bojie619

commented on

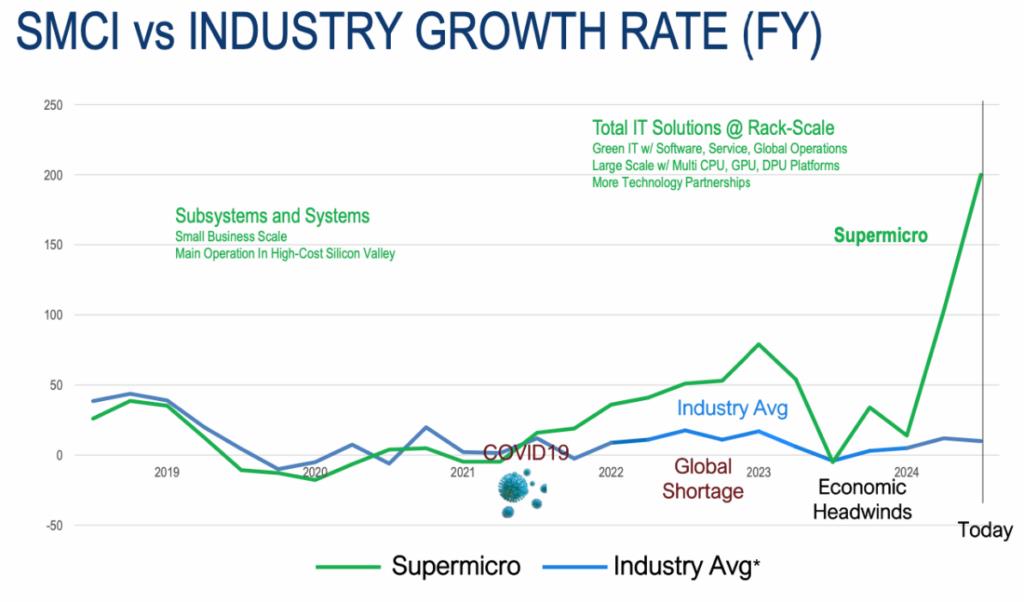

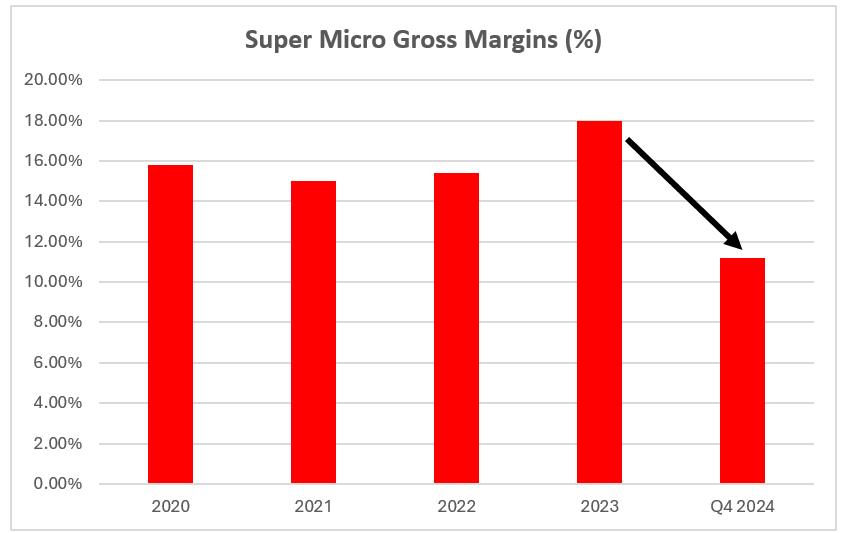

$Super Micro Computer (SMCI.US)$ stock fell over 27% this week after Hindenburg Research announced a short position in the maker of server equipment. The company had become a tech market favorite as a key beneficiary of the AI boom. After the brief report, the server-hardware company delayed submitting its annual financial report for fiscal year 2024.

After an investigation from Hindenburg, the report pointed out "glaring accou...

After an investigation from Hindenburg, the report pointed out "glaring accou...

26

4

19

bojie619

voted

Semiconductor stocks suffered a brutal sell-off on Wednesday, with the $PHLX Semiconductor Index (.SOX.US)$ dropping nearly 7%, marking its worst performance since 2020. $ASML Holding (ASML.US)$ plunged more than 12%, while $Applied Materials (AMAT.US)$, $Advanced Micro Devices (AMD.US)$, $Marvell Technology (MRVL.US)$, and $Lam Research (LRCX.US)$ all fell more than 10%, and $NVIDIA (NVDA.US)$ dropped 6.6%.

What Happened?

The sharp decline in the semico...

What Happened?

The sharp decline in the semico...

