Ahow3

commented on

$Palantir (PLTR.US)$ $Alibaba (BABA.US)$ $NIO Inc (NIO.US)$ Today is the day we hang the superman underwear in the sky

8

7

Ahow3

voted

Hi, mooers,

![]()

![]() Goodbye November. Hello December.

Goodbye November. Hello December. ![]()

![]() We officially enter intoed the last month of 2021. How would you answer if someone asks you how your November trades went?

We officially enter intoed the last month of 2021. How would you answer if someone asks you how your November trades went?![]()

![]() Can't conclude in one go? Don't worry! Just show them what you wrote here!

Can't conclude in one go? Don't worry! Just show them what you wrote here!

Review Your Trades to Win Free Stocks

![]() Before we announce the winners, we would like to thank and send our best wishes to all mooers who are committed to writing trade reviews and consider review writing as an excellent way to become a better trader. We do believe the consistent reviews on your trade is of great necessity.

Before we announce the winners, we would like to thank and send our best wishes to all mooers who are committed to writing trade reviews and consider review writing as an excellent way to become a better trader. We do believe the consistent reviews on your trade is of great necessity.

![]()

![]() Congratulations on our winners

Congratulations on our winners ![]()

![]()

![]()

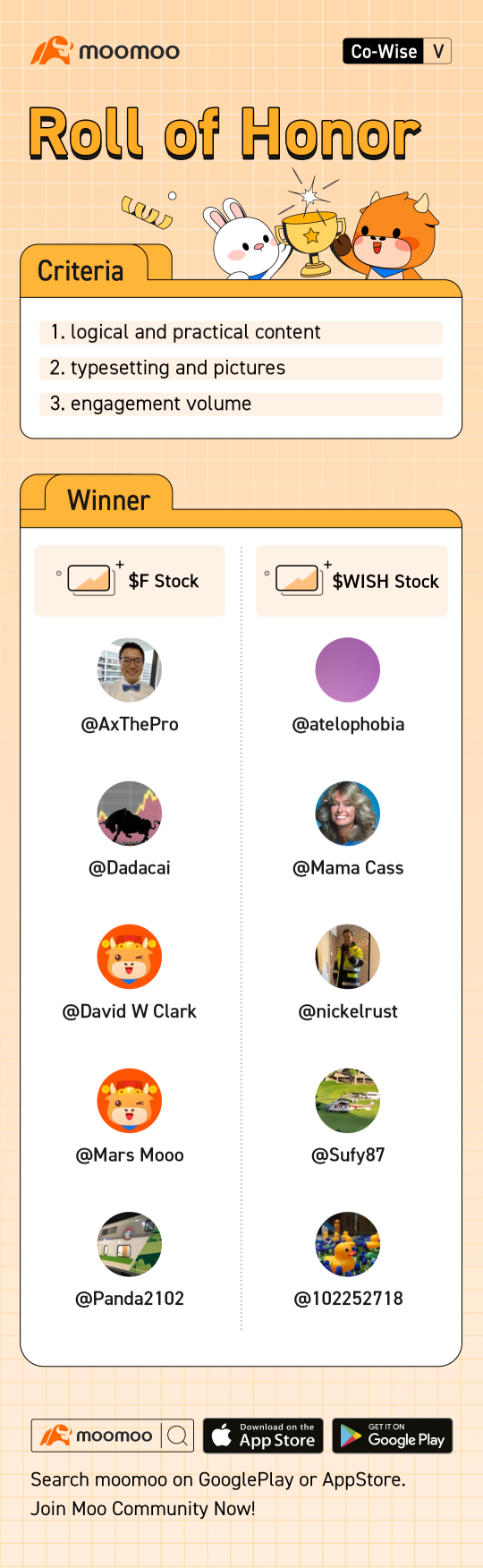

![]() $Ford Motor (F.US)$ share winners:

$Ford Motor (F.US)$ share winners:![]()

![]()

@Moo Topis an active reviewer and an advanced moomoo notes user. He is very familiar with the tools on moomoo that help him to record every trade's details, his ideas, and his feelings. Did you notice that his posts with moomoo notes are receiving more and more likes and comments? Please take a look at what did right!

@Jamesimwrote reviews on almost every trading day. He shared his understanding of the market and the, trending topics and consistently attached the current position and newly added tickers on his posts. Jamesim also shared the profits and losses in detail to record the happy moments and conduct analysis when losses occur. That's the secret to being a good trader. A piece of sharing snapshot is as follows:

@steady Pom pipiis a role model for check-in. He recorded P/L and his perception of trading and the overall market. What impressed us the most is that he stayed positive even if encountering drawbacks. He said if we missed the train, don't be too upset because another one is coming soon. Staying positive is what would help us through a a tough time. Check out his profile now!

