Bobothang

liked

$NIO Inc (NIO.US)$ tonight will reach back 32 👍

4

1

Bobothang

liked

Electric vehicle start-up Rivian Automotive plans to list its shares on the Nasdaq on November 10th. The company aims to trade under the ticker symbol “RIVN.”

Rivian had previously raised its expected price range to between $72 and $74, up from an initial range of $57 to $62. It priced its IPO on Tuesday at $78 a share above top of range.

According to Bloomberg, Rivian expects the IPO to bring in $11.9 billion. The $11.9 billion haul is the biggest first-time share sale this year as well as the sixth-largest ever on a U.S. exchange.

Based on the share count, Rivian is being valued at about $76.4 billion on a fully diluted basis that accounts for stock options.

Business Overview

Rivian, founded in 2009, design, develop, and manufacture category-defining electric vehicles (“EVs”) and accessories.

Rivian launched its R1T, a two-row, five-seat pickup truck, in September. It plans to launch an SUV, the R1S, in December. Wider sales of the truck and the SUV are expected to begin in December and January.

The pickup truck starts at $67,500 for a basic trim and can go 314 miles between charges. Rivian said it had 48,390 R1T and R1S preorders in the U.S. and Canada as of September.

Rivan also builds an electric delivery van for Amazon, referred to as the EDV, at the plant and has an contract to delivery 100,000 of them to the retail giant by 2025.

Like Tesla, Rivian is selling its vehicles directly to consumers, skipping dealership networks, and asking for a refundable deposit when people configure their vehicle on its website.

Rivian beat Tesla, GM and Ford to the market with an electric pickup, the R1T, which has received glowing early reviews.

Amazon and Ford Motor are among Rivian’s backers. The EV maker has raised $10.5 billion since 2019 after several investment rounds, with the latest a $2.5 billion funding round in July, led by Amazon.com’s Climate Pledge Fund, Ford, and T. Rowe Price funds, among others.

Amazon and Ford each own more than 5% of the company. Peter Krawiec, Amazon’s senior vice president of worldwide corporate and business development, sits on Rivian’s board.

Financial Performance

Perhaps not surprisingly, Rivian has never made money, and doesn’t expect to turn a profit in the “foreseeable future” as it invests in its business.

Rivian lost $426 million in 2019, and went on to lose $1 billion last year. For the first six months of this year, Rivian lost $994 million.In 2020 the company’s net loss came to $1.02 billion.

Click to view the prospectus

$Rivian Automotive (RIVN.US)$

Rivian had previously raised its expected price range to between $72 and $74, up from an initial range of $57 to $62. It priced its IPO on Tuesday at $78 a share above top of range.

According to Bloomberg, Rivian expects the IPO to bring in $11.9 billion. The $11.9 billion haul is the biggest first-time share sale this year as well as the sixth-largest ever on a U.S. exchange.

Based on the share count, Rivian is being valued at about $76.4 billion on a fully diluted basis that accounts for stock options.

Business Overview

Rivian, founded in 2009, design, develop, and manufacture category-defining electric vehicles (“EVs”) and accessories.

Rivian launched its R1T, a two-row, five-seat pickup truck, in September. It plans to launch an SUV, the R1S, in December. Wider sales of the truck and the SUV are expected to begin in December and January.

The pickup truck starts at $67,500 for a basic trim and can go 314 miles between charges. Rivian said it had 48,390 R1T and R1S preorders in the U.S. and Canada as of September.

Rivan also builds an electric delivery van for Amazon, referred to as the EDV, at the plant and has an contract to delivery 100,000 of them to the retail giant by 2025.

Like Tesla, Rivian is selling its vehicles directly to consumers, skipping dealership networks, and asking for a refundable deposit when people configure their vehicle on its website.

Rivian beat Tesla, GM and Ford to the market with an electric pickup, the R1T, which has received glowing early reviews.

