alchemysciviz

liked

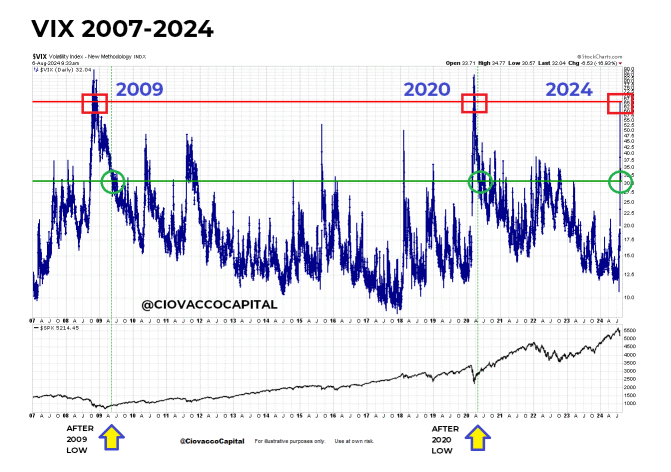

The $.VIX.US$ hit an intraday high of 65.73 Monday; this morning it hit an intraday low of 30.57.

Only other times it has seen moves from 65 back to 30: (a) 2009 after the Financial Crisis low, and (b) 2020 after the COVID low. 2024 case TBD. S&P 500 shown bottom panel.

ETFs that place bets on severe stock-market swings are coming back into vogue — delivering big gains and losses during this week’s rapid downturn and recovery.

...

Only other times it has seen moves from 65 back to 30: (a) 2009 after the Financial Crisis low, and (b) 2020 after the COVID low. 2024 case TBD. S&P 500 shown bottom panel.

ETFs that place bets on severe stock-market swings are coming back into vogue — delivering big gains and losses during this week’s rapid downturn and recovery.

...

5

alchemysciviz

liked

$HUMA.US$ same price action different recent weeks , if goes up $1 comes down $1.5 , going to take profit i am almost done if unable to test $10 within 3 days i am out….

2

2

alchemysciviz

liked

Focus on fundamentals, and the stock disaster is likely to continue for weeks

Report: Ling Qiaosen

$FTSE Bursa Malaysia KLCI Index.MY$

Pessimism and panic surround Asian stocks. Market participants believe that retail investors should focus on fundamental investments at this stage and seek stability during periods of stock market turmoil.

Huang Yuhan, founder and CEO of Tradeview Capital, pointed out in response to the “Nanyang Commercial Daily” inquiry that the current stock market crisis cycle is estimated to continue for one to two weeks, and there will probably not be a rebound too soon.

Concerns about the economic outlook caused by external factors are the main cause of the sharp decline in Asian stocks and blood flow.

Among them, weak US economic data, the heating up situation in the Middle East, and the Bank of Japan's move to raise interest rates all caused fear in the market, which in turn caused the stock market to decline steadily.

Huang Yuhan said, “In an environment where panic continues, the stock market has entered an arbitrage model. I believe the market will tend to choose to exit and wait and see to maintain previous profits.”

He also urged retail investors not to hastily deploy investment strategies during this period, because at a time when capital movements are uncertain, the stock crisis is expected to continue.

“Since the panic may not subside too quickly, and the ringgit has appreciated quite a bit recently, foreign investors are likely to arbitrage the exchange rate during this period, further worsening the overall Asian stock market.”

Financial stability, high dividends

Huang Weihan believes that if they want stability in the midst of chaos, in addition to waiting and watching for a while, retail investors should also shift their investment vision to financially sound stocks.

“Financial soundness means having good health...

Report: Ling Qiaosen

$FTSE Bursa Malaysia KLCI Index.MY$

Pessimism and panic surround Asian stocks. Market participants believe that retail investors should focus on fundamental investments at this stage and seek stability during periods of stock market turmoil.

Huang Yuhan, founder and CEO of Tradeview Capital, pointed out in response to the “Nanyang Commercial Daily” inquiry that the current stock market crisis cycle is estimated to continue for one to two weeks, and there will probably not be a rebound too soon.

Concerns about the economic outlook caused by external factors are the main cause of the sharp decline in Asian stocks and blood flow.

Among them, weak US economic data, the heating up situation in the Middle East, and the Bank of Japan's move to raise interest rates all caused fear in the market, which in turn caused the stock market to decline steadily.

Huang Yuhan said, “In an environment where panic continues, the stock market has entered an arbitrage model. I believe the market will tend to choose to exit and wait and see to maintain previous profits.”

He also urged retail investors not to hastily deploy investment strategies during this period, because at a time when capital movements are uncertain, the stock crisis is expected to continue.

