chatto1xx7

Set a live reminder

In conjunction with the release of the new issue of the corporate Shikiho, a live show will be held to uncover hidden gems!! In addition to announcing and presenting over 20 stocks pre-discovered by Katsuo, there will be a Q&A session, giveaways, and many more such as tips for checking benefits on the MOOMOO app!

※※Viewing is limited to those who have opened an account※※

Click here to open an account

>>How to apply for account opening - MOOMOO Securities

※It may take several business days, so please do it as soon as possible!!

※※Viewing is limited to those who have opened an account※※

Click here to open an account

>>How to apply for account opening - MOOMOO Securities

※It may take several business days, so please do it as soon as possible!!

Translated

【Shikiho Publication】Live Discovery of Hidden Gem Stocks!!

Dec 18 20:00

74

2

3

chatto1xx7

voted

$NVIDIA (NVDA.US)$ is On August 28th in the after-hours of the U.S. stock market (morning of August 29th in Japan), they are scheduled to announce the earnings for the second quarter of fiscal year 2025. While dominating the market for semiconductors for artificial intelligence (AI), the focus is on whether they can exceed market expectations with strong growth and performance. Please determine if Nvidia can outperform market expectations. Predict the closing price of Nvidia on the day following the earnings call and cast your vote!

【Compensation】

●Distribute 10,000 points equally

Until 10:00 PM on August 29th (Japan time)ToThe closing price of nvidia on August 29th (5:00 AM on August 30th Japan time)Please predict the financial estimates and select from the price range below. If the actual closing price matches the selected price range, points will be evenly distributed to all users who selected the corresponding price range (e.g. if 50 users correctly predict, each will receive 200 points)!

【Special Challenge! Win 500 yen worth of Amazon gift card】

Predict nvidia's closing price accurately and get a chance to win additional rewards!

By 10:00 PM on August 29th (Japan time)on August 29thWith...

【Compensation】

●Distribute 10,000 points equally

Until 10:00 PM on August 29th (Japan time)ToThe closing price of nvidia on August 29th (5:00 AM on August 30th Japan time)Please predict the financial estimates and select from the price range below. If the actual closing price matches the selected price range, points will be evenly distributed to all users who selected the corresponding price range (e.g. if 50 users correctly predict, each will receive 200 points)!

【Special Challenge! Win 500 yen worth of Amazon gift card】

Predict nvidia's closing price accurately and get a chance to win additional rewards!

By 10:00 PM on August 29th (Japan time)on August 29thWith...

Translated

174

748

6

chatto1xx7

voted

$Intel (INTC.US)$The stock price of Intel once again suffered a major blow in Monday's trading. The stock price of semiconductor companies ended the trading day with a 6.4% decline. On the other hand, $S&P 500 Index (.SPX.US)$ fell 3%, $Nasdaq Composite Index (.IXIC.US)$ fell 3.4%, $Dow Jones Industrial Average (.DJI.US)$ fell 2.6% at the end of trading.

Intel shares, which experienced a fierce sell-off last Friday, continued to decline today amid a market-wide retreat due to the backlash of carry trading with the Japanese yen. The release of the disappointing second-quarter report last week and the bearish research notes from analysts seemed to have a negative impact on the stock price.

With today's decline, Intel shares have fallen 60% in total trading in 2024, a 71% drop from its ten-year high. The future looks challenging for Intel.

Intel's second quarter report suggested significant structural issues within the company. It was already widely understood that the company was undergoing a business transformation to establish a better position for business opportunities in AI and datacenters, and this...

Intel shares, which experienced a fierce sell-off last Friday, continued to decline today amid a market-wide retreat due to the backlash of carry trading with the Japanese yen. The release of the disappointing second-quarter report last week and the bearish research notes from analysts seemed to have a negative impact on the stock price.

With today's decline, Intel shares have fallen 60% in total trading in 2024, a 71% drop from its ten-year high. The future looks challenging for Intel.

Intel's second quarter report suggested significant structural issues within the company. It was already widely understood that the company was undergoing a business transformation to establish a better position for business opportunities in AI and datacenters, and this...

Translated

7

3

chatto1xx7

voted

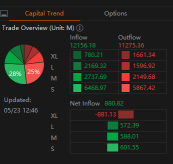

$NVIDIA (NVDA.US)$'s planned 10-for-1 stock split could make the stock more accessible to retail investors. We're already seeing increased participation. Capital trend data tracked by moomoo shows a net inflow into Nvidia of $819.7 million as of 12:49 p.m. on Thursday, even amid a net outflow of $904 million from financial giants. Here's a look at the latest capital trend data from the moomoo app.