Amazon and Ford Motor are among Rivian’s backers. The EV maker has raised $10.5 billion since 2019 after several investment rounds, with the latest a $2.5 billion funding round in July, led by Amazon.com’s Climate Pledge Fund, Ford, and T. Rowe Price funds, among others.

Amazon and Ford each own more than 5% of the company. Peter Krawiec, Amazon’s senior vice president of worldwide corporate and business development, sits on Rivian’s board.

Financial Performance

Perhaps not surprisingly, Rivian has never made money, and doesn’t expect to turn a profit in the “foreseeable future” as it invests in its business.

Rivian lost $426 million in 2019, and went on to lose $1 billion last year. For the first six months of this year, Rivian lost $994 million.In 2020 the company’s net loss came to $1.02 billion.

Click to view the prospectus

$Rivian Automotive (RIVN.US)$

+2

46

1

Bobothang

commented on

Investing is about balancing risk and reward. Reaching our investment goals will take patience and hard work. Avoiding bad investment is an important key to successful investing. It can take several years for a portfolio to recover from a few wrong investment that could have been avoided in the first place. As such, investors need to be watchful for warning signs that could signal companies in trouble. While continuous decline in earnings may be a reason for concern, investors should be more wary of companies that struggle to maintain a consistent cashflow profile, especially those that show continuous negative cash flow over a prolonged period as these companies tend to run a higher risk of insolvency. Increasing and high debt level is another warning sign to watch out for. Debt is not necessarily bad as it can be used to improve earnings and profit margins. But when companies are struggling to make scheduled interest and principal payments, this is a huge red flag to watch out for as such companies run a higher risk of liquidation should they be unable to meet their debt obligations. Other than unusually high insider selling that can be interpreted as an ominous sign, investors can check if a company's shares are the target of short sellers, especially hedge funds that aggressively bet against a company's share price. When a company's shares are consistently targeted by short sellers, it could be an early warning of greater danger ahead. Investors should also be cautioned should there be any frequent change of auditors or if a company changes its auditors abruptly as this may indicate that the company could be trying to conceal information they do not wish to disclose. To help spot stock I should avoid, I would always relook at a stock whenever I notice consecutive quarters of declining earnings, a company's cash shrinking or debt increasing. Unusual insider sales, heavy short selling or auditor resignation are other warning signs that a company may be in trouble.

$BlackBerry (BB.US)$

$Clover Health (CLOV.US)$

$ContextLogic (WISH.US)$

$Luckin Coffee (LKNCY.US)$

$Oatly Group AB (OTLY.US)$

$SNDL Inc (SNDL.US)$

$Virgin Galactic (SPCE.US)$

$Zomedica (ZOM.US)$

$BlackBerry (BB.US)$

$Clover Health (CLOV.US)$

$ContextLogic (WISH.US)$

$Luckin Coffee (LKNCY.US)$

$Oatly Group AB (OTLY.US)$

$SNDL Inc (SNDL.US)$

$Virgin Galactic (SPCE.US)$

$Zomedica (ZOM.US)$

98

101

Bobothang

commented on

$TENCENT (00700.HK)$

Experienced from 2020 to the present stock market, in fact, I think the stock market can make money is:

1 point vision +1 point patience +8 points luck

Watch it. Whatever It's up or down

Never use emergency money to buy stocks unless you think you have a good life

Experienced from 2020 to the present stock market, in fact, I think the stock market can make money is:

