Mr TradTher

voted

Hi, mooers! 👋

The AI world holds its breath! $NVIDIA (NVDA.US)$ will release its Q4 FY2025 earnings on February 26, just before the market opens. As the AI kingpin faces heightened scrutiny amid market volatility, will it defy expectations again? This is your chance to earn rewards and gain insights by predicting the opening price. Let’s get into it! 🎉

Stay Ahead of the Game

Subscribe to @Moo Live for real-time updates, expert analysis, and t...

The AI world holds its breath! $NVIDIA (NVDA.US)$ will release its Q4 FY2025 earnings on February 26, just before the market opens. As the AI kingpin faces heightened scrutiny amid market volatility, will it defy expectations again? This is your chance to earn rewards and gain insights by predicting the opening price. Let’s get into it! 🎉

Stay Ahead of the Game

Subscribe to @Moo Live for real-time updates, expert analysis, and t...

644

1022

40

$Apple (AAPL.US)$

concerns about slowing iPhone sales and AI competition could impact momentum.

1. Short-Term Trading (1–4 weeks)

Strategy: Buy near support, sell near resistance

• Buy if: AAPL dips to $230–$232 (support zone)

• Sell Target: $245–$250 (next resistance)

• Stop-Loss: $225 (to minimize losses)

Breakout Trade: If AAPL breaks above $240, momentum could push it toward $250.

2. Swing Trading (1–6 months)

Strategy: Buy on dips & ride momentum

• Buy Range: $225–$230 (ideal accumulatio...

concerns about slowing iPhone sales and AI competition could impact momentum.

1. Short-Term Trading (1–4 weeks)

Strategy: Buy near support, sell near resistance

• Buy if: AAPL dips to $230–$232 (support zone)

• Sell Target: $245–$250 (next resistance)

• Stop-Loss: $225 (to minimize losses)

Breakout Trade: If AAPL breaks above $240, momentum could push it toward $250.

2. Swing Trading (1–6 months)

Strategy: Buy on dips & ride momentum

• Buy Range: $225–$230 (ideal accumulatio...

11

1

1

$Tesla (TSLA.US)$

Tesla (TSLA) Trading Strategies – Buy or Sell

1. Short-Term Trading (1–4 weeks)

Strategy: Buy near support, sell near resistance

• Buy if: Tesla pulls back to $340–$345 (support zone)

• Sell Target: $370–$380 (next resistance levels)

• Stop-Loss: $330 (to limit downside risk)

Alternative: If it breaks $350 with strong momentum, a breakout trade could push it toward $370+.

2. Swing Trading (1–6 months)

Strategy: Ride momentum & news-driven moves

• Buy Range: $330–$345 (if it d...

Tesla (TSLA) Trading Strategies – Buy or Sell

1. Short-Term Trading (1–4 weeks)

Strategy: Buy near support, sell near resistance

• Buy if: Tesla pulls back to $340–$345 (support zone)

• Sell Target: $370–$380 (next resistance levels)

• Stop-Loss: $330 (to limit downside risk)

Alternative: If it breaks $350 with strong momentum, a breakout trade could push it toward $370+.

2. Swing Trading (1–6 months)

Strategy: Ride momentum & news-driven moves

• Buy Range: $330–$345 (if it d...