Disclaimer: This prese...

Disclaimer: This prese...

15

1

2

chatto1xx7

liked

Financial results for major semiconductor-related companies have been completed. What is each company's stock priceImproving semiconductor market conditionsbyPerformance recovery expectationsSince it was factored in quite a bit, it's conservativeDisappointing sales in response to earnings forecast announcementsstood out.

In the regular stock exchange of the Nikkei Stock Average in April this year, semiconductor-related stocks $Disco (6146.JP)$with $Socionext (6526.JP)$has been newly adopted, and the Nikkei AverageAn index that is also susceptible to semiconductor-related headlinesIt became.5/22 (early morning Japan time on the 23rd)Is a major US semiconductor company leading advanced products $NVIDIA (NVDA.US)$Financial results for the fiscal year ending February to April are being announced, and the announcement includes 7 companiesShaking up the Nikkei Stock AverageThe chances are very high.7 major semiconductor-related stock companies with high weight (composition ratio) in the Nikkei AverageWe confirmed the financial results points, the current position of stock prices, and the analysts' views. (Note: Lasertech only accounts for the 3rd quarter of the fiscal year ending 2014/6; the rest are full year accounts for the fiscal year ending 24/3)

[Overview]

▼5 out of 7The stock price of will be on the business day after the financial results are announcedwhereabouts。 $Screen Holdings (7735.JP)$,...

In the regular stock exchange of the Nikkei Stock Average in April this year, semiconductor-related stocks $Disco (6146.JP)$with $Socionext (6526.JP)$has been newly adopted, and the Nikkei AverageAn index that is also susceptible to semiconductor-related headlinesIt became.5/22 (early morning Japan time on the 23rd)Is a major US semiconductor company leading advanced products $NVIDIA (NVDA.US)$Financial results for the fiscal year ending February to April are being announced, and the announcement includes 7 companiesShaking up the Nikkei Stock AverageThe chances are very high.7 major semiconductor-related stock companies with high weight (composition ratio) in the Nikkei AverageWe confirmed the financial results points, the current position of stock prices, and the analysts' views. (Note: Lasertech only accounts for the 3rd quarter of the fiscal year ending 2014/6; the rest are full year accounts for the fiscal year ending 24/3)

[Overview]

▼5 out of 7The stock price of will be on the business day after the financial results are announcedwhereabouts。 $Screen Holdings (7735.JP)$,...

Translated

![What semiconductor-related stocks have strong expectations of rising even after disappointing sales? 7 stocks that are responsible for the fate of the Nikkei Average! [Summary of financial results]](https://sgsnsimg.moomoo.com/sns_client_feed/181000001/20240515/501a1e2b22e22bbe358bcb11e6c90792.jpg/thumb?area=105&is_public=true)

![What semiconductor-related stocks have strong expectations of rising even after disappointing sales? 7 stocks that are responsible for the fate of the Nikkei Average! [Summary of financial results]](https://sgsnsimg.moomoo.com/sns_client_feed/181000001/20240515/3025ace416425f67b441dfcced36ed13.jpg/thumb?area=105&is_public=true)

![What semiconductor-related stocks have strong expectations of rising even after disappointing sales? 7 stocks that are responsible for the fate of the Nikkei Average! [Summary of financial results]](https://sgsnsimg.moomoo.com/sns_client_feed/181000001/20240515/b42c576676adfa77d84a6c997e4e4247.jpg/thumb?area=105&is_public=true)

+6

103

1

47

chatto1xx7

Set a live reminder

Warren Buffett, the famous American investor, will lead Berkshire Hathaway to hold its annual shareholders' meeting in Omaha, Nebraska, in the Midwest, on May 4th. After the passing of his ally, Mr. Munger, Abel, Buffett's successor, took on a major role. Will Buffett be able to continue his legend in the future? How will Abel, who has taken on this heavy responsibility, respond to questions from shareholders?

If you wish to watch, "reserve"by clicking the button.

Note:

The content of this live stream is provided for the convenience of our customers through subtitle translation services. The subtitles are generated using Microsoft Azure and Amazon Translate. We do not provide any type of guarantee regarding the accuracy, reliability, or precision of machine translation from English to Japanese, either explicit or implicit. We are not responsible for any damages caused by the translated content. Please keep this in mind when viewing.

If you wish to watch, "reserve"by clicking the button.