![]()

![]() $ContextLogic (WISH.US)$share winners:

$ContextLogic (WISH.US)$share winners:![]()

![]()

@MONDAY86is full of sharp insights into fundamentals and news.

@doctorpot1has just started to use the moomoo notes features. Well done, and keep it up!

@钱包君你要振作起来is very active in trading meme stocks like $Phunware (PHUN.US)$ $Digital World Acquisition Corp (DWAC.US)$ $Sienna Senior Living Inc (SIA.CA)$ $Camber Energy (CEI.US)$ He's always emotional when reviewing his trades.

@JP GO @笨犇犇犇犇牛 @102678535 @AM5945Your reviews are very impressive, too!

Again, thank you all for joining us at this event. For those participants who miss a free share, you can still find points rewards in your Rewards Club if your reviews meet our criteria. View the event rules here.

![]()

![]() Final words

Final words

We want to restate our purpose for this check-in event: to help you understand the importance of writing trading review, and to encourage you to adopt the powerful tool of trading review to become advanced traders. moomoo notes feature is designed to be an easy tool to empower you on writing reviews. Check out what moomoo offers here and vote for your favorite features now!

Didn't see your favorite ones? Leave a comment to let us know!

Review Your Trades to Win Free Stocks

@Moo Topis an active reviewer and an advanced moomoo notes user. He is very familiar with the tools on moomoo that help him to record every trade's details, his ideas, and his feelings. Did you notice that his posts with moomoo notes are receiving more and more likes and comments? Please take a look at what did right!

@Jamesimwrote reviews on almost every trading day. He shared his understanding of the market and the, trending topics and consistently attached the current position and newly added tickers on his posts. Jamesim also shared the profits and losses in detail to record the happy moments and conduct analysis when losses occur. That's the secret to being a good trader. A piece of sharing snapshot is as follows:

@steady Pom pipiis a role model for check-in. He recorded P/L and his perception of trading and the overall market. What impressed us the most is that he stayed positive even if encountering drawbacks. He said if we missed the train, don't be too upset because another one is coming soon. Staying positive is what would help us through a a tough time. Check out his profile now!

@MONDAY86is full of sharp insights into fundamentals and news.

@doctorpot1has just started to use the moomoo notes features. Well done, and keep it up!

@钱包君你要振作起来is very active in trading meme stocks like $Phunware (PHUN.US)$ $Digital World Acquisition Corp (DWAC.US)$ $Sienna Senior Living Inc (SIA.CA)$ $Camber Energy (CEI.US)$ He's always emotional when reviewing his trades.

@JP GO @笨犇犇犇犇牛 @102678535 @AM5945Your reviews are very impressive, too!

Again, thank you all for joining us at this event. For those participants who miss a free share, you can still find points rewards in your Rewards Club if your reviews meet our criteria. View the event rules here.

We want to restate our purpose for this check-in event: to help you understand the importance of writing trading review, and to encourage you to adopt the powerful tool of trading review to become advanced traders. moomoo notes feature is designed to be an easy tool to empower you on writing reviews. Check out what moomoo offers here and vote for your favorite features now!

Didn't see your favorite ones? Leave a comment to let us know!

+1

278

10

Ahow3

commented on and voted

27

3

Ahow3

liked

Once more, Co-Wise: moomoo Tutorial Contest Part 5, "How to build a portfolio with a windfall of $1 million?" ended successfully. Thanks for participating in the contest.![]() With the $1 million windfalls, everyone has a different asset allocation method and a unique way to build the best portfolio. The top three candidates to be put into the portfolio are stocks, ETFs, and cryptocurrencies. Asset allocation aims to maximize future returns and minimize risks.

With the $1 million windfalls, everyone has a different asset allocation method and a unique way to build the best portfolio. The top three candidates to be put into the portfolio are stocks, ETFs, and cryptocurrencies. Asset allocation aims to maximize future returns and minimize risks.![]() However, high returns come with high stakes. There is no best, only the most suitable portfolio for investors. Would you please follow me to review some of the high-quality posts from mooers?

However, high returns come with high stakes. There is no best, only the most suitable portfolio for investors. Would you please follow me to review some of the high-quality posts from mooers?

Here are the rewards for your active participation: 1 FREE $Ford Motor (F.US)$ share for the five best posts, 1 FREE $ContextLogic (WISH.US)$ share for the five outstanding posts, and 66 points for posts with a minimum of 30 words. Congratulations to all the winners!![]()

*The rewards will be distributed to winners within 15 working days. The ranking is sorted in alphabetical order.

Part Ⅰ: High-Quality Post Collection

![]() @AxThePro Balanced portfolio

@AxThePro Balanced portfolio

1 million is a huge sum to begin with, it is very important to have growth for this portfolio. At the same time, we also must make sure it is safe from significant losses. I’ll allocate my portfolio with 4-3-2-1 strategy. I am an agreesive investors, I do not believe in bonds, so I will allocate 100% in equity portfolio.

