Amaranth13

commented on

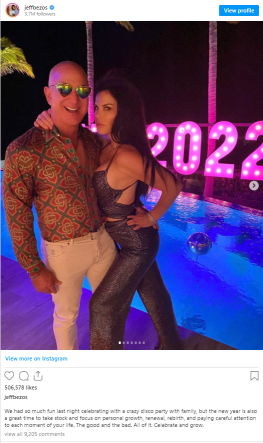

$AMC Entertainment (AMC.US)$ ape wheres my ape shares

3

6

Amaranth13

liked

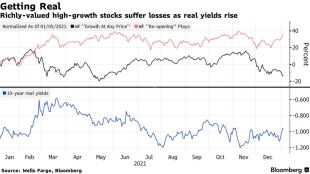

Accroding to Bloomberg and Financial times, investors dumped shares in many of the technology companies that surged during the pandemic as the looming spectre of higher interest rates prompted them to buy into businesses more tightly linked to the economic recovery.

Thanks to the new-year bond selloff, Wall Street pros are doubling down on a big stock call for 2022: The leadership of high-growth tech darlings is no more.

A closely watc...

Thanks to the new-year bond selloff, Wall Street pros are doubling down on a big stock call for 2022: The leadership of high-growth tech darlings is no more.

A closely watc...

37

17

Amaranth13

commented on

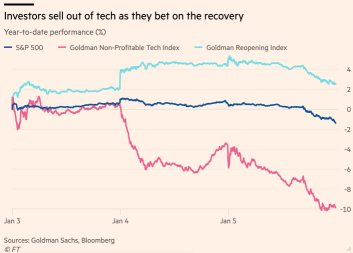

Jeff Bezos and his girlfriend Lauren Sanchez rang in the New Year with a raucous pool party in St. Barts along her ex fiance, adult son, and others. Bezos also posted photos to Instagram of their outfits for a poolside disco-themed New Year's Eve party.![]()

![]()

![]()

Not all of his social media followers were impressed with his splashy look. In fact, his New Year's Disco style hits a nerve.

It's riling people up, at least on social media. On his...

Not all of his social media followers were impressed with his splashy look. In fact, his New Year's Disco style hits a nerve.

It's riling people up, at least on social media. On his...

37

22

Amaranth13

liked

10

Amaranth13

liked

A challenging but surprising earnings season has almost come to an end. As stock prices rise and fall based on a company's earnings, quarterly report can change both the intrinsic value and the market value of a company. Do earnings reports affect the stock price? How can we maximize profits? Let's take a look at mooers' insights.

Earnings and stock price have a direct relation with each other

@Anonymoo said:

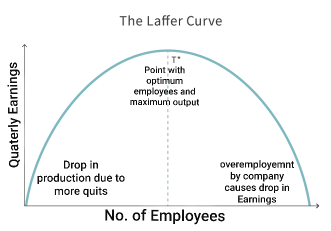

The reason earnings are directly related to the stock price is because, if the stock price is overvalued, then sometimes organizations has to cut their employee salaries, bonuses or sometimes their jobs to cover up the appropriate earnings for their overvalued stock price. This was seen after the pandemic hit, people lost jobs and most quit. Which affected the S&P in a direct way as low workers caused the industries to have higher earnings and stock prices to go up.This also follows the "laffer curve".

View More>>

But realistically,

it's common to see a stock's price fall after beating earnings.

As @Syuee said:

Share prices do dip after robust earnings release. Sometimes the expectation of beating earnings is already priced into the stock. There is no rule that the stock must immediately reflect the optimism or pessimism of quarterly results in the price. Fundamentals like profits, sales and everything else align with price only in the long term. In the short term, nothing is predictable or rational.

Take $Apple (AAPL.US)$ as an example. After a remarkable Q2 and Q3 earnings report, why the value of your stock was going down rather than up?The possible reasons:

-Warning that chip supply constraints could impact iPhones and iPads will weigh on the short-term outlook.

