3 million.

Unity Software (U) $Unity Software (U.US)$

This video game software developer recently acquired the visual effects studio behind the Avatar and Lord of the Rings movies — and Cramer is keen.In Q3, Unity earned $286.3 million of revenue, representing a 43% increase year-over-year. The company also generated $34.2 million of free cash flow, which more than tripled the $10.9 million it generated in the year-ago period.

Part of the content is taken from Yahoo.

This one shouldn’t come as a surprise. The company formerly known as Facebook is one of the main reasons why everyone is talking about metaverse today.

Shares have climbed 24% this year to $326 apiece. If that’s too steep, you can use a popular investing app to buy fractions of shares with as much money as you are willing to spend.

Nvidia (NVDA) $NVIDIA (NVDA.US)$

Nvidia shares have more than doubled year-to-date.

And since the company is famous for its powerful graphics chips, Cramer sees Nvidia as a key metaverse play.

In the three months ended Oct. 31, Nvidia’s revenue soared 50% year-over-year to a record $7.1 billion. Adjusted earnings came in at $1.17 per share, up 60% from a year ago.

Roblox (RBLX) $Roblox (RBLX.US)$

This game developer enables users to make block-based worlds and games without needing to know how to code. It also allows creators to get paid through an in-game currency called Robux.

In Q3, the platform had 47.3 million average daily active users, up 31% year-over-year. Revenue rose 102% year-over-year to $509.3 million.

Unity Software (U) $Unity Software (U.US)$

This video game software developer recently acquired the visual effects studio behind the Avatar and Lord of the Rings movies — and Cramer is keen.In Q3, Unity earned $286.3 million of revenue, representing a 43% increase year-over-year. The company also generated $34.2 million of free cash flow, which more than tripled the $10.9 million it generated in the year-ago period.

Part of the content is taken from Yahoo.

34

1

AhOngOng

liked

U.S. stock futures were steady in overnight trading on Tuesday after stocks continued their upward climb from the omicron sell-off.

On Tuesday, the $S&P 500 Index (.SPX.US)$ and $Nasdaq Composite Index (.IXIC.US)$ posted their best days since March.

The $Dow Jones Industrial Average (.DJI.US)$ rallied 492 points helped by gains in $Apple (AAPL.US)$, $Salesforce (CRM.US)$ and $American Express (AXP.US)$. The S&P 500 also registered a gain, climbing 2.1%. The tech-focused Nasdaq Composite was the stand-out performer after gaining more than 3%.

$Fortinet (FTNT.US)$ $NVIDIA (NVDA.US)$ $AutoZone (AZO.US)$ $ServiceNow (NOW.US)$ $Diamondback Energy (FANG.US)$ $Comcast (CMCSA.US)$ $Charter Communications (CHTR.US)$ $The Western Union (WU.US)$ $McCormick & Co (MKC.US)$ $Generac (GNRC.US)$

On Tuesday, the $S&P 500 Index (.SPX.US)$ and $Nasdaq Composite Index (.IXIC.US)$ posted their best days since March.

The $Dow Jones Industrial Average (.DJI.US)$ rallied 492 points helped by gains in $Apple (AAPL.US)$, $Salesforce (CRM.US)$ and $American Express (AXP.US)$. The S&P 500 also registered a gain, climbing 2.1%. The tech-focused Nasdaq Composite was the stand-out performer after gaining more than 3%.

$Fortinet (FTNT.US)$ $NVIDIA (NVDA.US)$ $AutoZone (AZO.US)$ $ServiceNow (NOW.US)$ $Diamondback Energy (FANG.US)$ $Comcast (CMCSA.US)$ $Charter Communications (CHTR.US)$ $The Western Union (WU.US)$ $McCormick & Co (MKC.US)$ $Generac (GNRC.US)$

52

2

6

AhOngOng

liked

$Qraft AI-Enhanced U.S. Large Cap Momentum ETF (AMOM.US)$ an exchange-traded fund driven by artificial intelligence, has acquired new stakes in $Tesla (TSLA.US)$ , $Netflix (NFLX.US)$ and $Autodesk (ADSK.US)$ , while entirely divesting its holdings in $Intel (INTC.US)$ , $PayPal (PYPL.US)$ and $Moderna (MRNA.US)$ .

What Happened: The ETF’s latest portfolio after rebalancing in early December showed that it has also entirely divested its holdings in technology company $IBM Corp (IBM.US)$ and oil giant $ConocoPhillips (COP.US)$ .

The ETF, which has assets under management of $27.07 million, has a history of accurately predicting the price movements of Tesla’s shares.

The fund now has electric vehicle maker Tesla as its largest investment with a 7.7% weighting, followed by streaming giant Netflix with a weighting of 6.8% and biotechnology firm $Merck & Co (MRK.US)$ with 5.1% weighting.

The other two stocks that make up the top five holdings in the AMOM portfolio are software company Autodesk with a 2.5% weighting and glucose monitoring systems maker $DexCom (DXCM.US)$ with 2.4%.

Prior to the rebalancing, the ETF had Intel, PayPal, Moderna, IBM and ConocoPhillips as its five largest holdings.

What Happened: The ETF’s latest portfolio after rebalancing in early December showed that it has also entirely divested its holdings in technology company $IBM Corp (IBM.US)$ and oil giant $ConocoPhillips (COP.US)$ .

The ETF, which has assets under management of $27.07 million, has a history of accurately predicting the price movements of Tesla’s shares.

The fund now has electric vehicle maker Tesla as its largest investment with a 7.7% weighting, followed by streaming giant Netflix with a weighting of 6.8% and biotechnology firm $Merck & Co (MRK.US)$ with 5.1% weighting.

The other two stocks that make up the top five holdings in the AMOM portfolio are software company Autodesk with a 2.5% weighting and glucose monitoring systems maker $DexCom (DXCM.US)$ with 2.4%.

Prior to the rebalancing, the ETF had Intel, PayPal, Moderna, IBM and ConocoPhillips as its five largest holdings.

16

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)