Alfred8189

voted

Hi, mooers!

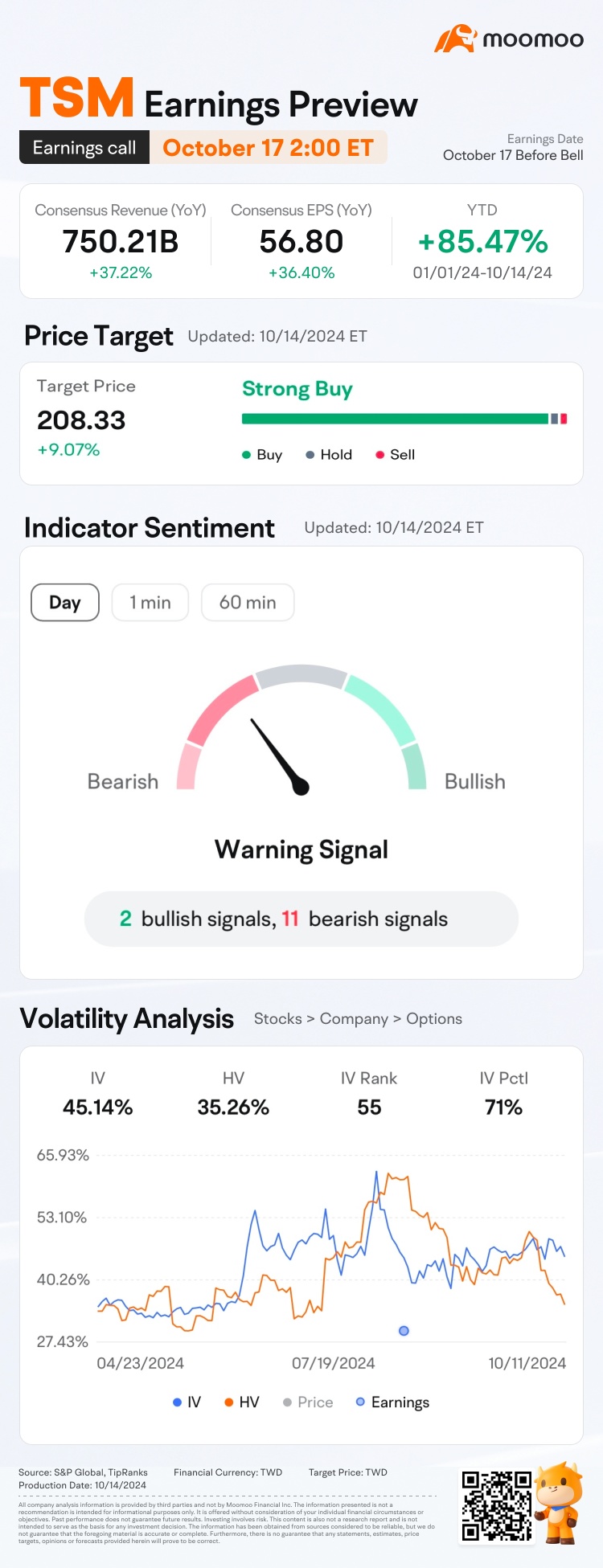

$Taiwan Semiconductor (TSM.US)$ is releasing its Q3 2024 earnings on October 17 before the bell. Unlock insights with TSM Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q2 2024 earnings release, shares of $Taiwan Semiconductor (TSM.US)$ have seen an increase of 11.42%.![]() How will the market react to the upcoming results? Make your guess now!

How will the market react to the upcoming results? Make your guess now!

Rewards

● An equal share of 5,000 ...

$Taiwan Semiconductor (TSM.US)$ is releasing its Q3 2024 earnings on October 17 before the bell. Unlock insights with TSM Earnings Hub>>

For the details of indicator sentiment, please tap the link and check.

Since its Q2 2024 earnings release, shares of $Taiwan Semiconductor (TSM.US)$ have seen an increase of 11.42%.

Rewards

● An equal share of 5,000 ...

Expand

Expand 134

212

16

money or time. its uo to you. what do you choose?

Alfred8189

voted

Singapore is my home and where my heart lies. There is nowhere else in the world where you can find authentic Singapore food. I hope Singapore and her people will never forget how far we have come as a nation and continue to maintain racial harmony and forge a better life for everyone, regardless of the challenges that lie ahead. Happy ![]() Singapore!

Singapore!

