Annie_3ALovve

liked

$Broadcom (AVGO.US)$

Lesson learnt. bought it at 180. Panic selling at very low price during Black Friday. Discarded my emotions and used rational thoughts instead. Bought it at 140-ish and average cost it. Patience was tested when it wasn't growing much, sometimes it fell, and people were trashing on this stock so hard. Decided not to repeat my mistake by panicking and just waited. Worth the wait.

Lesson learnt. bought it at 180. Panic selling at very low price during Black Friday. Discarded my emotions and used rational thoughts instead. Bought it at 140-ish and average cost it. Patience was tested when it wasn't growing much, sometimes it fell, and people were trashing on this stock so hard. Decided not to repeat my mistake by panicking and just waited. Worth the wait.

12

1

1

Annie_3ALovve

reacted to

After the US presidential election, the electric car giant Tesla (TESLA) stock prices went wild and even doubled compared to this year's low. America's wealthy investors are still optimistic that Tesla can rise several times more.

Investing in Regal RON BARON (RON BARON), he is also Tesla's main shareholder. He said that Tesla's market value can rise to 5 trillion US dollars within 10 years. Also, Tesla CEO Musk believes that Tesla's market value will be 30 trillion US dollars.

In response to Trump's election as the next president of the United States, and Musk played a big role in his election, Tesla's stock price recently surged by more than 25%, and the market capitalization has returned above 1 trillion dollars.

Barron was one of Tesla's early investors, and Baron Capital, which is in charge of it, invested 0.4 billion dollars in the company from 2014 to 2016.

He once revealed that investing in Tesla made him profit of 6 billion dollars. Tesla still accounts for 10% of Barron's stock investment.

In an interview with the financial channel CNBC on Friday, Barron believes that in response to the development of the robotic robot Optimus, Tesla could reach more than 3 trillion dollars, or even 4 trillion or 5 trillion dollars, within 10 years. Therefore, he will not sell his Tesla shares at this stage.

He also revealed that Musk believes Tesla's market capitalization is more likely to be worth 30 trillion dollars.

Tesla closed the market and rose $9.54 to $320.72 on Friday.

Source: 9Share

Investing in Regal RON BARON (RON BARON), he is also Tesla's main shareholder. He said that Tesla's market value can rise to 5 trillion US dollars within 10 years. Also, Tesla CEO Musk believes that Tesla's market value will be 30 trillion US dollars.

In response to Trump's election as the next president of the United States, and Musk played a big role in his election, Tesla's stock price recently surged by more than 25%, and the market capitalization has returned above 1 trillion dollars.

Barron was one of Tesla's early investors, and Baron Capital, which is in charge of it, invested 0.4 billion dollars in the company from 2014 to 2016.

He once revealed that investing in Tesla made him profit of 6 billion dollars. Tesla still accounts for 10% of Barron's stock investment.

In an interview with the financial channel CNBC on Friday, Barron believes that in response to the development of the robotic robot Optimus, Tesla could reach more than 3 trillion dollars, or even 4 trillion or 5 trillion dollars, within 10 years. Therefore, he will not sell his Tesla shares at this stage.

He also revealed that Musk believes Tesla's market capitalization is more likely to be worth 30 trillion dollars.

Tesla closed the market and rose $9.54 to $320.72 on Friday.

