$E-mini NASDAQ 100 Futures(DEC4) (NQmain.US)$ Just stick to being long in the US stock market, all the money in the world is in the US stock market, what are you afraid of 🥳🥳🥳

Translated

1

$U.S. 10-Year Treasury Notes Yield (US10Y.BD)$ Wow~ It has already reached the heavy pressure area from 20 years ago, various news and information are tricking you into buying long-term debts, various panic selling, who wants to catch a flying knife, who wants to pick up cheap items, US Treasury bonds have collapsed, don't have any illusions, sticking to shorting is the right choice.![]()

![]()

![]()

Translated

ASOTM1

commented on

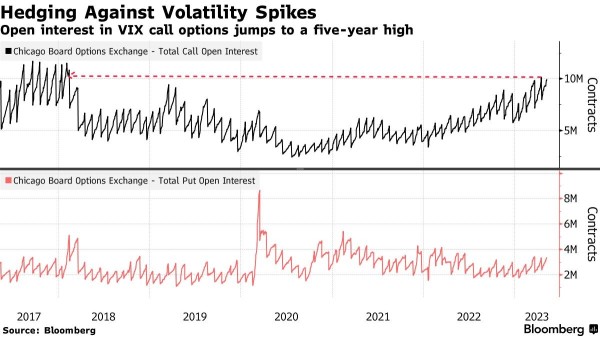

In Washington debt-ceiling brinkmanship is threatening to push the US into default. And on Wall Street, traders are gaming out what could be a rare Black Swan event with the well known fear gauge.

Demand for hedges against a sudden increase in volatility has reached its highest level in five years in the options market. Investors are paying more to protect themselves against a potential market drop of 10% (one-s...

Demand for hedges against a sudden increase in volatility has reached its highest level in five years in the options market. Investors are paying more to protect themselves against a potential market drop of 10% (one-s...

30

8

$Spdr Series Trust S&P Regional Bkg Etf (KRE.US)$ In fact, the financial crisis has already begun, but the senior management is trying hard to conceal it to avoid panic. Believe in what your own eyes see, shorting is still good. At least in this regional bank crisis, we are still putting in good returns, so we can make big money by going with the trend.![]()

![]()

![]()

Translated

ASOTM1

commented on

$E-mini NASDAQ 100 Futures(DEC4) (NQmain.US)$ A lot of novices have shorted, they are all very smart, and have all become rich overnight ✌🏻️![]()

![]()

![]()

Translated

9

$Nasdaq Composite Index (.IXIC.US)$ The retail investors insist on a bearish view, triggering all short positions. Institutions, in such a harsh situation, continue to play the opposite side market, the firm belief in going long continues, even if a world war breaks out, institutions will still pull the US stock market into a bull market in order to play against the retail investors.![]()

![]()

![]()

Translated

$ProShares UltraPro QQQ ETF (TQQQ.US)$ Sorry, it's my influence that has left the market in a dilemma, because I have both long and short positions.![]()

![]()

![]()

Translated

1

1

$Nasdaq Composite Index (.IXIC.US)$ Unless World War III breaks out, the stock index plummets by another 50%, ends 20 years of growth, recovers in the next round of 10-year sideways trading, and is slow for another 10 years, then the NASDAQ will fluctuate sideways for two or three years and continue to rise. It's impossible to change anything with any other method![]()

![]()

![]()

Translated

ASOTM1

commented on

$ProShares Ultra Bloomberg Natural Gas (BOIL.US)$ The one that is shorting is the gas company's big bookmaker. They're not afraid of delivery and lack of gas for you. Retail investors are very fond of it, so they play games against the game![]()

![]()

![]()

Translated

1

3

ASOTM1

commented on

$Nasdaq Composite Index (.IXIC.US)$ If OTC funds don't come in to take over, the increase will be quite strenuous. Come on, this is the bottom. From the chips we got in October until now, don't hesitate any longer and boldly come in and take it in![]()

![]()

![]()

Translated

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)