alextan000

liked

Billionaire investor Bill Ackman said he believed 30-year interest rates would rise further, while his Pershing Square Capital Management hedge fund remains short on bonds, as he sees inflation remaining stubbornly high.

1.The world is structurally different now than before. There is no longer a peace dividend. The long-term deflationary effects of outsourcing production to China no longer exist. The bargaining power of workers and u...

1.The world is structurally different now than before. There is no longer a peace dividend. The long-term deflationary effects of outsourcing production to China no longer exist. The bargaining power of workers and u...

8

alextan000

liked

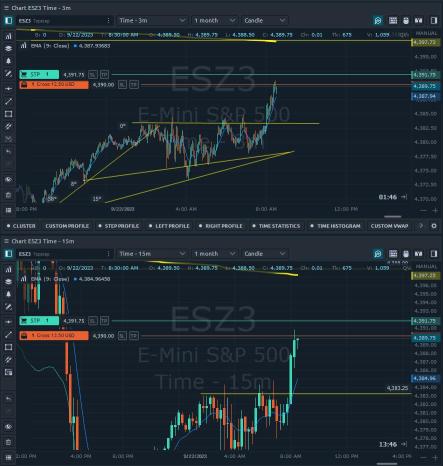

What if today is a green day?

Some wild thesis:

Powell does not sound very hawkish during his speech on Wed. He basically repeated what he said in the past: data dependent, proceed carefully, 1 more rate hike, higher for longer etc.

Then, the market sold off, where it “should have” rallied, because there was no surprise from Powell per se.

On Thurs, some may think that the market should bounce (which happened previously during post FOMC). Yet the market sold off again.

Okay, that is when...

Some wild thesis:

Powell does not sound very hawkish during his speech on Wed. He basically repeated what he said in the past: data dependent, proceed carefully, 1 more rate hike, higher for longer etc.

Then, the market sold off, where it “should have” rallied, because there was no surprise from Powell per se.

On Thurs, some may think that the market should bounce (which happened previously during post FOMC). Yet the market sold off again.

Okay, that is when...

From YouTube

7

15

alextan000

liked

All 3 major indices actually tested or went close to Aug’s low. Well, I guess both Aug and Sep really lived up to its expectation of bearish months.

Wouldn’t say we didn’t see it coming, right?

Anyway, today is option expiry day. Market makers could bring up the market a little or stay flat to wipe out late Put buyers. But of course, I could be wrong. We could have a third day of sell off. If it’s the latter, I’m ready to pick up some shares.

$SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ $Invesco QQQ Trust (QQQ.US)$ $ProShares UltraPro QQQ ETF (TQQQ.US)$ $ProShares UltraPro Short QQQ ETF (SQQQ.US)$ $Arm Holdings (ARM.US)$ $Tesla (TSLA.US)$ $Apple (AAPL.US)$ $NVIDIA (NVDA.US)$ $Meta Platforms (META.US)$ $Microsoft (MSFT.US)$ $Alphabet-A (GOOGL.US)$ $Alphabet-C (GOOG.US)$ $CBOE Volatility S&P 500 Index (.VIX.US)$ $USD (USDindex.FX)$ $Amazon (AMZN.US)$ $Netflix (NFLX.US)$ $Adobe (ADBE.US)$ $DocuSign (DOCU.US)$ $Workday (WDAY.US)$ $Dow Jones Industrial Average (.DJI.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$ $Upstart (UPST.US)$ $Snowflake (SNOW.US)$ $CrowdStrike (CRWD.US)$ $ProShares Ultra VIX Short-Term Futures ETF (UVXY.US)$ $Lululemon Athletica (LULU.US)$ $Micron Technology (MU.US)$ $McDonald's (MCD.US)$ $Starbucks (SBUX.US)$ $Johnson & Johnson (JNJ.US)$ $HP Inc (HPQ.US)$

Wouldn’t say we didn’t see it coming, right?

Anyway, today is option expiry day. Market makers could bring up the market a little or stay flat to wipe out late Put buyers. But of course, I could be wrong. We could have a third day of sell off. If it’s the latter, I’m ready to pick up some shares.

$SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ $Invesco QQQ Trust (QQQ.US)$ $ProShares UltraPro QQQ ETF (TQQQ.US)$ $ProShares UltraPro Short QQQ ETF (SQQQ.US)$ $Arm Holdings (ARM.US)$ $Tesla (TSLA.US)$ $Apple (AAPL.US)$ $NVIDIA (NVDA.US)$ $Meta Platforms (META.US)$ $Microsoft (MSFT.US)$ $Alphabet-A (GOOGL.US)$ $Alphabet-C (GOOG.US)$ $CBOE Volatility S&P 500 Index (.VIX.US)$ $USD (USDindex.FX)$ $Amazon (AMZN.US)$ $Netflix (NFLX.US)$ $Adobe (ADBE.US)$ $DocuSign (DOCU.US)$ $Workday (WDAY.US)$ $Dow Jones Industrial Average (.DJI.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$ $Upstart (UPST.US)$ $Snowflake (SNOW.US)$ $CrowdStrike (CRWD.US)$ $ProShares Ultra VIX Short-Term Futures ETF (UVXY.US)$ $Lululemon Athletica (LULU.US)$ $Micron Technology (MU.US)$ $McDonald's (MCD.US)$ $Starbucks (SBUX.US)$ $Johnson & Johnson (JNJ.US)$ $HP Inc (HPQ.US)$

