Big_Long_Investor

liked

$Direxion Daily Regional Banks Bull 3X Shares ETF (DPST.US)$ I wanted to do a quick update for everybody hopefully nobody jumped in yesterday or this morning for that matter. consumer prices obviously shook the whole marketplace and what it means is interest rates you can pretty much forget June and probably August at this point and we may not get any rate cuts this year and what they did in a nutshell is take every interest rate sensitive stock outside behind the barn and shoot it. so regional B...

2

2

Big_Long_Investor

liked

4

Big_Long_Investor

liked

I've been playing the stock market for a few years now and I've noticed that very often a stock will fall when quarterly reports seem positive.

Is it a case of people price in exceeding analysts expectations by more than reported? I don't understand.

$Advanced Micro Devices (AMD.US)$ $Microsoft (MSFT.US)$ $Apple (AAPL.US)$ $Amazon (AMZN.US)$ $Tesla (TSLA.US)$

Is it a case of people price in exceeding analysts expectations by more than reported? I don't understand.

$Advanced Micro Devices (AMD.US)$ $Microsoft (MSFT.US)$ $Apple (AAPL.US)$ $Amazon (AMZN.US)$ $Tesla (TSLA.US)$

2

2

Big_Long_Investor

reacted to

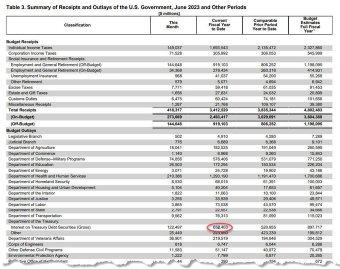

Yesterday, the US released their Budget Deficit Report.

To see how much interest the US has paid on Federal debt, you have to scroll to page 9 of the report.

Then, go to the bottom of the table to the small line item below.

Finally, you'll see that the US has paid an alarming $652 BILLION in interest YTD, up 25% since last year.

As rates rise, we will soon see the first ever year with $1 TRILLION+ in annual interest expense.

Interest expense will soon be the US government's biggest expense, even...

To see how much interest the US has paid on Federal debt, you have to scroll to page 9 of the report.

Then, go to the bottom of the table to the small line item below.

Finally, you'll see that the US has paid an alarming $652 BILLION in interest YTD, up 25% since last year.

As rates rise, we will soon see the first ever year with $1 TRILLION+ in annual interest expense.

Interest expense will soon be the US government's biggest expense, even...

4

Big_Long_Investor

reacted to

I think we should just have a national campaign where IRS agents go door-to-door and overturn everyone's couch cushions. Who knows how much money we could find? Maybe you'll find $10, maybe you'll find $1.05, maybe nothing, but the times you find a $100 bill should offset that.

Recent studies show that Americans have a couch for about six years and they usually contain at least $1.55 in change at any giv...

Recent studies show that Americans have a couch for about six years and they usually contain at least $1.55 in change at any giv...

1

6

Big_Long_Investor

commented on

5 US Stocks that have returned 10X in 5 years🚀

1. Xpel $XPEL Inc (XPEL.US)$

2. The Trade Desk $The Trade Desk (TTD.US)$

3. Celsius Holding $Celsius Holdings (CELH.US)$

4. Enphase Energy $Enphase Energy (ENPH.US)$

5. Lattice Semiconductor $Lattice Semiconductor (LSCC.US)$

What future 10-bagger are you holding in your portfolio?

1. Xpel $XPEL Inc (XPEL.US)$

2. The Trade Desk $The Trade Desk (TTD.US)$

3. Celsius Holding $Celsius Holdings (CELH.US)$

4. Enphase Energy $Enphase Energy (ENPH.US)$

5. Lattice Semiconductor $Lattice Semiconductor (LSCC.US)$

What future 10-bagger are you holding in your portfolio?

2

2

Big_Long_Investor

liked and commented on

$First Republic Bank (FRC.US)$ enter at 8?

1

1

Big_Long_Investor

liked

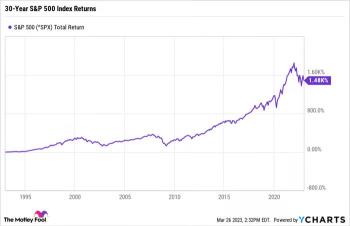

The first two and a half months of 2023 have been a mixed bag for the $S&P 500 Index (.SPX.US)$ . The index, a widely used proxy for the U.S. stock market, was up nearly 4% as of March 24.

Why short-term volatility doesn't matter

The $CBOE Volatility S&P 500 Index (.VIX.US)$ is known as Wall Street's fear index. Developed by the Chicago Board Options Exchange (CBOE), it measures the level of fluctuation investors predict in the S&P 500 inde...

Why short-term volatility doesn't matter

The $CBOE Volatility S&P 500 Index (.VIX.US)$ is known as Wall Street's fear index. Developed by the Chicago Board Options Exchange (CBOE), it measures the level of fluctuation investors predict in the S&P 500 inde...

1

1

Big_Long_Investor

voted

The share prices of a number of regional banks rebounded on Tuesday after taking a sharp fall following the failure of Silicon Valley Bank last week, showing a stabilization in the banking industry following a burst of panic from investors.

Shares for $First Republic Bank (FRC.US)$ , a San Francisco-based firm with assets totaling over $212 billion, rebounded by nearly 27 percent on Tuesday afternoon, after its shares fell by ...

Shares for $First Republic Bank (FRC.US)$ , a San Francisco-based firm with assets totaling over $212 billion, rebounded by nearly 27 percent on Tuesday afternoon, after its shares fell by ...

4

Big_Long_Investor

liked

Current situation:

1. Stocks are trading like the Fed won't pivot

2. Bonds are trading like the Fed pivoted

3. Gold is trading like inflation is 15%

4. Crude oil is trading like we are in a recession

5. $CBOE Volatility S&P 500 Index (.VIX.US)$ is trading like we are in a bull market

Things still don't add up.

$Nasdaq Composite Index (.IXIC.US)$ $Invesco QQQ Trust (QQQ.US)$ $ProShares UltraPro Short QQQ ETF (SQQQ.US)$ $Dow Jones Industrial Average (.DJI.US)$ $SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ $Apple (AAPL.US)$

1. Stocks are trading like the Fed won't pivot

2. Bonds are trading like the Fed pivoted

3. Gold is trading like inflation is 15%

4. Crude oil is trading like we are in a recession

5. $CBOE Volatility S&P 500 Index (.VIX.US)$ is trading like we are in a bull market

Things still don't add up.

$Nasdaq Composite Index (.IXIC.US)$ $Invesco QQQ Trust (QQQ.US)$ $ProShares UltraPro Short QQQ ETF (SQQQ.US)$ $Dow Jones Industrial Average (.DJI.US)$ $SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ $Apple (AAPL.US)$

20

3

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)