“Since the panic may not subside too quickly, and the ringgit has appreciated quite a bit recently, foreign investors are likely to arbitrage the exchange rate during this period, further worsening the overall Asian stock market.”

Financial stability, high dividends

Huang Weihan believes that if they want stability in the midst of chaos, in addition to waiting and watching for a while, retail investors should also shift their investment vision to financially sound stocks.

“Financial soundness means having good health...

Translated

From YouTube

28

1

alchemysciviz

liked

After Amazon announced its latest second-quarter results (NASDAQ: AMZN), the market did not respond well to this, and its stock price fell one after another after the announcement. Will this downward trend continue, and how should we consider our investment behavior? This requires a more careful study of its fundamentals to make a specific assessment.

2024 First Quarter Results Review

The highlight of the company's earnings for the first quarter of 2024 was strong operating income, which was 27.5% above the upper limit of the guidance range. As a result, the operating margin looked particularly healthy at 10.7% (Q1 2023:3.7%).

There are clear risks to Amazon's future profit margins. Specifically, three challenges are obvious — companies such as Temu, a subsidiary of Pinduoduo Holdings (NASDAQ: PDD), are becoming increasingly competitive, the growth of Amazon's huge US market is slowing, and rising cost pressure due to labor costs. However, in the first quarter of 2024, the company clearly excelled in these risks. A healthy net sales growth forecast for the second quarter of 2024 and the stock's price-earnings ratio also make Amazon attractive.

It is in this context that we are now taking a look at the company's latest data to assess whether the price drop will continue.

Why did Amazon's stock fall after the announcement of results for the second quarter of 2024

From the beginning, there was an obvious reason for the latest price drop. This is due to some data...

2024 First Quarter Results Review

The highlight of the company's earnings for the first quarter of 2024 was strong operating income, which was 27.5% above the upper limit of the guidance range. As a result, the operating margin looked particularly healthy at 10.7% (Q1 2023:3.7%).

There are clear risks to Amazon's future profit margins. Specifically, three challenges are obvious — companies such as Temu, a subsidiary of Pinduoduo Holdings (NASDAQ: PDD), are becoming increasingly competitive, the growth of Amazon's huge US market is slowing, and rising cost pressure due to labor costs. However, in the first quarter of 2024, the company clearly excelled in these risks. A healthy net sales growth forecast for the second quarter of 2024 and the stock's price-earnings ratio also make Amazon attractive.

It is in this context that we are now taking a look at the company's latest data to assess whether the price drop will continue.

Why did Amazon's stock fall after the announcement of results for the second quarter of 2024

From the beginning, there was an obvious reason for the latest price drop. This is due to some data...

Translated

+2

13

1

alchemysciviz

liked

Stocks to Watch

Chevron Corp (CVX US) $CVX.US$

Daily Chart -[BEARISH ↘ **] CVX shaped a bearish breakout of a triangle to the downside. As long as price is holding below 154.10 resistance, a further push down towards 144.35 support then 138.90 support is possible. Technical indicators are advocating for a bearish scenario as well.

Alternatively: A daily candlestick closing above 154.10 resistance will open a...

Chevron Corp (CVX US) $CVX.US$

Daily Chart -[BEARISH ↘ **] CVX shaped a bearish breakout of a triangle to the downside. As long as price is holding below 154.10 resistance, a further push down towards 144.35 support then 138.90 support is possible. Technical indicators are advocating for a bearish scenario as well.

Alternatively: A daily candlestick closing above 154.10 resistance will open a...

+3

46

3

alchemysciviz

liked

$BTC.CC$ don't buy till 4o k simples every big whale selling wonder why mmmmmm it's the top obviously 🙄 40 k then buyyyyyyyyyyy

2

alchemysciviz

liked

$COIN.US$ Key financial data

1. Total revenue:

• Total revenue of $1.44963 billion, higher than the forecast of $1.42732 billion.

• Revenue increased year over year, reflecting the company's strong performance in terms of diversified revenue streams and market demand.

2. Earnings per share (EPS):

• The actual value was $1.07, higher than the forecast of $0.9593.

3. Net profit:

• Net profit for the second quarter was $36 million.

Performance of each business unit

1. Trading revenue:

• Trading revenue was $0.781 billion, down 27% year over year, mainly due to reduced spot trading volume due to reduced volatility in crypto assets.

• Increased transaction fees for derivatives and Coinbase wallets partially offset the decline in spot trading revenue.

2. Subscription and service revenue:

• Subscription and service revenue grew 17% to $0.599 billion, mainly driven by stablecoin revenue and blockchain rewards revenue.

3. Operating expenses:

• Total operating expenses were $1.1 billion, up $0.229 billion from the previous quarter, mainly due to changes in earnings from operating crypto assets, increased sales and marketing expenses, and increased policy expenses.

