I only dare buy options with simulated trade. too high risk in my opinion

BoluoGG

voted

Dear mooers, have you joined Black Friday yet? To celebrate this exciting season, we’ve compiled moomoo’s exclusive deals to help you save big while investing smarter!

🟡 Offer 1: [New customer special] Free Stocks + 8.1% APY

🌟 Get up to 15 FREE stocks when you make your first deposit.

💰 Enjoy an 8.1% APY on uninvested cash for up to 3 months.

🟠 Offer 2: Refer & Earn $100 Cash Rewards

Already deposited? Refer a friend! For each friend who dep...

🟡 Offer 1: [New customer special] Free Stocks + 8.1% APY

🌟 Get up to 15 FREE stocks when you make your first deposit.

💰 Enjoy an 8.1% APY on uninvested cash for up to 3 months.

🟠 Offer 2: Refer & Earn $100 Cash Rewards

Already deposited? Refer a friend! For each friend who dep...

155

223

5

BoluoGG

liked

Today I have indiscriminately reduced most of the stocks I hold, including $NVIDIA (NVDA.US)$ And $Taiwan Semiconductor (TSM.US)$ All stocks are to be reduced across the board.

The Fed has clearly turned hawkish, so at this time, it's best not to confront them. Stocks will drop first, and then they will be able to rise better.

The Fed has clearly turned hawkish, so at this time, it's best not to confront them. Stocks will drop first, and then they will be able to rise better.

Translated

11

4

1

BoluoGG

liked

$GameStop (GME.US)$ the inverted yield curve is starting to uninvert... margin calls will start hitting soon. but the market has to dump first. this might bring down GME AMC KOSS... etc. yet keep in mind, Hodling will force those margin calls on the Memes first.

11

1

BoluoGG

liked and voted

Morning mooers! It's Wednesday, May 29th, The market is trailing into decline after one more day of tech stock advancement Tuesday that saw the Nasdaq jump over 17k for the first time.

My name is Kevin Travers, the market is so red even $NVIDIA (NVDA.US)$ is finally pulling back, and here are stories heard on Wall Street today:

$American Airlines (AAL.US)$'s stock fell 14% Wednesday after the company cut its performance...

My name is Kevin Travers, the market is so red even $NVIDIA (NVDA.US)$ is finally pulling back, and here are stories heard on Wall Street today:

$American Airlines (AAL.US)$'s stock fell 14% Wednesday after the company cut its performance...

65

15

3

BoluoGG

liked

Whilst interest rate remains elevated for longer, I will remain invested in Fullerton Cashplus funds to capture stable returns.

As 10Y bond yields have rose to 4.72% recently, I will be on the lookout for a good entry point to $iShares 20+ Year Treasury Bond ETF(TLT.US)$. The idea is to reap some monthly dividends and to gain capital appreciation when interest rate eventually falls. If I do indeed hold a position in the near future, I certainly wont hold for long term as...

As 10Y bond yields have rose to 4.72% recently, I will be on the lookout for a good entry point to $iShares 20+ Year Treasury Bond ETF(TLT.US)$. The idea is to reap some monthly dividends and to gain capital appreciation when interest rate eventually falls. If I do indeed hold a position in the near future, I certainly wont hold for long term as...

4

6

BoluoGG

liked

Let's vent about the recent hot stocks.

$Advanced Micro Devices (AMD.US)$ , also known as 1.5 times leverage long on NVIDIA

$Super Micro Computer (SMCI.US)$ , also known as 3 times leverage long on NVIDIA

$Taiwan Semiconductor (TSM.US)$ , also known as high dividend version of NVIDIA

$ASML Holding (ASML.US)$ , also known as low volatility version of NVIDIA

$Tesla (TSLA.US)$ , inverse leverage short on NVIDIA

![]()

![]()

![]()

$NVIDIA (NVDA.US)$

$Advanced Micro Devices (AMD.US)$ , also known as 1.5 times leverage long on NVIDIA