Note:

The content of this live stream is provided for the convenience of our customers through subtitle translation services. The subtitles are generated using Microsoft Azure and Amazon Translate. We do not provide any type of guarantee regarding the accuracy, reliability, or precision of machine translation from English to Japanese, either explicit or implicit. We are not responsible for any damages caused by the translated content. Please keep this in mind when viewing.

Translated

Buffett Shareholders' Meeting Live Broadcast

May 4 21:30

17

3

chatto1xx7

voted

Hello, Moomoo users!![]() This is the market sentiment for New York stocks tonight.

This is the market sentiment for New York stocks tonight.![]()

Market Overview

The USA market started with the Dow Jones Industrial Average, which consists of high-quality stocks, increasing by $49.10 to reach $38,552.79, while the Nasdaq Composite Index, which has a high proportion of technology stocks, started with an increase of 108.96 points to reach 15,805.60. The S&P 500 Index, which consists of 500 large-cap stocks in the US, increased by 14.31 points to reach 5,084.86.

$Dow Jones Industrial Average (.DJI.US)$

$Nasdaq Composite Index (.IXIC.US)$

$S&P 500 Index (.SPX.US)$

Top news of individual stocks

US core capital goods orders saw a slight increase, highlighting companies' cautious stance - the previous month's figures were revised downward.

Orders for business equipment in the US manufacturing sector in March remained only slightly higher, indicating that companies are cautiously restraining capital investment due to concerns about future demand.

Israel conducted airstrikes on 40 Hezbollah bases in southern Lebanon.

The Israeli Defense Forces attacked approximately 40 bases associated with the pro-Iran militia group Hezbollah in southern Lebanon...

Market Overview

The USA market started with the Dow Jones Industrial Average, which consists of high-quality stocks, increasing by $49.10 to reach $38,552.79, while the Nasdaq Composite Index, which has a high proportion of technology stocks, started with an increase of 108.96 points to reach 15,805.60. The S&P 500 Index, which consists of 500 large-cap stocks in the US, increased by 14.31 points to reach 5,084.86.

$Dow Jones Industrial Average (.DJI.US)$

$Nasdaq Composite Index (.IXIC.US)$

$S&P 500 Index (.SPX.US)$

Top news of individual stocks

US core capital goods orders saw a slight increase, highlighting companies' cautious stance - the previous month's figures were revised downward.

Orders for business equipment in the US manufacturing sector in March remained only slightly higher, indicating that companies are cautiously restraining capital investment due to concerns about future demand.

Israel conducted airstrikes on 40 Hezbollah bases in southern Lebanon.

The Israeli Defense Forces attacked approximately 40 bases associated with the pro-Iran militia group Hezbollah in southern Lebanon...

Translated

21

2

3

chatto1xx7

liked

Looking back on last week

“Semiconductor stocks split 37,000 yen for the first time in 2 months due to the double punch of falling semiconductor stocks and the situation in the Middle East”

The Nikkei Average fell sharply last week to 37,68.35 yen (-6.21%), weakening by 2455.20 yen (-6.21%) per week. Weakness in the US market, such as the NASDAQ, put downward pressure on Japanese stocks, and the situation was severe throughout the week. The depreciation of the yen and appreciation of the dollar progressed from speculation that interest rate differences between Japan and the US would widen until the latter half of the 154 yen range per dollar. There was a tailwind for export-related stocks, but aggressive purchases were refrained in the stock market due to heightened sense of caution against implementing yen buying intervention by the government and the Bank of Japan.

The fact that there were no financial results for ASML Holding, a Dutch semiconductor lithography equipment that attracted attention, and that TSMC, the world's largest semiconductor contract manufacturer in Taiwan, lowered the overall growth forecast for the semiconductor market in 24 slightly lower than before, etc., and semiconductor stocks around the world depreciated drastically. While semiconductor stocks completely collapsed in the Tokyo market over the weekend, news such as “explosions at multiple locations in Iran” spread, and investor sentiment worsened further. In response to the complete depreciation of semiconductor stocks and the tense situation in the Middle East, the Nikkei Average temporarily split 37,000 yen since 2/9.

This week's outlook...

“Semiconductor stocks split 37,000 yen for the first time in 2 months due to the double punch of falling semiconductor stocks and the situation in the Middle East”

The Nikkei Average fell sharply last week to 37,68.35 yen (-6.21%), weakening by 2455.20 yen (-6.21%) per week. Weakness in the US market, such as the NASDAQ, put downward pressure on Japanese stocks, and the situation was severe throughout the week. The depreciation of the yen and appreciation of the dollar progressed from speculation that interest rate differences between Japan and the US would widen until the latter half of the 154 yen range per dollar. There was a tailwind for export-related stocks, but aggressive purchases were refrained in the stock market due to heightened sense of caution against implementing yen buying intervention by the government and the Bank of Japan.