From YouTube

8

alextan000

liked

Hello Mooers! ![]()

As the weather today is not bad, do you think the US stock market will rally today?![]()

![]()

![]()

![]()

$Futu Holdings Ltd (FUTU.US)$ $Tesla (TSLA.US)$ $Apple (AAPL.US)$ $Meta Platforms (META.US)$ $Amazon (AMZN.US)$ $AMC Entertainment (AMC.US)$ $NVIDIA (NVDA.US)$ $NIO Inc (NIO.US)$ $GameStop (GME.US)$ $GameStop (GME.US)$ $BlackBerry (BB.US)$ $VinFast Auto (VFS.US)$ $Arm Holdings (ARM.US)$ $Netflix (NFLX.US)$ $SIA (C6L.SG)$ $DBS (D05.SG)$ $Seatrium (S51.SG)$ $CapLand IntCom T (C38U.SG)$ $ARK Innovation ETF (ARKK.US)$ $Imperial Petroleum (IMPP.US)$ ���������...

As the weather today is not bad, do you think the US stock market will rally today?

$Futu Holdings Ltd (FUTU.US)$ $Tesla (TSLA.US)$ $Apple (AAPL.US)$ $Meta Platforms (META.US)$ $Amazon (AMZN.US)$ $AMC Entertainment (AMC.US)$ $NVIDIA (NVDA.US)$ $NIO Inc (NIO.US)$ $GameStop (GME.US)$ $GameStop (GME.US)$ $BlackBerry (BB.US)$ $VinFast Auto (VFS.US)$ $Arm Holdings (ARM.US)$ $Netflix (NFLX.US)$ $SIA (C6L.SG)$ $DBS (D05.SG)$ $Seatrium (S51.SG)$ $CapLand IntCom T (C38U.SG)$ $ARK Innovation ETF (ARKK.US)$ $Imperial Petroleum (IMPP.US)$ ���������...

19

11

alextan000

liked

Good morning everyone! I hope you made some thick cheese yesterday while I spammed MooMoo with a ton of different trades hahaha. Sorry about that. I'll try to hold back on spamming posts on possible trades. Besides, yesterday was one of those golden days to be incredibly thankful for. We saw multiple setups throughout the day and everyone who was in the market sort of had the same pre-concieved notion about how the market would end on the day.

Right now the market is moving to the upsi...

Right now the market is moving to the upsi...

+2

11

3

alextan000

liked

We have seen report of China cutting treasury holdings as there is growing security concerns amidst geopolitical tensions.

Another way I look at is China is trying to strengthen its renminbi (RMB) so this might be one other reason why they are reducing the U.S. Treasury Yield holdings.

https://www.scmp.com/economy/economic-indicators/article/3231288/china-cuts-us-treasury-holdings-14-year-low-amid-persisting-security-...

Another way I look at is China is trying to strengthen its renminbi (RMB) so this might be one other reason why they are reducing the U.S. Treasury Yield holdings.

https://www.scmp.com/economy/economic-indicators/article/3231288/china-cuts-us-treasury-holdings-14-year-low-amid-persisting-security-...

+3

5

alextan000

liked

Hi Mooers, Nasdaq is looking forward to using the Moomoo Platform as an additional channel for shareholder communication and audience engagement.

In today's environment, we feel it's essential to be meeting our shareholders where they are and for them to have better access to updates that is increasingly routine and transparent.

To stay up to date on the Company's most recent developments, be sure to follow Nasdaq (NASDAQ: NDAQ) on Moomoo and turn o...

In today's environment, we feel it's essential to be meeting our shareholders where they are and for them to have better access to updates that is increasingly routine and transparent.

To stay up to date on the Company's most recent developments, be sure to follow Nasdaq (NASDAQ: NDAQ) on Moomoo and turn o...

338

53

19

alextan000

liked

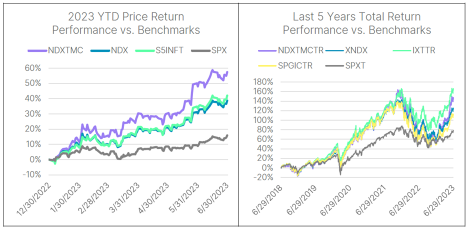

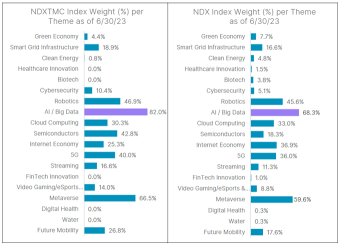

The Nasdaq-100 Technology Sector Market-Cap Weighted™ Index (NDXTMC) offers investors the option of tracking only those constituents that are considered pure Technology companies (per the Industry Classification Benchmark (ICB), the sector classification system of FTSE Russell) and, as a result, provides a concentrated approach to investing in the innovation-driven growth of the Nasdaq-100.

NDXTMC Performance vs. Benchmarks...

NDXTMC Performance vs. Benchmarks...

240

8

9

My biggest mistake is not understanding options and trading options. I made a little profit, but ended up losing more later.![]()

![]()

![]()

Translated

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)