alsmoov

liked

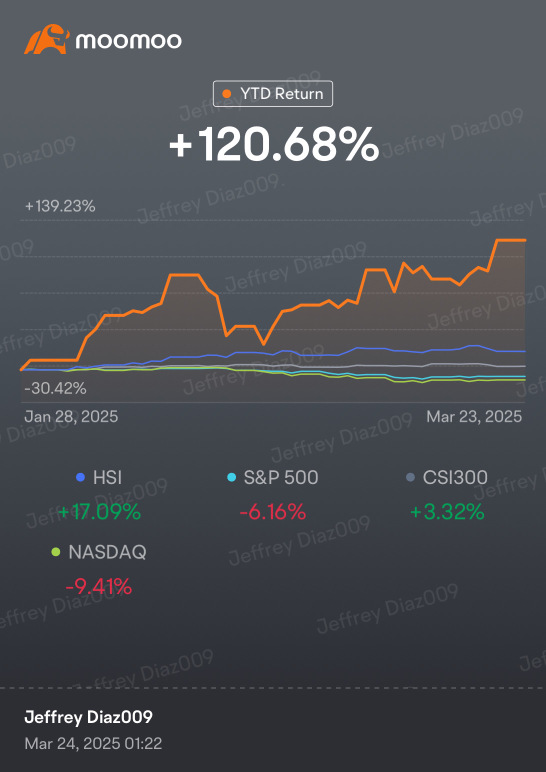

Thank you girls 🐈⬛😜🖤 . Im off to CHEAP CHINESE EV CALLS … (DT gonna play Tarrif Nice this week?🤷♂️<—Thats Trump 👀😀

$Tenon Medical (TNON.US)$

$Tenon Medical (TNON.US)$

7

alsmoov

liked

10

alsmoov

liked

$PBA (5041.MY)$

PBA presents a compelling risk-reward opportunity, underpinned by:

1. Upcoming Tariff Revisions – Key Catalyst

- The government allows water tariff adjustments every three years.

- Air Selangor is proposing a 30% hike—Penang’s water rates are much lower and could see a larger percentage increase, directly benefiting PBA’s bottom line.

- Non-domestic tariff hikes (the bulk of PBA’s revenue) are less politically sensitive, reducing execut...

PBA presents a compelling risk-reward opportunity, underpinned by:

1. Upcoming Tariff Revisions – Key Catalyst

- The government allows water tariff adjustments every three years.

- Air Selangor is proposing a 30% hike—Penang’s water rates are much lower and could see a larger percentage increase, directly benefiting PBA’s bottom line.

- Non-domestic tariff hikes (the bulk of PBA’s revenue) are less politically sensitive, reducing execut...

10

1

alsmoov

liked

28

24

alsmoov

liked

In 2024, Wall Street's ETF market is experiencing an unprecedented wave of derivative ETF applications, with 71 new ETF proposals already submitted for regulatory review within just a few months, setting a historical record.71 new ETFs. This surge in ETFs is not only reflected in the spike in issuance numbers but also shows the growing market demand for Options, leverage, and structured products. However, are these derivative ETFs suitable for ordinary investors? What are their market potential, risks, and returns? This article will delve deeply into the market trends of derivative ETFs from an investment and financial perspective, interpreting investment opportunities and potential risks through data to assist investors in making more precise decisions.

Why are derivative ETFs so popular in the market? Capital trends reveal increasing demand.

衍生性 ETF 的興起,與市場對高波動環境下的風險管理需求息息相關。根據 ETFGI 數據,截至 2023 年底,全球 ETF 資產規模已突破 10 trillion dollars,其中衍生性 ETF 市場更是近三年成長 150%。特別是在選擇權相關 ETF 方面,資金流入激增,從 2020 年的 30 billion USD Rising to 80 billion USD in 2024,indicating strong interest in hedging and leveraged products from both Institutions and retail investors.

From the perspective of Capital Trend, large Asset Management companies on Wall Street such asJP Morgan Chase (JP...

Why are derivative ETFs so popular in the market? Capital trends reveal increasing demand.

衍生性 ETF 的興起,與市場對高波動環境下的風險管理需求息息相關。根據 ETFGI 數據,截至 2023 年底,全球 ETF 資產規模已突破 10 trillion dollars,其中衍生性 ETF 市場更是近三年成長 150%。特別是在選擇權相關 ETF 方面,資金流入激增,從 2020 年的 30 billion USD Rising to 80 billion USD in 2024,indicating strong interest in hedging and leveraged products from both Institutions and retail investors.

From the perspective of Capital Trend, large Asset Management companies on Wall Street such asJP Morgan Chase (JP...

Translated

5

1

alsmoov

liked

$Nasdaq Composite Index (.IXIC.US)$

While U.S. equities have recently shown signs of a technical rebound, I maintain that the current market remains fundamentally overvalued. Even under a soft landing scenario, the Nasdaq Composite could still correct to the 14,000-15,000 range. This relief rally is likely to be followed by intensified downward pressure.

Policy Divergence: Biden vs. Trump Economics

The Biden administration's strategy has been characterized by aggressive rate hikes coupled with ...

While U.S. equities have recently shown signs of a technical rebound, I maintain that the current market remains fundamentally overvalued. Even under a soft landing scenario, the Nasdaq Composite could still correct to the 14,000-15,000 range. This relief rally is likely to be followed by intensified downward pressure.

Policy Divergence: Biden vs. Trump Economics

The Biden administration's strategy has been characterized by aggressive rate hikes coupled with ...

9

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)