-Earnings may not seem good enough for an investor looking at every short-term opportunity to move funds to where the next quick buck is likely to be.

-Earnings were not as high as anticipated.

-Speculators already drove up the price in the days before the earnings report and then sold just before the report was released

-Stock markets are not always rational.

View More>>

With that being said,

whether the stock price goes up or down needs to be considered in different ways.

As @股票小丑 said:

-When the earnings report is good:

1. The current stock price exceeds the all-time high and the results exceed expectations. It is basically in a state of rise, because there is no pressure on the stock price to rise.

2. When the stock price is near the all-time high, the good earnings report will push the stock price to near the all-time high and then start to fall back, because the people who were trapped at the all-time high thought that it's time to cash out.

3. When the stock price is low at present, a good earning will basically turn the stock into an uptrend, because people trapped at higher prices won't sell until they break even.

-When the earnings report is bad:

1. If the company's fundamentals are still solid, investors will only think that it is a discount to buy when it falls, causing the stock price to return to its pre-report price.

2. For companies with poor fundamentals, they are likely to drop further and difficult to get back.

View More>>

So for investors like us,

how to use earning results to maximize profits?

@Panda2102 gives us some hints.

One good practice to do before the earnings are released is to have in your mind how this quarter earnings will be. In that case, you can have a good gauge how well you understand the business.

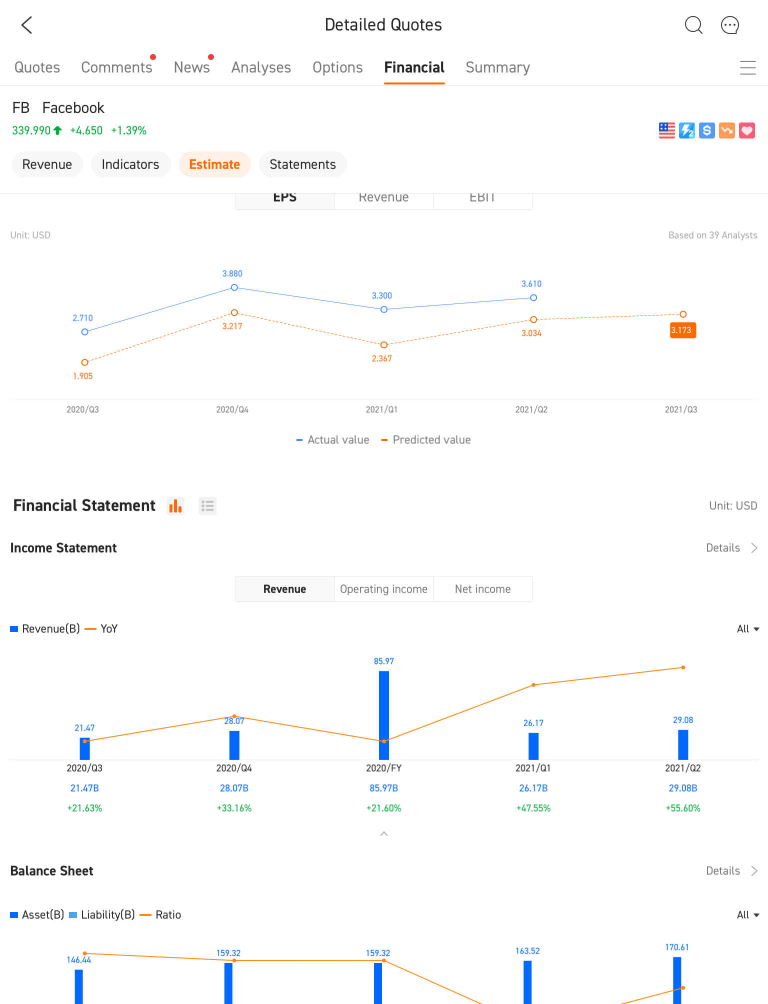

You can compare to the key metrics that you use to measure the company. Some of the obvious ones are: Revenue, Earnings, Gross Margin, and Operating Margin. Moomoo has also made them available in the app.