KEY HIGHLIGHTS

1. Regulatory Clarity:

• ...

1. Total revenue:

• Total revenue of $1.44963 billion, higher than the forecast of $1.42732 billion.

• Revenue increased year over year, reflecting the company's strong performance in terms of diversified revenue streams and market demand.

2. Earnings per share (EPS):

• The actual value was $1.07, higher than the forecast of $0.9593.

3. Net profit:

• Net profit for the second quarter was $36 million.

Performance of each business unit

1. Trading revenue:

• Trading revenue was $0.781 billion, down 27% year over year, mainly due to reduced spot trading volume due to reduced volatility in crypto assets.

• Increased transaction fees for derivatives and Coinbase wallets partially offset the decline in spot trading revenue.

2. Subscription and service revenue:

• Subscription and service revenue grew 17% to $0.599 billion, mainly driven by stablecoin revenue and blockchain rewards revenue.

3. Operating expenses:

• Total operating expenses were $1.1 billion, up $0.229 billion from the previous quarter, mainly due to changes in earnings from operating crypto assets, increased sales and marketing expenses, and increased policy expenses.

KEY HIGHLIGHTS

1. Regulatory Clarity:

• ...

Translated

5

alchemysciviz

liked

$5E2.SG$ I think this share is better than Sia 🤣now is falling I'm selling some my Sia stock to buy soon it will go up unlike Sia take more longer time to recover for the bad news now 😞

3

alchemysciviz

liked

The strong performance of the US stock market on Wednesday was boosted by news that Federal Reserve Chairman Powell suggested that interest rate cuts might be discussed in September. The S&P 500 and NASDAQ indices each recorded their biggest one-day gains in five months. The Nasdaq index was particularly prominent, rising more than 3% at one point. Although the Nasdaq was the only major index to fall in July, the small-cap stock index performed strongly, with a cumulative increase of 10%, making it the best performing month of the year.

At the latest FOMC meeting, the Federal Reserve kept interest rates unchanged, but emphasized that in addition to inflation, it is now also concerned about employment risks. This marks a major shift in the Federal Reserve's strategy, balancing the dual goals of employment and inflation, thus paving the way for interest rate cuts in September.

In terms of technology stocks, Meta's second-quarter report and guidance for the next quarter both exceeded market expectations, and the stock price rose 5% in after-hours trading. Zuckerberg predicts that Meta AI will become the most used artificial intelligence assistant in the world. Meanwhile, Morgan Stanley once again emphasized that Nvidia is its “stock of choice” and expects strong Blackwell chip deliveries in the fourth quarter. On Wednesday, Nvidia's stock price surged nearly 13%, and Huang Renxun's net worth increased by about 12 billion dollars in a single day, setting a record.

Furthermore, the Bank of Japan unexpectedly raised interest rates and announced a quarterly reduction of 400 billion yen in bond purchases. This led to a sharp appreciation of the yen against the US dollar, reaching a 2% increase, and a cumulative increase of nearly 7% in July, the best performance in 20 months.

Geopolitical tension in the Middle East has also driven a sharp jump in oil prices,...

At the latest FOMC meeting, the Federal Reserve kept interest rates unchanged, but emphasized that in addition to inflation, it is now also concerned about employment risks. This marks a major shift in the Federal Reserve's strategy, balancing the dual goals of employment and inflation, thus paving the way for interest rate cuts in September.

In terms of technology stocks, Meta's second-quarter report and guidance for the next quarter both exceeded market expectations, and the stock price rose 5% in after-hours trading. Zuckerberg predicts that Meta AI will become the most used artificial intelligence assistant in the world. Meanwhile, Morgan Stanley once again emphasized that Nvidia is its “stock of choice” and expects strong Blackwell chip deliveries in the fourth quarter. On Wednesday, Nvidia's stock price surged nearly 13%, and Huang Renxun's net worth increased by about 12 billion dollars in a single day, setting a record.

Furthermore, the Bank of Japan unexpectedly raised interest rates and announced a quarterly reduction of 400 billion yen in bond purchases. This led to a sharp appreciation of the yen against the US dollar, reaching a 2% increase, and a cumulative increase of nearly 7% in July, the best performance in 20 months.

Geopolitical tension in the Middle East has also driven a sharp jump in oil prices,...

Translated

23

1

alchemysciviz

liked

The recent Fed rate cuts in 2024 have significantly lowered borrowing costs, making it an opportune time for investors to explore various asset classes. With cheaper loans available, individuals might consider increasing their investments in real estate, which often benefits from lower mortgage rates. Similarly, the stock market may attract attention as companies may benefit from reduced borrowing costs and improved profit margins. It's also worth exploring sectors like te...

2

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)