23

2

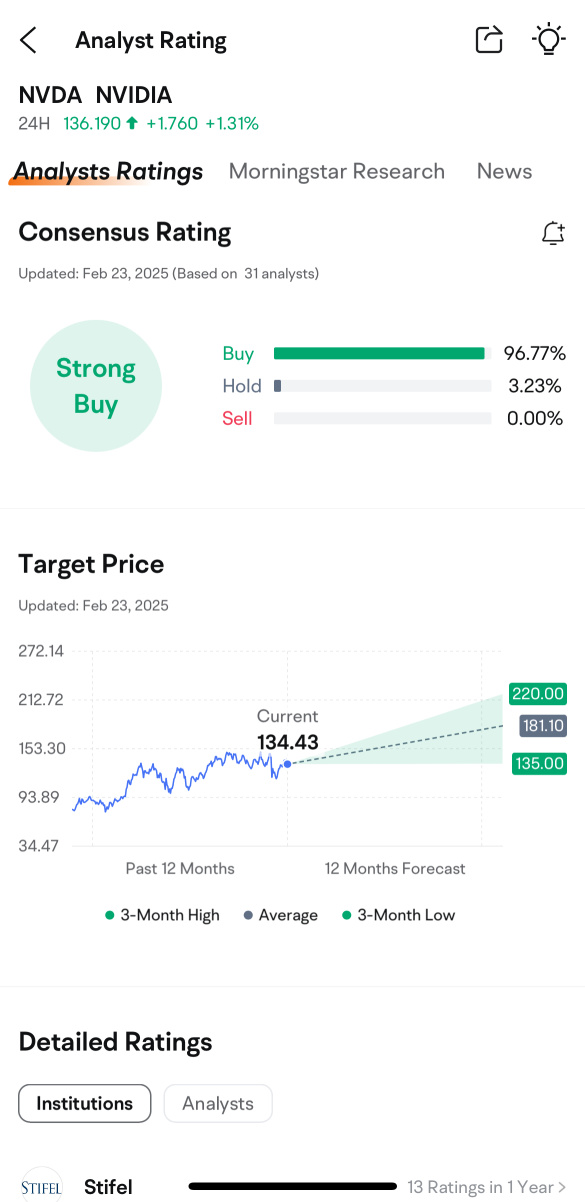

$NVIDIA (NVDA.US)$

Here are some possible strategies:

Short-Term Trading (1–4 weeks)

• Entry Price: Around $132.76 (current price)

• Target Price: $135–$140 (next resistance level)

• Stop Loss: $128–$130 (recent low)

• Sell if: The stock struggles to break resistance at $135–$140 or if it falls below $128

Swing Trading (1–6 months)

• Target Price: $150–$160, depending on AI market strength

• Sell if: The stock hits resistance, or if AI/tech sentiment turns negative

Long-Term Investing (1+ year...

Here are some possible strategies:

Short-Term Trading (1–4 weeks)

• Entry Price: Around $132.76 (current price)

• Target Price: $135–$140 (next resistance level)

• Stop Loss: $128–$130 (recent low)

• Sell if: The stock struggles to break resistance at $135–$140 or if it falls below $128

Swing Trading (1–6 months)

• Target Price: $150–$160, depending on AI market strength

• Sell if: The stock hits resistance, or if AI/tech sentiment turns negative

Long-Term Investing (1+ year...

9

1

$Tesla (TSLA.US)$

Reasons to Buy (Bullish Case)

✅ Long-Term Uptrend – Despite the recent correction, Tesla has gained +110% in the past year and remains in an uptrend.

✅ Robotaxi Catalyst – Tesla plans to launch its robotaxi service by late 2025, which could be a game-changer.

✅ Technical Support – The current price of $364.54 is near key support at $360, which could act as a rebound level.

✅ Neutral to Bullish Technical Indicators – Moving Averages and RSI suggest potential upside in the medium...

Reasons to Buy (Bullish Case)

✅ Long-Term Uptrend – Despite the recent correction, Tesla has gained +110% in the past year and remains in an uptrend.

✅ Robotaxi Catalyst – Tesla plans to launch its robotaxi service by late 2025, which could be a game-changer.

✅ Technical Support – The current price of $364.54 is near key support at $360, which could act as a rebound level.

✅ Neutral to Bullish Technical Indicators – Moving Averages and RSI suggest potential upside in the medium...

7

1

1

$Tesla (TSLA.US)$

1. Candlestick Analysis

• Daily Timeframe: The last candlestick shows a bullish engulfing pattern, which typically indicates further potential price increases.

• Volume: Trading volume has increased compared to the previous day, signaling strong buying interest.

2. Key Indicators

a. Moving Average (MA)

• 50-Day MA: $410 (the price is above the 50-day MA, indicating a medium-term bullish trend).

• 200-Day MA: $375 (the price is well above the 200-day MA, confirming a long-t...

1. Candlestick Analysis

• Daily Timeframe: The last candlestick shows a bullish engulfing pattern, which typically indicates further potential price increases.

• Volume: Trading volume has increased compared to the previous day, signaling strong buying interest.

2. Key Indicators

a. Moving Average (MA)

• 50-Day MA: $410 (the price is above the 50-day MA, indicating a medium-term bullish trend).

