alleybetwixt

liked

The best Christmas present I can get this year is for my father’s recent health issue to resolve on its own. He is greatly troubled by it and has been making frequent visits to the doctors. The medications prescribed are only giving short term relief. I was also hospitalised not long ago and am still on the road of recovery. Growing up, Christmas was associated with gift exchanges but as one gets older, one appreciates that good health is essential to ma...

45

23

6

alleybetwixt

liked

Here’s wishing all a Merry Christmas and a Blessed New Year in 2025! 🥰🎄🎊![]()

![]()

Santa Claus is here this year!![]()

![]() 24/12/24

24/12/24

and going to be “less” active in adjusting and over trading my investment portfolio! lessons from my paper account!![]()

Santa Claus is here this year!

and going to be “less” active in adjusting and over trading my investment portfolio! lessons from my paper account!

16

alleybetwixt

liked

alleybetwixt

liked

Columns Christmas gifts?

Hello everyone, I wish you a Merry Christmas Eve and Christmas. These days have been full of eating and drinking. This morning's Hong Kong stocks can be said to have lived up to expectations, giving most Hong Kong stock investors the biggest Christmas gift, right?

$Hang Seng Index (800000.HK)$ Today's closing price: 20098.29. Friday's trend prediction: handling high-level volatility, stock price oscillating between 20,000 and 20,150, waiting for the moving average to catch up further, digesting previous gains. Bullish trend is established, but overbought signals are evident, indicating a need for short-term market adjustment. Volume has not further increased, showing a slight lack of upward momentum.

Short-term investorsReduce positions on rallies, wait for a stable pullback before considering entry.

Medium to long-term investors.: When pulling back to the key Resistance, it is acceptable to appropriately increase positions, focusing on the support strength at 20,000 points.

$TENCENT (00700.HK)$ Today's closing price is 420, with a forecast of a strong upward oscillation on Friday, accompanied by a slight increase in Volume. It is currently undergoing a pullback after falling from a high level, with the formation of a bullish cross in the KDJ, and the J line trending upwards.

$BABA-W (09988.HK)$ Today's closing price is 83.15, with a forecast of a downward oscillation on Friday. The reason for the forecast is that today's high opening has not yet stabilized upwards, and the bearish trend remains strong. If the Volume continues to increase on Friday, there is a possibility of a breakthrough.

$XIAOMI-W (01810.HK)$ Closing price today: 32.75, Friday's trend forecast: upward oscillation, forecast reason: Bollinger Bands opening up, MACD showing a golden cross, increasing volume and rising price.

$KUAISHOU-W (01024.HK)$ Today's closing price is 43.0...

$Hang Seng Index (800000.HK)$ Today's closing price: 20098.29. Friday's trend prediction: handling high-level volatility, stock price oscillating between 20,000 and 20,150, waiting for the moving average to catch up further, digesting previous gains. Bullish trend is established, but overbought signals are evident, indicating a need for short-term market adjustment. Volume has not further increased, showing a slight lack of upward momentum.

Short-term investorsReduce positions on rallies, wait for a stable pullback before considering entry.

Medium to long-term investors.: When pulling back to the key Resistance, it is acceptable to appropriately increase positions, focusing on the support strength at 20,000 points.

$TENCENT (00700.HK)$ Today's closing price is 420, with a forecast of a strong upward oscillation on Friday, accompanied by a slight increase in Volume. It is currently undergoing a pullback after falling from a high level, with the formation of a bullish cross in the KDJ, and the J line trending upwards.

$BABA-W (09988.HK)$ Today's closing price is 83.15, with a forecast of a downward oscillation on Friday. The reason for the forecast is that today's high opening has not yet stabilized upwards, and the bearish trend remains strong. If the Volume continues to increase on Friday, there is a possibility of a breakthrough.

$XIAOMI-W (01810.HK)$ Closing price today: 32.75, Friday's trend forecast: upward oscillation, forecast reason: Bollinger Bands opening up, MACD showing a golden cross, increasing volume and rising price.

$KUAISHOU-W (01024.HK)$ Today's closing price is 43.0...