$Super Micro Computer (SMCI.US)$ , also known as 3 times leverage long on NVIDIA

$Taiwan Semiconductor (TSM.US)$ , also known as high dividend version of NVIDIA

$ASML Holding (ASML.US)$ , also known as low volatility version of NVIDIA

$Tesla (TSLA.US)$ , inverse leverage short on NVIDIA

$NVIDIA (NVDA.US)$

Translated

29

2

BoluoGG

voted

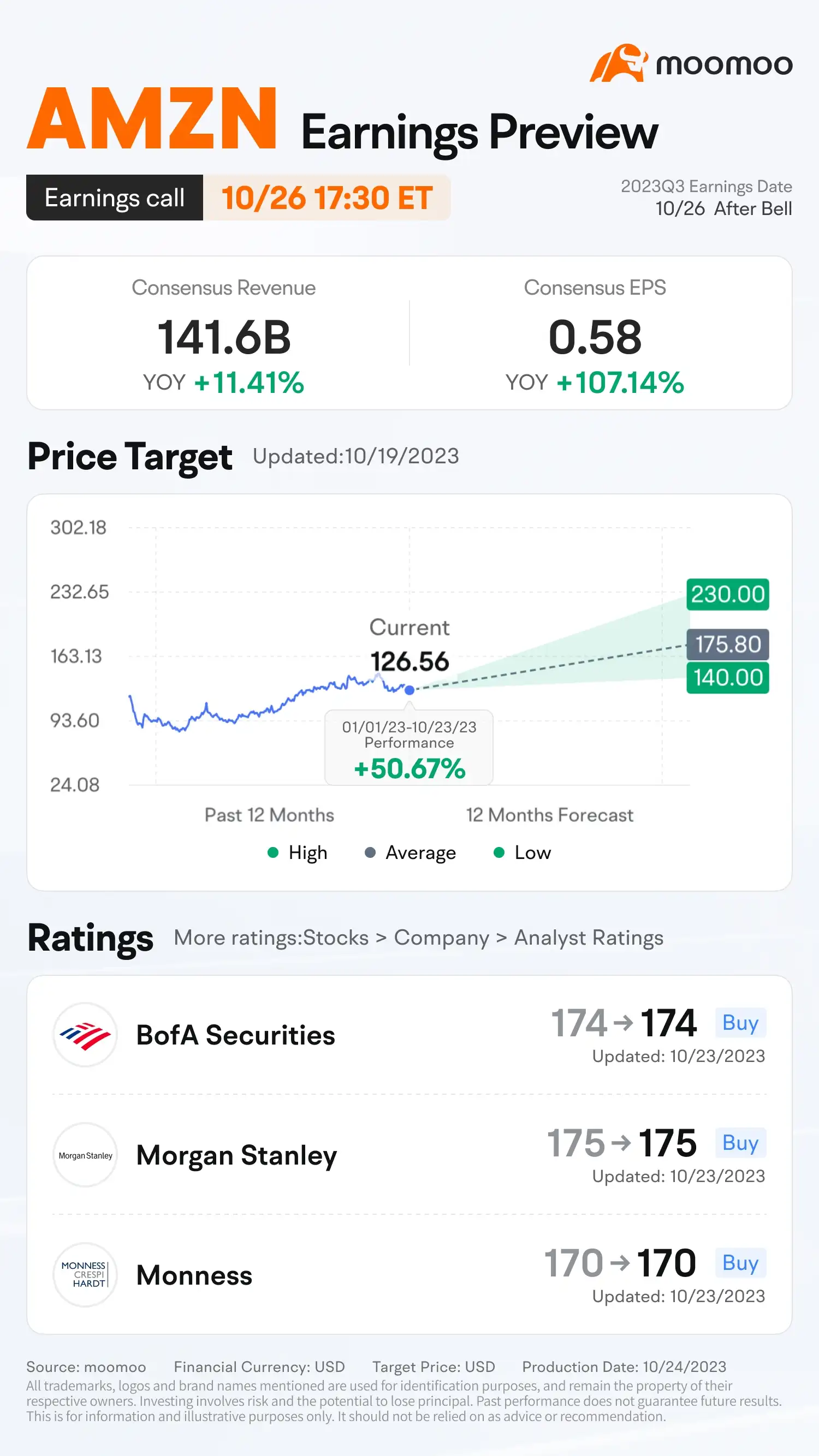

$Amazon (AMZN.US)$ is releasing its Q3 2023 earnings on October 26 after the bell. How will the market react to the company's quarterly results? Vote your answer to participate!