58

17

88

bojie619

liked

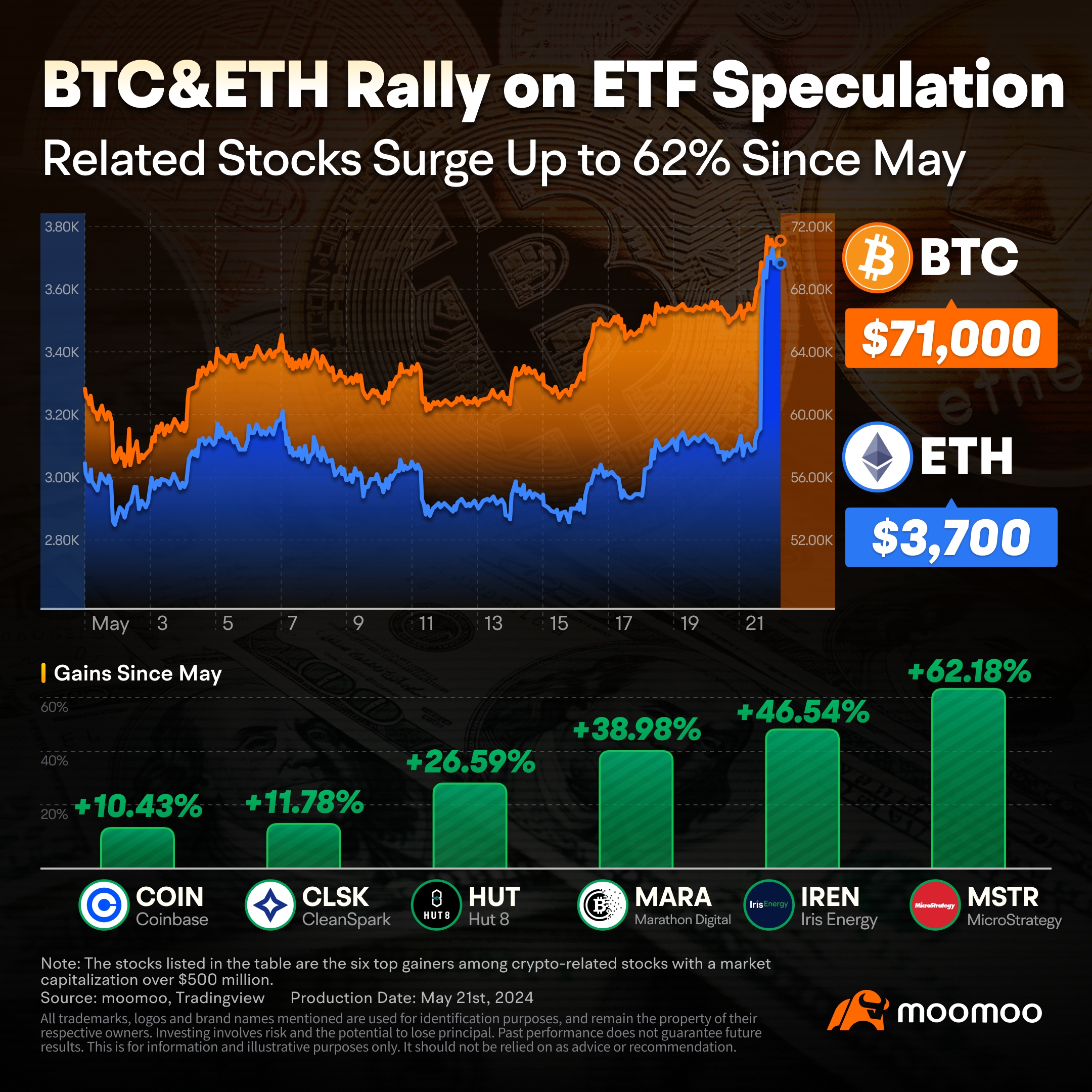

On May 21, Bitcoin (BTC) soared above $70,000, propelled by heavy investment in spot Bitcoin ETFs and an overall market upturn, reaching a high of $71,980 — a 6% rise within a day — then stabilizing at $71,000.

Also, Ethereum (ETH) spearheaded the market surge in the last few hours, soaring an impressive 14.5% in just one hour on Monday, fueled by rumors that the US SEC could greenlight spot Ethereum ETFs. ETH...

Also, Ethereum (ETH) spearheaded the market surge in the last few hours, soaring an impressive 14.5% in just one hour on Monday, fueled by rumors that the US SEC could greenlight spot Ethereum ETFs. ETH...

51

2

32

bojie619

liked

1. $Apple (AAPL.US)$ : +59,918% (20 year total return)

2. $Monster Beverage (MNST.US)$ : +59,299%

3. $NVIDIA (NVDA.US)$ : +28,712%

4. $Intuitive Machines (LUNR.US)$: +18,221%

5. $Booking Holdings (BKNG.US)$ : +16,299%

6. $Netflix (NFLX.US)$ : +13,442%

7. $Old Dominion Freight Line (ODFL.US)$ : +9,403%

8. $SBA Communications Corp (SBAC.US)$ : +7,356%

9. $Copart (CPRT.US)$ : +6,592%

10. $Regeneron Pharmaceuticals (REGN.US)$ : +6,296%

11. $Amazon (AMZN.US)$ ���������...

2. $Monster Beverage (MNST.US)$ : +59,299%

3. $NVIDIA (NVDA.US)$ : +28,712%

4. $Intuitive Machines (LUNR.US)$: +18,221%

5. $Booking Holdings (BKNG.US)$ : +16,299%

6. $Netflix (NFLX.US)$ : +13,442%

7. $Old Dominion Freight Line (ODFL.US)$ : +9,403%

8. $SBA Communications Corp (SBAC.US)$ : +7,356%

9. $Copart (CPRT.US)$ : +6,592%

10. $Regeneron Pharmaceuticals (REGN.US)$ : +6,296%

11. $Amazon (AMZN.US)$ ���������...

7

2

5

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)

bojie619 : Institutions want to control the market at a low stock price, and they can always come up with various reasons to confuse people. If there is no panic selling, where would cheap chips come from? How to maximize profits? Even high-quality stocks like Nvidia can find flaws. Even if all your indicators exceed expectations, I can find uncertainties in elections to collaborate and suppress stock prices for various personal interests! How can we make profits without snatching chips from retail investors and small institutions? Various dark bearish institutions have contributed to the current downward trend... Fortunately, we are not leveraged traders, if it continues to drop, we will buy the dip!