![]() @Dadacai My Portfolio If I Had A S$1 Million Windfall

@Dadacai My Portfolio If I Had A S$1 Million Windfall

If I had a $1 million windfall, I would put 90% of it in an S&P ETF like $Vanguard S&P 500 ETF (VOO.US)$ , $SPDR S&P 500 ETF (SPY.US)$ and $iShares Core S&P 500 ETF (IVV.US)$ , and 5% in Treasury bills. The remaining 5% will be reserved for stocks that I think have the potential to become the next $Amazon (AMZN.US)$ , $Tesla (TSLA.US)$ , $Sea (SE.US)$ , $Apple (AAPL.US)$ and $Microsoft (MSFT.US)$ .

![]() @David W Clark How would I invest $1,000,000

@David W Clark How would I invest $1,000,000

I'd put it in an account that at least pays as much interest as possible while researching for stocks, bonds, ETFs and other such ways to invest and grow. I may do this with a 45/45/10 split, Dividend Stocks/ Value Stocks / Cash.

![]() @Mars Mooo The Squid Game Multi-Portfolios Portfolio

@Mars Mooo The Squid Game Multi-Portfolios Portfolio

The Squid Game Multi-Portfolios portfolio is made up of 4 main portfolios, as follows:

40% weightage: Player 456 (Seong Gi-hun) Portfolio.

30% weightage: Player 218 (Cho Sang-woo) Portfolio.

20% weightage: Player 067 (Kang Sae-byeok) Portfolio.

10%: weightage: Liquid Portfolio.

![]() @Panda2102 Barbell strategy to build a portfolio with a $1m windfall

@Panda2102 Barbell strategy to build a portfolio with a $1m windfall

One portfolio (85-90%) holds extremely safe investments, while the other aggressive portfolio (10-15%) holds highly speculative or leveraged investments. Depending if you are in the Wealth Accumulation stage or Wealth Preservation stage of your life, you can tweak the two portfolio accordingly.

![]() @atelophobia Portfolio building

@atelophobia Portfolio building

Building a portfolio is aka finding the best equilibrium and striking a balance of allocation across the different classes. There is no right or wrong answer to how should one build a portfolio for the fact that Trading/Investment is an Art not a Sciene as such there is no scientific way to judge an artpiece as beauty lies in the eyes of beholder!

![]() @Mama Cass $1M Playmoney!

@Mama Cass $1M Playmoney!

If lucky enough to find or be given $1M to invest I'm afraid that at my age (55) I wouldn't go crazy with aggressive return seeking investments. Different age groups have different portfolio allocations. I'm a caviar kind of gal so I'm going to get a pro to take my million and make it pay off without loss.

![]() @nickelrust Buy. Hold. Sell. Repeat.

@nickelrust Buy. Hold. Sell. Repeat.

Me as a lower risk taker would opt for a safer option, to put the money into a basket of bluechip stocks and let it grow over a period of 3 to 5 years. With the current market still at its low, and globally economies are opening up and striving to stabilise and enter the real new normal.

![]() @Sufy87 It comes down to portfolio allocation and what you know best.

@Sufy87 It comes down to portfolio allocation and what you know best.

Personally, I would allocate 60% stocks, 20% into ETFs, 15% options, 5% cash. Stocks are basically what builds wealth. ETFs are basically to get exposure to segments of the economy. Options are just to hedge against some of my positions. Cash is always as "bullets" when opportunity arise.

![]() @102252718 What is your purpose to invest?

@102252718 What is your purpose to invest?

Everyone invest for a different reason. For me, I invest to grow my wealth pot for retirement and my child's education.

70-80% GROWTH STOCKS $TSLA $PLTR.

10% ETF $ARK Innovation ETF (ARKK.US)$ $ARKF.

10% Crypto $ETH. $BTC.

Please click "How to build a portfolio with a windfall of $1 million?" for more engaging posts.![]() If you are inspired by any post from "How to build a strong portfolio?", please share your thoughts and join us for further discussion. Don't forget to leave your comments and tell mooers what you have learned.

If you are inspired by any post from "How to build a strong portfolio?", please share your thoughts and join us for further discussion. Don't forget to leave your comments and tell mooers what you have learned.![]()

Part Ⅱ: Voting on the “Mentor Moo” Title

It's time for voting! Let's vote for the candidates to see who will win the "Mentor Moo" title. Whose idea do you think is the best? When evaluating the posts, please take the following factors into account: logic, practical content, type settings, picture displays, and engagement.

By the end of the poll, the one with the most votes will win the "Mentor Moo" title. What a great honor! Come and vote for your favorite mentors. Your vote means a lot to them.