Rewards

● An equal share of 1,000 points: For mooers who correctly guess the price range of $Amazon (AMZN.US)$'s opening price at 9:30 AM ET Oct 27 (e.g., If 50 mooers make a correct guess, each of them will get 20 points.)

(Vote will close on 8...

Rewards

● An equal share of 1,000 points: For mooers who correctly guess the price range of $Amazon (AMZN.US)$'s opening price at 9:30 AM ET Oct 27 (e.g., If 50 mooers make a correct guess, each of them will get 20 points.)

(Vote will close on 8...

50

34

6

BoluoGG

liked

$iShares 20+ Year Treasury Bond ETF (TLT.US)$

Yesterday, I deduced the trend of TLT. There are four paths:

1. After another week or so of trading sideways, you'll be able to stand on MA20 while lying down. There is no need to make up for today's gap; time is replaced by space. This is a bullish signal.

2. After a second bottoming, it broke through the neck line and was bullish. Assuming that the gap is closed and the bottom is explored twice, today's price is likely to be the neck line.

3. Continue to attack, jump from place to place, and break through MA20 directly upward.

4. The volume fell below 84 and was bearish. The probability is small.

The gap has now been filled. Let's say 1 and 3 don't hold up anymore. So there are only two possibilities left:

1. It bottomed out around 84-85 two or more times, and rebounded after stopping the decline. Yesterday's price was the neck line. The volume breaks through the neck line, forms the bottom of the head or shoulder, and then becomes bullish. Currently seeing around 100 for the time being. The probability is high. Judging from today's CPI data, I think inflation has begun to ease. It is unlikely that it will go to the bottom more than once.

2. It effectively fell below 84. Bearish, less likely.

Trading strategies to consider

A steady entry on the right side should wait for volume breakthroughs. The entry price is 88-89, and there is room for 10% to 12%. If it falls below the neck line (yesterday's closing price), the loss will stop.

The aggressive left side falls to around 85. If there is volume and bottom shape, it enters the market. Entering the market at 86-87, there is about 15% room. The risk is to fall below 84 and stop loss immediately.

But if it falls below 8...

Yesterday, I deduced the trend of TLT. There are four paths:

1. After another week or so of trading sideways, you'll be able to stand on MA20 while lying down. There is no need to make up for today's gap; time is replaced by space. This is a bullish signal.

2. After a second bottoming, it broke through the neck line and was bullish. Assuming that the gap is closed and the bottom is explored twice, today's price is likely to be the neck line.

3. Continue to attack, jump from place to place, and break through MA20 directly upward.

4. The volume fell below 84 and was bearish. The probability is small.

The gap has now been filled. Let's say 1 and 3 don't hold up anymore. So there are only two possibilities left:

1. It bottomed out around 84-85 two or more times, and rebounded after stopping the decline. Yesterday's price was the neck line. The volume breaks through the neck line, forms the bottom of the head or shoulder, and then becomes bullish. Currently seeing around 100 for the time being. The probability is high. Judging from today's CPI data, I think inflation has begun to ease. It is unlikely that it will go to the bottom more than once.

2. It effectively fell below 84. Bearish, less likely.

Trading strategies to consider

A steady entry on the right side should wait for volume breakthroughs. The entry price is 88-89, and there is room for 10% to 12%. If it falls below the neck line (yesterday's closing price), the loss will stop.

The aggressive left side falls to around 85. If there is volume and bottom shape, it enters the market. Entering the market at 86-87, there is about 15% room. The risk is to fall below 84 and stop loss immediately.

But if it falls below 8...

Translated

5

5

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)