Translated

+3

8

1

alleybetwixt

liked

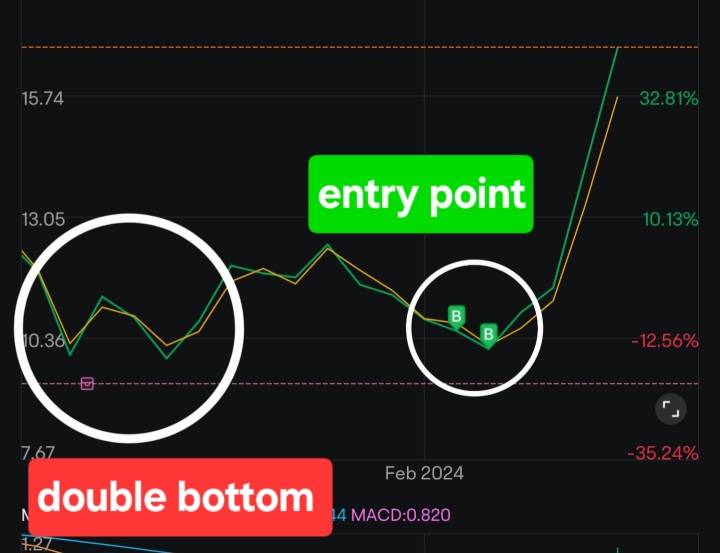

In a word, yes! However, achieving this simplicity requires several basic strategies and patience. If you're looking to get rich quickly, this article is not for you.

We all know the adage: "Buy low, sell high." However, an equally important but less known phrase is "time in the market, not timing the market."

The Pitfalls of Perfect Timing

Attempting to time the market's bottom for the perfect entry point is a strategy fraught with difficulty ...

We all know the adage: "Buy low, sell high." However, an equally important but less known phrase is "time in the market, not timing the market."

The Pitfalls of Perfect Timing

Attempting to time the market's bottom for the perfect entry point is a strategy fraught with difficulty ...

39

10

2

alleybetwixt

liked

2024 review

Before you know it, it's already Christmas, which also means 2024 is coming to an end and a new year. This year was a big bull market full of opportunities for both US stocks and cryptocurrency. Although Hong Kong stocks $Hang Seng Index (800000.HK)$ Probably no one would think of it as a bull market, but it also ushered in at least two small summers, and I believe everyone should also reap some benefits. However, even if there are no gains or losses, it should be viewed as a learning opportunity, scrutinize the mistakes made and missed opportunities, and prepare for the next year.

Let's start with early 2024. In January, the first thing to mention was a Bitcoin spot ETF $Crypto Spot ETF (LIST22873.HK)$ Listed. On the day of listing, the market immediately provided a short-term short selling opportunity for “Sell The News”. Bitcoin dropped to a maximum of $49,000 to $38,500 within the next two weeks. However, this event laid the foundation for this year's big cryptocurrency year.

Also in January, the two major shareholders of this year were born, Nvidia (NVDA) $NVIDIA (NVDA.US)$ and ultra-microcomputer (SMCI) $Super Micro Computer (SMCI.US)$ They all broke through the long-term consolidation range, then swayed all the way up, and the AI sector boom was rekindled. If you're a trend investor, these two stocks are textbook-style breakout trades. It's actually not difficult to seize rising points; the difficulty is whether you...

Before you know it, it's already Christmas, which also means 2024 is coming to an end and a new year. This year was a big bull market full of opportunities for both US stocks and cryptocurrency. Although Hong Kong stocks $Hang Seng Index (800000.HK)$ Probably no one would think of it as a bull market, but it also ushered in at least two small summers, and I believe everyone should also reap some benefits. However, even if there are no gains or losses, it should be viewed as a learning opportunity, scrutinize the mistakes made and missed opportunities, and prepare for the next year.

Let's start with early 2024. In January, the first thing to mention was a Bitcoin spot ETF $Crypto Spot ETF (LIST22873.HK)$ Listed. On the day of listing, the market immediately provided a short-term short selling opportunity for “Sell The News”. Bitcoin dropped to a maximum of $49,000 to $38,500 within the next two weeks. However, this event laid the foundation for this year's big cryptocurrency year.