Source: 9Share

Translated

58

10

2

Annie_3ALovve

voted

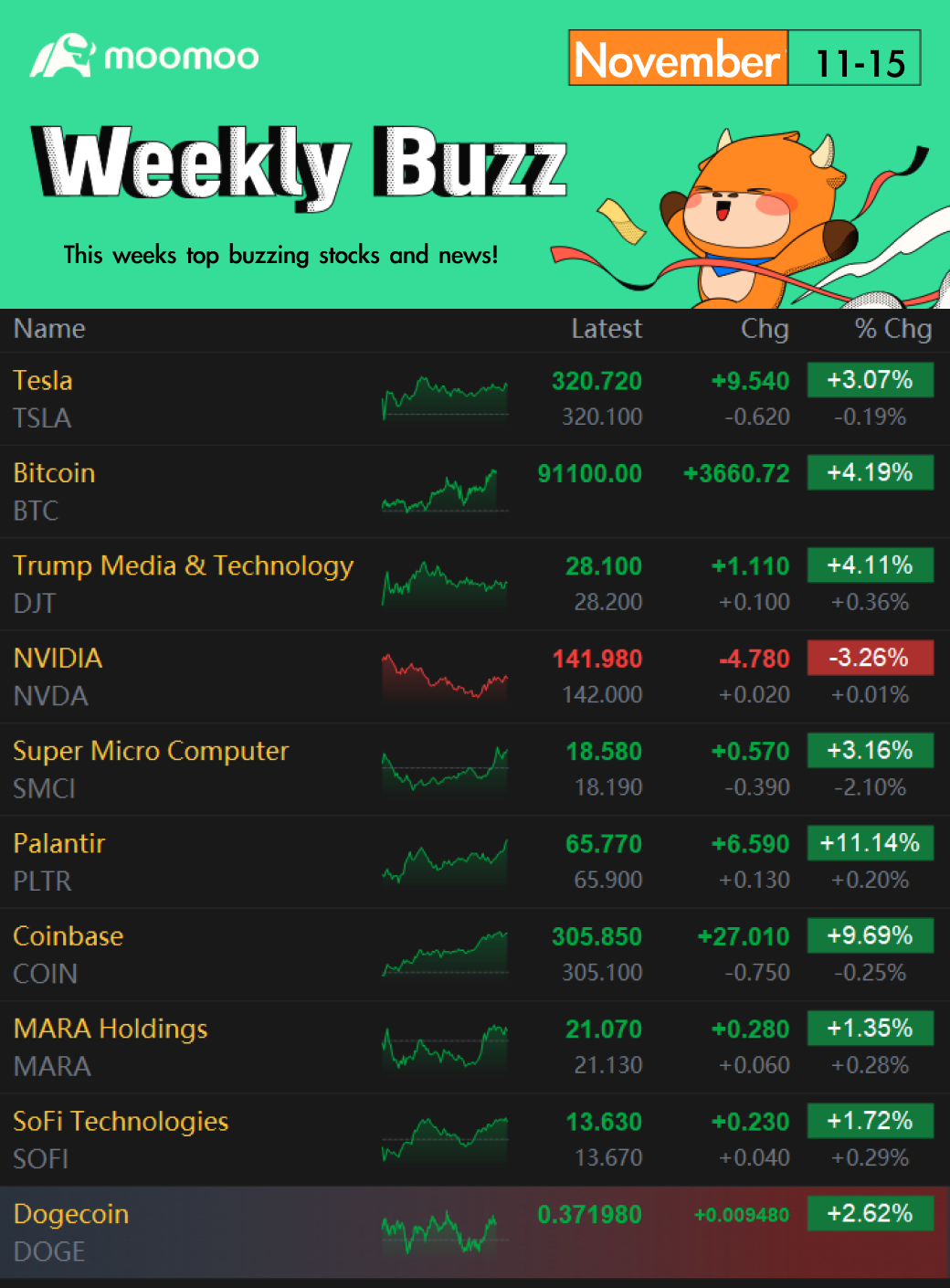

Happy weekend, investors! Welcome back to Weekly Buzz where we talk about the top ten buzzing stocks on moomoo this week! Comment below to answer the Weekly Topic question for a chance to win an award!

Make Your Choice

Weekly Buzz

This week was the first full trading week after the presidential election, and the market continued to respond positively to President-Elect Donald Trump and watched as the GOP won a majority in the Congressional House and Senat...

Make Your Choice

Weekly Buzz

This week was the first full trading week after the presidential election, and the market continued to respond positively to President-Elect Donald Trump and watched as the GOP won a majority in the Congressional House and Senat...