1 point vision +1 point patience +8 points luck

Watch it. Whatever It's up or down

Never use emergency money to buy stocks unless you think you have a good life

6

2

Bobothang

liked

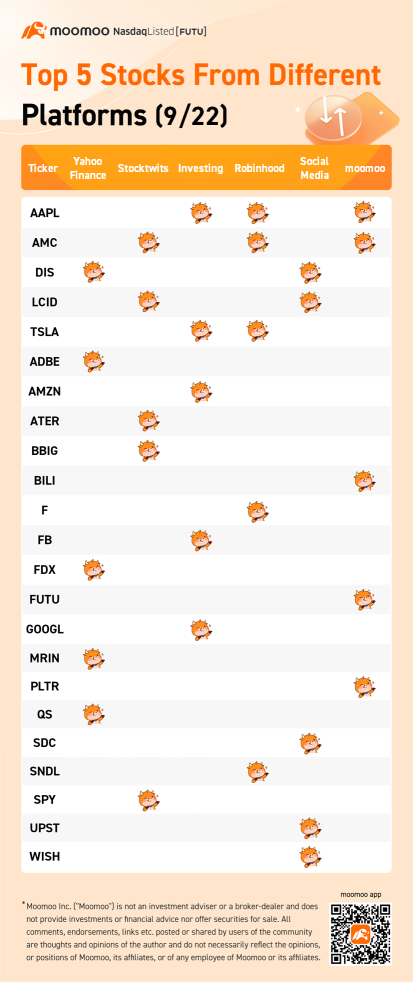

Top 5 stocks from different platforms is a collection of top trending stocks from major investment platforms and social media, giving investors a list of trending stocks across places.

Moomoo selected the hottest stocks from Robinhood and Investing.com; the most active stocks from Yahoo Finance, Stocktwits, and moomoo; also, the most mentioned stocks across social media platforms captured by SwaggyStocks.

Latest News for Top Stocks:

- $QuantumScape (QS.US)$revealed signing on a new automaker partner, its second after $VOLKSWAGEN A G (VWAGY.US)$, while gearing to start producing next-gen battery cells for an anticipated flood of electric vehicles. QuantumScape stock soared.

Read more:Bill Gates' venture backed-QuantumScape soars 16% as a 'Top 10' automaker is set to test its EV battery prototypes

-Shares of $Disney (DIS.US)$closed down 4.1% in Tuesday trading after the House of Mouse disclosed a disappointing forecast for growth in its Disney+ division.

Read more:Disney+ subscriber growth slows down

- $FedEx (FDX.US)$reported its fiscal first-quarter numbers after Tuesday's close. It missed earnings projections and cut full-year profit guidance, causing its stock to drop more than 5.7% in premarket trading.

-Shares of $Marin Software (MRIN.US)$spiked higher following an announcement from management that the company entered into a revenue share agreement with $Alphabet-C (GOOG.US)$to develop its enterprise tech platform and software products.

- $Meta Platforms (FB.US)$has told Australian publishers it has stopped negotiating licensing deals, an email to the industry seen by Reuters showed, a move which came just six months after the passing of a law designed to make tech giants pay for news content.

Moomoo selected the hottest stocks from Robinhood and Investing.com; the most active stocks from Yahoo Finance, Stocktwits, and moomoo; also, the most mentioned stocks across social media platforms captured by SwaggyStocks.

Latest News for Top Stocks:

- $QuantumScape (QS.US)$revealed signing on a new automaker partner, its second after $VOLKSWAGEN A G (VWAGY.US)$, while gearing to start producing next-gen battery cells for an anticipated flood of electric vehicles. QuantumScape stock soared.

Read more:Bill Gates' venture backed-QuantumScape soars 16% as a 'Top 10' automaker is set to test its EV battery prototypes

-Shares of $Disney (DIS.US)$closed down 4.1% in Tuesday trading after the House of Mouse disclosed a disappointing forecast for growth in its Disney+ division.

Read more:Disney+ subscriber growth slows down

- $FedEx (FDX.US)$reported its fiscal first-quarter numbers after Tuesday's close. It missed earnings projections and cut full-year profit guidance, causing its stock to drop more than 5.7% in premarket trading.

-Shares of $Marin Software (MRIN.US)$spiked higher following an announcement from management that the company entered into a revenue share agreement with $Alphabet-C (GOOG.US)$to develop its enterprise tech platform and software products.

- $Meta Platforms (FB.US)$has told Australian publishers it has stopped negotiating licensing deals, an email to the industry seen by Reuters showed, a move which came just six months after the passing of a law designed to make tech giants pay for news content.

Expand

Expand 19

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)