CaiCai99

liked

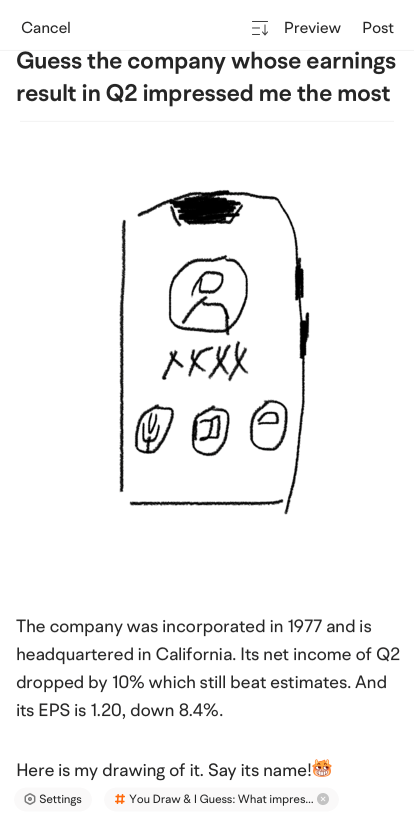

Q2 earnings season is almost coming to an end. Which company impressed you the most in the past Q2 earnings season?

But this time we invite you to draw it! We've prepared a 「You Draw, I Guess」 event for you. You can either make puzzles or solve puzzles to participate. Plenty of rewards awaits!

* Note:

1. Have no idea? Tap here and check out our updated Earnings Calendar to recall your memory of Q2 earni...

119

37

CaiCai99

liked

MACRO

· Stock Market Bottom Remains Elusive Despite Deepening Decline

Market selloffs have long stumped strategists trying to predict when they were close to done. Some have concluded with bursts of panicked selling. Others, such as the one lasting from 1973 to 1974, ground to an end after days of subdued trading volumes.

Many investors and analysts looking back at historic pullbacks believe that the current slump ...

· Stock Market Bottom Remains Elusive Despite Deepening Decline

Market selloffs have long stumped strategists trying to predict when they were close to done. Some have concluded with bursts of panicked selling. Others, such as the one lasting from 1973 to 1974, ground to an end after days of subdued trading volumes.

Many investors and analysts looking back at historic pullbacks believe that the current slump ...

36

4

CaiCai99

liked

Former President Donald Trump responded to the news that $Tesla (TSLA.US)$ CEO Elon Musk's planned $Twitter (Delisted) (TWTR.US)$ buyout is temporarily on hold.

"There is no way Elon Musk is going to buy Twitter at such a ridiculous price, especially since realizing it is a company largely based on BOTS or Spam Accounts," Trump posted on his social media platform, Truth Social.

"Fake anyone?" Trump posted, Mashable reports. "...

"There is no way Elon Musk is going to buy Twitter at such a ridiculous price, especially since realizing it is a company largely based on BOTS or Spam Accounts," Trump posted on his social media platform, Truth Social.

"Fake anyone?" Trump posted, Mashable reports. "...

757

510

CaiCai99

liked

Columns 'Do not panic': Experts explain how to stay calm and carry on investing amid rising interest rates

Last week the Reserve Bank of Australia (RBA) has raised the official cash rate by 25 basis points to 0.35%, amidst a backdrop of rising inflation. The RBA's Board also said that there will be further rate increases to come.

This follows on from moves by the United States Federal Reserve and other leading central banks to increase their nations' interest rates, with most banks hiking rates for the f...

This follows on from moves by the United States Federal Reserve and other leading central banks to increase their nations' interest rates, with most banks hiking rates for the f...

14

3

CaiCai99

liked

Stocks set to decline on Fed fallout; Crude lower: Markets wrap

Stocks in Asia looked set to fall Thursday after the Federal Reserve outlined plans to pare its balance sheet by over $1 trillion a year while hiking interest rates in a push to curb elevated inflation.

Futures declined for Australia, Japan and Hong Kong, while those for the U.S. fluctuated. Technology was among the sectors the led a retreat on Wall ...

