ARISMENDEZJEREMIAH

reacted to and voted

ARISMENDEZJEREMIAH

voted

$Bitcoin (BTC.CC)$has advanced 27% in October, its strongest showing since January, as the crypto rally widened.

Sentiment hit an "exuberant" level as many traders "panic bought" amid the rally, Matrixport noted.

BTC could still run higher, targeting $40,000 in the coming weeks, an LMAX strategist said.

$Nasdaq Composite Index (.IXIC.US)$ $SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$

Sentiment hit an "exuberant" level as many traders "panic bought" amid the rally, Matrixport noted.

BTC could still run higher, targeting $40,000 in the coming weeks, an LMAX strategist said.

$Nasdaq Composite Index (.IXIC.US)$ $SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$

8

1

ARISMENDEZJEREMIAH

voted

$Crude Oil Futures(APR5) (CLmain.US)$

Follow the links to my previous posts to get the bigger picture of my oil futures thesis. Click the link below to check them out.

Crude Futures are Near an Inflection Point

Crude feature's prices has been on a downward trajectory but is currently sitting just beneath the 200-day exponential moving average. This moving average is widely considered as a very strong support/resistance level.

The 200-Day E...

Follow the links to my previous posts to get the bigger picture of my oil futures thesis. Click the link below to check them out.

Crude Futures are Near an Inflection Point

Crude feature's prices has been on a downward trajectory but is currently sitting just beneath the 200-day exponential moving average. This moving average is widely considered as a very strong support/resistance level.

The 200-Day E...

2

1

ARISMENDEZJEREMIAH

voted

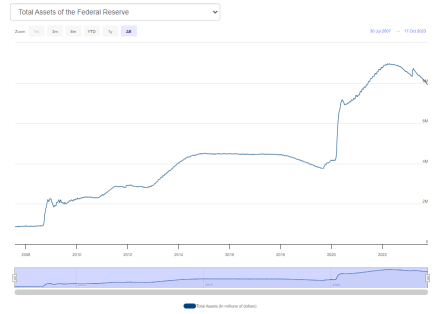

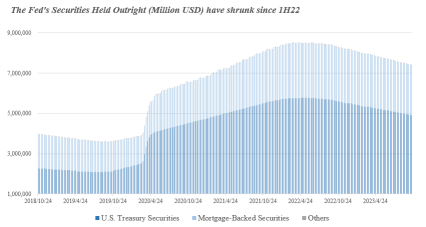

Amid the intensified market sell-off, the $U.S. 10-Year Treasury Notes Yield (US10Y.BD)$ - a critical driver of U.S. borrowing costs - accelerated its surge and surpassed the 5% milestone for the first time this week. This marks a level not seen since the height of the US subprime mortgage crisis in 2007.

With major overseas buyers, US banks, mutual funds, and other investors showing weak demand for Treasury purc...

With major overseas buyers, US banks, mutual funds, and other investors showing weak demand for Treasury purc...

+2

19

1

9

ARISMENDEZJEREMIAH

voted

Hi, mooers! ![]()

Over the past three months, the Federal Reserve is rumored to be ending rate hikes, leading to a rise in US Treasury yields and market uncertainty. As a result, investors are seeking diversified asset allocation. Experts and institutions have shared their interpretations and suggestions on moomoo, while mooers have also contributed their investment performance and insights.

Join us for a summary of moomoo's most t...

Over the past three months, the Federal Reserve is rumored to be ending rate hikes, leading to a rise in US Treasury yields and market uncertainty. As a result, investors are seeking diversified asset allocation. Experts and institutions have shared their interpretations and suggestions on moomoo, while mooers have also contributed their investment performance and insights.

Join us for a summary of moomoo's most t...

280

122

3

ARISMENDEZJEREMIAH

voted

$SPDR S&P 500 ETF (SPY.US)$

Major Selling Last Week

Equity markets experienced some serious selling last week. S&P Futures fell over 3.5% in 3 days. There was a substantial amount of volume involved in the selling. I should say that the selling is very overheated in the very short term. A small rebound should be expected soon to cool off the meltdown down.

The high relative volume leads me to believe that the selling has some validity and is not just a contr...

Major Selling Last Week

Equity markets experienced some serious selling last week. S&P Futures fell over 3.5% in 3 days. There was a substantial amount of volume involved in the selling. I should say that the selling is very overheated in the very short term. A small rebound should be expected soon to cool off the meltdown down.

The high relative volume leads me to believe that the selling has some validity and is not just a contr...

+3

5

9

3

ARISMENDEZJEREMIAH

voted

$Tesla (TSLA.US)$

Here is an excerpt from my previous post. The price of TSLA has since dropped but the lower support levels you can see in the chart are still valid. The fibonacci support levels are the stronger levels to watch with the higher probability of a rebound, in my opinion. Here is a link to my previous post.

Fibonacci Support/Resistance

In the chart directly below, I have highlighted the major support levels and the fibinacci levels that of...

Here is an excerpt from my previous post. The price of TSLA has since dropped but the lower support levels you can see in the chart are still valid. The fibonacci support levels are the stronger levels to watch with the higher probability of a rebound, in my opinion. Here is a link to my previous post.

Fibonacci Support/Resistance

In the chart directly below, I have highlighted the major support levels and the fibinacci levels that of...

12

3

1

ARISMENDEZJEREMIAH

voted

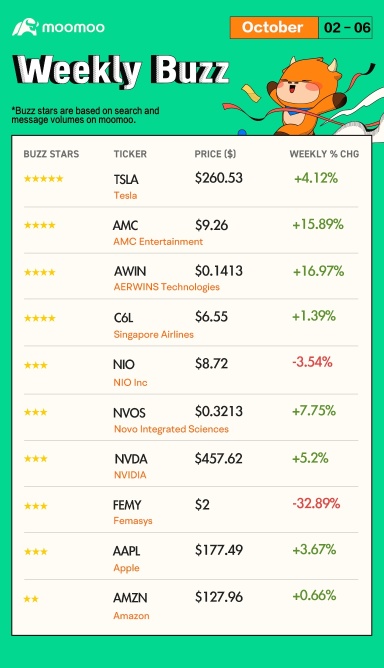

Spoiler: At the end of this post, there is a chance for you to win points! ![]() Happy Friday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of this week! (Nano caps are excluded.)

Happy Friday, mooers! Welcome back to Weekly Buzz, where we review the news, performance, and community sentiment of the selected buzzing stocks on moomoo platform based on search and message volumes of this week! (Nano caps are excluded.)

📊 Make Your Choices

💡Buzzing Stocks List & Mooers Comments

This week, the market took a beating as labor macroeconomic data show...

📊 Make Your Choices

💡Buzzing Stocks List & Mooers Comments

This week, the market took a beating as labor macroeconomic data show...

36

17

11

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)