Also in January, the two major shareholders of this year were born, Nvidia (NVDA) $NVIDIA (NVDA.US)$ and ultra-microcomputer (SMCI) $Super Micro Computer (SMCI.US)$ They all broke through the long-term consolidation range, then swayed all the way up, and the AI sector boom was rekindled. If you're a trend investor, these two stocks are textbook-style breakout trades. It's actually not difficult to seize rising points; the difficulty is whether you...

Translated

70

1

9

alleybetwixt

liked

earnings. and im not done yet. still have hundreds of stocks to go .,

135

10

1

alleybetwixt

liked

$Geo Energy Res (RE4.SG)$

Global demand for coal is set to hit fresh records every year through at least 2027, International Energy Agency data show, overturning a previous estimate that it peaked last year, highlighting the challenges to limiting emissions that cause global warming.

The latest forecast from the IEA sees demand for coal rising to nearly 8.9 billion tonnes by 2027, about 1% higher than 2024 levels. That overwrites last...

Global demand for coal is set to hit fresh records every year through at least 2027, International Energy Agency data show, overturning a previous estimate that it peaked last year, highlighting the challenges to limiting emissions that cause global warming.

The latest forecast from the IEA sees demand for coal rising to nearly 8.9 billion tonnes by 2027, about 1% higher than 2024 levels. That overwrites last...

14

alleybetwixt

liked

Individual retail investors in stock trading often experience significant emotional fluctuations, this is because their trading decisions are often influenced by external market information, personal psychological factors, and trading experience.

Individual retail investors in stock trading often experience significant emotional fluctuations, this is because their trading decisions are often influenced by external market information, personal psychological factors, and trading experience. Below are several typical manifestations of the emotions of individual retail investors and their impact on trading:

---

1. Greed and Fear

Emotional Behavior:

1. Greed: During rapid stock market growth, retail investors tend to have a 'fear of missing out' mentality (FOMO) and rush to buy high.

2. Fear: During stock market declines, retail investors often hastily cut losses due to fear of further expansion of losses.

Impact:

Greed leads to buying at high levels, ignoring risks.

Fear leads to selling at low levels, missing out on rebound opportunities.

Recommendation:

Develop a trading plan and strictly adhere to stop-loss and take-profit.

Avoid emotional trading and maintain rationality.

---

2. Herd Mentality

Emotional performance:

Many retail investors tend to blindly follow the "majority" or "hot trends" when investing, thinking what everyone else is buying must be right.

Keen on chasing after "limit up stocks" and "hot sectors", even relying on recommendations from social media or WeChat groups.

Impact:

容易在市场高峰时买入,低谷时卖出。

缺乏独立分析,依赖他人导致决策失误。

建...

Individual retail investors in stock trading often experience significant emotional fluctuations, this is because their trading decisions are often influenced by external market information, personal psychological factors, and trading experience. Below are several typical manifestations of the emotions of individual retail investors and their impact on trading:

---

1. Greed and Fear

Emotional Behavior:

1. Greed: During rapid stock market growth, retail investors tend to have a 'fear of missing out' mentality (FOMO) and rush to buy high.

2. Fear: During stock market declines, retail investors often hastily cut losses due to fear of further expansion of losses.

Impact:

Greed leads to buying at high levels, ignoring risks.

Fear leads to selling at low levels, missing out on rebound opportunities.

Recommendation:

Develop a trading plan and strictly adhere to stop-loss and take-profit.

Avoid emotional trading and maintain rationality.

---

2. Herd Mentality

Emotional performance:

Many retail investors tend to blindly follow the "majority" or "hot trends" when investing, thinking what everyone else is buying must be right.

Keen on chasing after "limit up stocks" and "hot sectors", even relying on recommendations from social media or WeChat groups.

Impact:

容易在市场高峰时买入,低谷时卖出。

缺乏独立分析,依赖他人导致决策失误。

建...

Translated

19

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)