Al Uhn

liked

$Direxion Daily Semiconductor Bull 3x Shares ETF (SOXL.US)$ you can see for yourself and went right to the 20-day moving average and reversed everybody else sees this and you see the general trend of the moving average the purple line. we're just cruising around there will come a point and I thought we reached it because Friday last week we rallied $29 and change yesterday approach $30 today cross $30. it looked like it was genuinely under accumulation again by institutions and I heard several bo...

6

4

1

Al Uhn

voted

Happy weekend investors! Welcome back to Weekly Buzz, where we discuss the top buzzing stock news on moomoo this week! Comment below to answer the Weekly Topic question for a chance to win an award!

Make Your Choice

Weekly Buzz

The market faced the most busy week, with earnings results from hundreds of companies before and after the market traded. We saw results from five of the Mag Seven, and yet there is more still to come. There is just a couple...

Make Your Choice

Weekly Buzz

The market faced the most busy week, with earnings results from hundreds of companies before and after the market traded. We saw results from five of the Mag Seven, and yet there is more still to come. There is just a couple...

+10

75

37

12

Al Uhn

commented on

What happen to our account and money in the event of death? I don't advise parking too much money on this platform until they can provide us with some assurance.

$Fullerton SGD Cash Fund (SG9999005961.MF)$ $HSBC GIF Ultra Short Duration Bond MDis (LU2334458192.MF)$ $SPDR S&P 500 ETF (SPY.US)$

@Moomoo SG @Moomoo Buddy

$Fullerton SGD Cash Fund (SG9999005961.MF)$ $HSBC GIF Ultra Short Duration Bond MDis (LU2334458192.MF)$ $SPDR S&P 500 ETF (SPY.US)$

@Moomoo SG @Moomoo Buddy

10

4

Al Uhn

voted

FOMC happens Wednesday.

Will the Fed cut?🤔

🤩Key takeaways

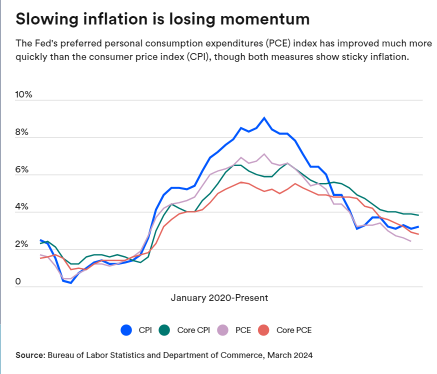

The Federal Reserve is expected to leave borrowing costs at a 23-year high of 5.25-5.5 percent, pushing back on investors’ hopes that it’ll be quick to cut interest rates.

Inflation is not slowing as quickly as it once was, with consumer prices rising 3.2 percent in February and hitting a hotter 3.8 percent when excluding food and energy.

Consumers should focus on paying off debt and improving their credit scor...

Will the Fed cut?🤔

🤩Key takeaways

The Federal Reserve is expected to leave borrowing costs at a 23-year high of 5.25-5.5 percent, pushing back on investors’ hopes that it’ll be quick to cut interest rates.

Inflation is not slowing as quickly as it once was, with consumer prices rising 3.2 percent in February and hitting a hotter 3.8 percent when excluding food and energy.

Consumers should focus on paying off debt and improving their credit scor...

+1

12

5

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)