Stocks in Asia looked set to fall Thursday after the Federal Reserve outlined plans to pare its balance sheet by over $1 trillion a year while hiking interest rates in a push to curb elevated inflation.

Futures declined for Australia, Japan and Hong Kong, while those for the U.S. fluctuated. Technology was among the sectors the led a retreat on Wall ...

17

3

CaiCai99

liked

After a slow and somewhat painful Monday, the stock markets burst higher on Tuesday, rallying on impressive upside breadth. With that in mind, let's look at a few top stock trades as we push through the holiday-shortened trading week. ![]()

![]()

![]()

![]() Top stock trades for today No. 1: The Ark Innovation Fund

Top stock trades for today No. 1: The Ark Innovation Fund![]()

The $ARK Innovation ETF (ARKK.US)$ is clearly trying to find its footing to call a bottom, but the selling in growth stocks has been relentless.

On Monday, I was looking for a potential weekly-up rotation over $97.50, following an inside week last week. Then on Monday, ARKK gave bulls and inside day — opening up the potential for a daily-up rotation over the area near $96.50.

It didn't matter which you chose, with ARKK clearing both levels today.

My preference laid with the first rotation — the weekly-up — because it's more significant in my opinion and it would put ARKK back above the bear-market low from May.

From here, let's see if we can get a tag of $100 and the 21-day moving average. Above these measures, and the $103 to $104 area could be on the table. Above that puts the 50-day in play.![]()

![]()

![]()

However, a break of this week's low flashes some rather bright caution signs, in my view.

![]() Top stock trades for today No. 2: Pfizer

Top stock trades for today No. 2: Pfizer![]()

$Pfizer (PFE.US)$ gave the robust rotation last week and the subsequent rally to new highs.

This morning it pulled back to its 10-day moving average, which set up the dip-buy opportunity for bulls who were prepared. Bouncing hard off this level now, let's see if shares can get back above $60.![]()

![]()

![]()

North of $60 and the highs are back in play at $61.71, followed by $62.75 and then potentially $69 to $70 down the road.![]()

![]()

![]()

![]() Top trades for today No. 3: Rite Aid

Top trades for today No. 3: Rite Aid![]()

$Rite Aid (RAD.US)$ has been a dog for most of the year, as it continues to put in a series of lower highs. But the stock may try to end that trend soon.

Shares are erupting over the 10-day, 21-day and 50-day moving averages on the day. However, the stock is running right into the 10-month moving average and the monthly VWAP measure.

If it can clear this area, the November high is on the table at $15.65. If we get a monthly-up rotation in Rite Aid (and thus, ending the series of lower highs), it could open the door up to $16.50 and the 200-day moving average.

On the downside, though, let's see if the 50-day moving average holds as support until some of Rite Aid's shorter-term moving averages can catch up.![]()

![]()

![]()

Source: InvestorPlace

The $ARK Innovation ETF (ARKK.US)$ is clearly trying to find its footing to call a bottom, but the selling in growth stocks has been relentless.

On Monday, I was looking for a potential weekly-up rotation over $97.50, following an inside week last week. Then on Monday, ARKK gave bulls and inside day — opening up the potential for a daily-up rotation over the area near $96.50.

It didn't matter which you chose, with ARKK clearing both levels today.

My preference laid with the first rotation — the weekly-up — because it's more significant in my opinion and it would put ARKK back above the bear-market low from May.

From here, let's see if we can get a tag of $100 and the 21-day moving average. Above these measures, and the $103 to $104 area could be on the table. Above that puts the 50-day in play.

However, a break of this week's low flashes some rather bright caution signs, in my view.

$Pfizer (PFE.US)$ gave the robust rotation last week and the subsequent rally to new highs.

This morning it pulled back to its 10-day moving average, which set up the dip-buy opportunity for bulls who were prepared. Bouncing hard off this level now, let's see if shares can get back above $60.

North of $60 and the highs are back in play at $61.71, followed by $62.75 and then potentially $69 to $70 down the road.

$Rite Aid (RAD.US)$ has been a dog for most of the year, as it continues to put in a series of lower highs. But the stock may try to end that trend soon.