Diversification is a critical concept in portfolio management. Different levels of risk tolerance and holding time could directly affect the category selections of investors. Do you have any other portfolio-building methods? Share your portfolio with mooers to explore investment opportunities together.![]()

Disclaimer: All investment involves risk. Neither Futu Inc, nor Futu SG, nor moomoo endorses any particular investment strategy. You should carefully consider your investment goals and objectives when deciding on an investment strategy. Past performance is no guarantee of future results.

Here are the rewards for your active participation: 1 FREE $Ford Motor (F.US)$ share for the five best posts, 1 FREE $ContextLogic (WISH.US)$ share for the five outstanding posts, and 66 points for posts with a minimum of 30 words. Congratulations to all the winners!

*The rewards will be distributed to winners within 15 working days. The ranking is sorted in alphabetical order.

Part Ⅰ: High-Quality Post Collection

1 million is a huge sum to begin with, it is very important to have growth for this portfolio. At the same time, we also must make sure it is safe from significant losses. I’ll allocate my portfolio with 4-3-2-1 strategy. I am an agreesive investors, I do not believe in bonds, so I will allocate 100% in equity portfolio.

If I had a $1 million windfall, I would put 90% of it in an S&P ETF like $Vanguard S&P 500 ETF (VOO.US)$ , $SPDR S&P 500 ETF (SPY.US)$ and $iShares Core S&P 500 ETF (IVV.US)$ , and 5% in Treasury bills. The remaining 5% will be reserved for stocks that I think have the potential to become the next $Amazon (AMZN.US)$ , $Tesla (TSLA.US)$ , $Sea (SE.US)$ , $Apple (AAPL.US)$ and $Microsoft (MSFT.US)$ .

I'd put it in an account that at least pays as much interest as possible while researching for stocks, bonds, ETFs and other such ways to invest and grow. I may do this with a 45/45/10 split, Dividend Stocks/ Value Stocks / Cash.

The Squid Game Multi-Portfolios portfolio is made up of 4 main portfolios, as follows:

40% weightage: Player 456 (Seong Gi-hun) Portfolio.

30% weightage: Player 218 (Cho Sang-woo) Portfolio.

20% weightage: Player 067 (Kang Sae-byeok) Portfolio.

10%: weightage: Liquid Portfolio.

One portfolio (85-90%) holds extremely safe investments, while the other aggressive portfolio (10-15%) holds highly speculative or leveraged investments. Depending if you are in the Wealth Accumulation stage or Wealth Preservation stage of your life, you can tweak the two portfolio accordingly.

Building a portfolio is aka finding the best equilibrium and striking a balance of allocation across the different classes. There is no right or wrong answer to how should one build a portfolio for the fact that Trading/Investment is an Art not a Sciene as such there is no scientific way to judge an artpiece as beauty lies in the eyes of beholder!

If lucky enough to find or be given $1M to invest I'm afraid that at my age (55) I wouldn't go crazy with aggressive return seeking investments. Different age groups have different portfolio allocations. I'm a caviar kind of gal so I'm going to get a pro to take my million and make it pay off without loss.

Me as a lower risk taker would opt for a safer option, to put the money into a basket of bluechip stocks and let it grow over a period of 3 to 5 years. With the current market still at its low, and globally economies are opening up and striving to stabilise and enter the real new normal.

Personally, I would allocate 60% stocks, 20% into ETFs, 15% options, 5% cash. Stocks are basically what builds wealth. ETFs are basically to get exposure to segments of the economy. Options are just to hedge against some of my positions. Cash is always as "bullets" when opportunity arise.

Everyone invest for a different reason. For me, I invest to grow my wealth pot for retirement and my child's education.

70-80% GROWTH STOCKS $TSLA $PLTR.

10% ETF $ARK Innovation ETF (ARKK.US)$ $ARKF.

10% Crypto $ETH. $BTC.

Please click "How to build a portfolio with a windfall of $1 million?" for more engaging posts.

Part Ⅱ: Voting on the “Mentor Moo” Title

It's time for voting! Let's vote for the candidates to see who will win the "Mentor Moo" title. Whose idea do you think is the best? When evaluating the posts, please take the following factors into account: logic, practical content, type settings, picture displays, and engagement.

By the end of the poll, the one with the most votes will win the "Mentor Moo" title. What a great honor! Come and vote for your favorite mentors. Your vote means a lot to them.

Diversification is a critical concept in portfolio management. Different levels of risk tolerance and holding time could directly affect the category selections of investors. Do you have any other portfolio-building methods? Share your portfolio with mooers to explore investment opportunities together.

Disclaimer: All investment involves risk. Neither Futu Inc, nor Futu SG, nor moomoo endorses any particular investment strategy. You should carefully consider your investment goals and objectives when deciding on an investment strategy. Past performance is no guarantee of future results.

154

32

Ahow3

commented on

$Palantir (PLTR.US)$ Possible to hit 34 today?

8

7

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

Ahow3 : Say the wrong thing .