View More>>

Got any investing idea in mind? Feel free to leave your valuable comment below.

Last but not least, many thanks to our genius mooers! Our colorful investing journey can't be without you. If you wanna see more great content like these, don't forget to give us a like, and follow the winners of Q3 Earnings Event:

@Pray4 tennis star @Anonymoo @股票小丑 @Jamesim @Syuee @Lee Jessie @cowabanga @Mars Mooo @Panda2102 @Helen Swart

Earnings Call, Investing Note, Market Trend

All you need to about Q3 Earnings Season

Click Here for More>>

Earnings and stock price have a direct relation with each other

@Anonymoo said:

The reason earnings are directly related to the stock price is because, if the stock price is overvalued, then sometimes organizations has to cut their employee salaries, bonuses or sometimes their jobs to cover up the appropriate earnings for their overvalued stock price. This was seen after the pandemic hit, people lost jobs and most quit. Which affected the S&P in a direct way as low workers caused the industries to have higher earnings and stock prices to go up.This also follows the "laffer curve".

View More>>

But realistically,

it's common to see a stock's price fall after beating earnings.

As @Syuee said:

Share prices do dip after robust earnings release. Sometimes the expectation of beating earnings is already priced into the stock. There is no rule that the stock must immediately reflect the optimism or pessimism of quarterly results in the price. Fundamentals like profits, sales and everything else align with price only in the long term. In the short term, nothing is predictable or rational.

Take $Apple (AAPL.US)$ as an example. After a remarkable Q2 and Q3 earnings report, why the value of your stock was going down rather than up?The possible reasons:

-Warning that chip supply constraints could impact iPhones and iPads will weigh on the short-term outlook.

-Earnings may not seem good enough for an investor looking at every short-term opportunity to move funds to where the next quick buck is likely to be.

-Earnings were not as high as anticipated.

-Speculators already drove up the price in the days before the earnings report and then sold just before the report was released

-Stock markets are not always rational.

View More>>

With that being said,

whether the stock price goes up or down needs to be considered in different ways.

As @股票小丑 said:

-When the earnings report is good:

1. The current stock price exceeds the all-time high and the results exceed expectations. It is basically in a state of rise, because there is no pressure on the stock price to rise.

2. When the stock price is near the all-time high, the good earnings report will push the stock price to near the all-time high and then start to fall back, because the people who were trapped at the all-time high thought that it's time to cash out.

3. When the stock price is low at present, a good earning will basically turn the stock into an uptrend, because people trapped at higher prices won't sell until they break even.

-When the earnings report is bad:

1. If the company's fundamentals are still solid, investors will only think that it is a discount to buy when it falls, causing the stock price to return to its pre-report price.

2. For companies with poor fundamentals, they are likely to drop further and difficult to get back.

View More>>

So for investors like us,

how to use earning results to maximize profits?

@Panda2102 gives us some hints.

One good practice to do before the earnings are released is to have in your mind how this quarter earnings will be. In that case, you can have a good gauge how well you understand the business.

You can compare to the key metrics that you use to measure the company. Some of the obvious ones are: Revenue, Earnings, Gross Margin, and Operating Margin. Moomoo has also made them available in the app.

View More>>

Got any investing idea in mind? Feel free to leave your valuable comment below.

Last but not least, many thanks to our genius mooers! Our colorful investing journey can't be without you. If you wanna see more great content like these, don't forget to give us a like, and follow the winners of Q3 Earnings Event:

@Pray4 tennis star @Anonymoo @股票小丑 @Jamesim @Syuee @Lee Jessie @cowabanga @Mars Mooo @Panda2102 @Helen Swart

Earnings Call, Investing Note, Market Trend

All you need to about Q3 Earnings Season

Click Here for More>>

72

15

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

Amaranth13 : Ape is on the ticker! Here we goooooo…….