Shares are erupting over the 10-day, 21-day and 50-day moving averages on the day. However, the stock is running right into the 10-month moving average and the monthly VWAP measure.

If it can clear this area, the November high is on the table at $15.65. If we get a monthly-up rotation in Rite Aid (and thus, ending the series of lower highs), it could open the door up to $16.50 and the 200-day moving average.

On the downside, though, let's see if the 50-day moving average holds as support until some of Rite Aid's shorter-term moving averages can catch up.

Source: InvestorPlace

27

2

CaiCai99

liked

My youtube channel:

https://www.youtube.com/channel/UCAPWOEQKCpCWmzKkdo7v-iw

Xiaomi is showing resilience today finally after breaking 20 then 19 then 18 HKD before making a small gain today from 18.12 to 18.22 HKD. This is considered a blessing since Hang Seng Tech tanked close to 2.5%. Companies like Kuaishou Tech, Alibaba, Bilibili, Netease, Meituan, etc all came down by close to 3%... Well is it that Xiaomi has already fallen to the value territory and the point that it doesnt make sense for it to go further?

I cant say that for sure but the chip shortage, poor IR handling skills, handset competition in China and other markets plus the capital worries for the EV unit may weigh on Xiaomi... But so what? There was even the concern that Lei Jun had to step down from key business units may signal some problems.

Then again when Lei Jun emerged as the controlling individual of the Venture Cap or rather PE arm of Xiaomi, such panic over Lei Jun abated which may explain for today's resilience. Of course another part could be Xiaomi own share buyback. Even with the share buyback all the way from 27 HKD down to 18 HKD, such share buyback pales and cant work when the narrative and downside pressure over whatever can be said weigh on Xiaomi..

But VALUE WILL EVENTUALLY EMERGE.. will the IPO Price of 17 HKD provide a strong support? Only time will tell but I am a truly long-term investor of Xiaomi...

See this youtube video by me on Xiaomi if you want to know why I believe in Xiaomi:

https://www.youtube.com/watch?v=glRHKF1fQkU

As always, this should not be construed as any investment or trading advice.

$XIAOMI-W (01810.HK)$ $Xiaomi Corp. Unsponsored ADR Class B (XIACY.US)$ $Lenovo (05562.HK)$ $Haier Smart Home (600690.SH)$ $HAIER SMARTHOME (06690.HK)$

https://www.youtube.com/channel/UCAPWOEQKCpCWmzKkdo7v-iw

Xiaomi is showing resilience today finally after breaking 20 then 19 then 18 HKD before making a small gain today from 18.12 to 18.22 HKD. This is considered a blessing since Hang Seng Tech tanked close to 2.5%. Companies like Kuaishou Tech, Alibaba, Bilibili, Netease, Meituan, etc all came down by close to 3%... Well is it that Xiaomi has already fallen to the value territory and the point that it doesnt make sense for it to go further?

I cant say that for sure but the chip shortage, poor IR handling skills, handset competition in China and other markets plus the capital worries for the EV unit may weigh on Xiaomi... But so what? There was even the concern that Lei Jun had to step down from key business units may signal some problems.

Then again when Lei Jun emerged as the controlling individual of the Venture Cap or rather PE arm of Xiaomi, such panic over Lei Jun abated which may explain for today's resilience. Of course another part could be Xiaomi own share buyback. Even with the share buyback all the way from 27 HKD down to 18 HKD, such share buyback pales and cant work when the narrative and downside pressure over whatever can be said weigh on Xiaomi..

But VALUE WILL EVENTUALLY EMERGE.. will the IPO Price of 17 HKD provide a strong support? Only time will tell but I am a truly long-term investor of Xiaomi...

See this youtube video by me on Xiaomi if you want to know why I believe in Xiaomi:

https://www.youtube.com/watch?v=glRHKF1fQkU

As always, this should not be construed as any investment or trading advice.

$XIAOMI-W (01810.HK)$ $Xiaomi Corp. Unsponsored ADR Class B (XIACY.US)$ $Lenovo (05562.HK)$ $Haier Smart Home (600690.SH)$ $HAIER SMARTHOME (06690.HK)$

59

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)