The fact that there were no financial results for ASML Holding, a Dutch semiconductor lithography equipment that attracted attention, and that TSMC, the world's largest semiconductor contract manufacturer in Taiwan, lowered the overall growth forecast for the semiconductor market in 24 slightly lower than before, etc., and semiconductor stocks around the world depreciated drastically. While semiconductor stocks completely collapsed in the Tokyo market over the weekend, news such as “explosions at multiple locations in Iran” spread, and investor sentiment worsened further. In response to the complete depreciation of semiconductor stocks and the tense situation in the Middle East, the Nikkei Average temporarily split 37,000 yen since 2/9.

This week's outlook...

Translated

+1

51

2

chatto1xx7

voted

Good morning, Moomoo users!![]() Here are the key points from the morning session report today.

Here are the key points from the morning session report today.

● [Tokyo stock market forecast range] 73,000-79,000 yen (closing price on the 22nd: 74,386.61 yen)

● Different opinions among strategists regarding the earnings outlook of US companies - stock prices are struggling to rise

Hedge funds switch to buying stocks, even in an unstable environment - Goldman Sachs

Yen at a 34-year low, 154.80 yen, awareness of interest rate differentials once again

Listed companies buying back their own shares, reaching a record 10 trillion yen, supporting Japanese stocks

Tesla announces earnings on the 24th, Musk's next move in EV deceleration

Apple has been designated as the top pick for 2024, with earnings reports expected in January-March - BofA

- Moomoo News Amelia

Market Overview

In the U.S. stock market on the 22nd, the NY Dow Jones Industrial Average rose by 253.58 cents or 0.03 million8239 dollars to 98 cents for the third consecutive day. The Nasdaq Composite Index was 169.295 points higher at 0.01 million5451.305. On the 23rd, the Tokyo stock market saw a mix of bargain hunting following a sense of value from the previous day, with prevailing buying on dips and short covering by sellers...

● [Tokyo stock market forecast range] 73,000-79,000 yen (closing price on the 22nd: 74,386.61 yen)

● Different opinions among strategists regarding the earnings outlook of US companies - stock prices are struggling to rise

Hedge funds switch to buying stocks, even in an unstable environment - Goldman Sachs

Yen at a 34-year low, 154.80 yen, awareness of interest rate differentials once again

Listed companies buying back their own shares, reaching a record 10 trillion yen, supporting Japanese stocks

Tesla announces earnings on the 24th, Musk's next move in EV deceleration

Apple has been designated as the top pick for 2024, with earnings reports expected in January-March - BofA

- Moomoo News Amelia

Market Overview

In the U.S. stock market on the 22nd, the NY Dow Jones Industrial Average rose by 253.58 cents or 0.03 million8239 dollars to 98 cents for the third consecutive day. The Nasdaq Composite Index was 169.295 points higher at 0.01 million5451.305. On the 23rd, the Tokyo stock market saw a mix of bargain hunting following a sense of value from the previous day, with prevailing buying on dips and short covering by sellers...

Translated

![[Morning Report] Divergent views among strategists on U.S. stock earnings outlook, with the first-ever 10 trillion yen share buyback supporting Japanese stocks. Earnings reports from Tesla are expected on the 24th.](https://sgsnsimg.moomoo.com/sns_client_feed/181250687/20240423/e14712d1222955811ab7b232e401b2d4.png/thumb?area=105&is_public=true)

![[Morning Report] Divergent views among strategists on U.S. stock earnings outlook, with the first-ever 10 trillion yen share buyback supporting Japanese stocks. Earnings reports from Tesla are expected on the 24th.](https://sgsnsimg.moomoo.com/sns_client_feed/181250687/20240423/b7616a3af8e254ac59dceee907114516.png/thumb?area=105&is_public=true)

![[Morning Report] Divergent views among strategists on U.S. stock earnings outlook, with the first-ever 10 trillion yen share buyback supporting Japanese stocks. Earnings reports from Tesla are expected on the 24th.](https://sgsnsimg.moomoo.com/sns_client_feed/181250687/20240423/1713827596743-e873db4ee9.png/thumb?area=105&is_public=true)

26

6

![[empty]](https://static.moomoo.com/node_futunn_nnq/assets/images/folder.5c37692712.png)

![[error]](https://static.moomoo.com/node_futunn_nnq/assets/images/no-network.991ae8055c.png)