• 200-Day MA: $375 (the price is well above the 200-day MA, confirming a long-t...

8

1

$Tesla (TSLA.US)$

Detailed Technical Analysis:

1. Relative Strength Index (RSI):

• If RSI > 70: The stock is in the overbought zone (potential for correction).

• If RSI < 30: The stock is in the oversold zone (potential for a rebound).

2. Moving Average Convergence Divergence (MACD):

• If the MACD line > signal line: Strong bullish trend.

• If the MACD line < signal line: Bearish trend or weakening momentum.

3. Volume:

• High volume (40.18M) indicates strong investor interest, supporting ...

Detailed Technical Analysis:

1. Relative Strength Index (RSI):

• If RSI > 70: The stock is in the overbought zone (potential for correction).

• If RSI < 30: The stock is in the oversold zone (potential for a rebound).

2. Moving Average Convergence Divergence (MACD):

• If the MACD line > signal line: Strong bullish trend.

• If the MACD line < signal line: Bearish trend or weakening momentum.

3. Volume:

• High volume (40.18M) indicates strong investor interest, supporting ...

17

1

$NVIDIA (NVDA.US)$

The decision to buy or sell NVIDIA (NVDA) stock today (January 17, 2025) depends on intraday analysis and current market conditions. Here’s the breakdown:

Intraday Factors to Monitor

1. Current Price:

NVIDIA closed at $133.57 with bearish pressure (-1.94%). If the price continues to weaken and approaches the $130 support level, it may signal a sell or a wait for a reversal.

2. Support and Resistance Levels:

• Key Support: $130 (if the price holds, there’s potential for a re...

The decision to buy or sell NVIDIA (NVDA) stock today (January 17, 2025) depends on intraday analysis and current market conditions. Here’s the breakdown:

Intraday Factors to Monitor

1. Current Price:

NVIDIA closed at $133.57 with bearish pressure (-1.94%). If the price continues to weaken and approaches the $130 support level, it may signal a sell or a wait for a reversal.

2. Support and Resistance Levels:

• Key Support: $130 (if the price holds, there’s potential for a re...

14

2

3

$Tesla (TSLA.US)$

For today, the decision to buy or sell Tesla (TSLA) stock depends on intraday technical analysis and current market sentiment. Here’s a step-by-step guide to help you decide:

Intraday Factors to Consider (January 17, 2025):

1. Current Price:

Tesla closed at $413.82, down by 3.37%. If the price shows a rebound from this level this morning, it might be a buying opportunity.

2. Support and Resistance Levels:

• Key Support: $410 (if the price holds above this level, there’s pote...

For today, the decision to buy or sell Tesla (TSLA) stock depends on intraday technical analysis and current market sentiment. Here’s a step-by-step guide to help you decide:

Intraday Factors to Consider (January 17, 2025):

1. Current Price:

Tesla closed at $413.82, down by 3.37%. If the price shows a rebound from this level this morning, it might be a buying opportunity.

2. Support and Resistance Levels:

• Key Support: $410 (if the price holds above this level, there’s pote...

20

4

$Tesla (TSLA.US)$

Based on the latest data, here’s the technical analysis for Tesla (TSLA) stock:

Key Technical Indicators:

• Relative Strength Index (RSI 14):

The RSI value is at 68.379, indicating a nearly overbought condition.

• Stochastic Oscillator (STOCH 9,6):

The value is 79.533, signaling a buy.

• Stochastic RSI (14):

The value is 98.988, indicating an overbought condition.

• MACD (12,26):

A positive value of 6.62, signaling a buy.

• Average Directional Index (ADX 14):

The value is ...

Based on the latest data, here’s the technical analysis for Tesla (TSLA) stock:

Key Technical Indicators:

• Relative Strength Index (RSI 14):

The RSI value is at 68.379, indicating a nearly overbought condition.

• Stochastic Oscillator (STOCH 9,6):

The value is 79.533, signaling a buy.

• Stochastic RSI (14):

The value is 98.988, indicating an overbought condition.

• MACD (12,26):

A positive value of 6.62, signaling a buy.

• Average Directional Index (ADX 14):

The value is ...

11

1

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)