Can you spot my favourite stock in the photo?![]() $DBS (D05.SG)$

$DBS (D05.SG)$

$UOB (U11.SG)$ $OCBC Bank (O39.SG)$

PS: Cast your v...

Can you spot my favourite stock in the photo?

$UOB (U11.SG)$ $OCBC Bank (O39.SG)$

PS: Cast your v...

+1

44

20

2

Alfred8189

voted

TSM is releasing its Q2 earnings on July 18 before the bell.

For the details of indicator sentiment, please tap the link and check.

Since its Q1 earnings release, shares of $Taiwan Semiconductor (TSM.US)$ have seen an increase of 22.28%.![]() How will the market react to the upcoming results? Make your guess now!

How will the market react to the upcoming results? Make your guess now! ![]()

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range of $Taiwan Semiconductor (TSM.US)$'s opening...

For the details of indicator sentiment, please tap the link and check.

Since its Q1 earnings release, shares of $Taiwan Semiconductor (TSM.US)$ have seen an increase of 22.28%.

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range of $Taiwan Semiconductor (TSM.US)$'s opening...

Expand

Expand 153

260

29

Alfred8189

voted

$Broadcom (AVGO.US)$, which has soared 52% this year, will officially implement a 10-for-1 stock split plan after market close on July 12th (this Friday). This move follows $NVIDIA (NVDA.US)$, another major AI player, and has sparked market speculation.

Let's compare the recent stock trends of NVIDIA and Broadcom. From the announcement to the actual split, NVIDIA's share price jumped about 27%, and it has risen an additi...

Let's compare the recent stock trends of NVIDIA and Broadcom. From the announcement to the actual split, NVIDIA's share price jumped about 27%, and it has risen an additi...

+4

736

468

109

Alfred8189

voted

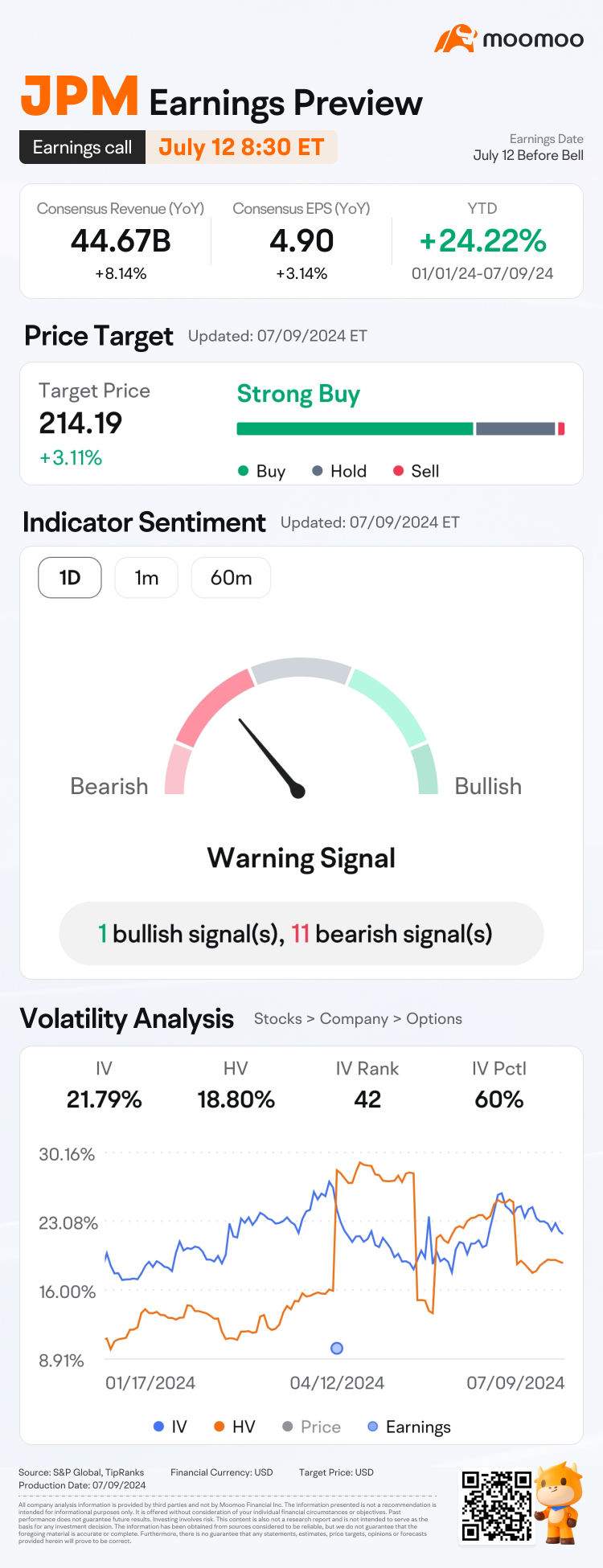

JPM is releasing its Q2 earnings on July 12 before the bell.