+10

82

42

8

Annie_3ALovve

liked

Annie_3ALovve

commented on

Hi, mooers! ![]()

Time has swiftly passed, bringing us to the final quarter of 2024.

When we reflect on the last few months, the standout theme has certainly been the interest rate cut. Which markets have thrived since the Fed's decision? How have your investments adapted to the decreasing interest rates, and what are your strategies moving forward?![]()

Let's dive into your fellow mooers' investment strategies and earnings insights!

Most investors remain s...

Time has swiftly passed, bringing us to the final quarter of 2024.

When we reflect on the last few months, the standout theme has certainly been the interest rate cut. Which markets have thrived since the Fed's decision? How have your investments adapted to the decreasing interest rates, and what are your strategies moving forward?

Let's dive into your fellow mooers' investment strategies and earnings insights!

Most investors remain s...

+5

130

56

12

Annie_3ALovve

liked

We are going to have a very busy week ahead with a few key economic reports and companies’ earnings lining up.

5 out of the Mag 7 are reporting this week - Meta, Amazon, Apple, Google and Microsoft.

On the economic calendar front, 2 huge data this week - Fed’s preferred inflation gauge - the PCE price index (Thurs)

Finally, on Friday, the October jobs report will come out.

$ProShares UltraPro QQQ ETF (TQQQ.US)$ $Enphase Energy (ENPH.US)$ $McDonald's (MCD.US)$ $Starbucks (SBUX.US)$ $Coca-Cola (KO.US)$ $PepsiCo (PEP.US)$ $Nike (NKE.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$ $Financial Select Sector SPDR Fund (XLF.US)$ $Crude Oil Futures(FEB5) (CLmain.US)$ $SPDR Gold ETF (GLD.US)$ $Adobe (ADBE.US)$ ��������...

5 out of the Mag 7 are reporting this week - Meta, Amazon, Apple, Google and Microsoft.

On the economic calendar front, 2 huge data this week - Fed’s preferred inflation gauge - the PCE price index (Thurs)

Finally, on Friday, the October jobs report will come out.

$ProShares UltraPro QQQ ETF (TQQQ.US)$ $Enphase Energy (ENPH.US)$ $McDonald's (MCD.US)$ $Starbucks (SBUX.US)$ $Coca-Cola (KO.US)$ $PepsiCo (PEP.US)$ $Nike (NKE.US)$ $SPDR Dow Jones Industrial Average Trust (DIA.US)$ $Financial Select Sector SPDR Fund (XLF.US)$ $Crude Oil Futures(FEB5) (CLmain.US)$ $SPDR Gold ETF (GLD.US)$ $Adobe (ADBE.US)$ ��������...

From YouTube

10

Annie_3ALovve

liked

1. We might see a negative reaction from investors following earnings because $Meta Platforms (META.US)$ , $Microsoft (MSFT.US)$ , $Amazon (AMZN.US)$ & $Alphabet-A (GOOGL.US)$ will all have to increase their CapEx quite significantly again. The reason is the release of OpenAI's o1 in mid-Q3 and what it means for Inference compute. All LLM building companies will have to front-load a lot of CapEx that was before planned to b...

3

Annie_3ALovve

voted

U.S. Election & Stock Market

During U.S. presidential elections, financial markets often experience increased volatility. Key trends include:

1. Market Uncertainty: Investors may react to the uncertainty surrounding potential policy changes, leading to fluctuations in stock prices.

2. Sector Performance: Certain sectors may perform better depending on the candidates’ platforms. For example, healthcare and energy stocks might rea...

During U.S. presidential elections, financial markets often experience increased volatility. Key trends include:

1. Market Uncertainty: Investors may react to the uncertainty surrounding potential policy changes, leading to fluctuations in stock prices.

2. Sector Performance: Certain sectors may perform better depending on the candidates’ platforms. For example, healthcare and energy stocks might rea...

47

27

7

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)