For the details of indicator sentiment, please tap the link and check.

Since its Q1 earnings release, shares of $JPMorgan (JPM.US)$ have seen an increase of 6.8%.![]() How will the market react to the upcoming results? Make your guess now!

How will the market react to the upcoming results? Make your guess now! ![]()

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range of $JPMorgan (JPM.US)$'s closing price at 16:...

For the details of indicator sentiment, please tap the link and check.

Since its Q1 earnings release, shares of $JPMorgan (JPM.US)$ have seen an increase of 6.8%.

Rewards

● An equal share of 5,000 points: For mooers who correctly guess the price range of $JPMorgan (JPM.US)$'s closing price at 16:...

Expand

Expand 89

145

17

Alfred8189

Set a live reminder

[Synopsis]

With the global market transitions since the start of 2024, how can an active investor possibly capture these pivotal turns and evolutions for their investment strategy? With the final live webinar for our mid-year funds series, learn how investors like yourselves can potentially leverage on Income strategies to navigate the changes on a global scale with our experts from PIMCO and Moomoo Singapore. Join us and you may be rewarded with qu...

With the global market transitions since the start of 2024, how can an active investor possibly capture these pivotal turns and evolutions for their investment strategy? With the final live webinar for our mid-year funds series, learn how investors like yourselves can potentially leverage on Income strategies to navigate the changes on a global scale with our experts from PIMCO and Moomoo Singapore. Join us and you may be rewarded with qu...

A Pivotal Year: Strategies for Capturing Income

Jun 28 17:00

24

3

Alfred8189

Set a live reminder

[Synopsis]

Mid-2024 - where are we for Asia's Fixed Income space? What is the outlook and how can investors utilise the potential window of opportunities in the current global market context? We delve deeper into possible strategies you may leverage on for Fixed Income, so join us to find out more on the analysis as we transition into the second half of the year with our experts from UOB Asset Management. Come learn with us and stand a chance to win some...

Mid-2024 - where are we for Asia's Fixed Income space? What is the outlook and how can investors utilise the potential window of opportunities in the current global market context? We delve deeper into possible strategies you may leverage on for Fixed Income, so join us to find out more on the analysis as we transition into the second half of the year with our experts from UOB Asset Management. Come learn with us and stand a chance to win some...

Asia Fixed Income: A Window of Opportunity

Jun 28 15:00

7

2

Alfred8189

Set a live reminder

[Synopsis]

With the US interest rate cycle transitions since the start of 2024 - where are we now given there is no rate cutes in 2024 by the Fed? How can investors potentially benefit and what can we expect from the US market going into the second half of the year? Find out more in the latest live webinar with our expert from CSOP Asset Management. Join us and you might be rewarded with some giveaways and quiz questions.@olivehiggo

[Speake...

With the US interest rate cycle transitions since the start of 2024 - where are we now given there is no rate cutes in 2024 by the Fed? How can investors potentially benefit and what can we expect from the US market going into the second half of the year? Find out more in the latest live webinar with our expert from CSOP Asset Management. Join us and you might be rewarded with some giveaways and quiz questions.@olivehiggo

[Speake...

US Interest rate cycle overview by CSOP Asset Management

Jun 27 17:00

8

2

Alfred8189

Set a live reminder

[Synopsis]

As we head into the mid-year, what is the assessment of the current economy and will interest rates take a turn? With a year of global elections, US rate changes, continued geopolitical risks, and potential stablization of the Chinese market - learn the analysis as we hit the emergence of a new season with our expert from Fullerton Fund Management. Tune in as well for potential quiz giveaways and stand a chance to be rewarded f...

As we head into the mid-year, what is the assessment of the current economy and will interest rates take a turn? With a year of global elections, US rate changes, continued geopolitical risks, and potential stablization of the Chinese market - learn the analysis as we hit the emergence of a new season with our expert from Fullerton Fund Management. Tune in as well for potential quiz giveaways and stand a chance to be rewarded f...

Emergence of a new season, in current interest rates cycle

Jun 27 15:00

7

1

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)